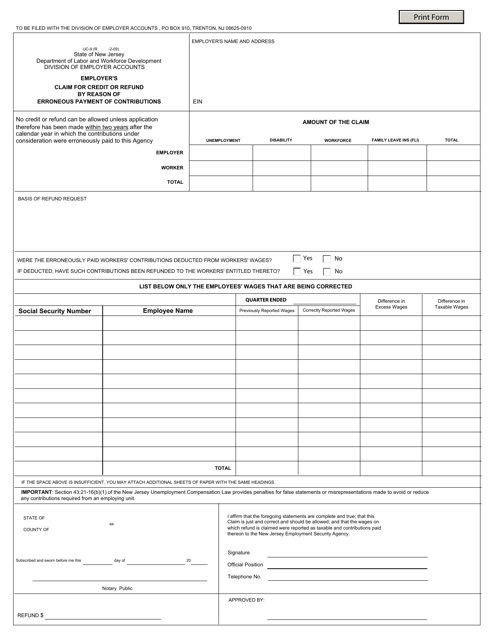

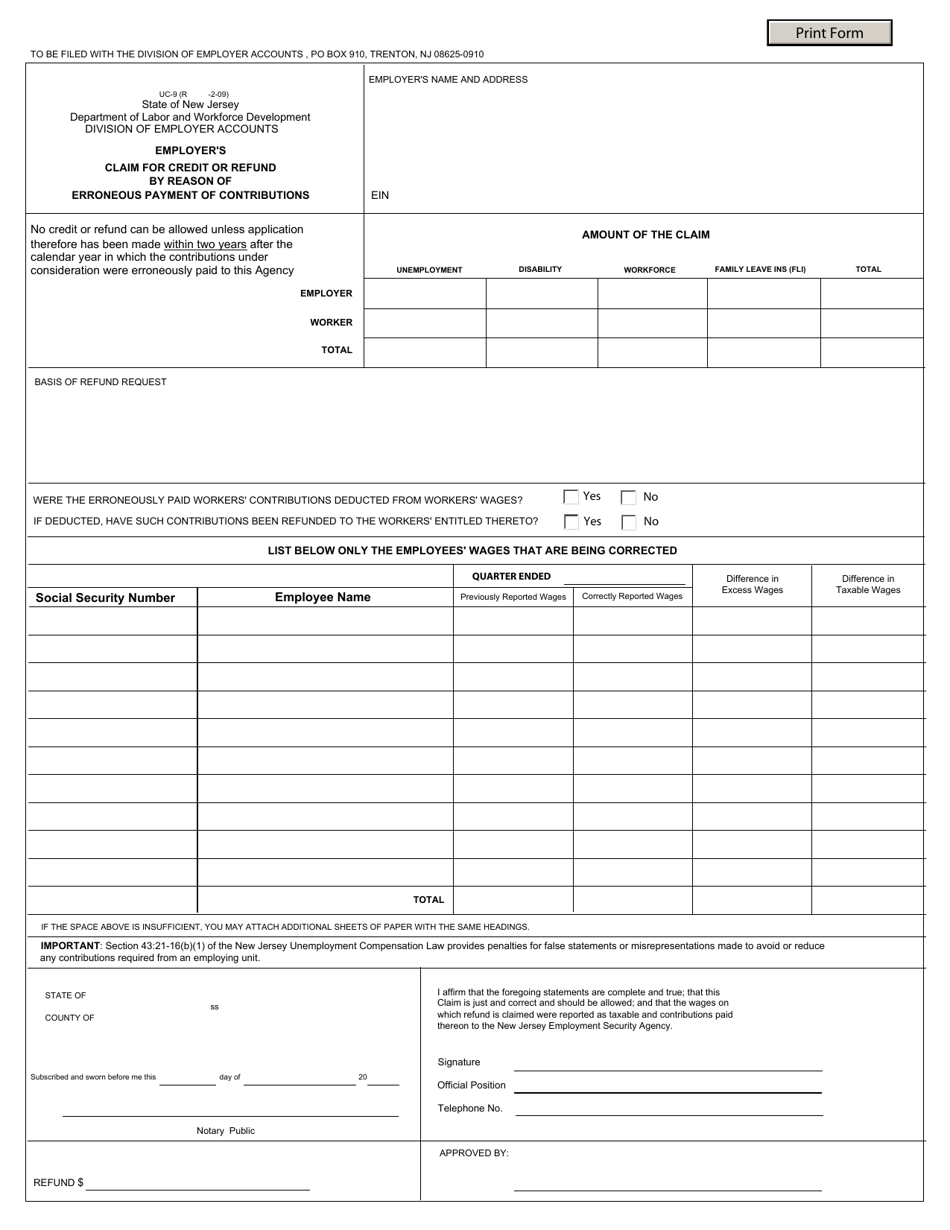

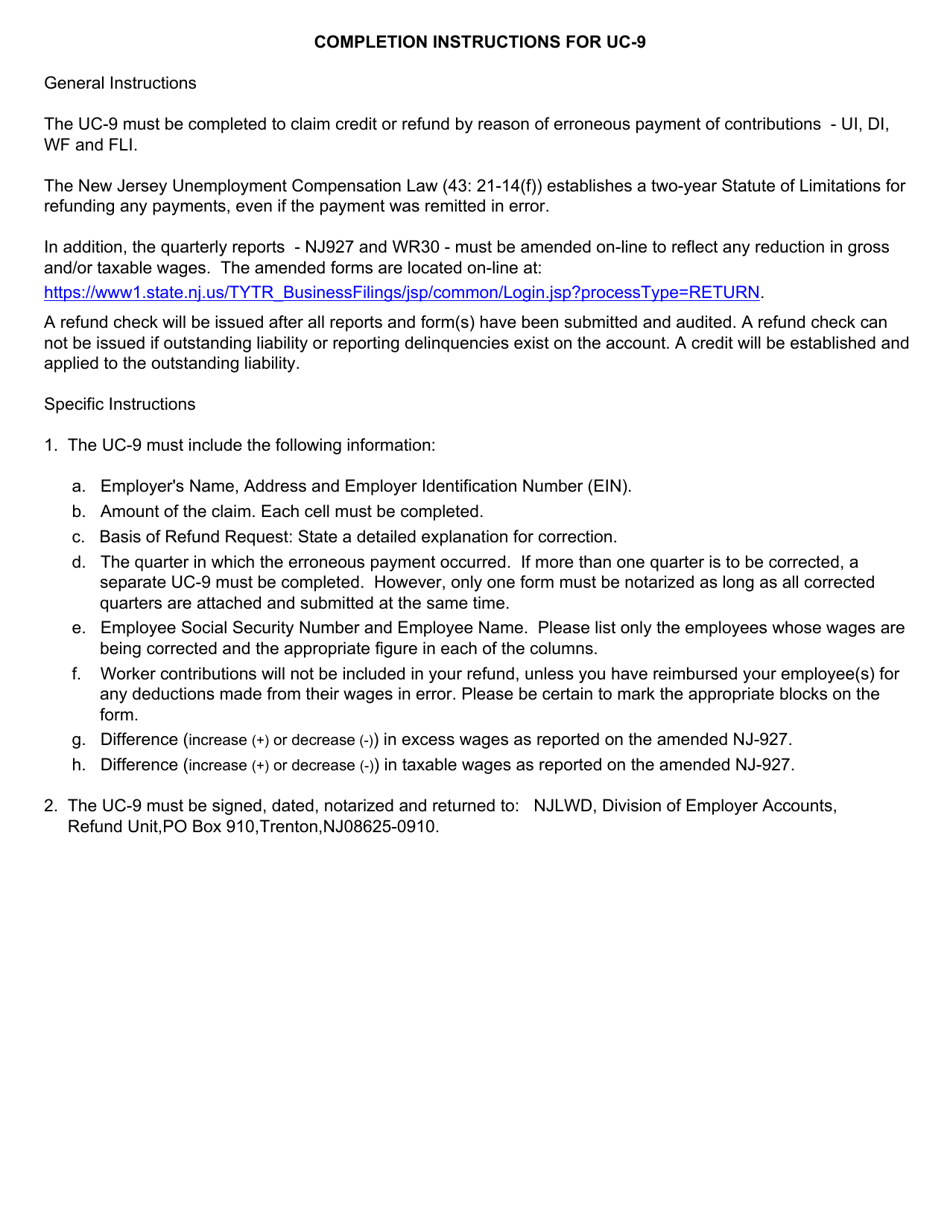

Form UC-9 Employer's Claim for Credit or Refund by Reason of Erroneous Payment of Contributions - New Jersey

What Is Form UC-9?

This is a legal form that was released by the New Jersey Department of Labor & Workforce Development - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UC-9?

A: Form UC-9 is the Employer's Claim for Credit or Refund by Reason of Erroneous Payment of Contributions in New Jersey.

Q: Who can use Form UC-9?

A: Employers in New Jersey who have made erroneous contributions can use Form UC-9 to claim a credit or refund.

Q: What is the purpose of Form UC-9?

A: The purpose of Form UC-9 is to request a credit or refund for any erroneous contributions made by an employer in New Jersey.

Q: Are there any eligibility criteria to use Form UC-9?

A: Yes, employers must meet certain eligibility criteria to use Form UC-9. These criteria are explained in the instructions provided with the form.

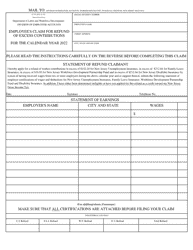

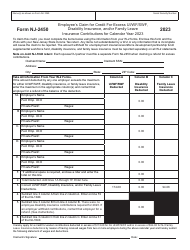

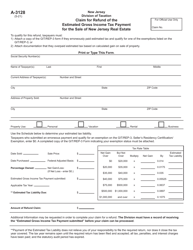

Q: What information is needed to fill out Form UC-9?

A: Employers will need to provide information such as their employer account number, the period for which the claim is being made, and the reason for the credit or refund.

Q: Is there a deadline for submitting Form UC-9?

A: Yes, there is a deadline for submitting Form UC-9. The specific deadline can be found in the instructions provided with the form.

Q: What happens after submitting Form UC-9?

A: After submitting Form UC-9, the Department will review the claim and notify the employer of their decision regarding the credit or refund requested.

Q: Can I appeal if my claim on Form UC-9 is denied?

A: Yes, if your claim on Form UC-9 is denied, you have the right to appeal the decision. The instructions provided with the form will explain the appeal process.

Form Details:

- Released on February 1, 2009;

- The latest edition provided by the New Jersey Department of Labor & Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UC-9 by clicking the link below or browse more documents and templates provided by the New Jersey Department of Labor & Workforce Development.