This version of the form is not currently in use and is provided for reference only. Download this version of

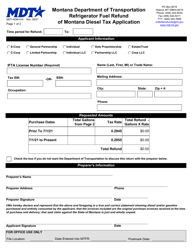

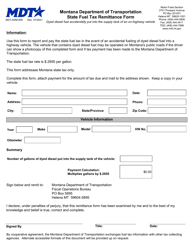

Form MDT-ADM-021

for the current year.

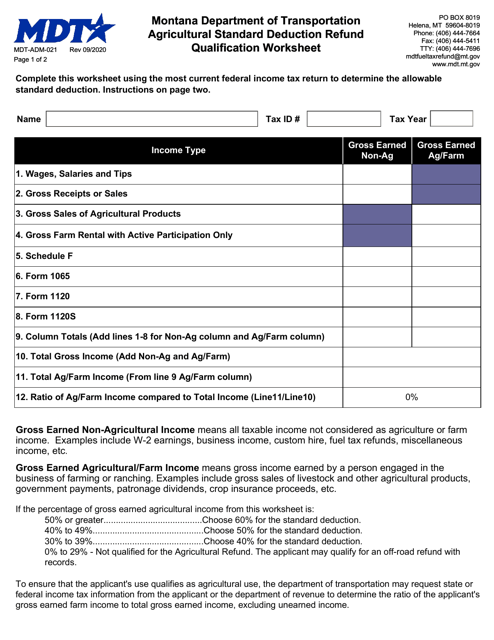

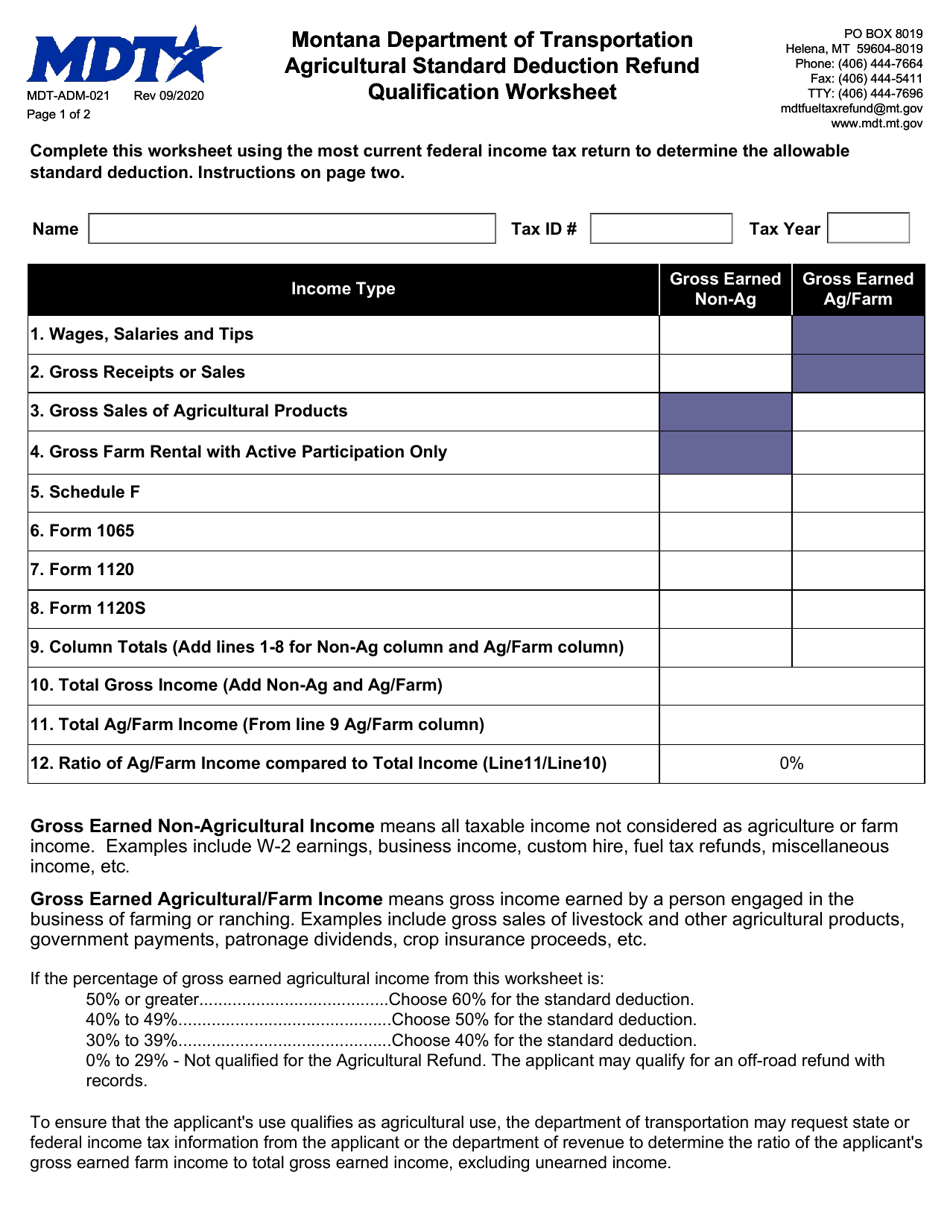

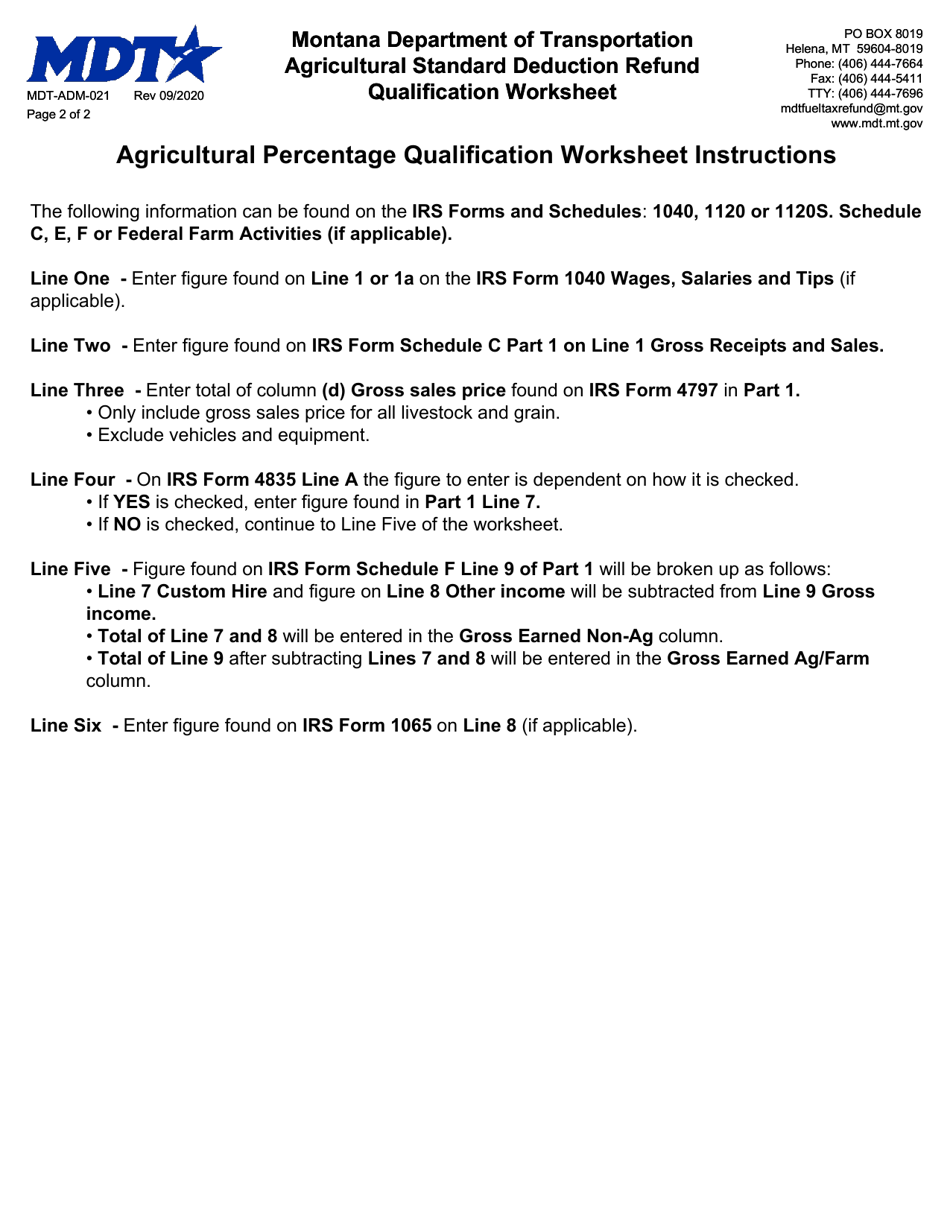

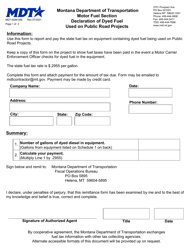

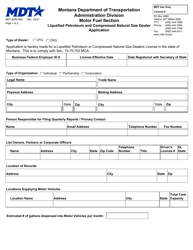

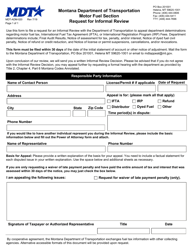

Form MDT-ADM-021 Agricultural Standard Deduction Refund Qualification Worksheet - Montana

What Is Form MDT-ADM-021?

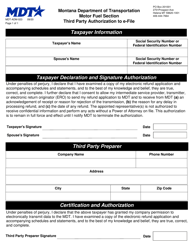

This is a legal form that was released by the Montana Department of Transportation - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MDT-ADM-021?

A: Form MDT-ADM-021 is the Agricultural Standard Deduction Refund Qualification Worksheet specifically for Montana.

