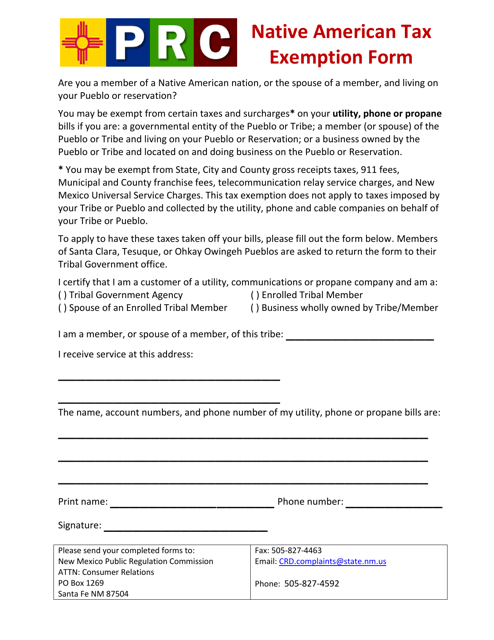

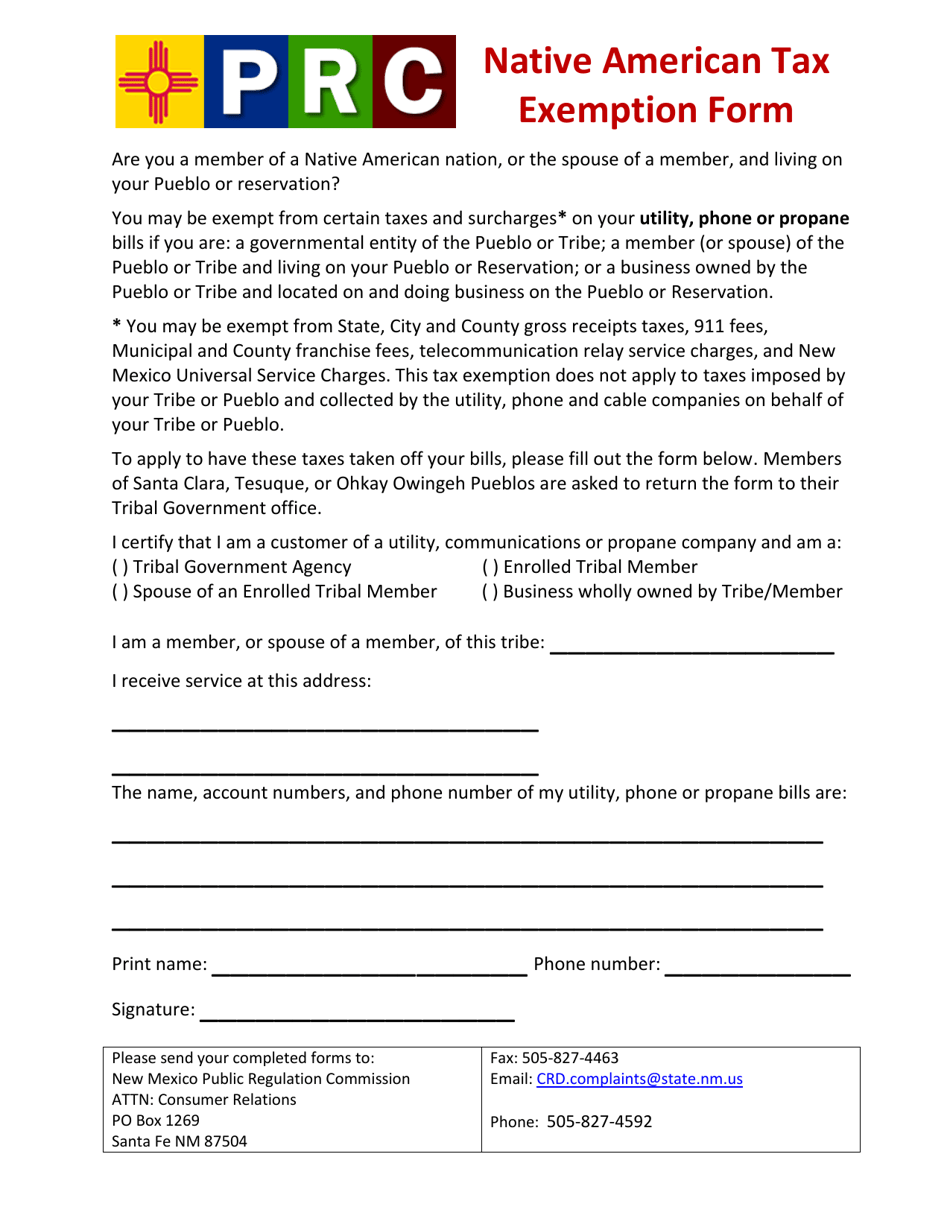

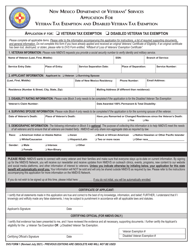

Native American Tax Exemption Form - New Mexico

Native American Tax Exemption Form is a legal document that was released by the New Mexico Public Regulation Commission - a government authority operating within New Mexico.

FAQ

Q: What is a Native American tax exemption form?

A: A Native American tax exemption form is a document that allows Native Americans living in New Mexico to claim exemption from certain state and local taxes.

Q: Who is eligible for the Native American tax exemption?

A: Native Americans who are enrolled members of a federally recognized tribe and live in New Mexico are eligible for the tax exemption.

Q: What taxes can be exempted using this form?

A: The Native American tax exemption form can be used to claim exemption from New Mexico gross receipts tax, New Mexico compensating tax, and certain local taxes.

Q: How can I obtain a Native American tax exemption form?

A: Native American tax exemption forms can be obtained from the New Mexico Taxation and Revenue Department or from tribal offices.

Q: Do I need to renew the tax exemption each year?

A: No, once you have been granted the Native American tax exemption, it does not expire and you do not need to renew it each year.

Form Details:

- The latest edition currently provided by the New Mexico Public Regulation Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Public Regulation Commission.