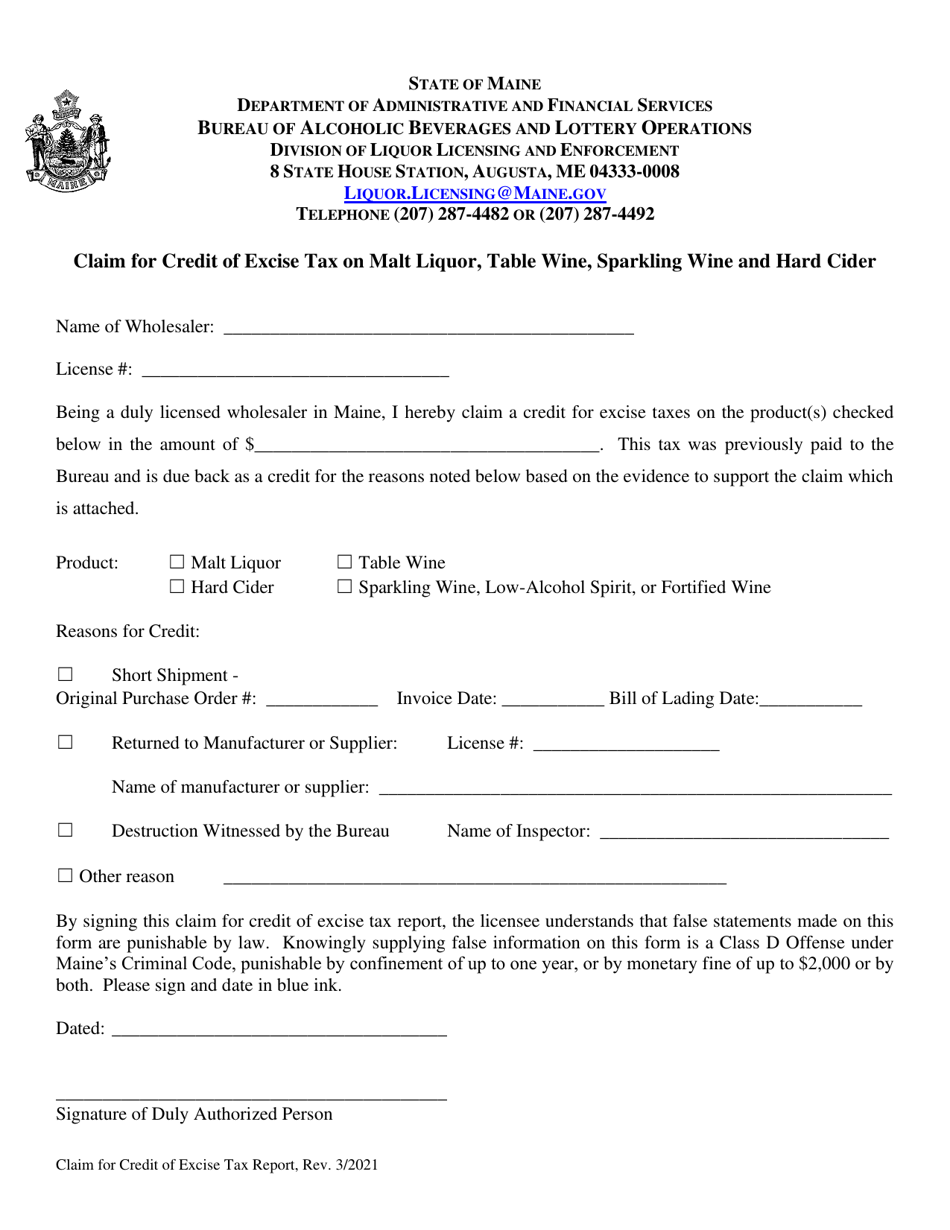

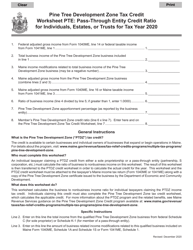

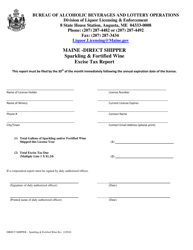

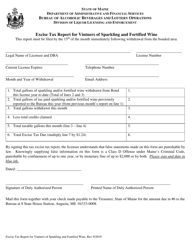

Claim for Credit of Excise Tax on Malt Liquor, Table Wine, Sparkling Wine and Hard Cider - Maine

Claim for Credit of Excise Tax on Sparkling Wine and Hard Cider is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Excise Tax on Malt Liquor, Table Wine, Sparkling Wine and Hard Cider in Maine?

A: The Excise Tax rates vary depending on the type of beverage.

Q: Can I claim a credit for Excise Tax on these beverages in Maine?

A: Yes, you may be eligible to claim a credit for Excise Tax paid on these beverages if certain conditions are met.

Q: What are the conditions to claim the credit for Excise Tax on these beverages?

A: The conditions include having paid the Excise Tax on the beverage and using it for a commercial purpose.

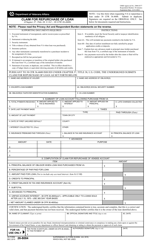

Q: How can I claim the credit for Excise Tax on these beverages?

A: You can claim the credit by completing the appropriate form and submitting it to the Maine Revenue Services.

Q: Is there a deadline to claim the credit for Excise Tax on these beverages?

A: Yes, the deadline to claim the credit is within 90 days from the date of purchase.

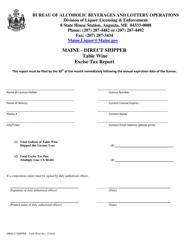

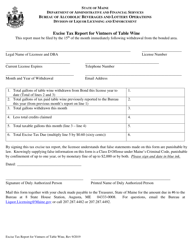

Form Details:

- Released on March 1, 2021;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.