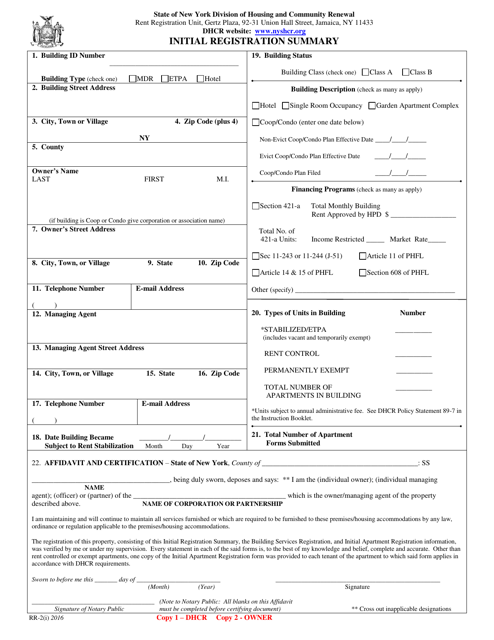

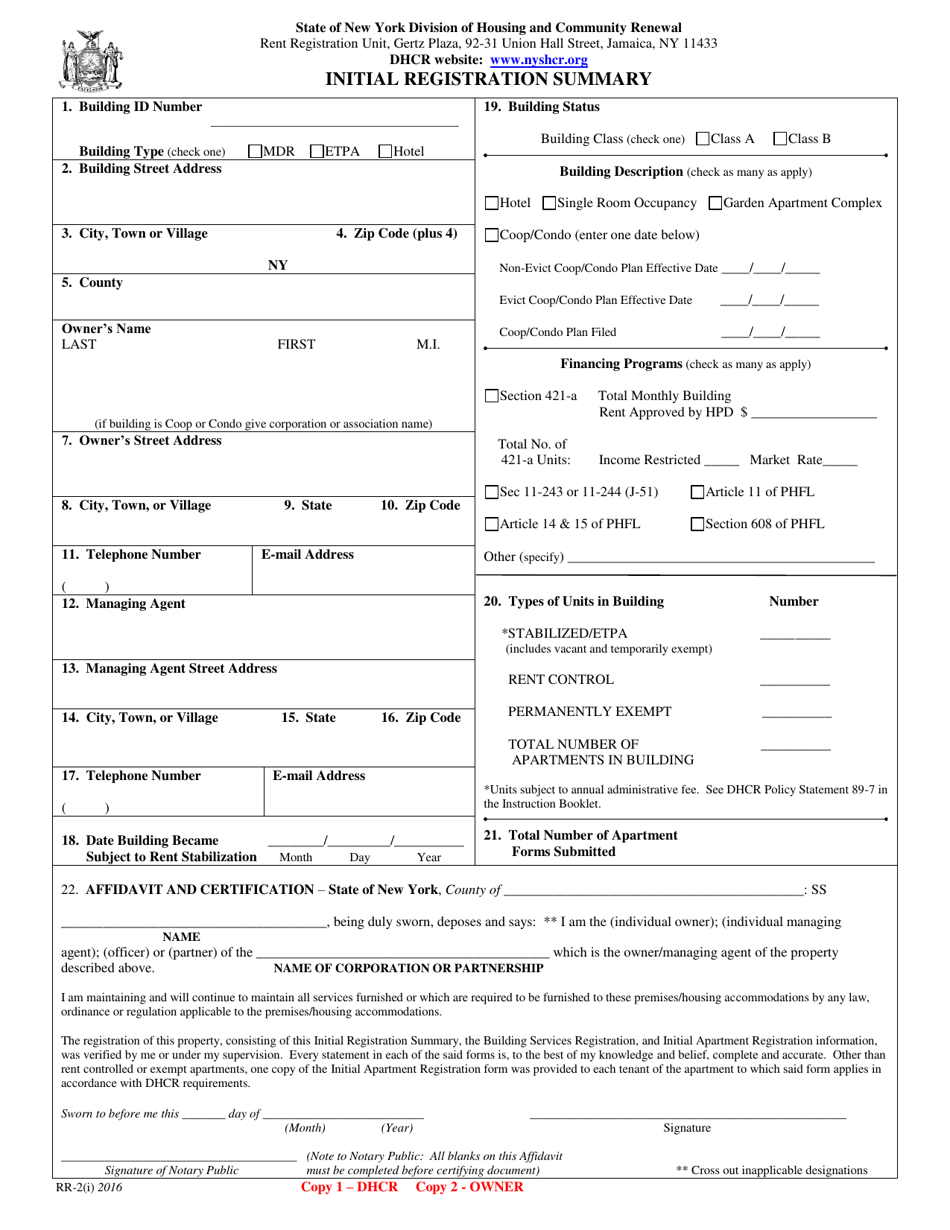

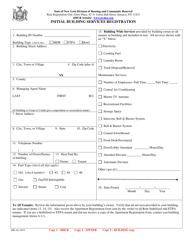

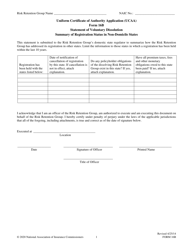

Form RR-2(I) Initial Registration Summary - New York

What Is Form RR-2(I)?

This is a legal form that was released by the New York State Homes and Community Renewal - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RR-2(I)?

A: Form RR-2(I) is the Initial Registration Summary form used in New York.

Q: Who needs to file Form RR-2(I)?

A: New York businesses engaged in interstate or international commerce need to file Form RR-2(I).

Q: What information is required on Form RR-2(I)?

A: Form RR-2(I) requires information such as the business name, address, legal structure, and types of activities.

Q: When is Form RR-2(I) due?

A: Form RR-2(I) is due within 30 days of commencing business activities in New York.

Q: Are there any fees associated with filing Form RR-2(I)?

A: Yes, there is a filing fee of $50 when submitting Form RR-2(I).

Q: Are there any penalties for not filing Form RR-2(I)?

A: Yes, failure to file Form RR-2(I) may result in penalties such as fines and the inability to maintain a legal business status in New York.

Q: Is Form RR-2(I) required for all types of businesses?

A: No, Form RR-2(I) is only required for businesses engaged in interstate or international commerce.

Q: Can I use Form RR-2(I) for multiple businesses?

A: No, each business needs to file a separate Form RR-2(I) with the required information.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the New York State Homes and Community Renewal;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RR-2(I) by clicking the link below or browse more documents and templates provided by the New York State Homes and Community Renewal.