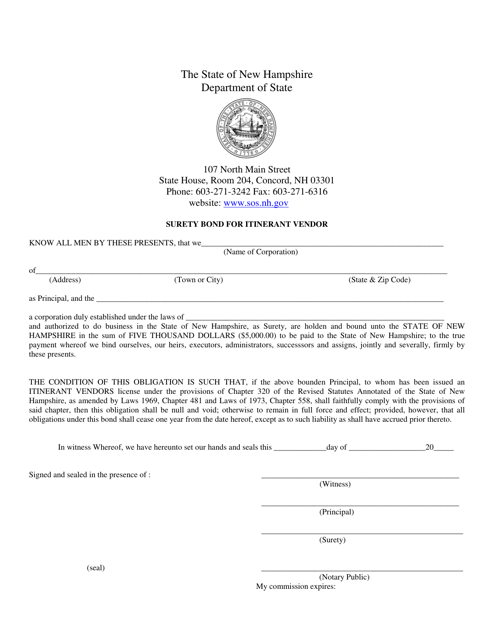

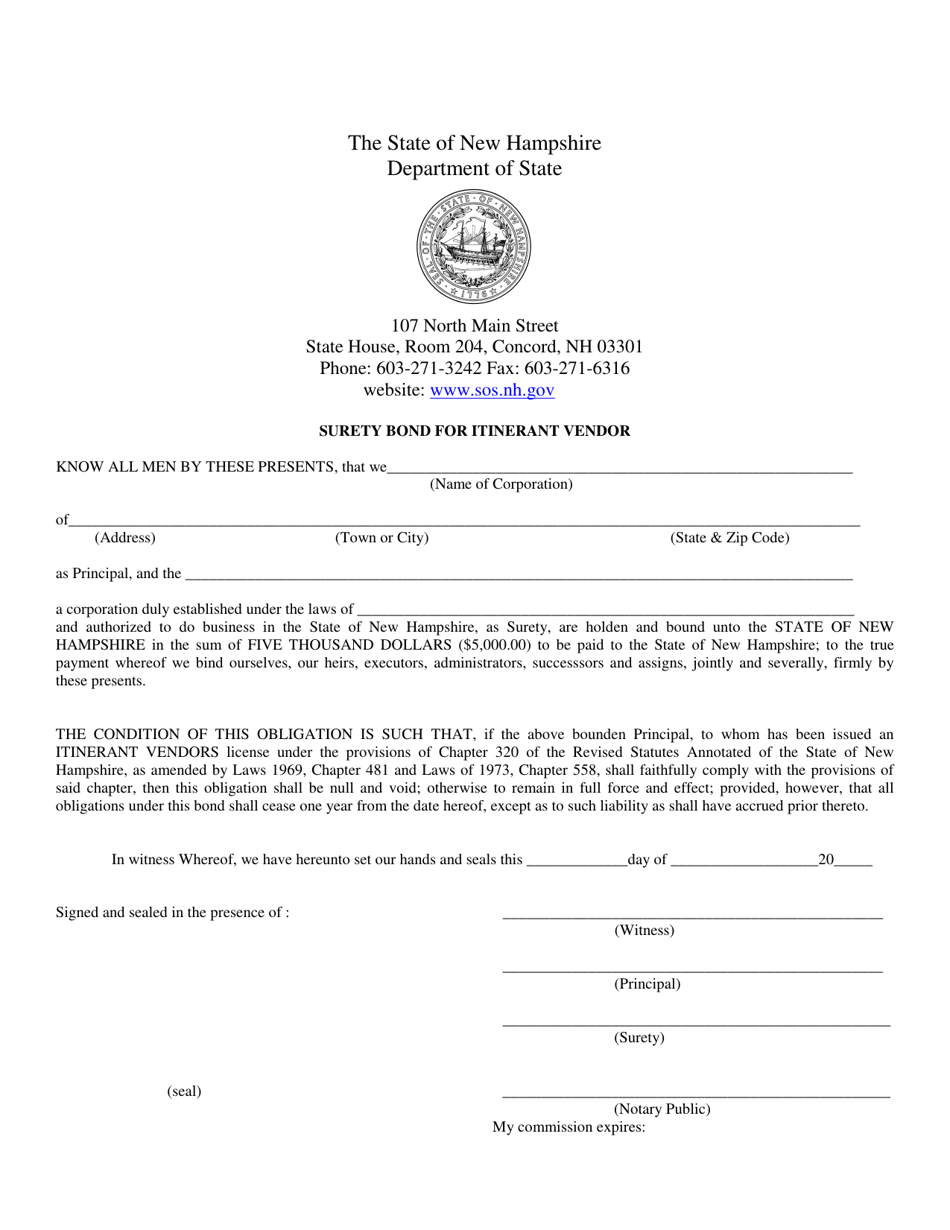

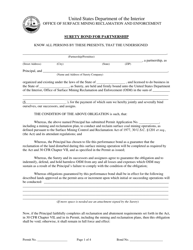

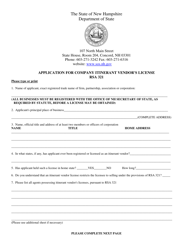

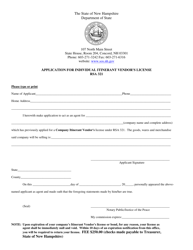

Surety Bond for Itinerant Vendor - New Hampshire

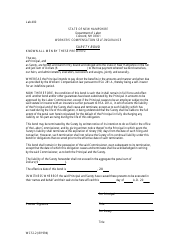

Surety Bond for Itinerant Vendor is a legal document that was released by the New Hampshire Secretary of State - a government authority operating within New Hampshire.

FAQ

Q: What is a surety bond for an itinerant vendor?

A: A surety bond for an itinerant vendor is a type of financial guarantee required by the state of New Hampshire for individuals or businesses that engage in temporary or mobile sales activities.

Q: Why do I need a surety bond as an itinerant vendor in New Hampshire?

A: New Hampshire requires itinerant vendors to obtain a surety bond as a form of consumer protection. The bond helps ensure that vendors fulfill their contractual obligations and provide compensation for any potential damages or financial losses to consumers.

Q: How does a surety bond for an itinerant vendor work?

A: If a consumer suffers a loss due to the actions of an itinerant vendor, they can file a claim against the vendor's surety bond. If the claim is valid, the surety company will compensate the consumer up to the bond amount. The vendor is then responsible for reimbursing the surety company.

Q: How much does a surety bond for an itinerant vendor cost in New Hampshire?

A: The cost of a surety bond for an itinerant vendor in New Hampshire depends on various factors, including the bond amount required by the state and the vendor's creditworthiness. Generally, vendors can expect to pay a percentage of the bond amount as the premium.

Q: How long does a surety bond for an itinerant vendor in New Hampshire remain valid?

A: The duration of a surety bond for an itinerant vendor in New Hampshire is typically one year. Vendors are required to renew their bond annually to maintain compliance with state regulations.

Q: Are there any alternatives to a surety bond for itinerant vendors in New Hampshire?

A: Yes, New Hampshire allows itinerant vendors to provide alternative forms of security, such as cash or an irrevocable letter of credit, instead of a surety bond. However, these options may have their own requirements and limitations.

Q: What happens if I don't get a surety bond as an itinerant vendor in New Hampshire?

A: Failure to obtain a required surety bond as an itinerant vendor in New Hampshire can result in fines, penalties, and even the inability to legally conduct sales activities in the state. It's essential to comply with all licensing and bonding requirements to avoid legal consequences.

Form Details:

- The latest edition currently provided by the New Hampshire Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Secretary of State.