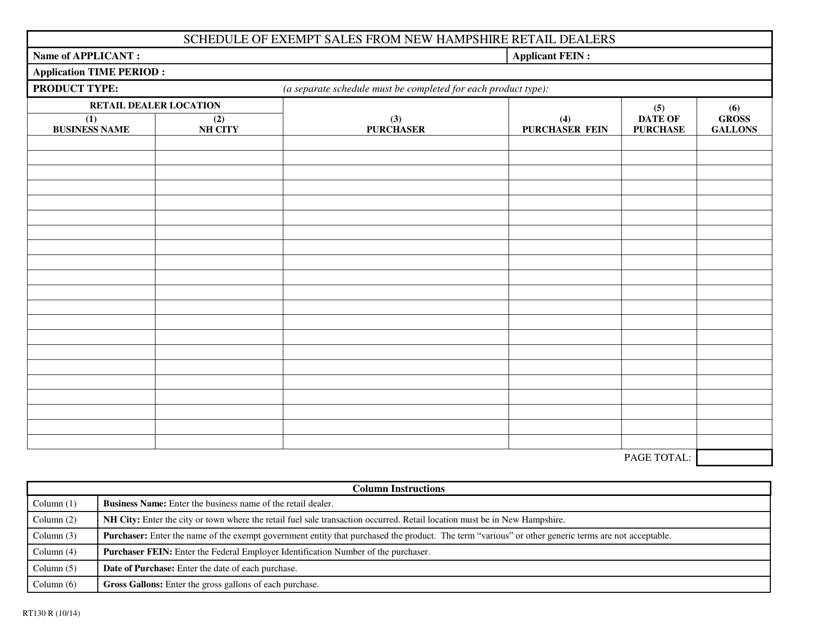

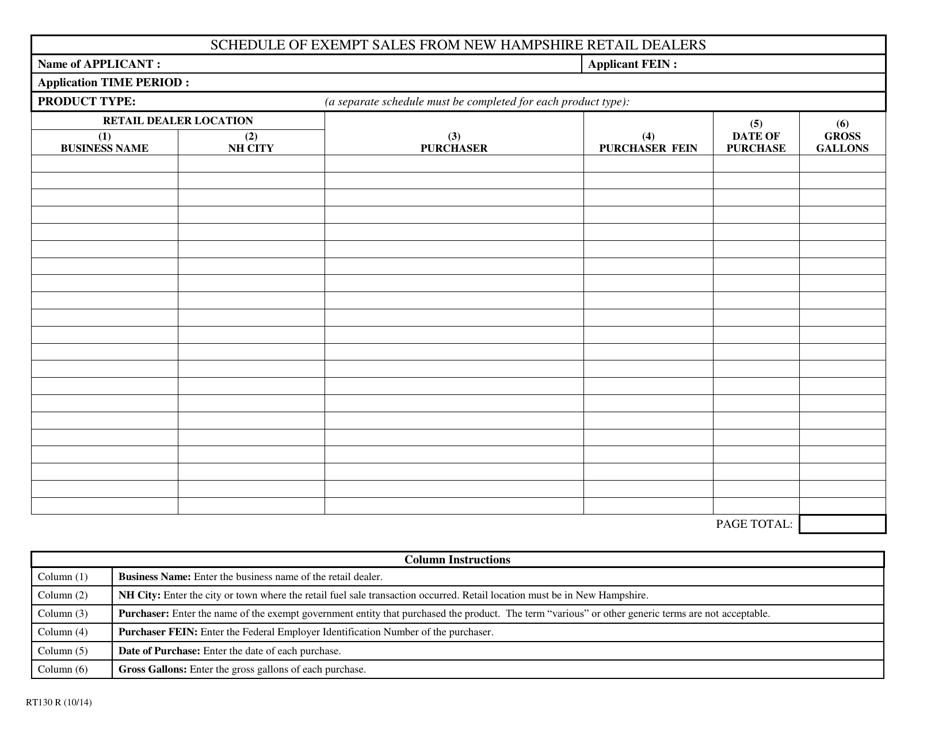

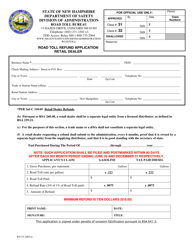

Form RT130R Schedule of Exempt Sales From New Hampshire Retail Dealers - New Hampshire

What Is Form RT130R?

This is a legal form that was released by the New Hampshire Department of Safety - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a RT130R Schedule?

A: RT130R Schedule is a form that lists exempt sales from retail dealers in New Hampshire.

Q: What is the purpose of the RT130R Schedule?

A: The purpose of the RT130R Schedule is to document exempt sales made by retail dealers in New Hampshire.

Q: Who needs to fill out the RT130R Schedule?

A: Retail dealers in New Hampshire need to fill out the RT130R Schedule if they have exempt sales.

Q: What are exempt sales?

A: Exempt sales are sales that are not subject to certain taxes or regulations.

Q: Is filling out the RT130R Schedule mandatory?

A: Yes, if you are a retail dealer with exempt sales in New Hampshire, filling out the RT130R Schedule is mandatory.

Q: When is the RT130R Schedule due?

A: The due date for the RT130R Schedule is determined by the New Hampshire Department of Revenue Administration.

Q: What happens if I don't fill out the RT130R Schedule?

A: If you fail to fill out the RT130R Schedule, you may face penalties or fines from the New Hampshire Department of Revenue Administration.

Q: Are there any supporting documents required for the RT130R Schedule?

A: You may be required to submit supporting documentation for your exempt sales, depending on the instructions provided by the New Hampshire Department of Revenue Administration.

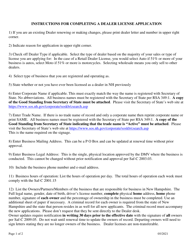

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the New Hampshire Department of Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RT130R by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Safety.