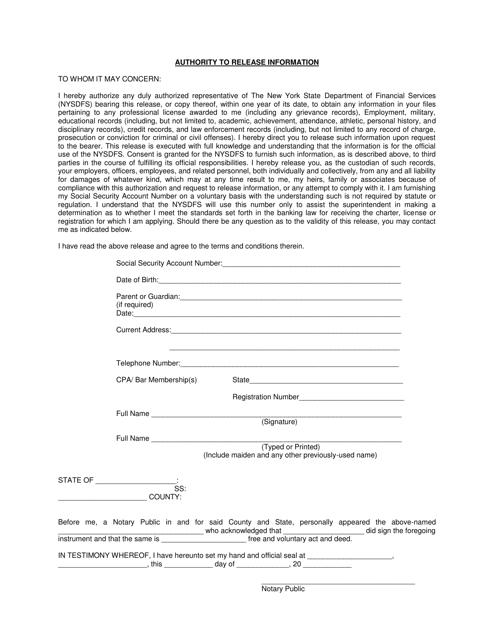

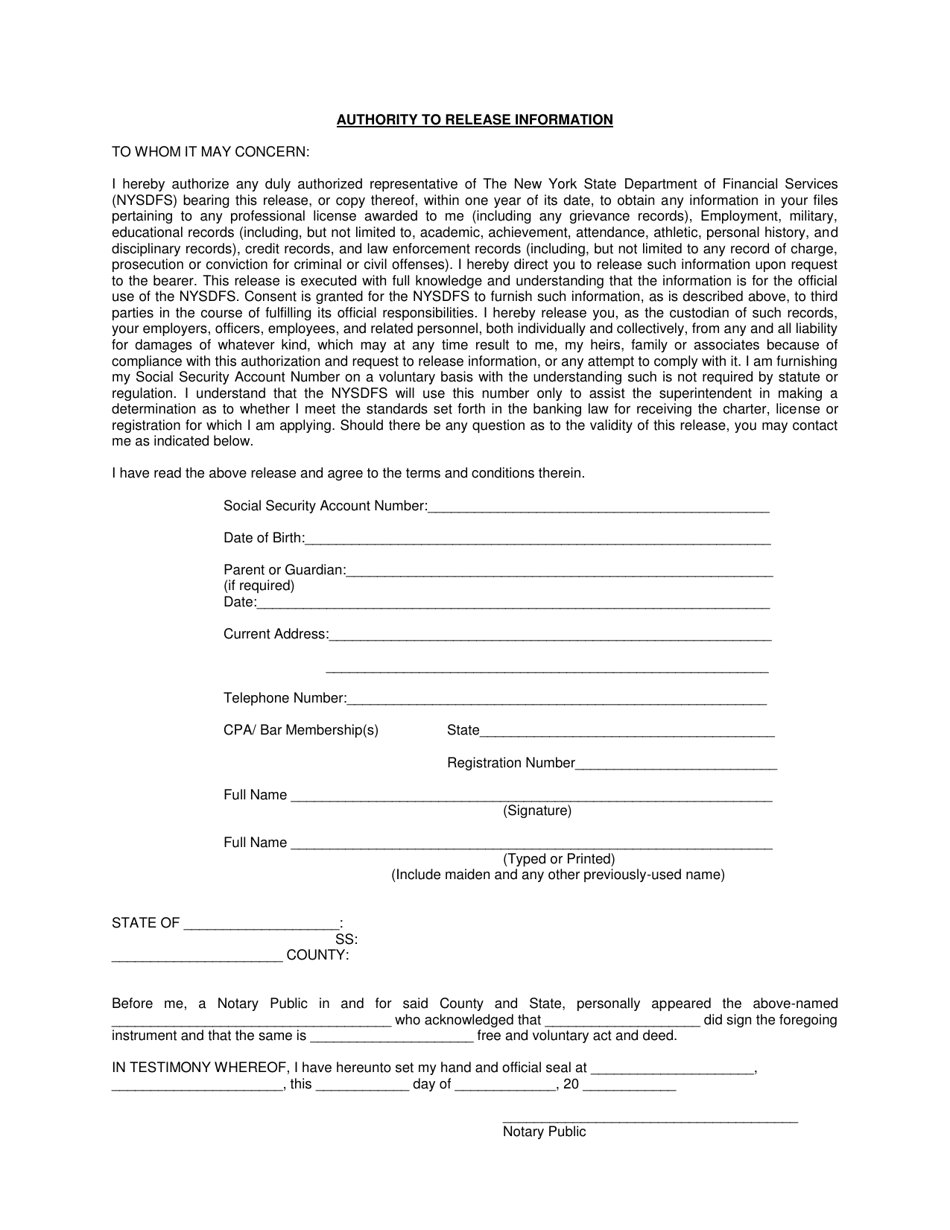

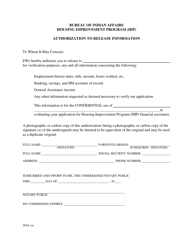

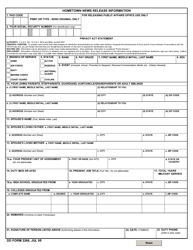

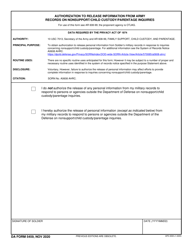

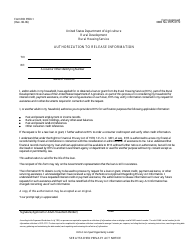

Authority to Release Information - Credit Unions - New York

Authority to Release Information - Credit Unions is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

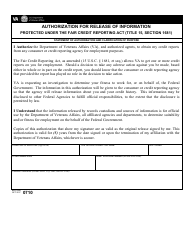

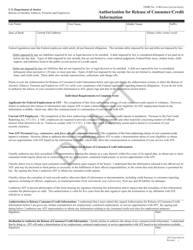

Q: What is the Authority to Release Information?

A: The Authority to Release Information is a legal document that allows credit unions in New York to share member information with third parties.

Q: Why do credit unions need the Authority to Release Information?

A: Credit unions need the Authority to Release Information to comply with federal and state privacy laws and regulations.

Q: What kind of information can credit unions share with third parties?

A: Credit unions can share member information such as account balances, transaction history, and personal identification information with third parties with the member's consent.

Q: Do credit unions need the member's consent to share information?

A: Yes, credit unions need the member's written consent to share information with third parties.

Q: Is the member's information safe when shared with third parties?

A: Credit unions have a responsibility to ensure that third parties adequately protect and secure the member's information.

Q: Can members revoke their consent to share information?

A: Yes, members can revoke their consent to share information by notifying the credit union in writing.

Q: Are credit unions required to inform members about information sharing practices?

A: Yes, credit unions are required to provide members with a privacy notice that explains their information sharing practices.

Q: What should I do if I have concerns about my information being shared by a credit union?

A: If you have concerns about your information being shared by a credit union, you should contact the credit union directly and inquire about their privacy policies and practices.

Form Details:

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.