This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

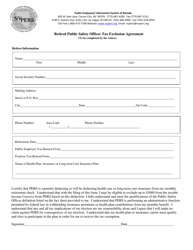

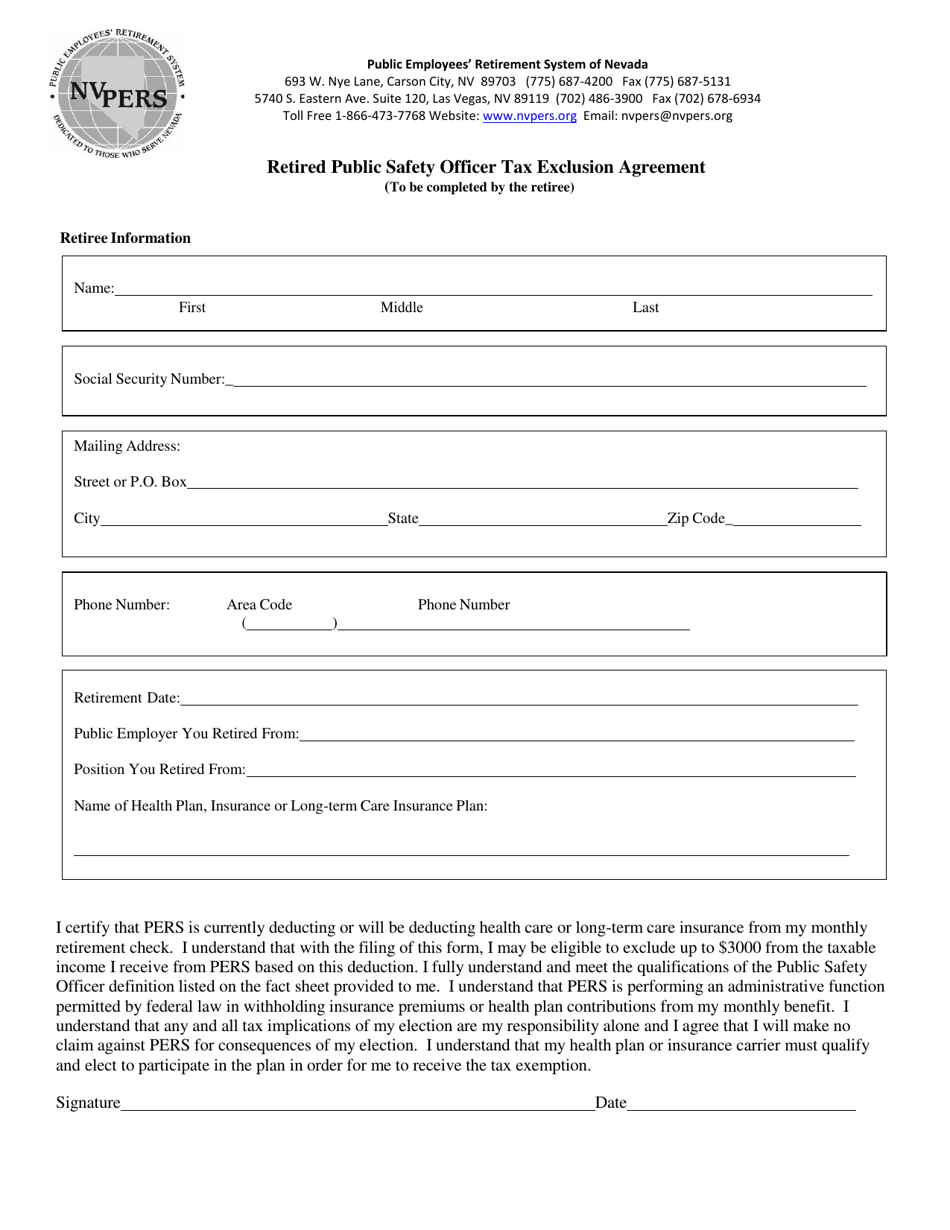

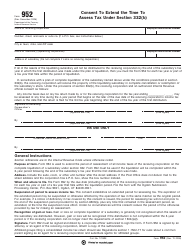

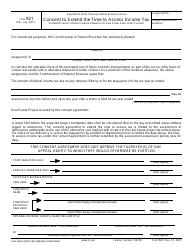

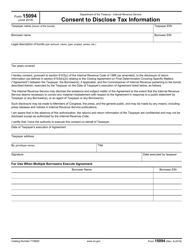

Retired Public Safety Officer Tax Exclusion Agreement - Nevada

Retired Tax Exclusion Agreement is a legal document that was released by the Public Employees’ Retirement System of Nevada - a government authority operating within Nevada.

