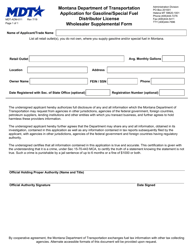

This version of the form is not currently in use and is provided for reference only. Download this version of

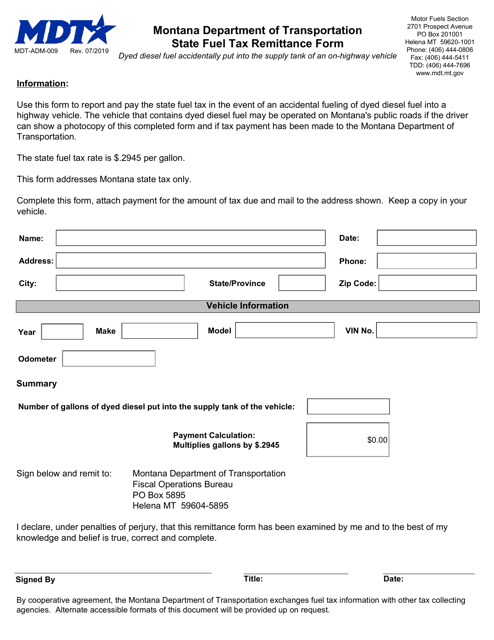

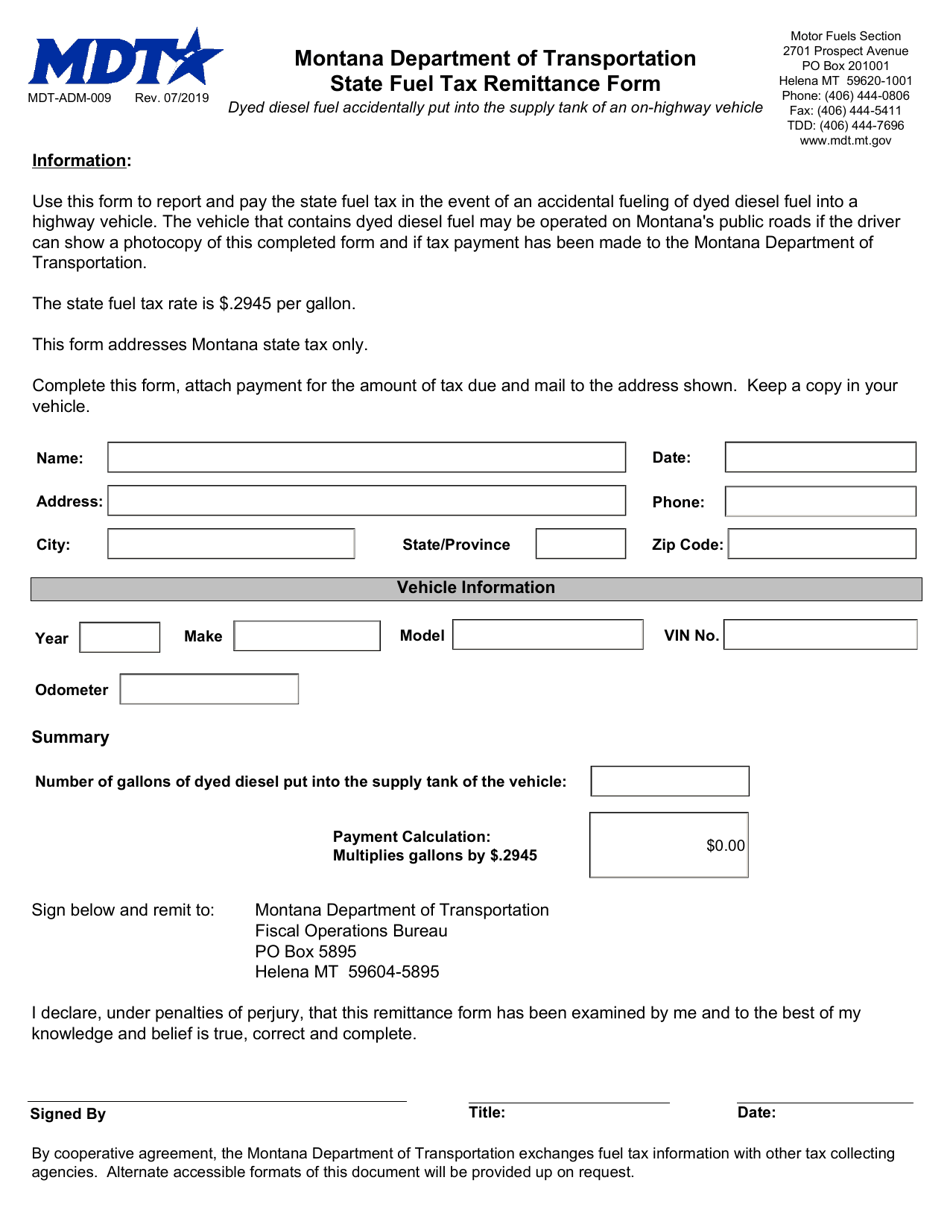

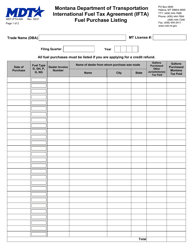

Form MDT-ADM-009

for the current year.

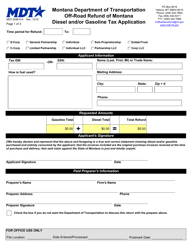

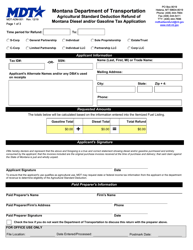

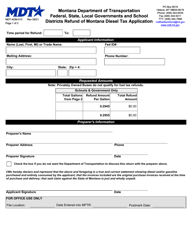

Form MDT-ADM-009 State Fuel Tax Remittance Form - Montana

What Is Form MDT-ADM-009?

This is a legal form that was released by the Montana Department of Transportation - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

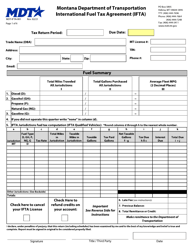

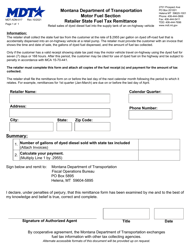

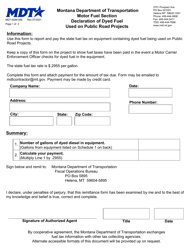

Q: What is the MDT-ADM-009 form?

A: The MDT-ADM-009 form is the State Fuel Tax Remittance Form for Montana.

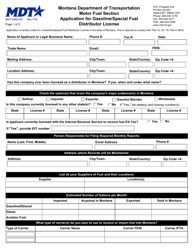

Q: Who needs to use the MDT-ADM-009 form?

A: Any individual or business that sells fuel in Montana and is required to remit state fuel taxes needs to use the MDT-ADM-009 form.

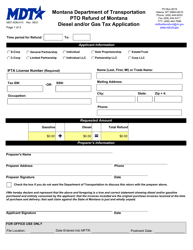

Q: How often do I need to file the MDT-ADM-009 form?

A: The MDT-ADM-009 form must be filed monthly.

Q: What information do I need to provide on the MDT-ADM-009 form?

A: You will need to provide information about the amount of fuel sold, tax rates, and other relevant details.

Q: Is there a deadline for filing the MDT-ADM-009 form?

A: Yes, the MDT-ADM-009 form must be filed by the 25th of each month.

Q: Are there any penalties for late filing of the MDT-ADM-009 form?

A: Yes, there are penalties for late filing, including interest charges on unpaid taxes.

Q: What should I do if I made a mistake on the MDT-ADM-009 form?

A: If you made a mistake on the MDT-ADM-009 form, you should contact the Montana Department of Transportation for guidance on how to correct the error.

Q: Is there any additional documentation required with the MDT-ADM-009 form?

A: No, there is no additional documentation required with the MDT-ADM-009 form.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Montana Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MDT-ADM-009 by clicking the link below or browse more documents and templates provided by the Montana Department of Transportation.