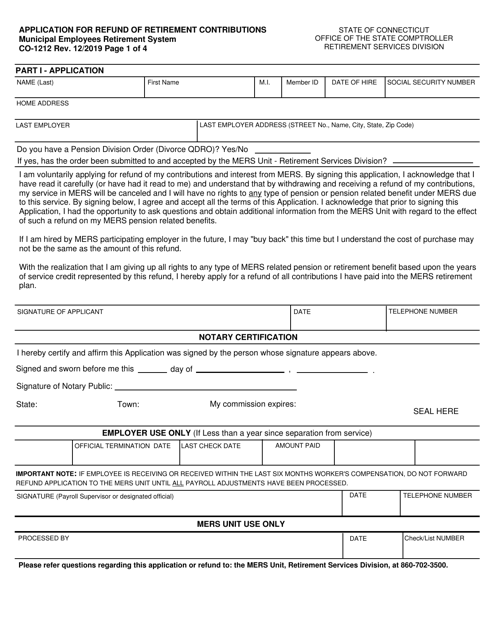

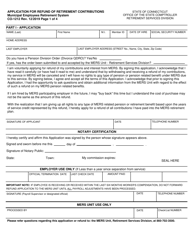

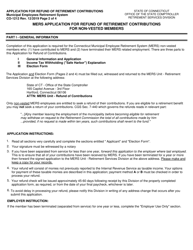

