This version of the form is not currently in use and is provided for reference only. Download this version of

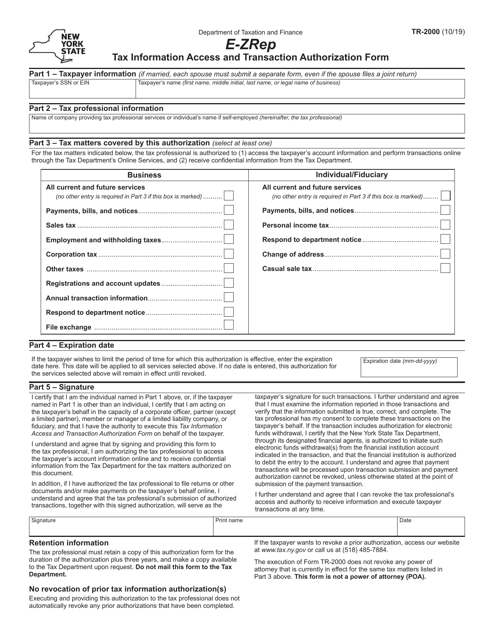

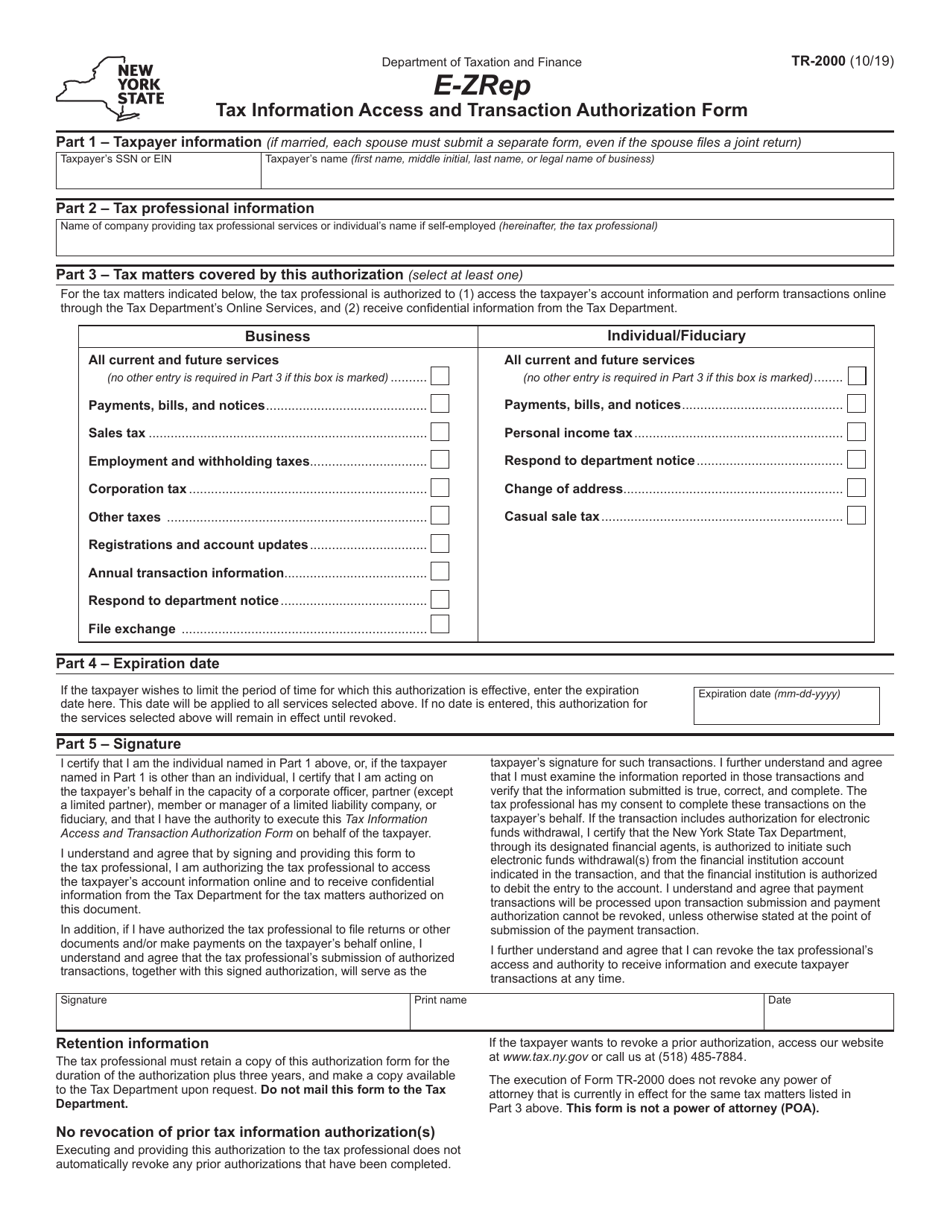

Form TR-2000

for the current year.

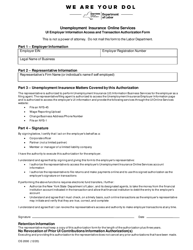

Form TR-2000 E-Zrep Tax Information Access and Transaction Authorization Form - New York

What Is Form TR-2000?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TR-2000 E-Zrep form?

A: The TR-2000 E-Zrep form is a tax information access and transaction authorization form in New York.

Q: What is the purpose of the TR-2000 E-Zrep form?

A: The purpose of the TR-2000 E-Zrep form is to authorize access to tax information and perform transactions on behalf of the taxpayer.

Q: Who can use the TR-2000 E-Zrep form?

A: The TR-2000 E-Zrep form can be used by taxpayers who want to grant someone else access to their tax information and authorize them to perform transactions on their behalf.

Q: What information is required on the TR-2000 E-Zrep form?

A: The TR-2000 E-Zrep form requires various personal and contact information of the taxpayer and the authorized representative.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-2000 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.