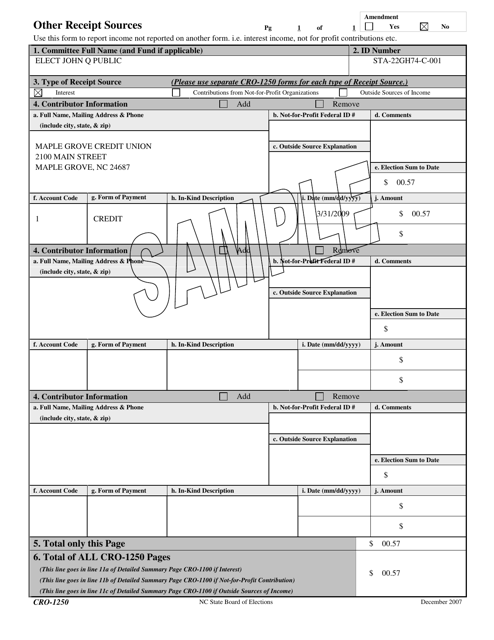

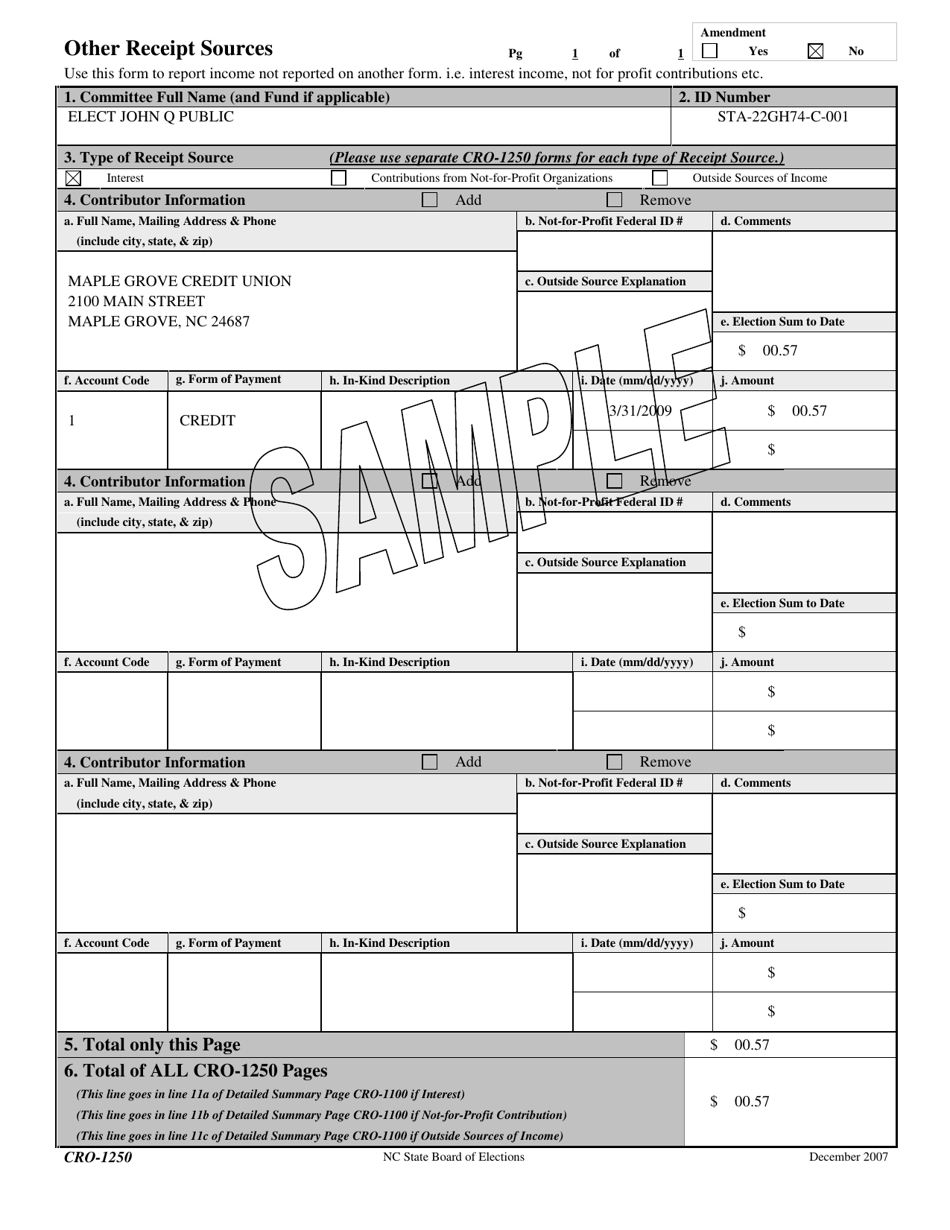

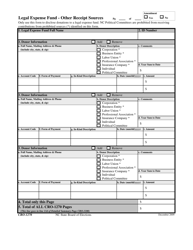

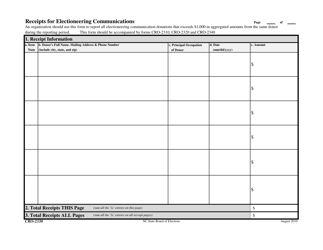

Sample Form CRO-1250 Other Receipt Sources - North Carolina

What Is Form CRO-1250?

This is a legal form that was released by the North Carolina State Board of Elections - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CRO-1250?

A: Form CRO-1250 is a document used in North Carolina to report other receipt sources.

Q: What are other receipt sources?

A: Other receipt sources refer to any income or revenue earned by an individual or business that is not derived from traditional sources like wages or salary.

Q: Who needs to file Form CRO-1250?

A: Individuals or businesses in North Carolina who have other receipt sources totaling $1,250 or more in a tax year must file this form.

Q: What information is required on Form CRO-1250?

A: The form requires details about the other receipt sources, including the description, amount, and the identification number of the payer.

Q: When is the deadline to file Form CRO-1250?

A: Form CRO-1250 must be filed annually by April 15th for the previous tax year.

Q: Are there any penalties for not filing Form CRO-1250?

A: Yes, failure to file Form CRO-1250 or reporting incorrect information may result in penalties and interest charges.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the North Carolina State Board of Elections;

- A printable and free sample of Form CRO-1250;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRO-1250 by clicking the link below or browse more documents and templates provided by the North Carolina State Board of Elections.