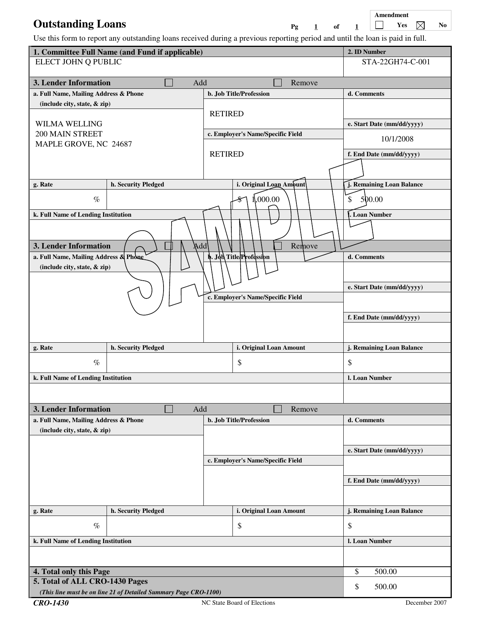

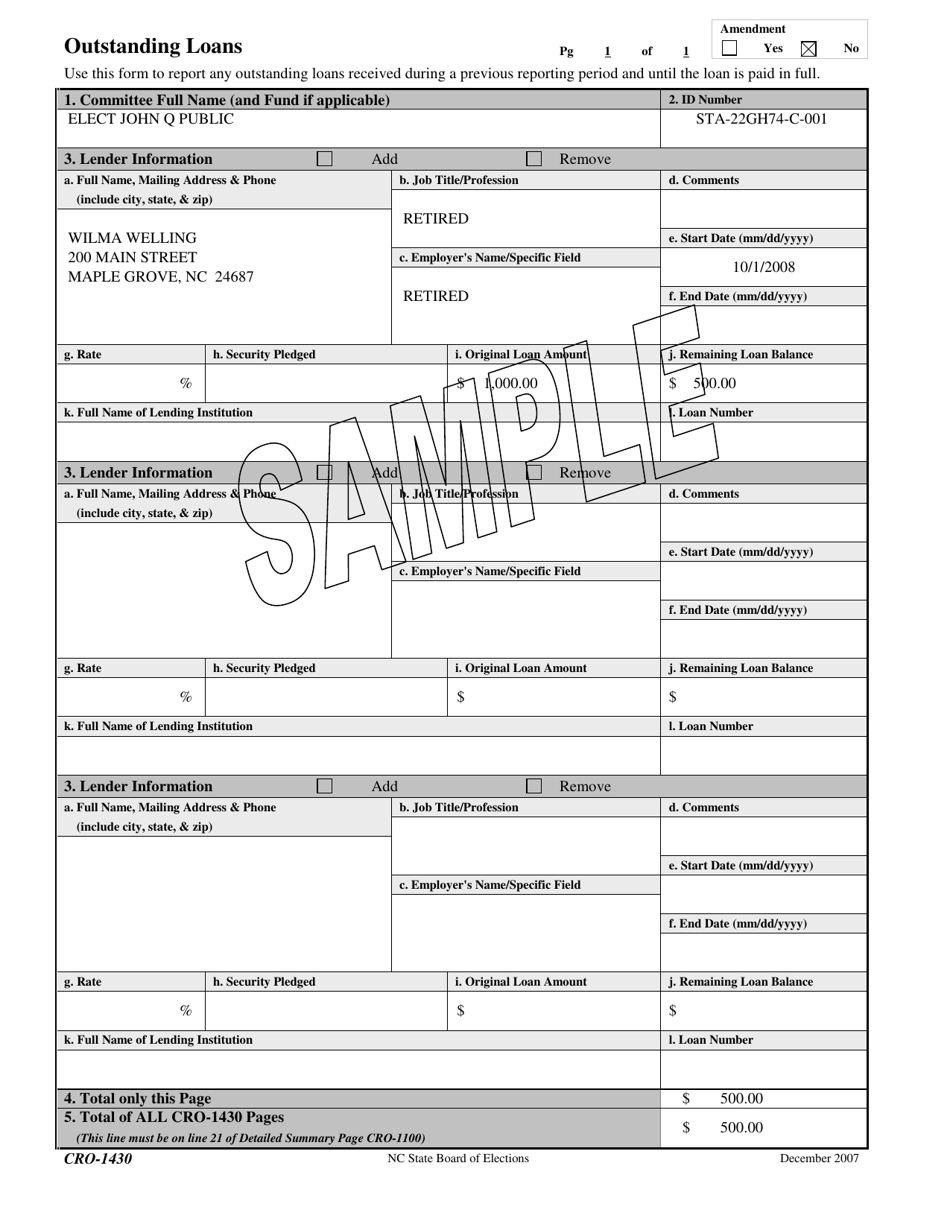

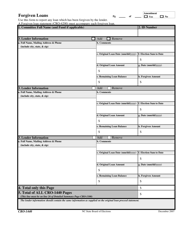

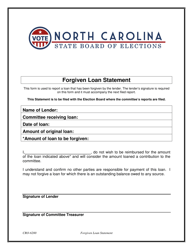

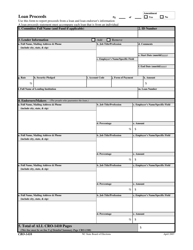

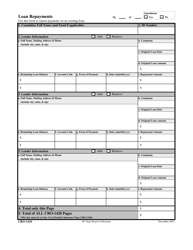

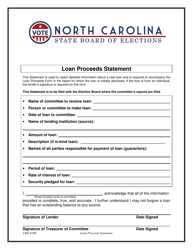

Sample Form CRO-1430 Outstanding Loans - North Carolina

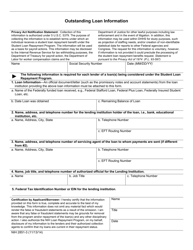

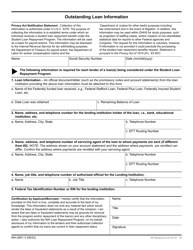

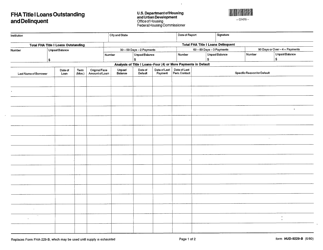

What Is Form CRO-1430?

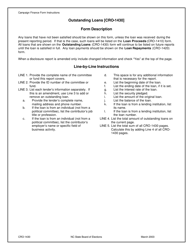

This is a legal form that was released by the North Carolina State Board of Elections - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CRO-1430?

A: Form CRO-1430 is a document used for reporting outstanding loans in North Carolina.

Q: Who needs to file Form CRO-1430?

A: Lenders in North Carolina who have outstanding loans must file Form CRO-1430.

Q: What is the purpose of Form CRO-1430?

A: The purpose of Form CRO-1430 is to report outstanding loans to the appropriate authorities in North Carolina.

Q: Is Form CRO-1430 specific to North Carolina?

A: Yes, Form CRO-1430 is specific to North Carolina and is not used in other states.

