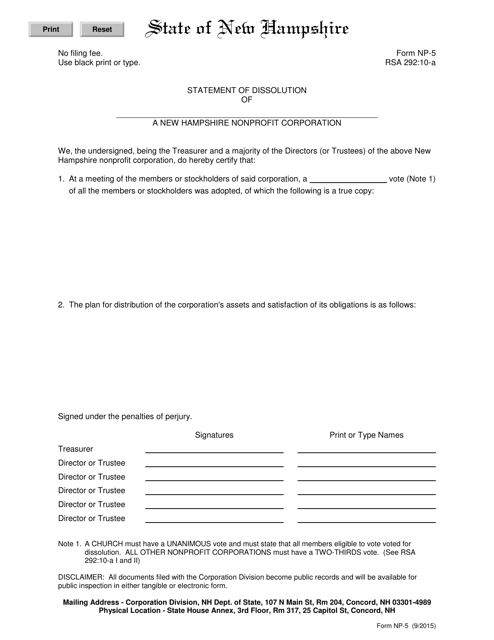

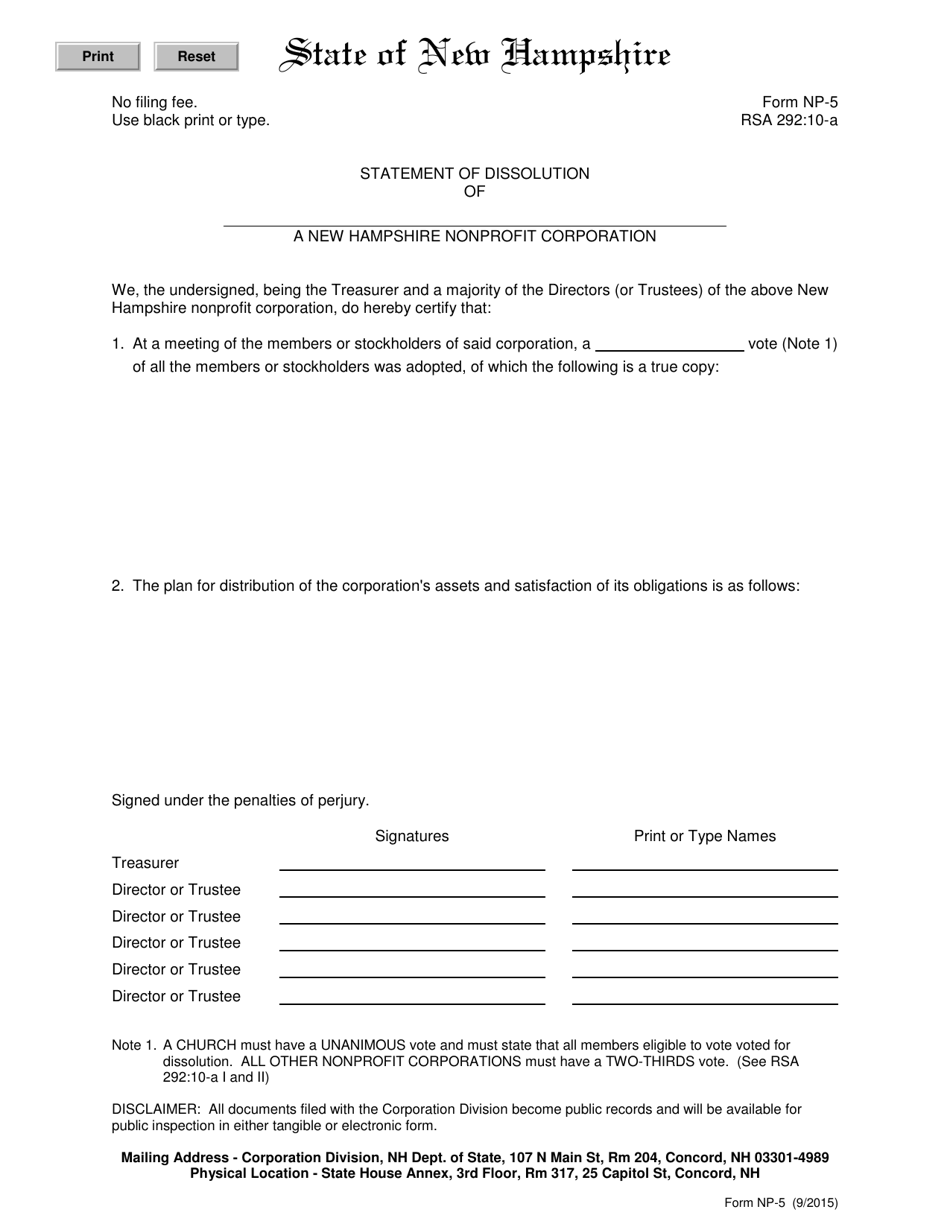

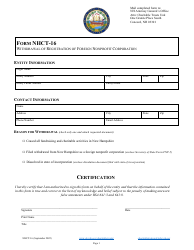

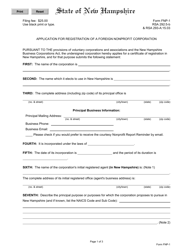

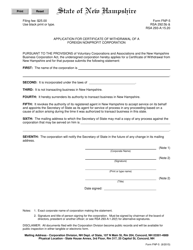

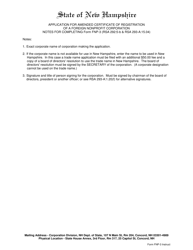

Form NP-5 Statement of Dissolution of a New Hampshire Nonprofit Corporation - New Hampshire

What Is Form NP-5?

This is a legal form that was released by the New Hampshire Secretary of State - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NP-5?

A: Form NP-5 is a statement of dissolution for a New Hampshire nonprofit corporation.

Q: What is a nonprofit corporation?

A: A nonprofit corporation is an organization structured for purposes other than earning profits.

Q: When should Form NP-5 be filed?

A: Form NP-5 should be filed when a New Hampshire nonprofit corporation is being dissolved.

Q: What information is required on Form NP-5?

A: Form NP-5 requires basic information about the nonprofit corporation, including its name, date of incorporation, and reason for dissolution.

Q: What are the consequences of not filing Form NP-5?

A: If Form NP-5 is not filed, the nonprofit corporation may continue to exist and be subject to certain legal obligations.

Q: Is legal assistance recommended when filing Form NP-5?

A: While not required, it is recommended to seek legal assistance when filing Form NP-5 to ensure compliance with all applicable regulations.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the New Hampshire Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NP-5 by clicking the link below or browse more documents and templates provided by the New Hampshire Secretary of State.