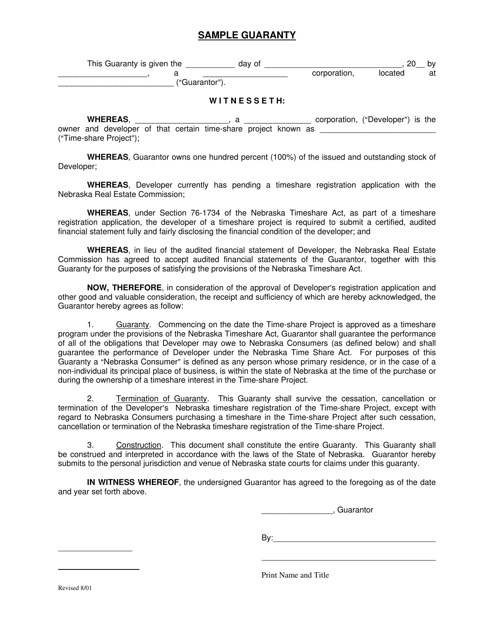

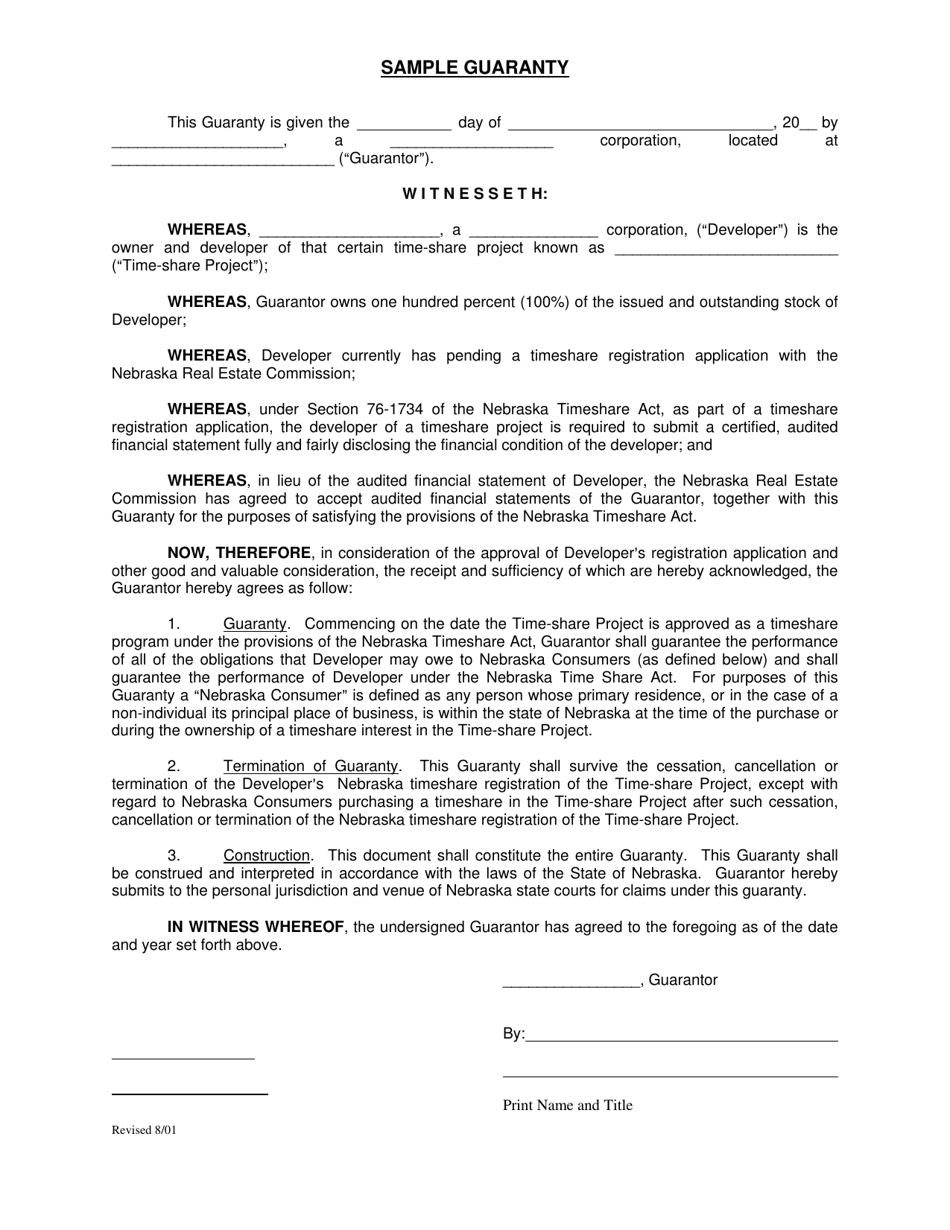

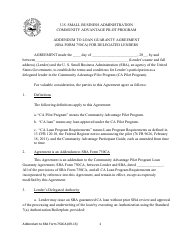

Sample Guaranty - Nebraska

Sample Guaranty is a legal document that was released by the Nebraska Real Estate Commission - a government authority operating within Nebraska.

FAQ

Q: What is a guaranty?

A: A guaranty is a promise by one person to be responsible for the debts or obligations of another person.

Q: What is a sample guaranty?

A: A sample guaranty is a template that outlines the terms and conditions of a guarantor's promise to pay the debts or obligations of a borrower.

Q: What is the purpose of a guaranty?

A: The purpose of a guaranty is to provide additional assurance to a lender that it will be repaid if the borrower fails to fulfill their obligations.

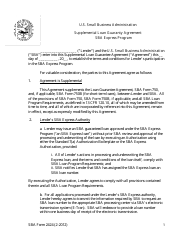

Q: What does a sample guaranty include?

A: A sample guaranty typically includes the names of the guarantor and borrower, the specific obligations covered, and the terms and conditions of the guaranty.

Q: Is a guaranty legally binding?

A: Yes, a guaranty is a legally binding contract between the guarantor and the lender.

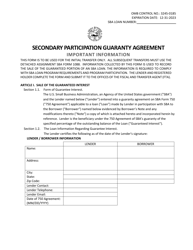

Q: Can a guaranty be revoked?

A: In most cases, a guaranty cannot be revoked once it has been entered into unless both parties agree to the revocation.

Q: What happens if a borrower defaults on their obligations?

A: If a borrower defaults on their obligations, the lender can demand payment from the guarantor under the terms of the guaranty.

Q: Can a guarantor limit their liability?

A: Yes, a guarantor may be able to limit their liability by including specific language in the guaranty contract.

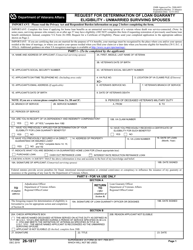

Q: Is a guaranty required for all loans?

A: No, a guaranty is not required for all loans. It is typically used in situations where the borrower's creditworthiness is in question.

Q: Is a sample guaranty specific to Nebraska?

A: No, a sample guaranty can be used in various states, including Nebraska. It provides a general template that can be customized to meet specific requirements.

Form Details:

- Released on August 1, 2001;

- The latest edition currently provided by the Nebraska Real Estate Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Real Estate Commission.