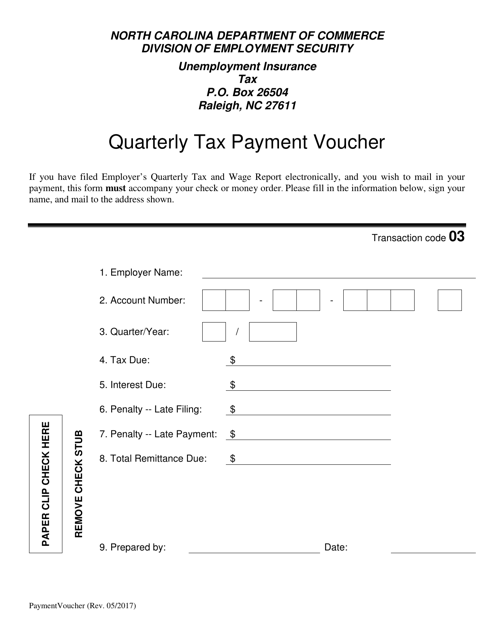

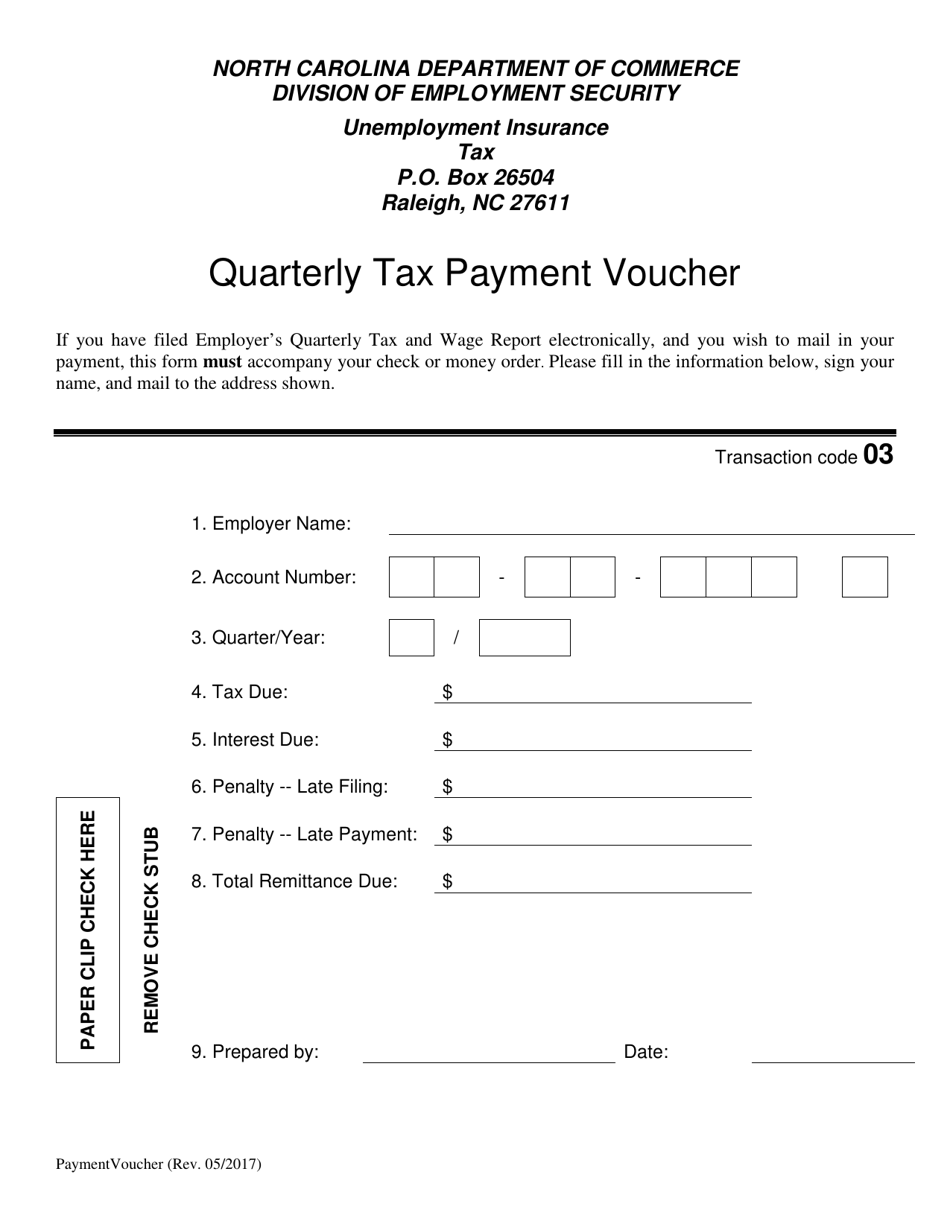

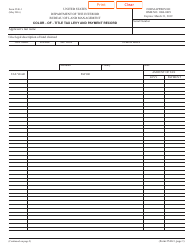

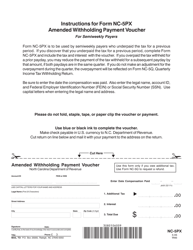

Quarterly Tax Payment Voucher - North Carolina

Quarterly Tax Payment Voucher is a legal document that was released by the North Carolina Department of Commerce - a government authority operating within North Carolina.

FAQ

Q: What is the Quarterly Tax Payment Voucher for?

A: The Quarterly Tax Payment Voucher is used for making tax payments to the state of North Carolina on a quarterly basis.

Q: Who needs to use the Quarterly Tax Payment Voucher?

A: Anyone who is required to make quarterly tax payments to the state of North Carolina needs to use this voucher.

Q: How often do I need to make quarterly tax payments in North Carolina?

A: Quarterly tax payments in North Carolina are due four times a year, in April, June, September, and January.

Q: What taxes can be paid using this voucher?

A: This voucher can be used to pay individual income tax, corporate income tax, and franchise tax.

Q: How do I fill out the Quarterly Tax Payment Voucher?

A: You need to provide your name, address, Social Security number or employer identification number, and the amount of tax due in the appropriate sections of the voucher.

Q: What happens if I don't make my quarterly tax payments?

A: If you fail to make your quarterly tax payments, you may be subject to penalties and interest charges.

Q: Is the Quarterly Tax Payment Voucher only for residents of North Carolina?

A: No, anyone who has a tax liability to the state of North Carolina, whether resident or nonresident, can use this voucher.

Q: Is there a deadline for submitting the Quarterly Tax Payment Voucher?

A: Yes, the voucher must be submitted by the due date specified by the North Carolina Department of Revenue for each quarter.

Form Details:

- Released on May 1, 2017;

- The latest edition currently provided by the North Carolina Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Commerce.