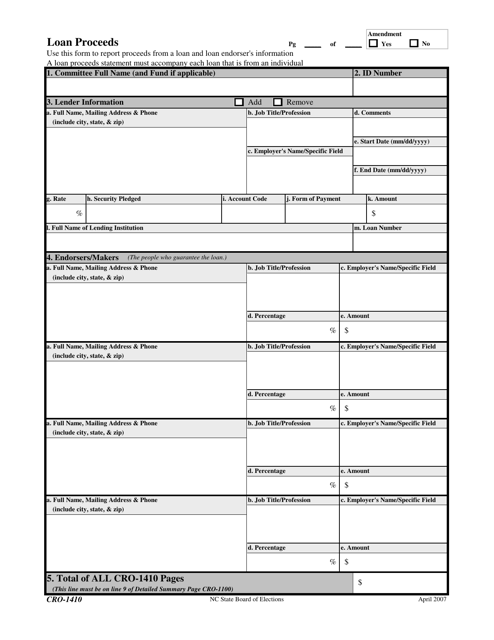

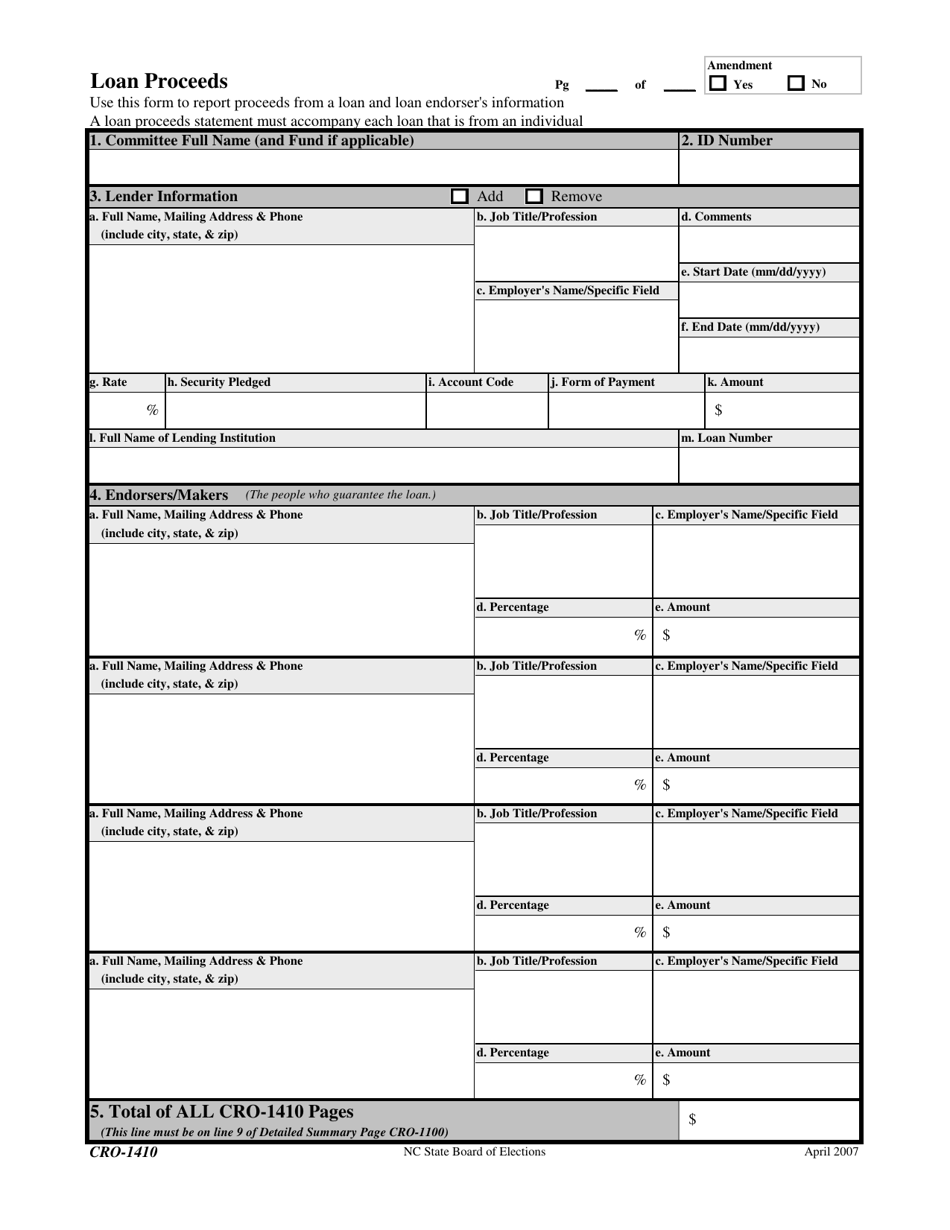

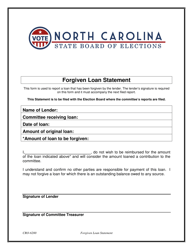

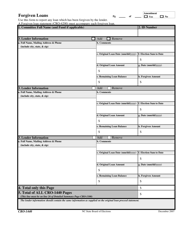

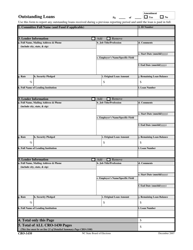

Form CRO-1410 Loan Proceeds - North Carolina

What Is Form CRO-1410?

This is a legal form that was released by the North Carolina Real Estate Commission - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

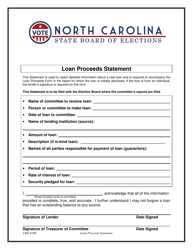

Q: What is Form CRO-1410?

A: Form CRO-1410 is a form used in North Carolina to report loan proceeds.

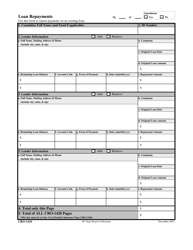

Q: What are loan proceeds?

A: Loan proceeds refer to the money borrowed from a lender.

Q: Who needs to fill out Form CRO-1410?

A: Individuals or businesses in North Carolina who receive loan proceeds need to fill out Form CRO-1410.

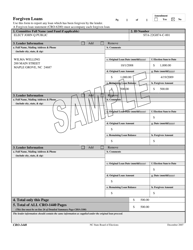

Q: What information is required on Form CRO-1410?

A: Form CRO-1410 requires information such as the name and address of the borrower, lender information, loan amount, and loan terms.

Q: When should Form CRO-1410 be filed?

A: Form CRO-1410 should be filed with the North Carolina Department of Revenue within 30 days of receiving the loan proceeds.

Q: Is there a fee for filing Form CRO-1410?

A: No, there is no fee for filing Form CRO-1410.

Q: What happens if I don't file Form CRO-1410?

A: Failure to file Form CRO-1410 may result in penalties or fines imposed by the North Carolina Department of Revenue.

Q: Do I need to include supporting documents with Form CRO-1410?

A: No, you do not need to include supporting documents with Form CRO-1410, but you should keep them for your records in case of an audit.

Form Details:

- Released on April 1, 2007;

- The latest edition provided by the North Carolina Real Estate Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRO-1410 by clicking the link below or browse more documents and templates provided by the North Carolina Real Estate Commission.