Q: What is the purpose of Form MDT-ADM-021?

A: The purpose of Form MDT-ADM-021 is to determine if a taxpayer qualifies for a refund of agricultural standard deduction.

Q: Who should use Form MDT-ADM-021?

A: Montana taxpayers who have claimed an agricultural standard deduction and want to check their eligibility for a refund should use this form.

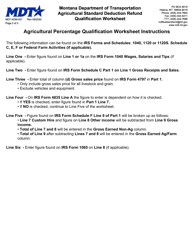

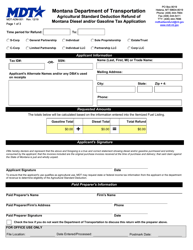

Q: What information is required to complete Form MDT-ADM-021?

A: Form MDT-ADM-021 requires information such as income from agriculture, deductions claimed, and other relevant financial details.

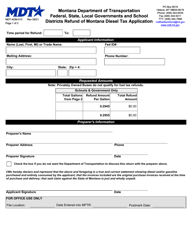

Q: What happens after submitting Form MDT-ADM-021?

A: After submitting Form MDT-ADM-021, the Montana Department of Revenue will review your eligibility for an agricultural standard deduction refund.

Q: Can I e-file Form MDT-ADM-021?

A: No, Form MDT-ADM-021 cannot be e-filed. It must be submitted in paper format.

Q: How long does it take to receive a refund after submitting Form MDT-ADM-021?

A: The refund processing time can vary, but generally, it takes a few weeks to receive a refund after submitting Form MDT-ADM-021.

Q: Do I need to include any supporting documents with Form MDT-ADM-021?

A: It is advisable to include any necessary supporting documents, such as receipts or financial statements, that support the information provided on Form MDT-ADM-021.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Montana Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MDT-ADM-021 by clicking the link below or browse more documents and templates provided by the Montana Department of Transportation.