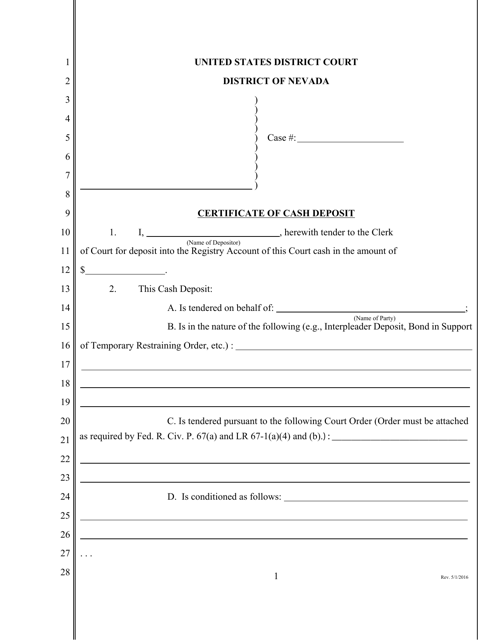

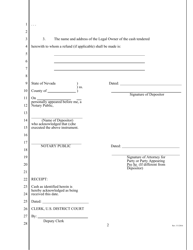

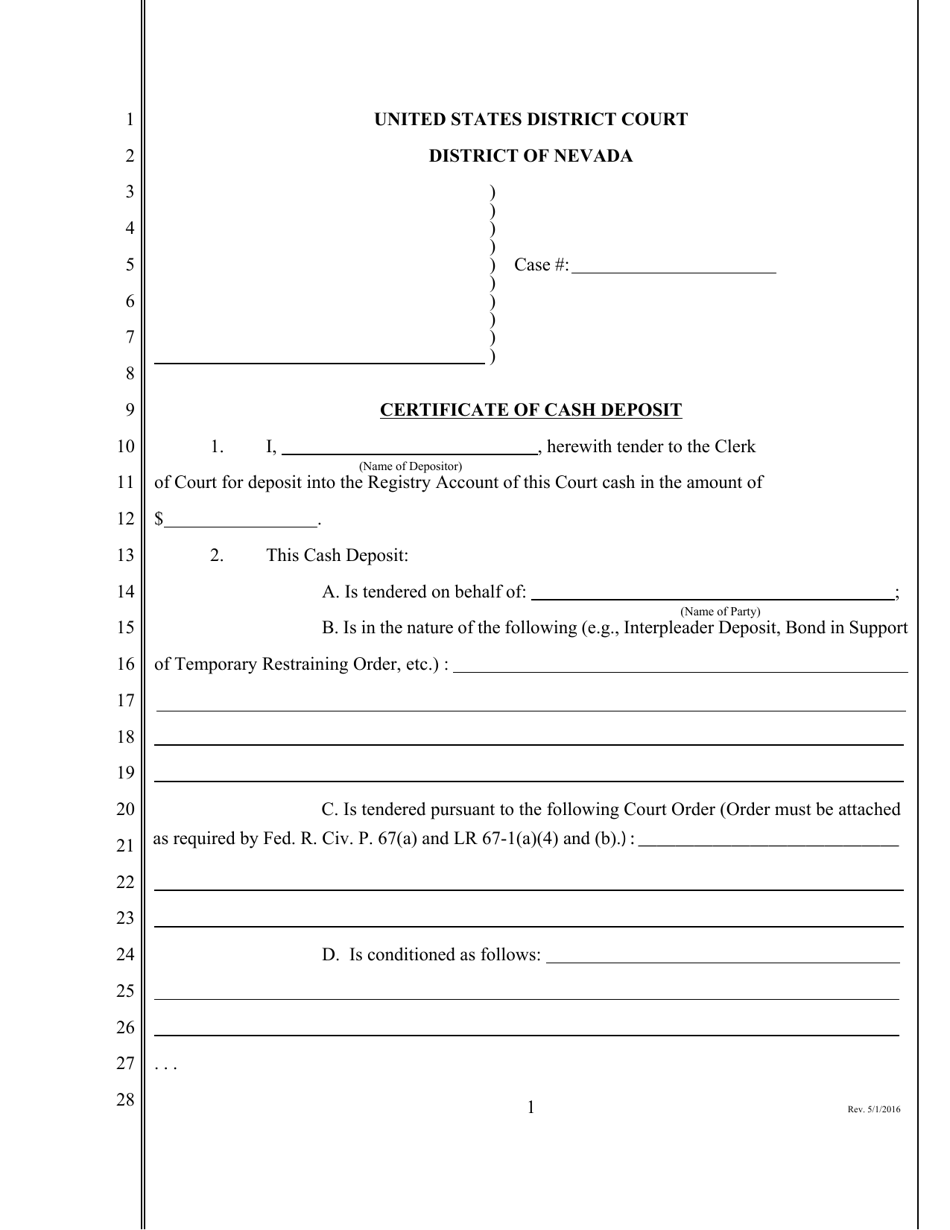

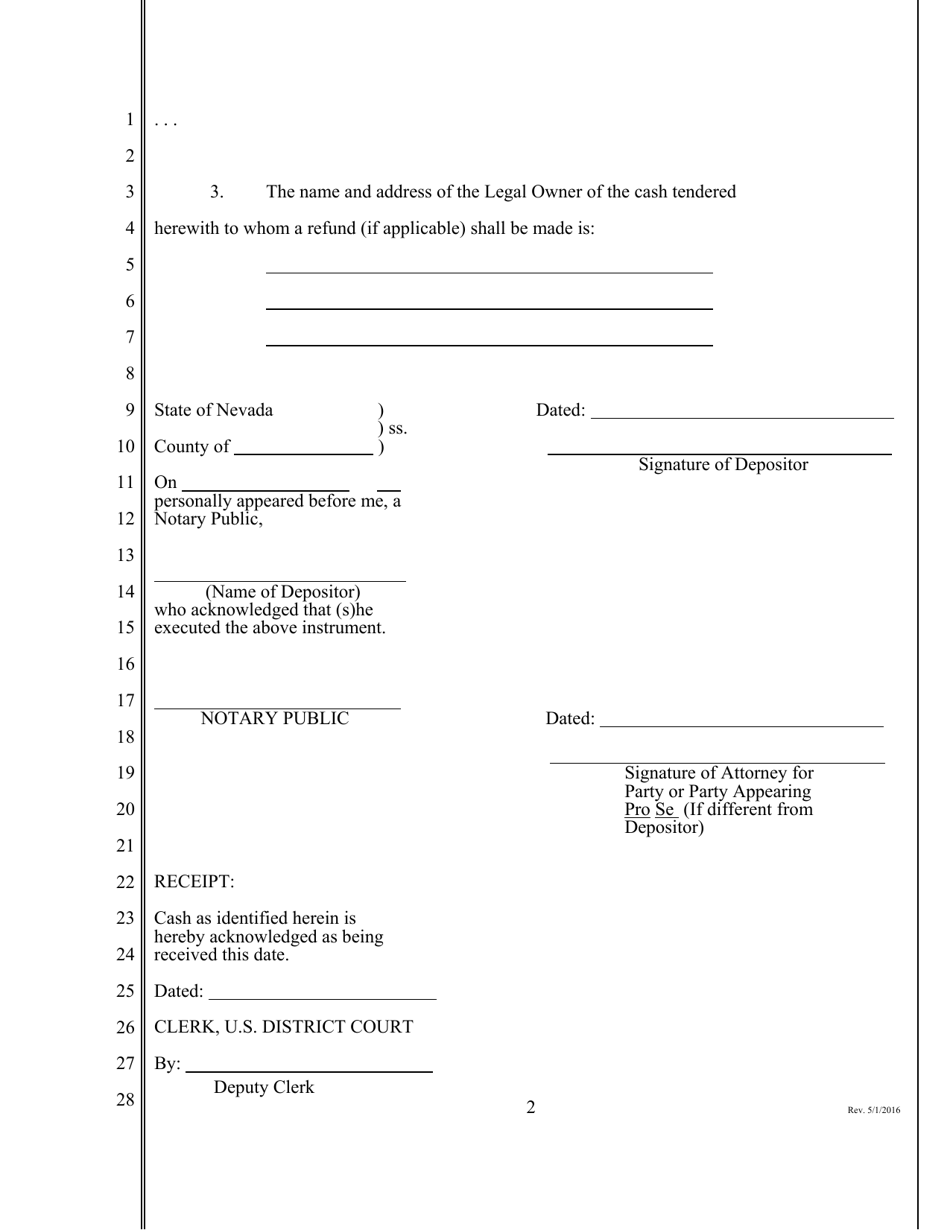

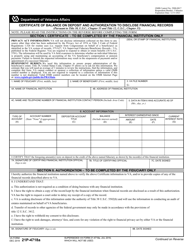

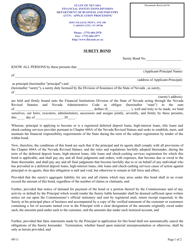

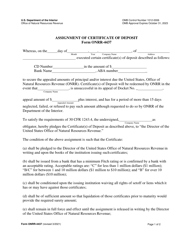

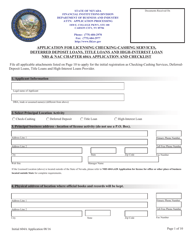

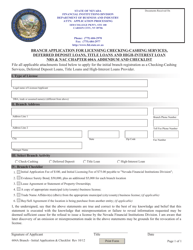

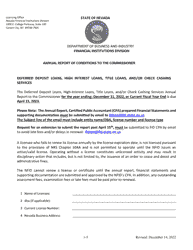

Certificate of Cash Deposit - Nevada

Certificate of Cash Deposit is a legal document that was released by the United States District Court for the District of Nevada - a government authority operating within Nevada.

FAQ

Q: What is a Certificate of Cash Deposit?

A: A Certificate of Cash Deposit is a document issued by a financial institution to confirm that a specific amount of money has been deposited and is held on deposit for a certain period of time.

Q: Who can issue a Certificate of Cash Deposit?

A: A Certificate of Cash Deposit is typically issued by a bank or other financial institution.

Q: What is the purpose of a Certificate of Cash Deposit?

A: The purpose of a Certificate of Cash Deposit is to provide evidence of a cash deposit and to specify the terms of the deposit, including the amount, interest rate, and duration of the deposit.

Q: What are the benefits of a Certificate of Cash Deposit?

A: Some of the benefits of a Certificate of Cash Deposit include earning interest on the deposited funds, having a fixed rate of return, and having the assurance that the funds are held securely by a financial institution.

Q: How long does a Certificate of Cash Deposit typically last?

A: The duration of a Certificate of Cash Deposit can vary, but it is commonly available in terms ranging from a few months to several years.

Q: Is a Certificate of Cash Deposit a safe investment?

A: A Certificate of Cash Deposit is generally considered a safe investment because it is backed by the issuing financial institution and is typically insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor.

Form Details:

- Released on May 1, 2016;

- The latest edition currently provided by the United States District Court for the District of Nevada;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the United States District Court for the District of Nevada.