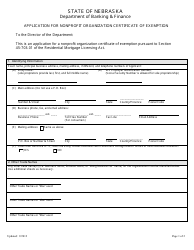

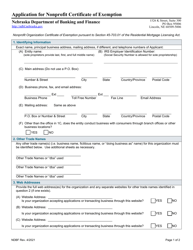

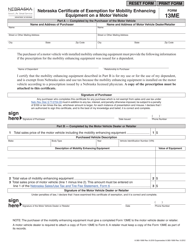

Nebraska Nonprofit Certificate of Exemption Checklist - Nebraska

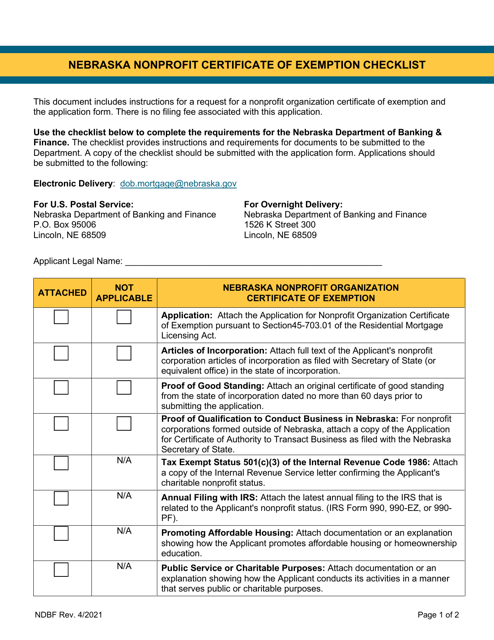

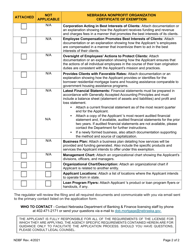

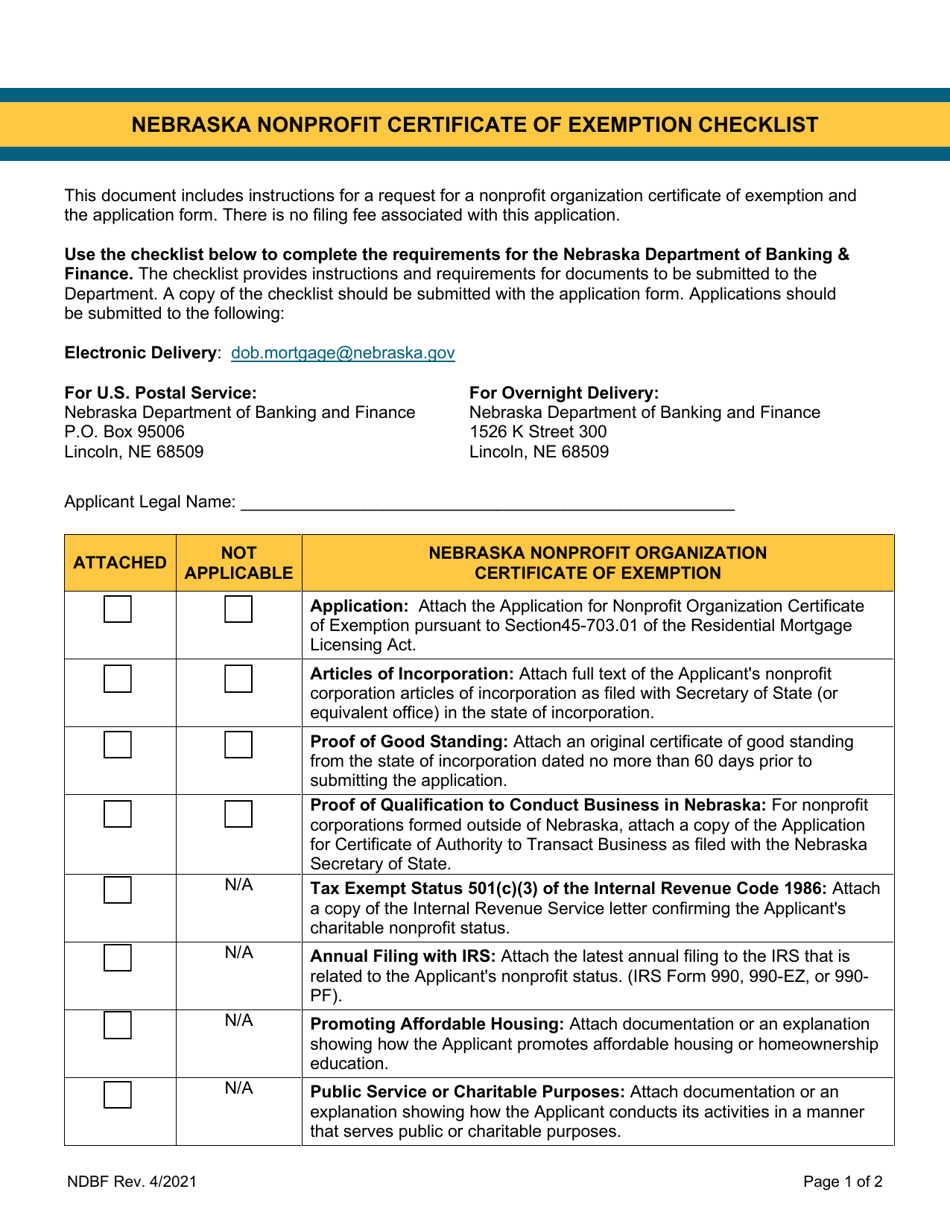

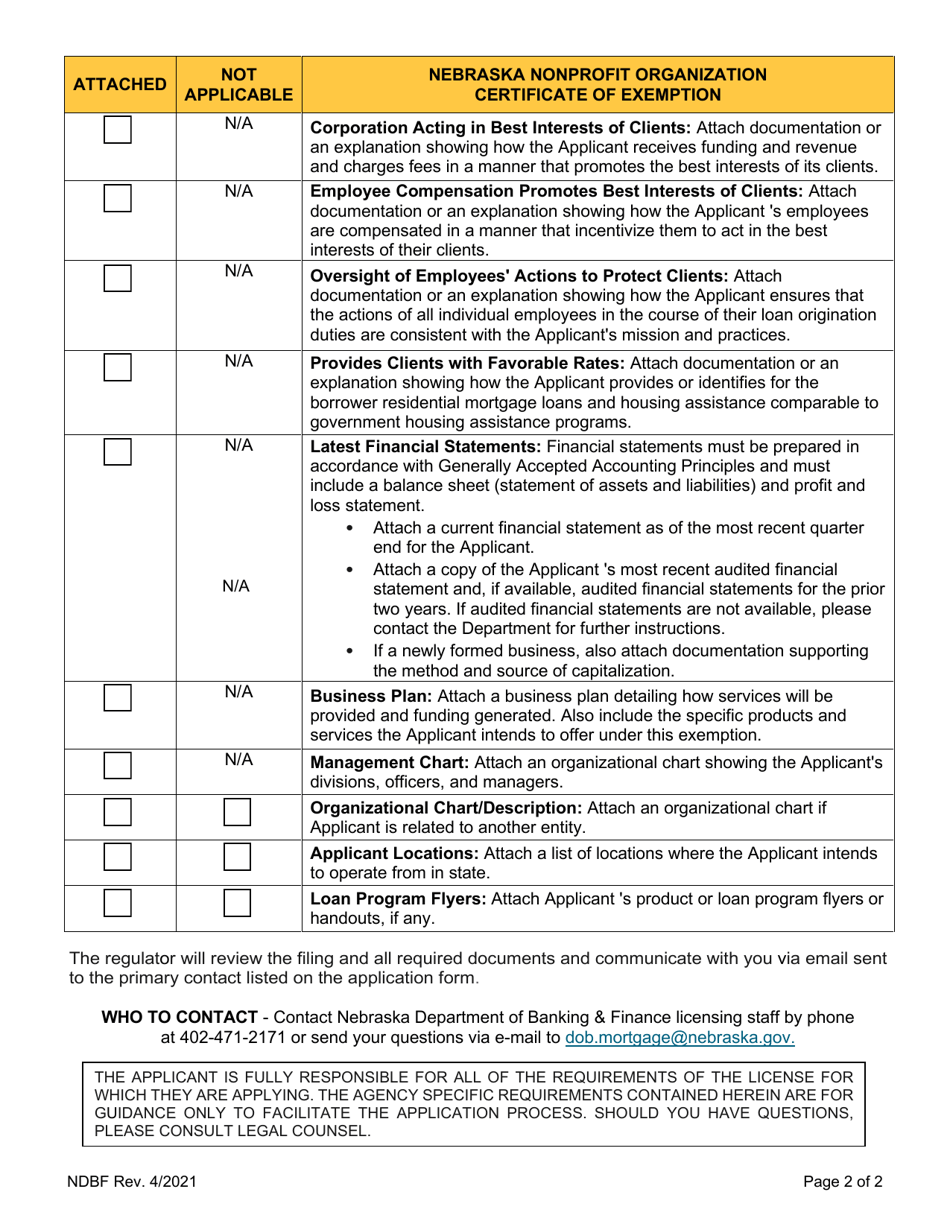

Nebraska Nonprofit Certificate of Exemption Checklist is a legal document that was released by the Nebraska Department of Banking and Finance - a government authority operating within Nebraska.

FAQ

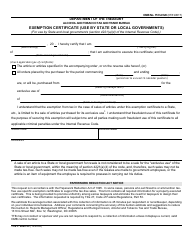

Q: What is a Nebraska Nonprofit Certificate of Exemption?

A: The Nebraska Nonprofit Certificate of Exemption is a document that allows nonprofit organizations in Nebraska to be exempt from certain taxes.

Q: What taxes are exempted with the Nebraska Nonprofit Certificate of Exemption?

