This version of the form is not currently in use and is provided for reference only. Download this version of

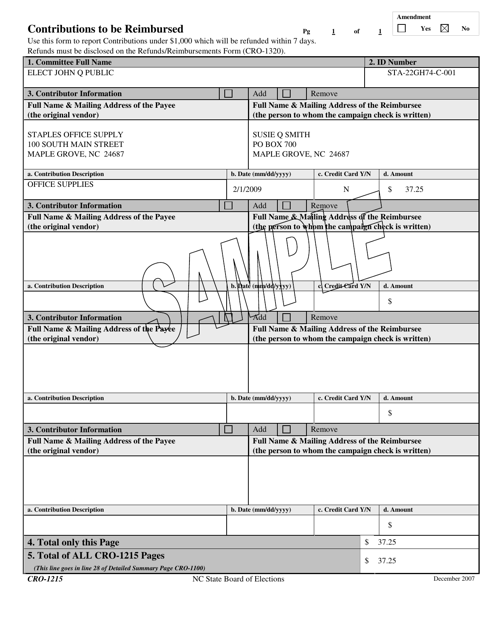

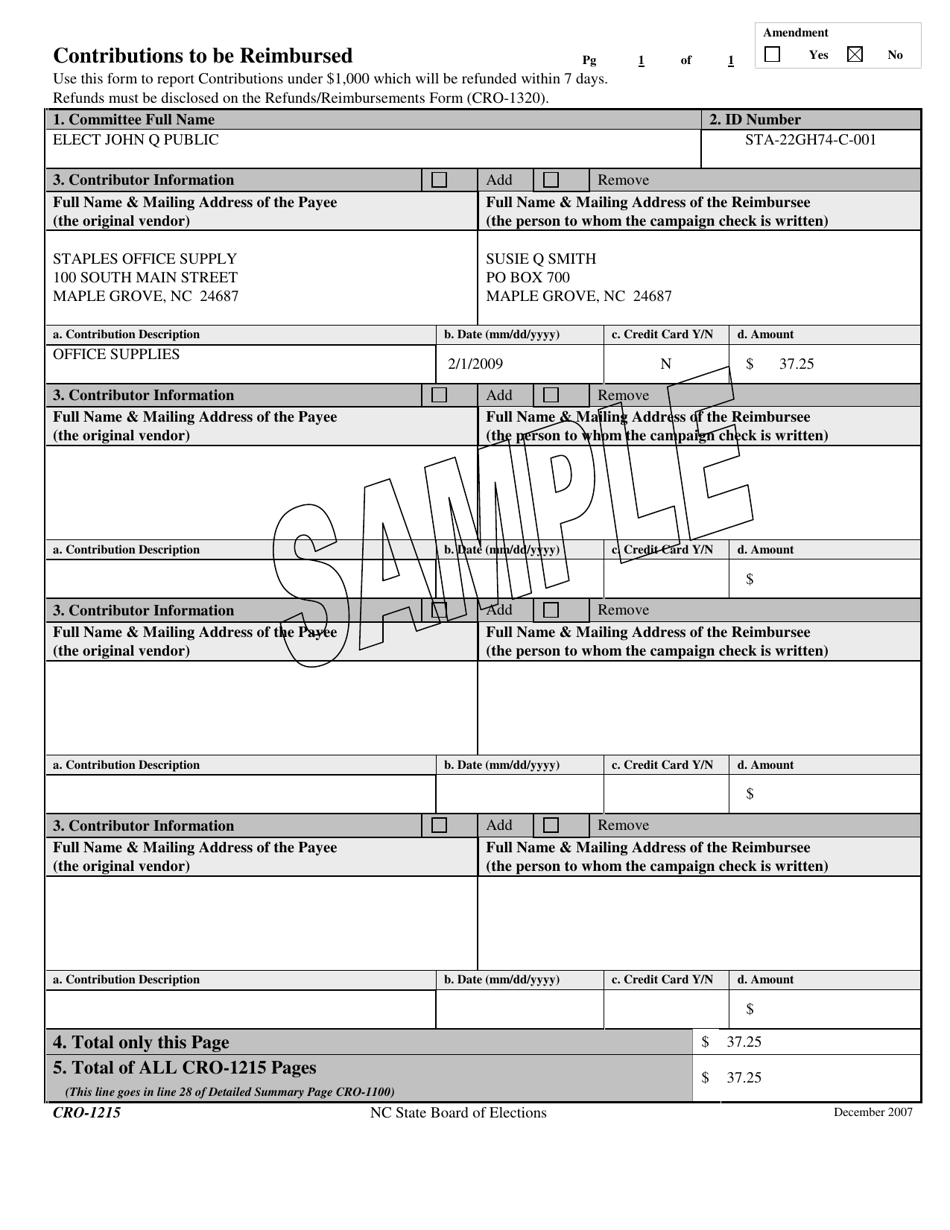

Form CRO-1215

for the current year.

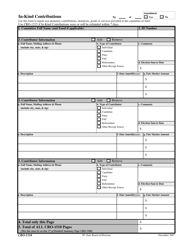

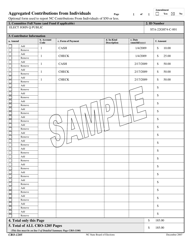

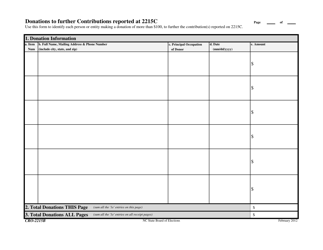

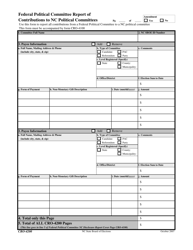

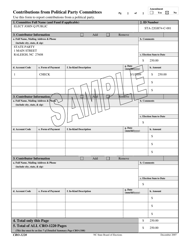

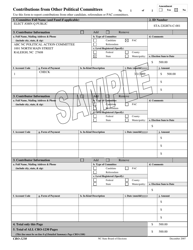

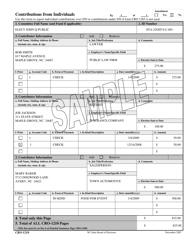

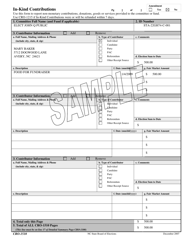

Sample Form CRO-1215 Contributions to Be Reimbursed - North Carolina

What Is Form CRO-1215?

This is a legal form that was released by the North Carolina State Board of Elections - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CRO-1215?

A: Form CRO-1215 is a form used for reporting contributions that are to be reimbursed.

Q: Who uses Form CRO-1215?

A: Form CRO-1215 is used by individuals or entities in North Carolina who have made contributions that are expected to be reimbursed.

Q: What is the purpose of Form CRO-1215?

A: The purpose of Form CRO-1215 is to report contributions that are made with the expectation of being reimbursed.

Q: Is Form CRO-1215 specific to North Carolina?

A: Yes, Form CRO-1215 is specific to the state of North Carolina.

Q: Are there any filing deadlines for Form CRO-1215?

A: Yes, the filing deadline for Form CRO-1215 is typically on or before the fifteenth day of the month following the end of the quarter in which the contributions were made.

Q: What happens if I do not file Form CRO-1215?

A: Failure to file Form CRO-1215 or filing a false or fraudulent form may result in penalties or other legal consequences.

Q: Is Form CRO-1215 related to income tax?

A: No, Form CRO-1215 is not related to income tax. It is specifically for reporting contributions to be reimbursed.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the North Carolina State Board of Elections;

- A printable and free sample of Form CRO-1215;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRO-1215 by clicking the link below or browse more documents and templates provided by the North Carolina State Board of Elections.