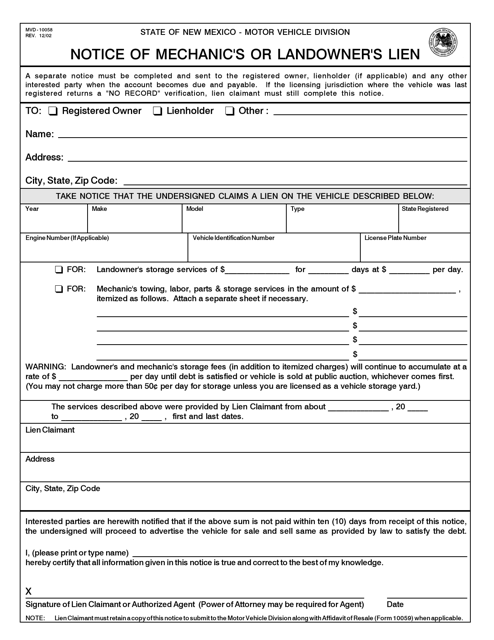

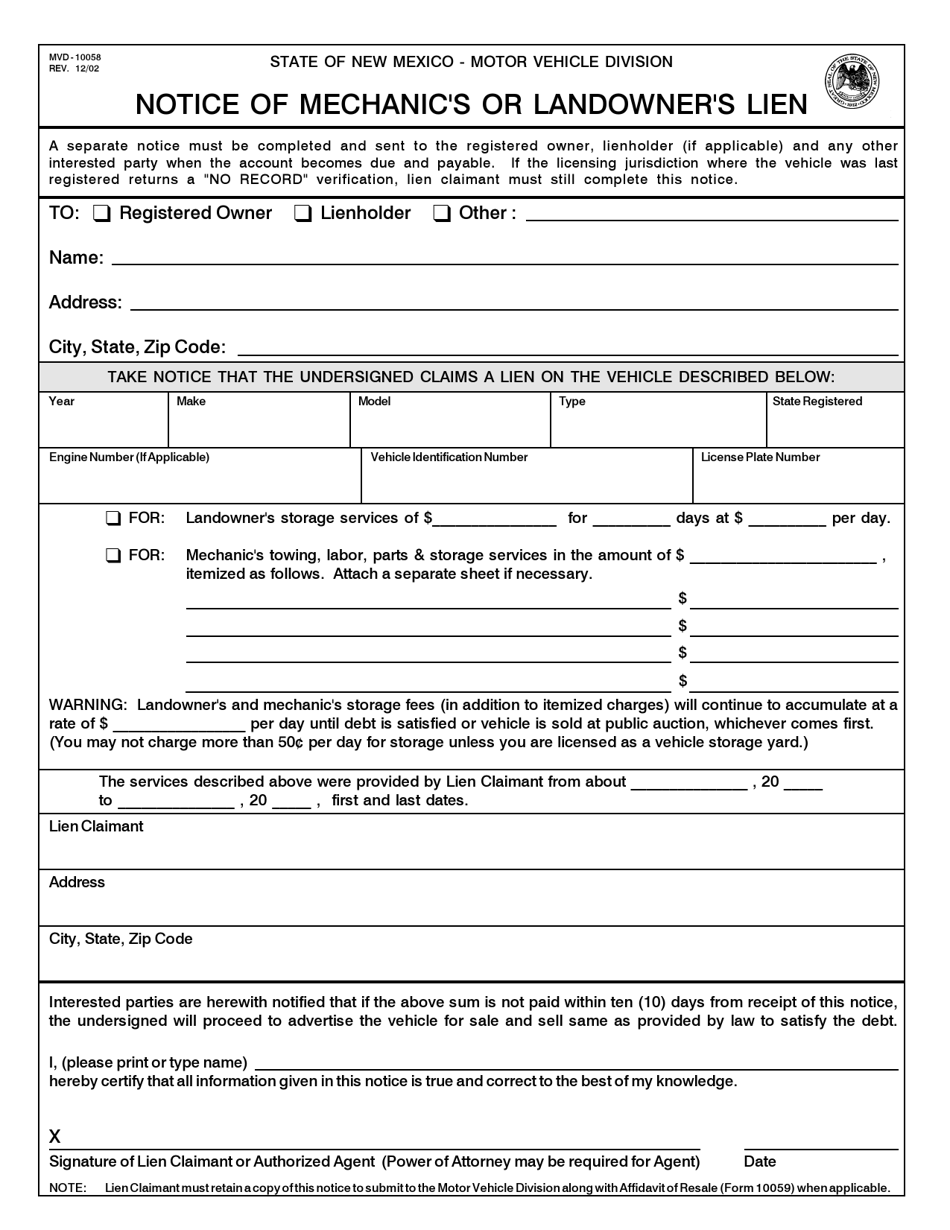

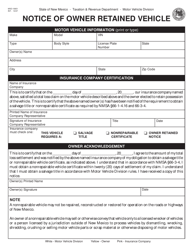

Form MVD-10058 Notice of Mechanic's or Landowner's Lien - New Mexico

What Is Form MVD-10058?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MVD-10058?

A: Form MVD-10058 is a Notice of Mechanic's or Landowner's Lien in New Mexico.

Q: Who needs to use Form MVD-10058?

A: Mechanics or landowners who have a lien on a vehicle in New Mexico need to use Form MVD-10058.

Q: What is a mechanic's or landowner's lien?

A: A mechanic's or landowner's lien is a legal claim against a vehicle for unpaid repairs or services.

Q: What information is required on Form MVD-10058?

A: Form MVD-10058 requires information such as the vehicle identification number (VIN), a description of the repairs or services, and the amount owed.

Q: How do I submit Form MVD-10058?

A: Form MVD-10058 should be submitted to the New Mexico Motor Vehicle Division (MVD).

Q: What happens after submitting Form MVD-10058?

A: After submitting Form MVD-10058, the MVD will notify the vehicle owner of the lien, and the owner will have a certain period of time to address the lien.

Q: Can I file a lien on a vehicle without using Form MVD-10058?

A: No, in New Mexico, Form MVD-10058 must be used to file a mechanic's or landowner's lien on a vehicle.

Q: How long is the lien valid?

A: The lien is valid for three years from the date the lien is recorded.

Q: What happens if the lien is not paid?

A: If the lien is not paid, the lienholder may proceed with legal action to collect the debt, such as seizing and selling the vehicle.

Form Details:

- Released on December 1, 2002;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MVD-10058 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.