FAQ

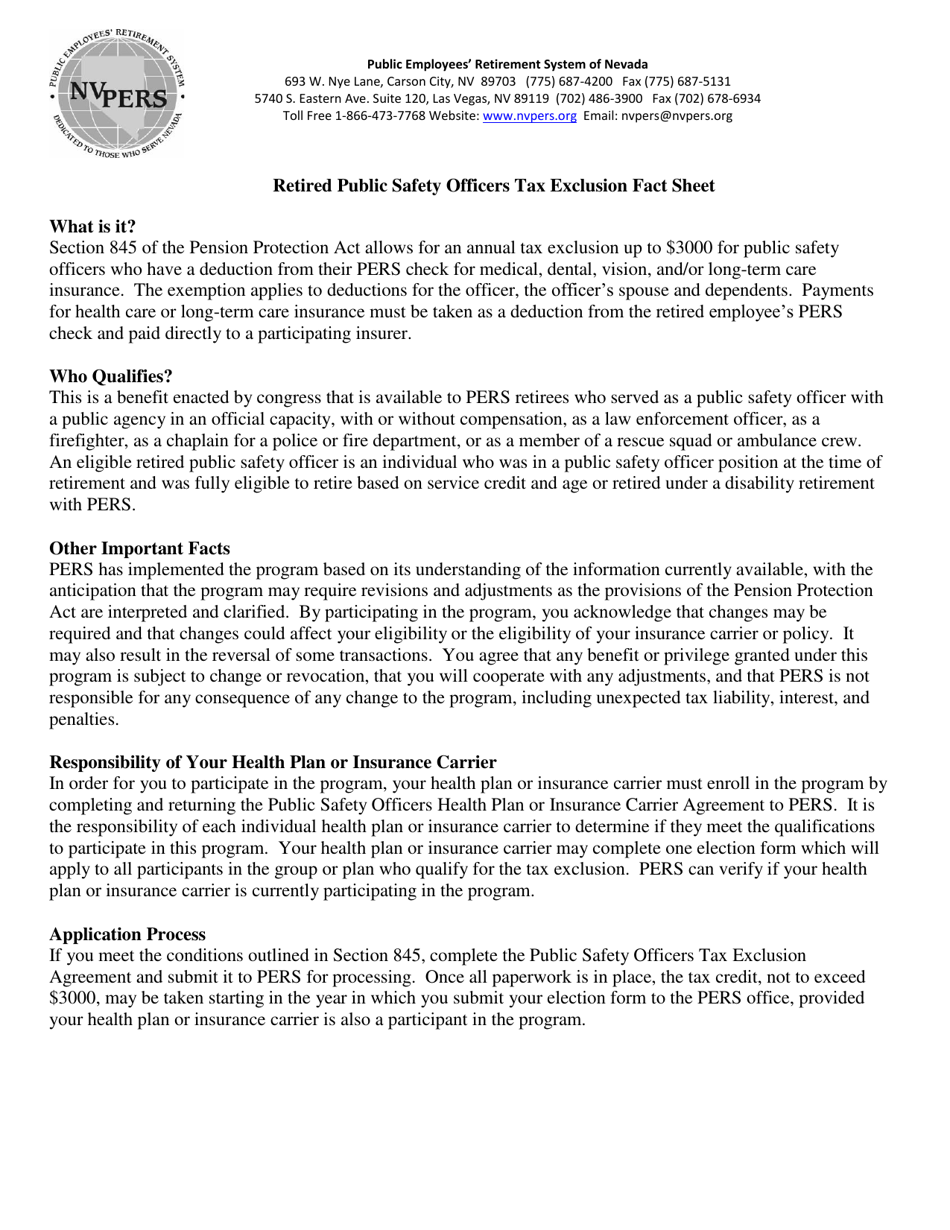

Q: What is the Retired Public Safety Officer Tax Exclusion Agreement in Nevada?

A: The Retired Public Safety Officer Tax Exclusion Agreement in Nevada is a program that provides tax benefits for retired public safety officers.

Q: Who is eligible for the Retired Public Safety Officer Tax Exclusion Agreement in Nevada?

A: Retired public safety officers in the state of Nevada are eligible for the tax exclusion agreement.

Q: What are the tax benefits provided by the Retired Public Safety Officer Tax Exclusion Agreement in Nevada?

A: The tax benefits include a $15,000 exclusion from federal adjusted gross income for retired public safety officers and their surviving spouses.

Q: How do retired public safety officers in Nevada apply for the tax exclusion agreement?

A: Retired public safety officers can apply for the tax exclusion agreement by completing and submitting the necessary forms to the Nevada Department of Taxation.

Q: Are there any requirements to maintain eligibility for the Retired Public Safety Officer Tax Exclusion Agreement in Nevada?

A: To maintain eligibility, retired public safety officers must have served at least 10 years as a public safety officer and meet other specified criteria in the agreement.

Form Details:

- The latest edition currently provided by the Public Employees’ Retirement System of Nevada;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Public Employees’ Retirement System of Nevada.