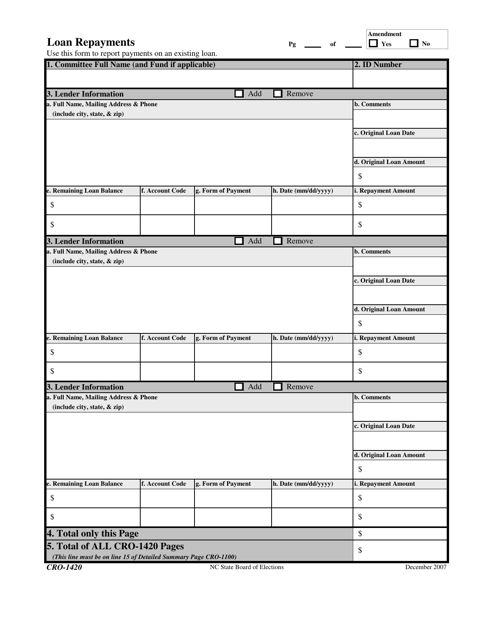

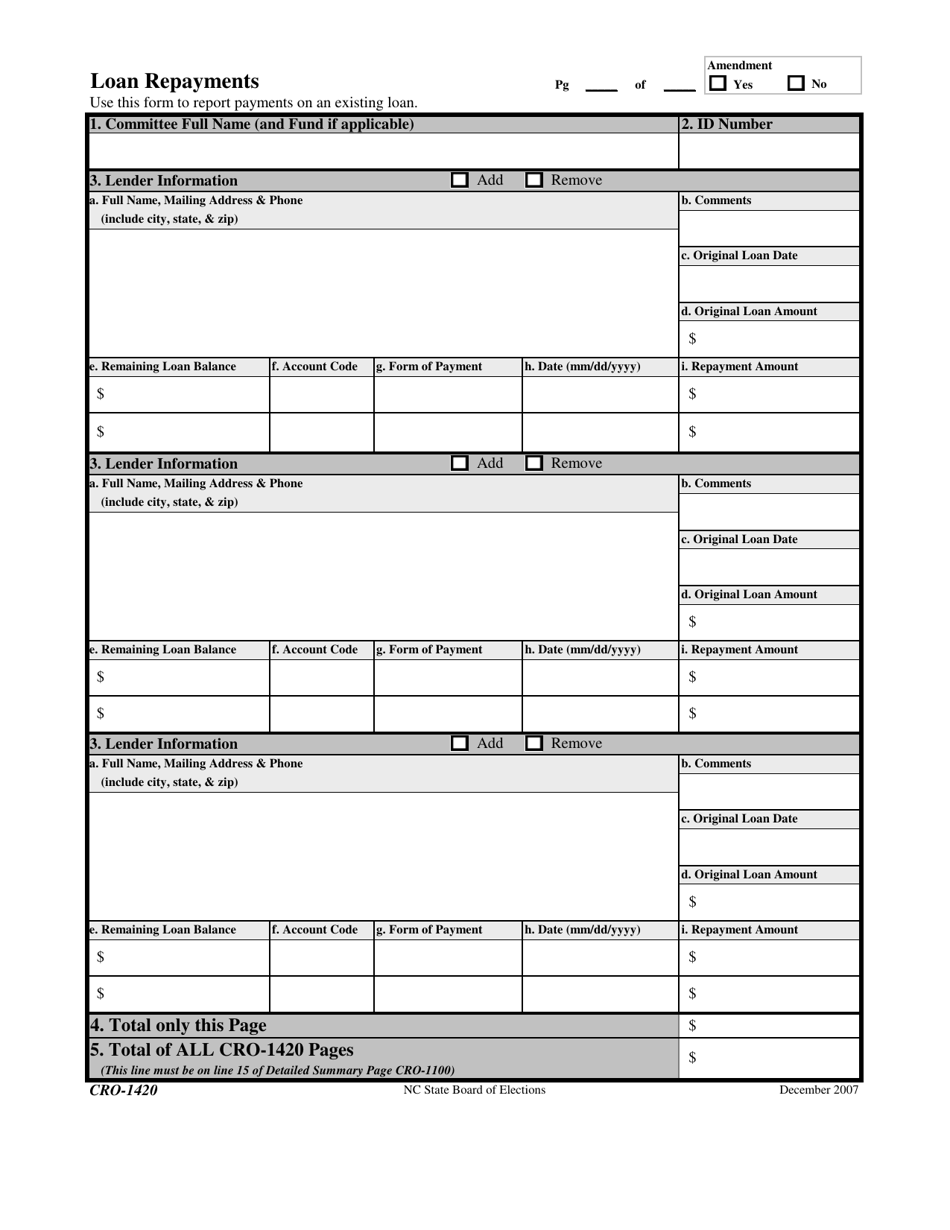

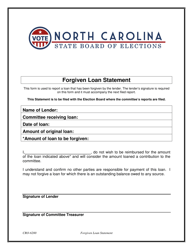

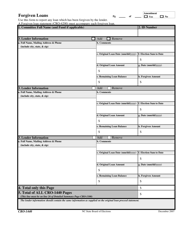

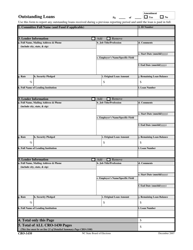

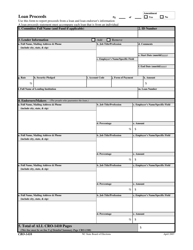

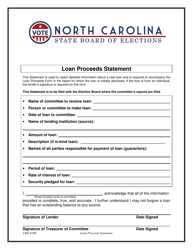

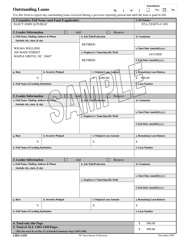

Form CRO-1420 Loan Repayments - North Carolina

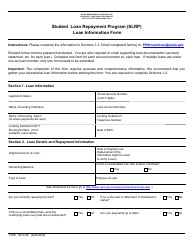

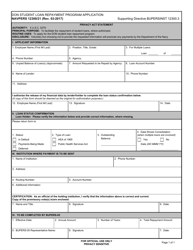

What Is Form CRO-1420?

This is a legal form that was released by the North Carolina State Board of Elections - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

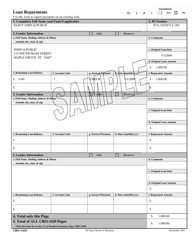

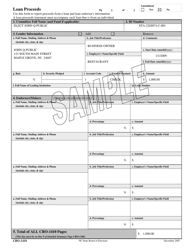

Q: What is Form CRO-1420?

A: Form CRO-1420 is a document used for reporting loan repayments in North Carolina.

Q: Who needs to file Form CRO-1420?

A: Lenders and financial institutions in North Carolina need to file Form CRO-1420 to report loan repayments.

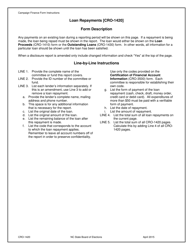

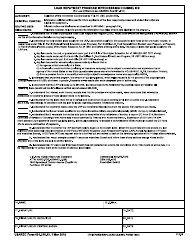

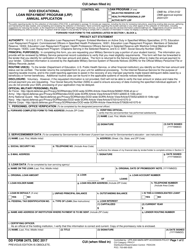

Q: What information is required on Form CRO-1420?

A: Form CRO-1420 requires information such as the lender's name, borrower's name, loan amount, repayment amount, and repayment date.

Q: When is Form CRO-1420 due?

A: Form CRO-1420 is typically due on a quarterly basis, with specific deadlines specified by the North Carolina Department of Revenue.

Q: Are there any penalties for not filing Form CRO-1420?

A: Yes, there can be penalties for not filing Form CRO-1420 or for filing it late, including potential fines and interest charges.

Q: What if I made an error on Form CRO-1420?

A: If you made an error on Form CRO-1420, you may need to file an amended form or contact the North Carolina Department of Revenue for further guidance.

Q: Can I request an extension to file Form CRO-1420?

A: Extensions for filing Form CRO-1420 may be granted on a case-by-case basis, and you would need to contact the North Carolina Department of Revenue to request an extension.

Q: Is Form CRO-1420 specific to North Carolina?

A: Yes, Form CRO-1420 is specific to loan repayments in North Carolina and may not be applicable in other states.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the North Carolina State Board of Elections;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRO-1420 by clicking the link below or browse more documents and templates provided by the North Carolina State Board of Elections.