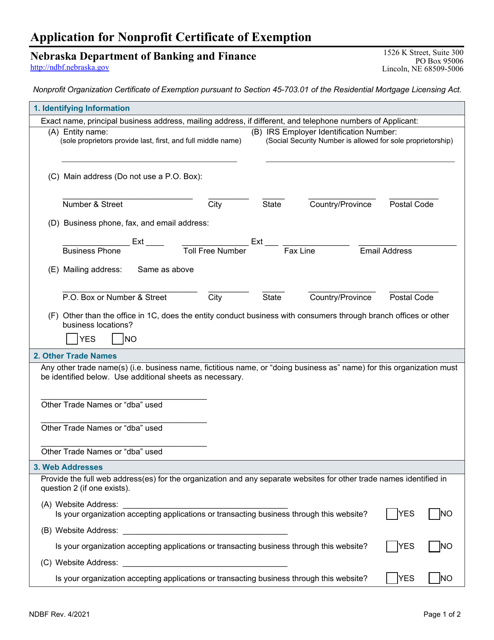

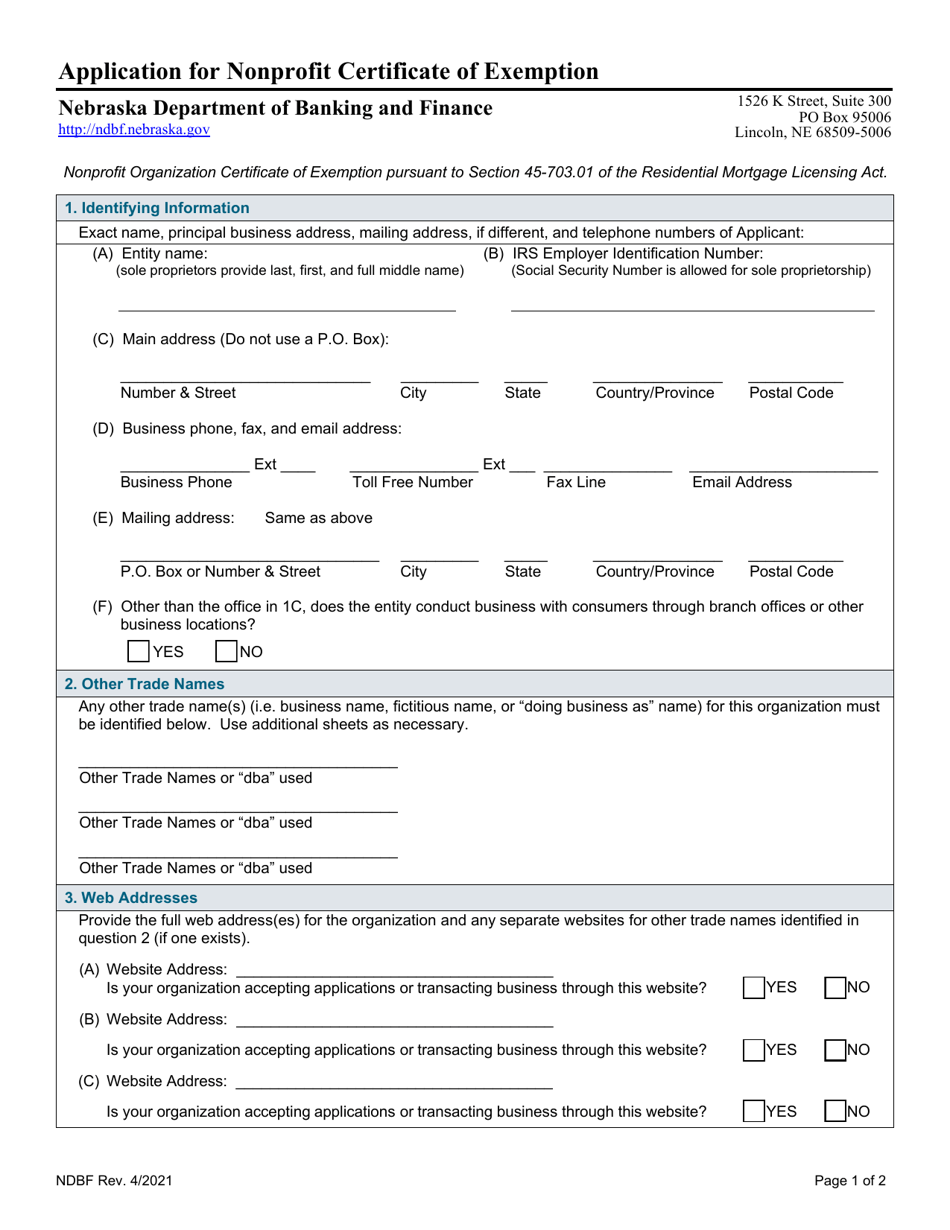

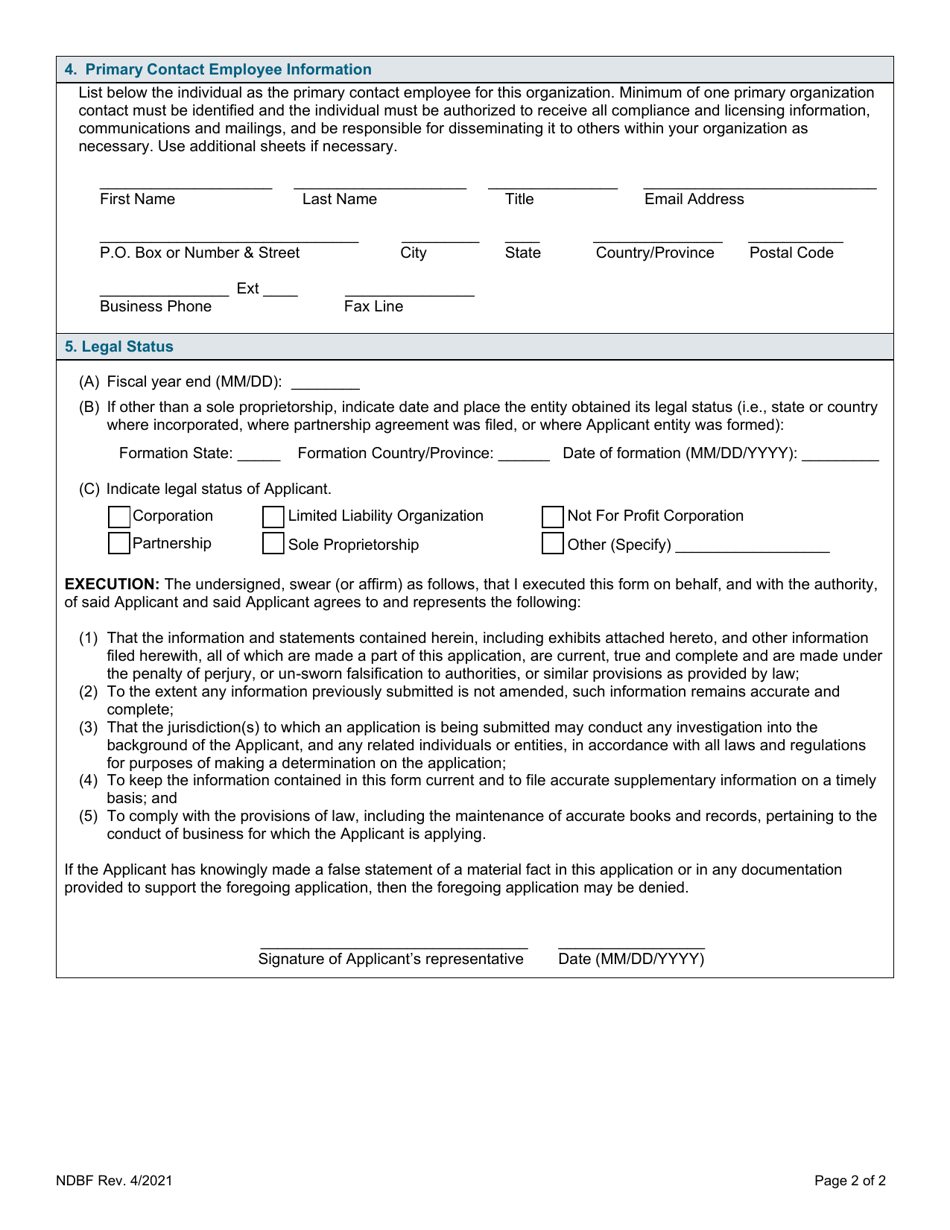

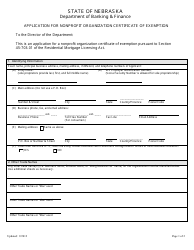

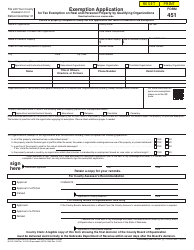

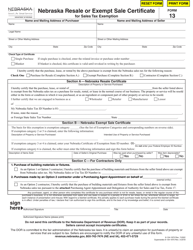

Application for Nonprofit Certificate of Exemption - Nebraska

Application for Nonprofit Certificate of Exemption is a legal document that was released by the Nebraska Department of Banking and Finance - a government authority operating within Nebraska.

FAQ

Q: What is a Nonprofit Certificate of Exemption?

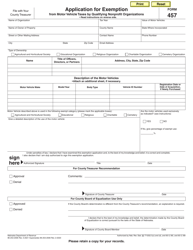

A: A Nonprofit Certificate of Exemption is a document that allows eligible nonprofit organizations to claim exemption from certain taxes in Nebraska.

Q: Who is eligible to apply for a Nonprofit Certificate of Exemption?

A: Nonprofit organizations, such as charities, religious organizations, and educational institutions, are typically eligible to apply for a Nonprofit Certificate of Exemption in Nebraska.

Q: What taxes are exempted with a Nonprofit Certificate of Exemption?

