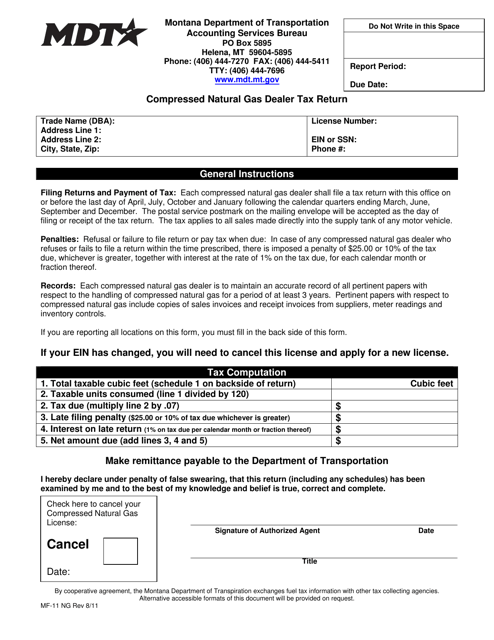

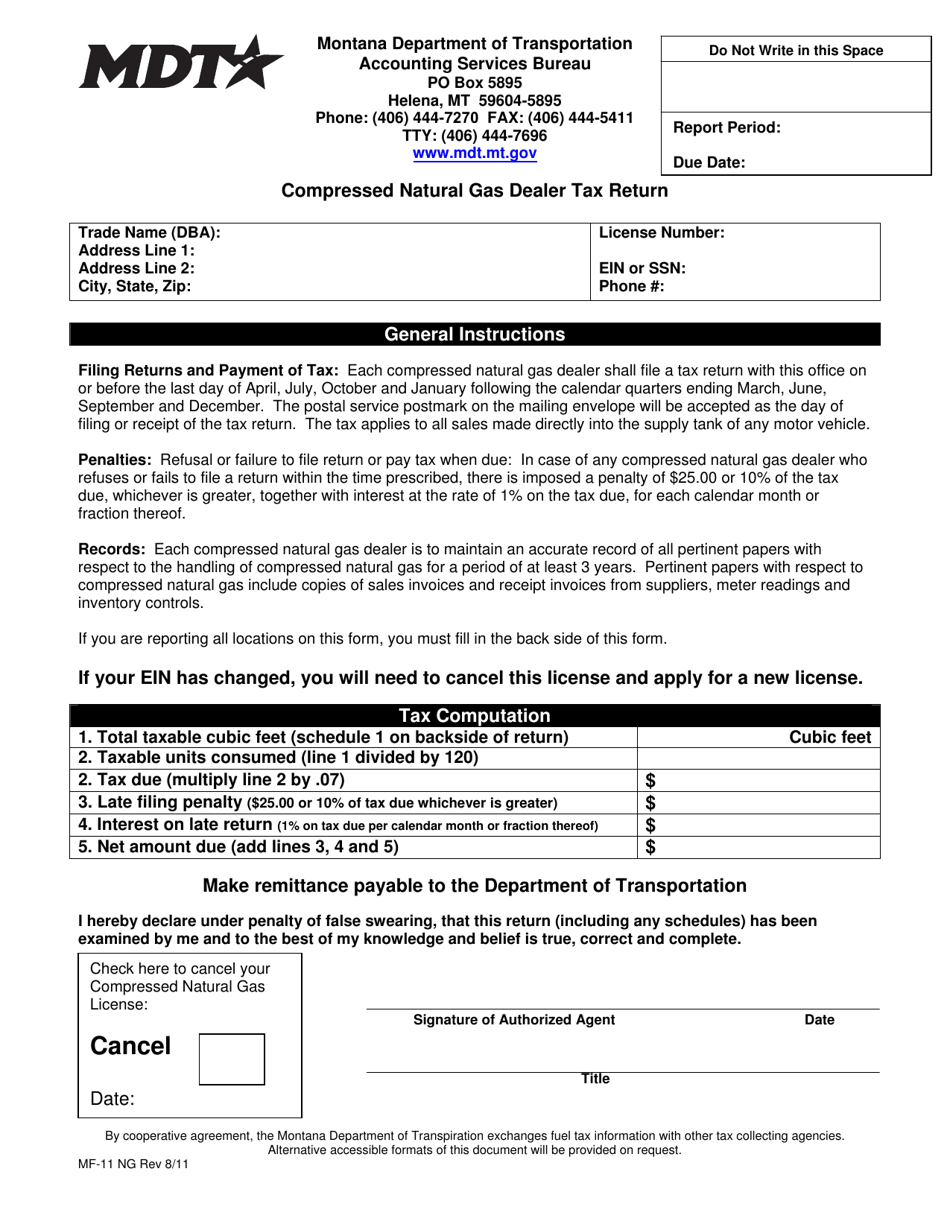

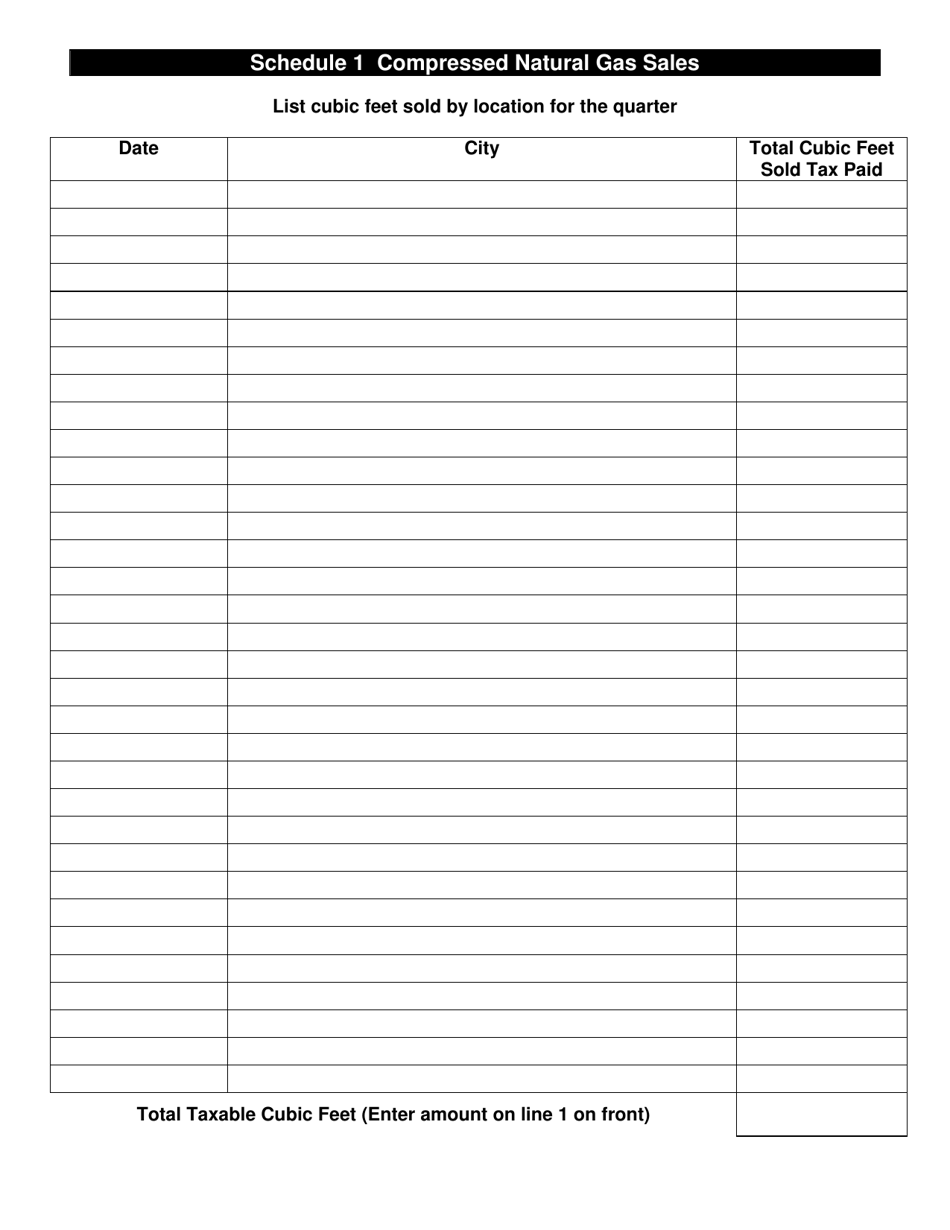

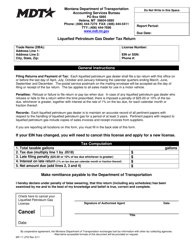

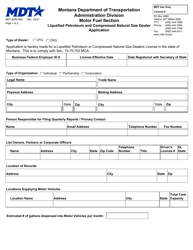

Form MF-11 NG Compressed Natural Gas Dealer Tax Return - Montana

What Is Form MF-11 NG?

This is a legal form that was released by the Montana Department of Transportation - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-11 NG?

A: Form MF-11 NG is the Compressed Natural Gas Dealer Tax Return in Montana.

Q: Who needs to file Form MF-11 NG?

A: Compressed natural gas dealers in Montana need to file Form MF-11 NG.

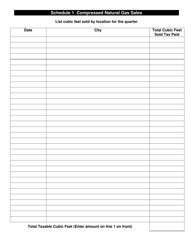

Q: What is the purpose of Form MF-11 NG?

A: The purpose of Form MF-11 NG is to report and remit the tax on the sale of compressed natural gas.

Q: Is Form MF-11 NG specific to Montana?

A: Yes, Form MF-11 NG is specific to Montana and is used for reporting taxes on compressed natural gas sales within the state.

Q: When is Form MF-11 NG due?

A: Form MF-11 NG is due on the last day of the month following the end of the reporting period.

Q: What are the penalties for late or non-filing of Form MF-11 NG?

A: Penalties may be assessed for late or non-filing of Form MF-11 NG, including interest on unpaid taxes and potential additional penalties for intentional disregard of tax laws.

Q: Are there any exemptions or deductions available on Form MF-11 NG?

A: Specific exemptions or deductions may be available for compressed natural gas dealers, and detailed information can be found in the instructions accompanying the form.

Q: What should I do if I have questions or need assistance with Form MF-11 NG?

A: If you have questions or need assistance with Form MF-11 NG, you can contact the Montana Department of Revenue's taxpayer services team for guidance.

Form Details:

- Released on August 1, 2011;

- The latest edition provided by the Montana Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MF-11 NG by clicking the link below or browse more documents and templates provided by the Montana Department of Transportation.