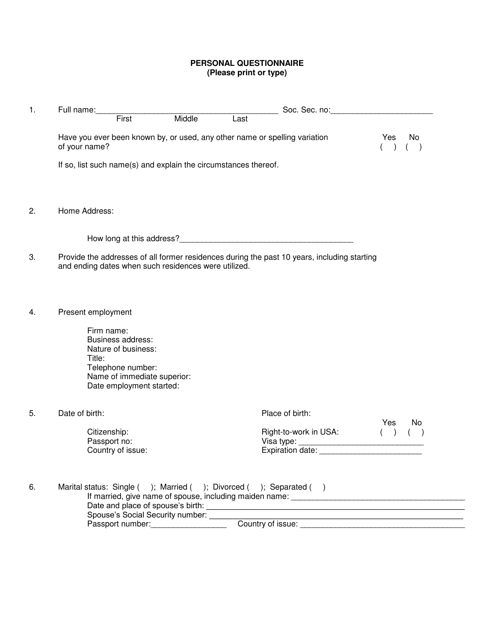

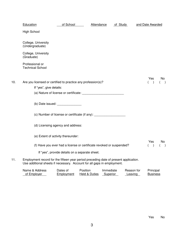

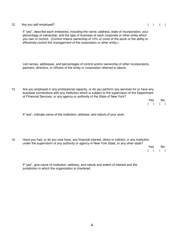

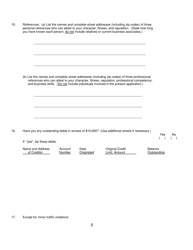

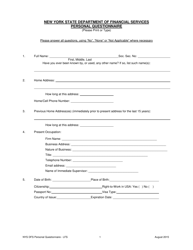

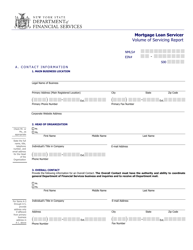

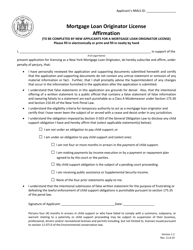

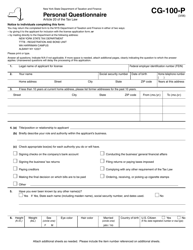

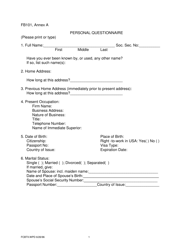

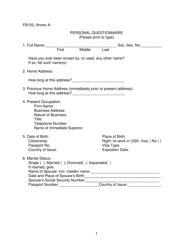

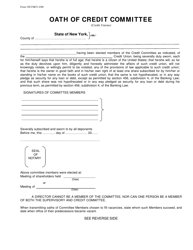

Personal Questionnaire - Credit Unions - New York

Personal Questionnaire - Credit Unions is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

Q: What is a credit union?

A: A credit union is a non-profit financial institution owned and operated by its members.

Q: How do credit unions differ from banks?

A: Credit unions are member-owned, while banks are owned by shareholders.

Q: Can anyone join a credit union?

A: Most credit unions have eligibility requirements, such as working for a specific employer or living in a particular area.

Q: What services do credit unions offer?

A: Credit unions offer a range of financial services, including savings accounts, loans, and credit cards.

Q: Are credit union deposits insured?

A: Yes, deposits at credit unions are typically insured up to $250,000 by the National Credit Union Administration (NCUA).

Q: What are the advantages of banking with a credit union?

A: Credit unions often offer lower fees and better interest rates compared to traditional banks.

Q: Are there any disadvantages to using a credit union?

A: Credit unions may have fewer physical branches and ATMs compared to larger banks.

