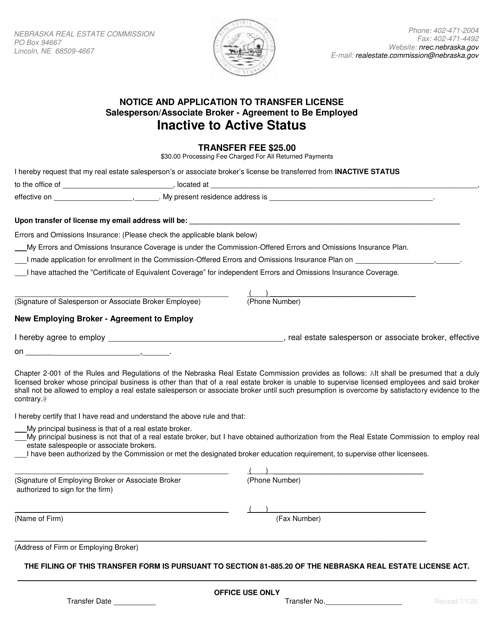

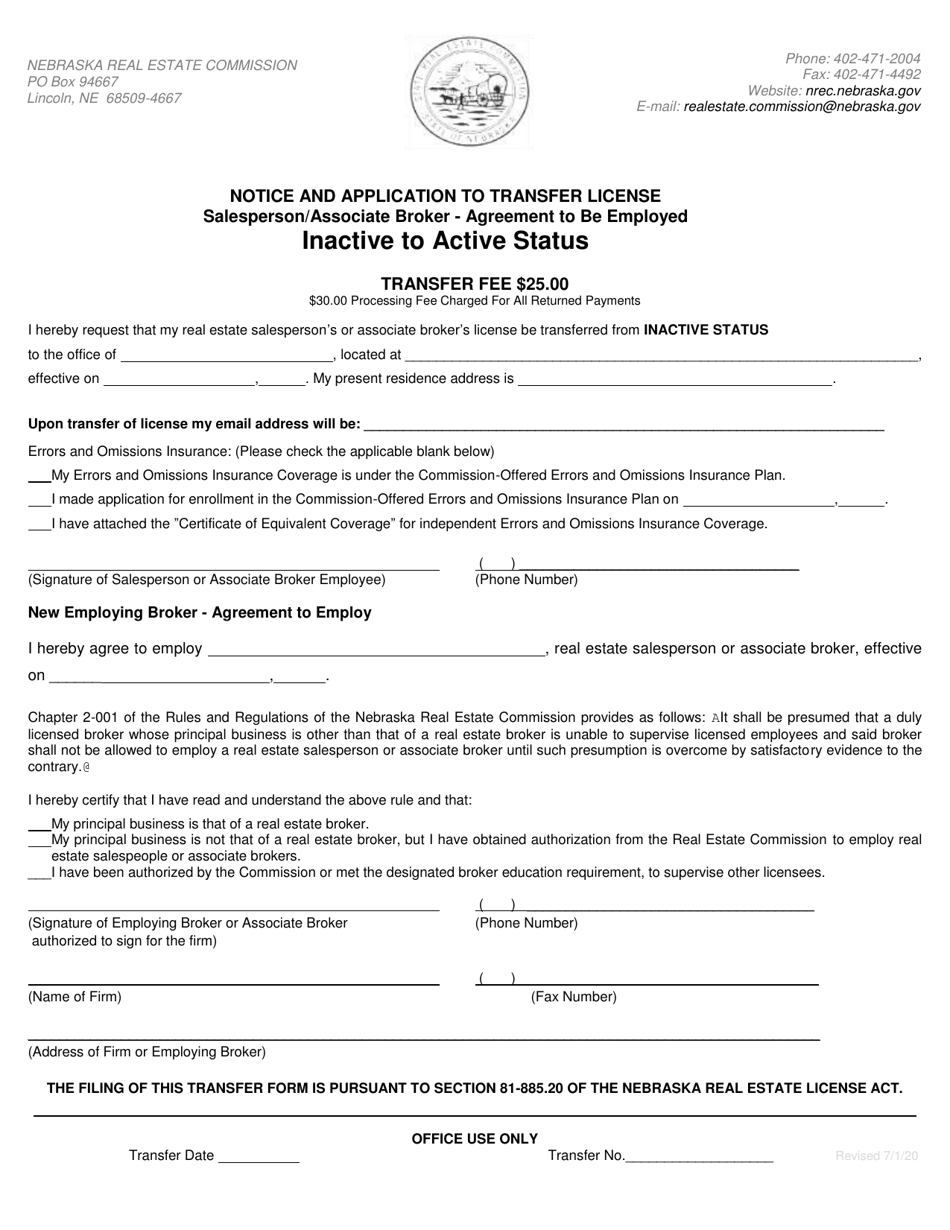

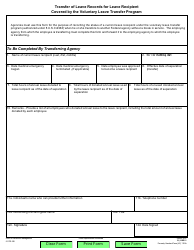

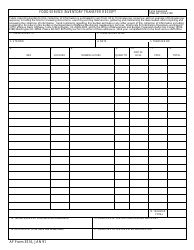

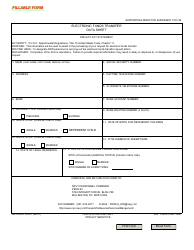

Transfer Form (From Inactive to Active Status) - Nebraska

Transfer Form (From Inactive to Active Status) is a legal document that was released by the Nebraska Real Estate Commission - a government authority operating within Nebraska.

FAQ

Q: What is the Transfer Form?

A: The Transfer Form is a document used in Nebraska to change a business entity's status from inactive to active.

Q: Why would a business entity need to use the Transfer Form?

A: A business entity may need to use the Transfer Form to resume operations after being in an inactive status.

Q: What information is required on the Transfer Form?

A: The Transfer Form typically requires the business entity's name, identification number, and the reason for the transfer to active status.

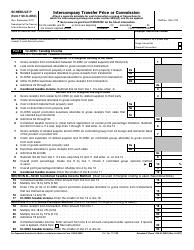

Q: Is there a fee to file the Transfer Form?

A: Yes, there is a fee associated with filing the Transfer Form. The fee varies depending on the type of business entity.

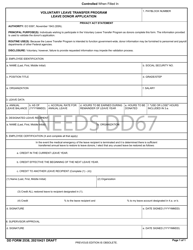

Q: How long does it take to process the Transfer Form?

A: The processing time for the Transfer Form can vary. It is recommended to contact the Nebraska Secretary of State's office for specific information regarding processing times.

Q: Are there any other requirements to transfer a business entity from inactive to active status?

A: In addition to filing the Transfer Form, there may be other requirements such as updating any necessary registrations or licenses.

Q: Can I transfer a business entity to active status if it has outstanding tax liabilities?

A: It is important to address any outstanding tax liabilities before transferring a business entity to active status. Contact the Nebraska Department of Revenue for guidance on resolving tax issues.

Q: What should I do if I have additional questions about the Transfer Form?

A: If you have additional questions about the Transfer Form, it is recommended to contact the Nebraska Secretary of State's office for clarification and guidance.

Form Details:

- Released on July 1, 2020;

- The latest edition currently provided by the Nebraska Real Estate Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Real Estate Commission.