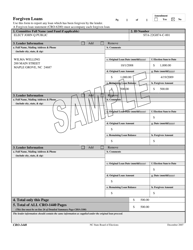

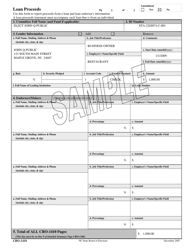

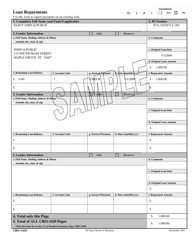

Q: What information is required on Form CRO-1430?

A: Form CRO-1430 requires information about the lender, borrower, loan amount, interest rate, and repayment terms.

Q: When is Form CRO-1430 due?

A: Form CRO-1430 is typically due annually, but specific deadlines may vary. Lenders should refer to the instructions provided with the form for the exact due date.

Q: Are there any penalties for not filing Form CRO-1430?

A: Yes, failure to file Form CRO-1430 or filing false or incomplete information may result in penalties and legal consequences.

Q: Can I amend Form CRO-1430 if there are changes to my outstanding loans?

A: Yes, if there are changes to your outstanding loans after filing Form CRO-1430, you can file an amended form to update the information.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the North Carolina State Board of Elections;

- A printable and free sample of Form CRO-1430;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRO-1430 by clicking the link below or browse more documents and templates provided by the North Carolina State Board of Elections.