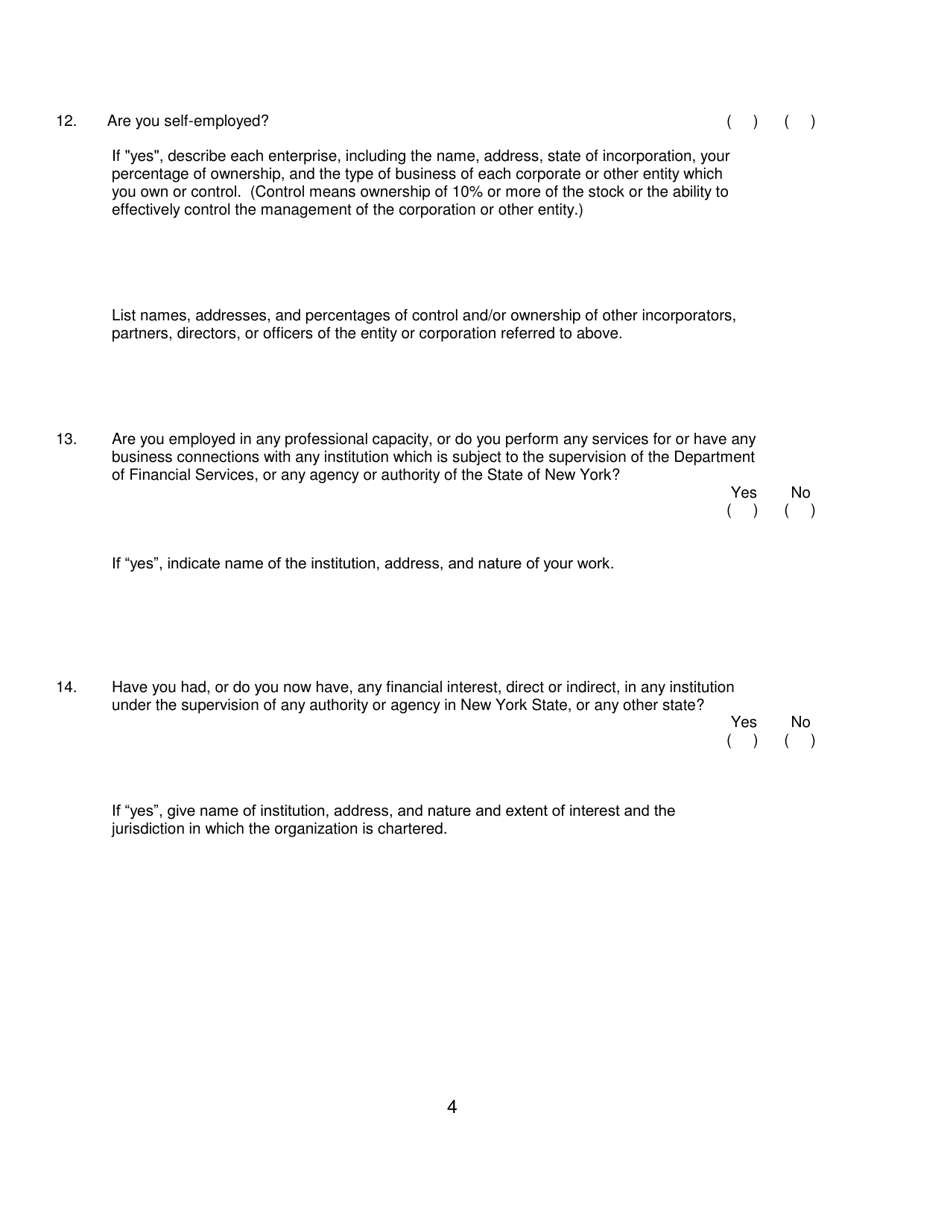

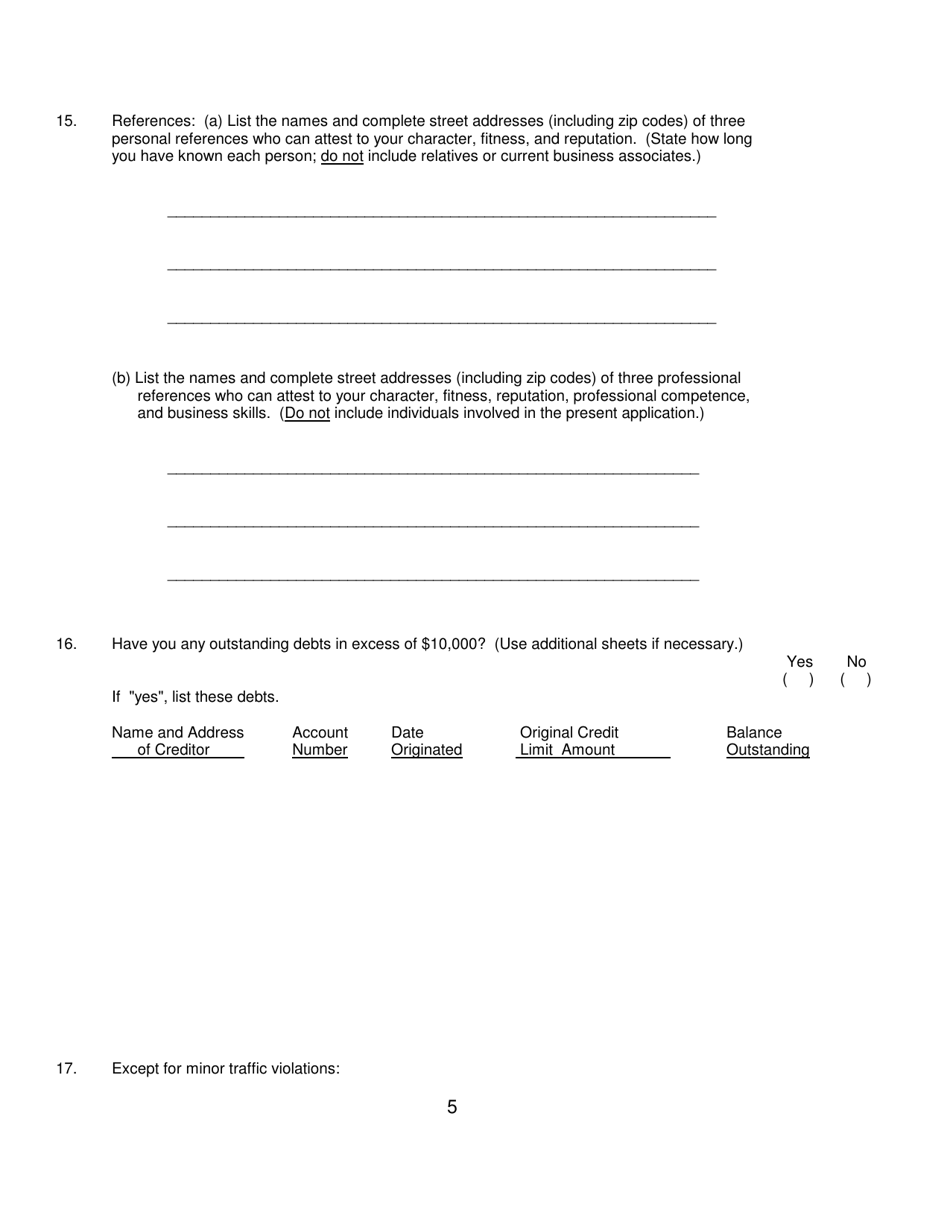

