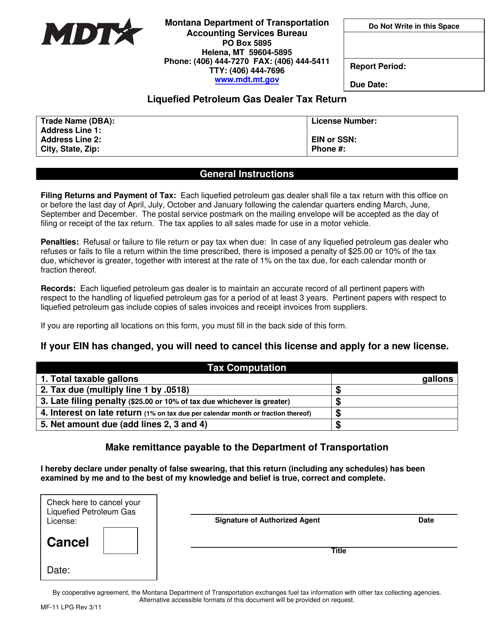

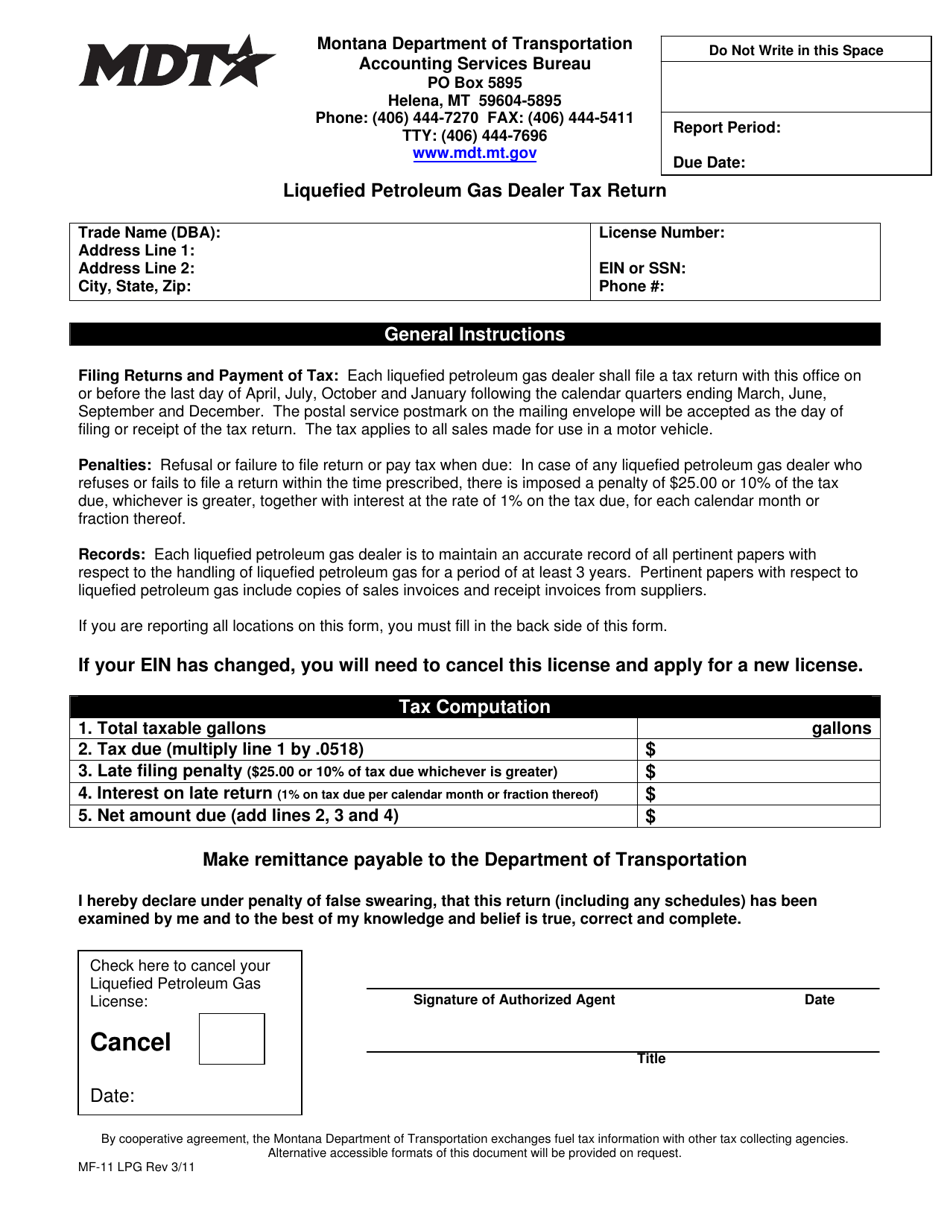

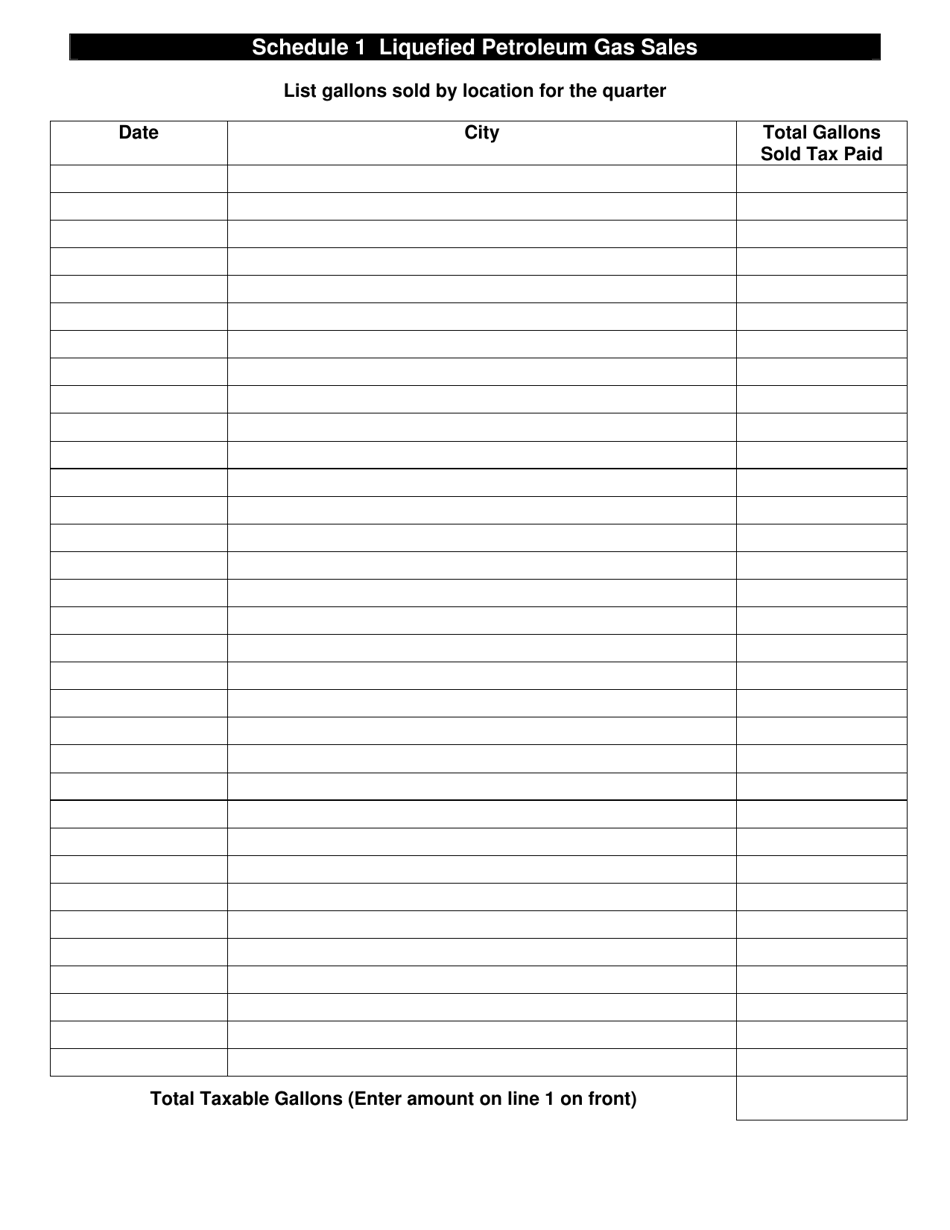

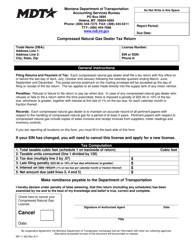

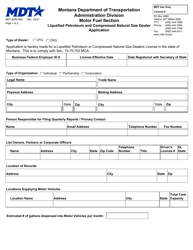

Form MF-11 LPG Liquefied Petroleum Gas Dealer Tax Return - Montana

What Is Form MF-11 LPG?

This is a legal form that was released by the Montana Department of Transportation - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-11?

A: Form MF-11 is the LPG Liquefied Petroleum Gas Dealer Tax Return for Montana.

Q: Who should file Form MF-11?

A: LPG Liquefied Petroleum Gas Dealers in Montana should file Form MF-11.

Q: What is the purpose of Form MF-11?

A: The purpose of Form MF-11 is to report and pay the LPG Liquefied Petroleum Gas Dealer Tax in Montana.

Q: When is Form MF-11 due?

A: Form MF-11 is due on the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form MF-11?

A: Yes, there are penalties for late filing of Form MF-11. It is important to file the form on time to avoid penalties.

Form Details:

- Released on March 1, 2011;

- The latest edition provided by the Montana Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MF-11 LPG by clicking the link below or browse more documents and templates provided by the Montana Department of Transportation.