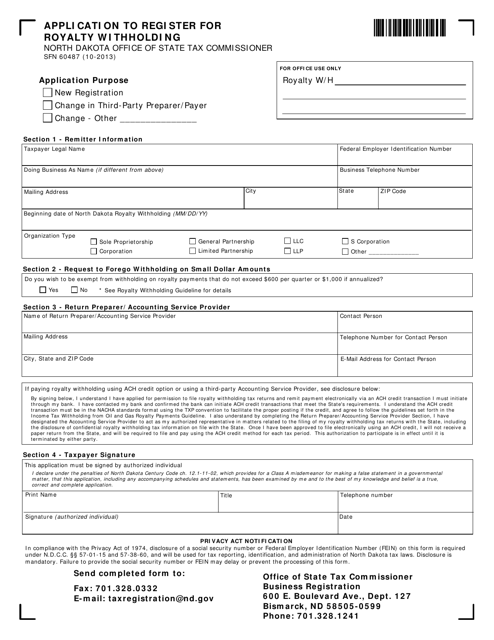

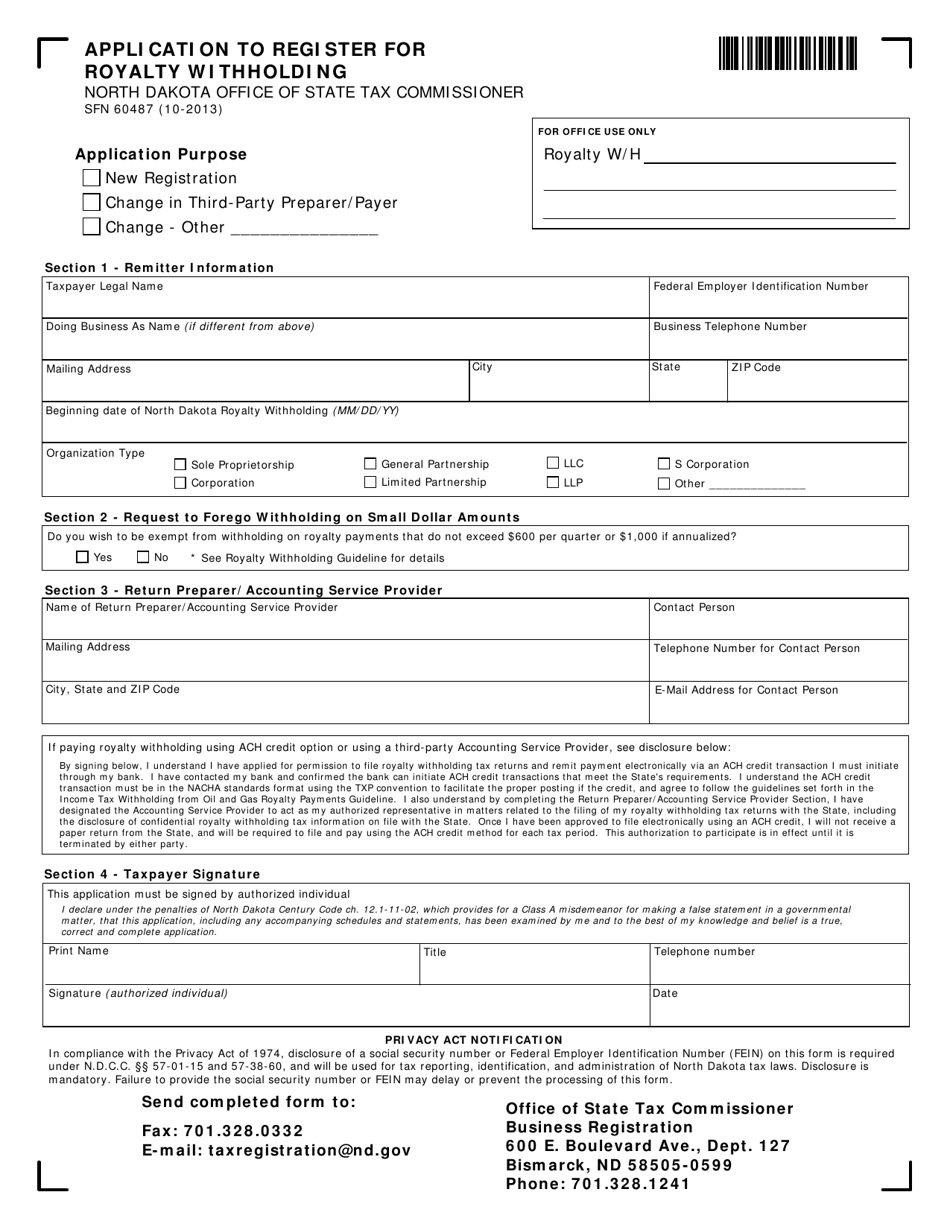

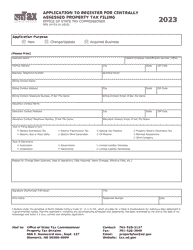

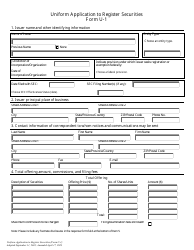

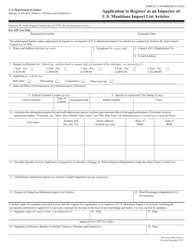

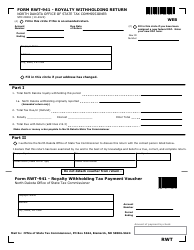

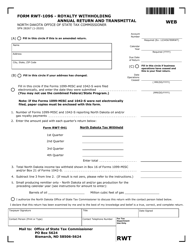

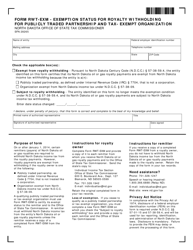

Form SFN60487 Application to Register for Royalty Withholding - North Dakota

What Is Form SFN60487?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN60487?

A: Form SFN60487 is the application to register for royalty withholding in North Dakota.

Q: Why do I need to register for royalty withholding?

A: You need to register for royalty withholding if you receive royalty income from North Dakota.

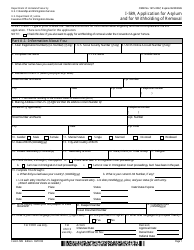

Q: What information do I need to provide on Form SFN60487?

A: You will need to provide your personal information, the details of the royalty income you receive, and any supporting documentation.

Q: Are there any fees associated with registering for royalty withholding?

A: There are no fees associated with registering for royalty withholding in North Dakota.

Q: How long does it take to process the application?

A: The processing time for the application may vary, but it is typically processed within a few weeks.

Q: Do I need to renew my registration for royalty withholding?

A: Yes, you will need to renew your registration every five years.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN60487 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.