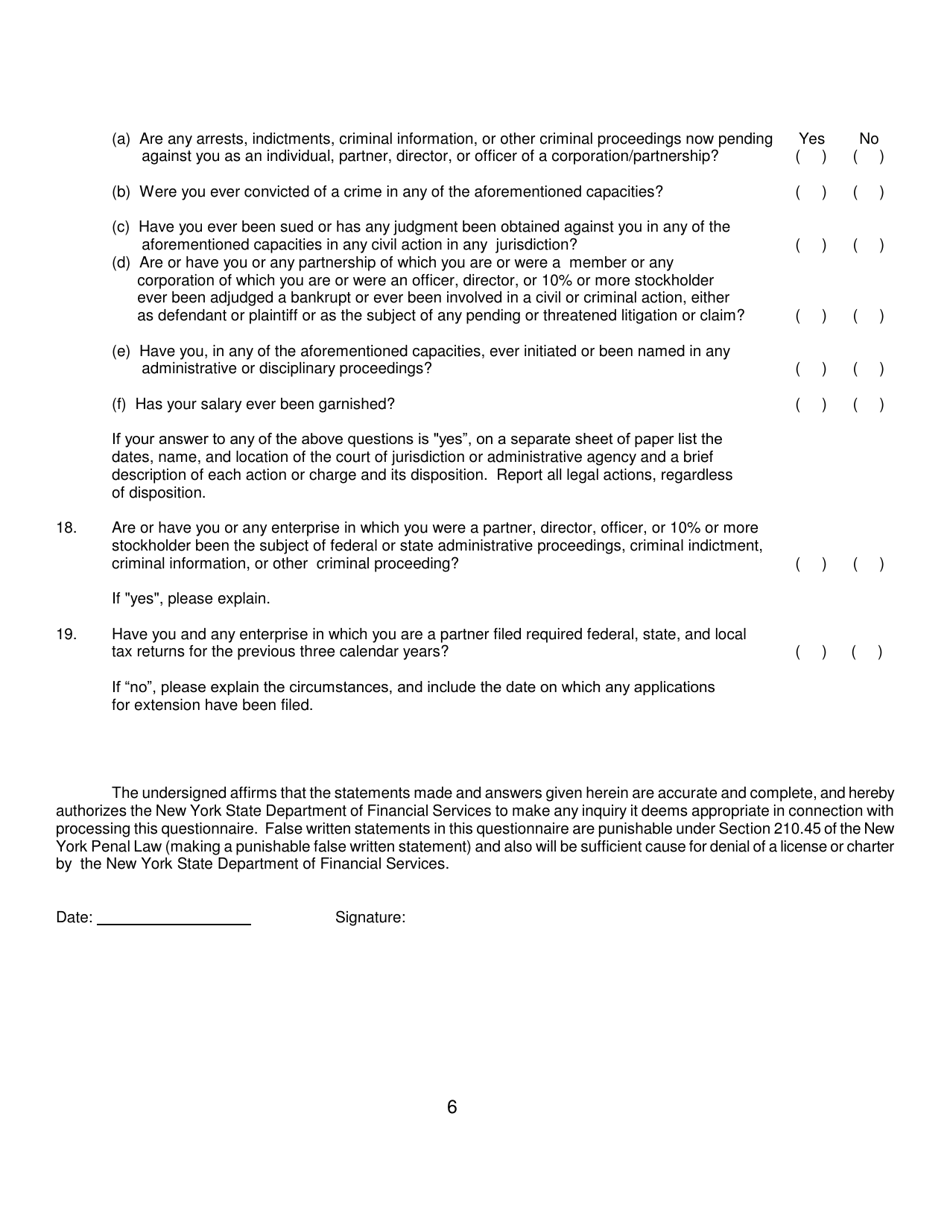

Form Details:

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.