A: A Nonprofit Certificate of Exemption allows eligible organizations to be exempt from paying sales and use taxes on items purchased for their nonprofit activities.

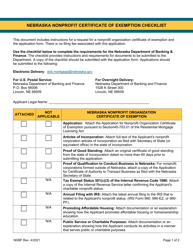

Q: How to apply for a Nonprofit Certificate of Exemption in Nebraska?

A: To apply for a Nonprofit Certificate of Exemption in Nebraska, organizations must complete and submit the Application for Nonprofit Certificate of Exemption to the Nebraska Department of Revenue.

Q: Is there a fee to apply for a Nonprofit Certificate of Exemption?

A: No, there is no fee to apply for a Nonprofit Certificate of Exemption in Nebraska.

Q: How long does it take to receive a Nonprofit Certificate of Exemption?

A: The processing time for a Nonprofit Certificate of Exemption in Nebraska can vary, but it typically takes a few weeks to receive a response from the Nebraska Department of Revenue.

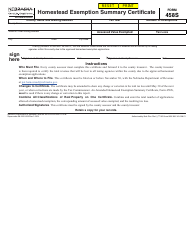

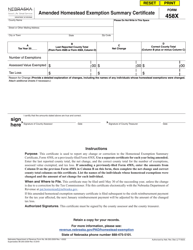

Form Details:

- Released on April 1, 2021;

- The latest edition currently provided by the Nebraska Department of Banking and Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Banking and Finance.