A: Nonprofit organizations with this certificate are exempt from Nebraska sales and use taxes.

Q: Which organizations are eligible for the Nebraska Nonprofit Certificate of Exemption?

A: Nonprofit organizations that have been granted tax-exempt status by the Internal Revenue Service (IRS) are eligible to apply for this certificate.

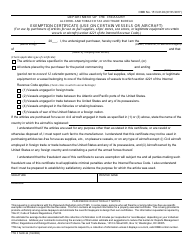

Q: How can a nonprofit organization apply for the Nebraska Nonprofit Certificate of Exemption?

A: To apply, nonprofits must complete and submit Form 13, the Nebraska Application for Sales/Use Tax Exemption, along with any required documentation.

Q: Is there a fee for the Nebraska Nonprofit Certificate of Exemption?

A: No, there is no fee to apply for or obtain this certificate.

Q: How long does it take to receive the Nebraska Nonprofit Certificate of Exemption?

A: The processing time is typically 4-6 weeks, but it may take longer during peak periods.

Q: Is the Nebraska Nonprofit Certificate of Exemption permanent?

A: No, the certificate is valid for 5 years, after which organizations must reapply to maintain their exempt status.

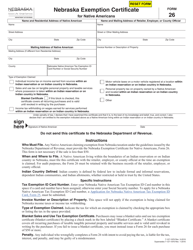

Q: What should a nonprofit organization do if there are changes to their exempt status or contact information?

A: Nonprofits must notify the Nebraska Department of Revenue within 30 days of any changes to their exempt status or contact information.

Q: What happens if a nonprofit organization uses the Nebraska Nonprofit Certificate of Exemption for non-exempt purchases?

A: If a nonprofit organization uses the certificate for non-exempt purchases, they may be subject to penalties or fines.

Form Details:

- Released on April 1, 2021;

- The latest edition currently provided by the Nebraska Department of Banking and Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Banking and Finance.