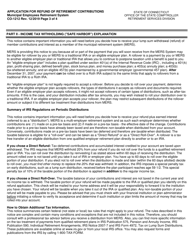

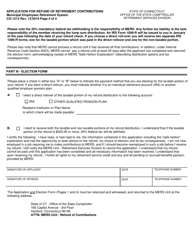

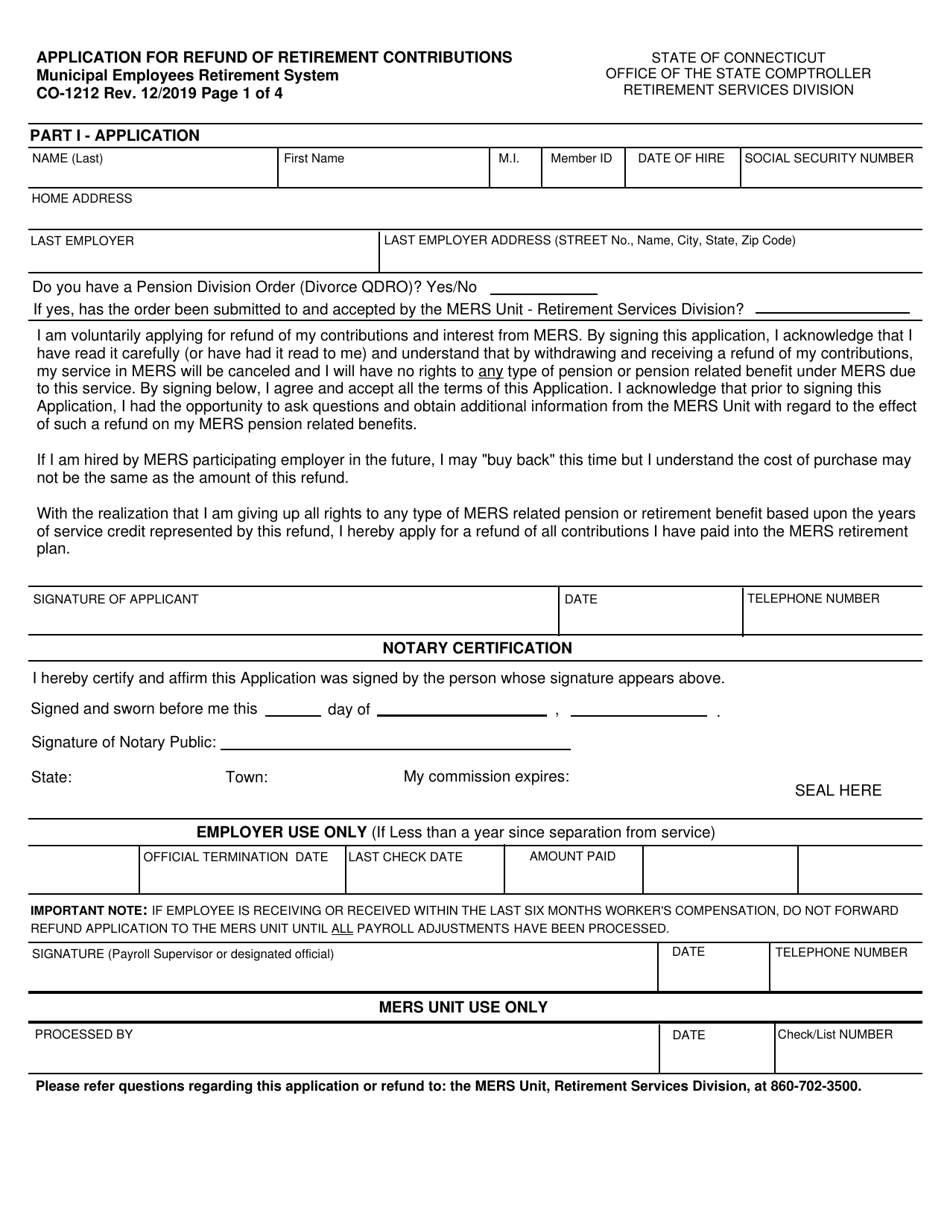

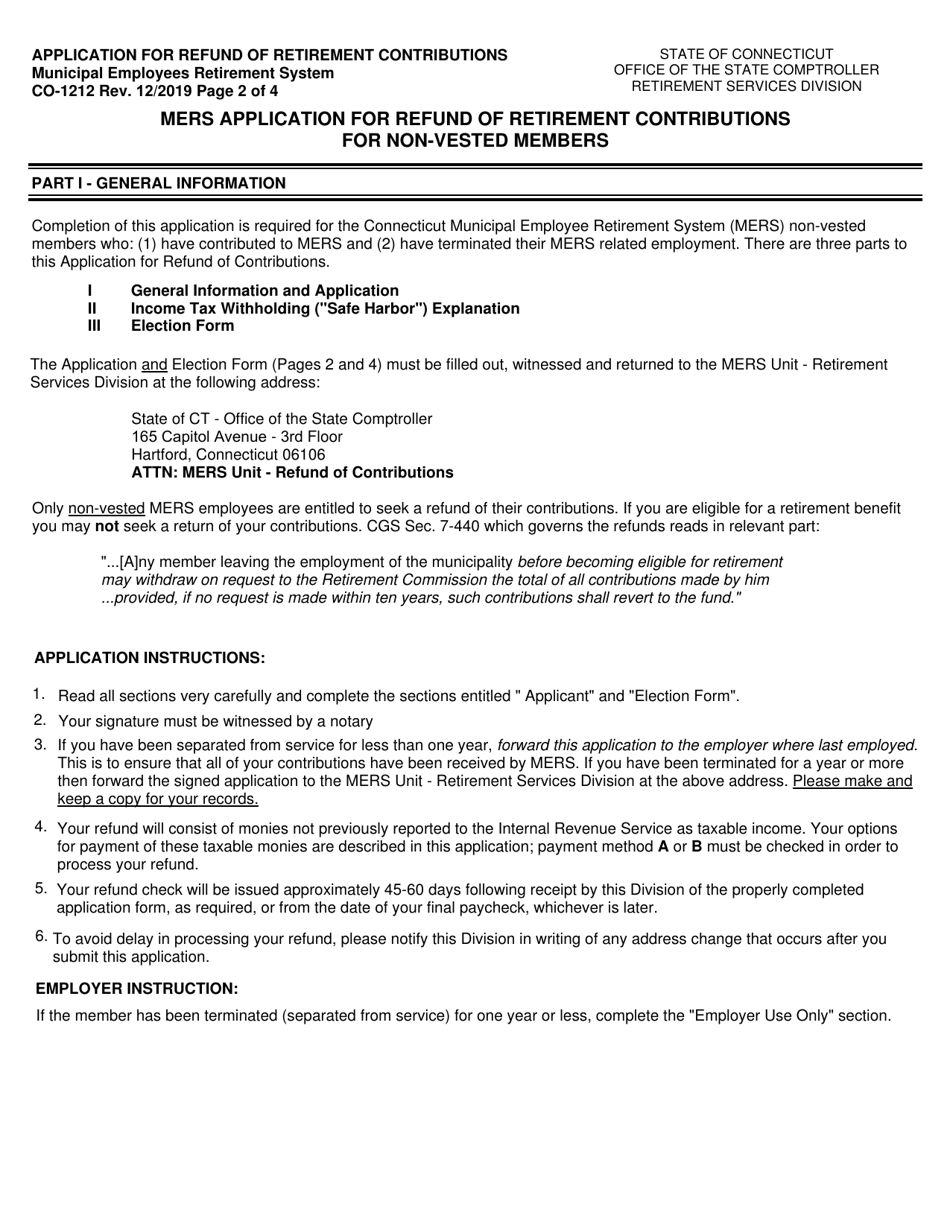

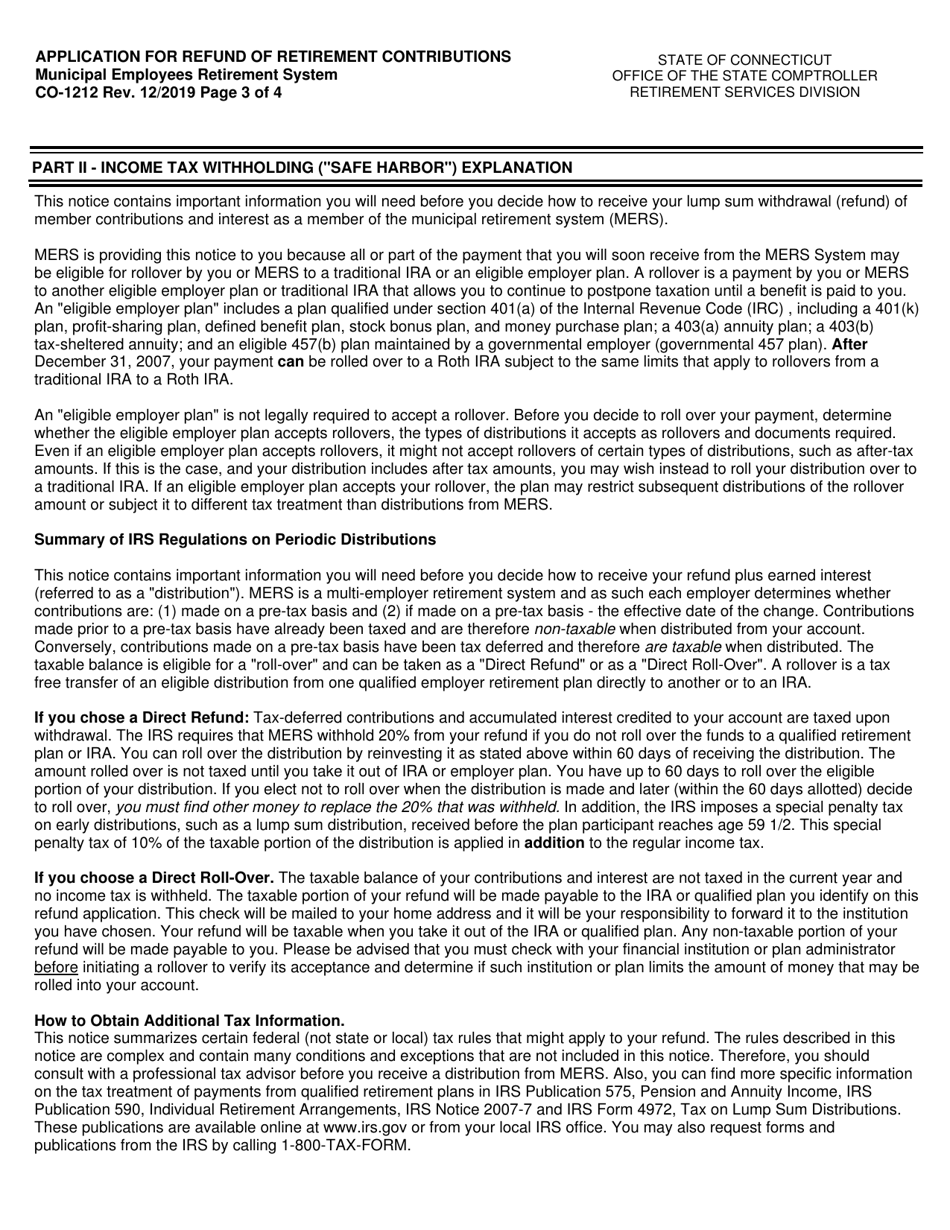

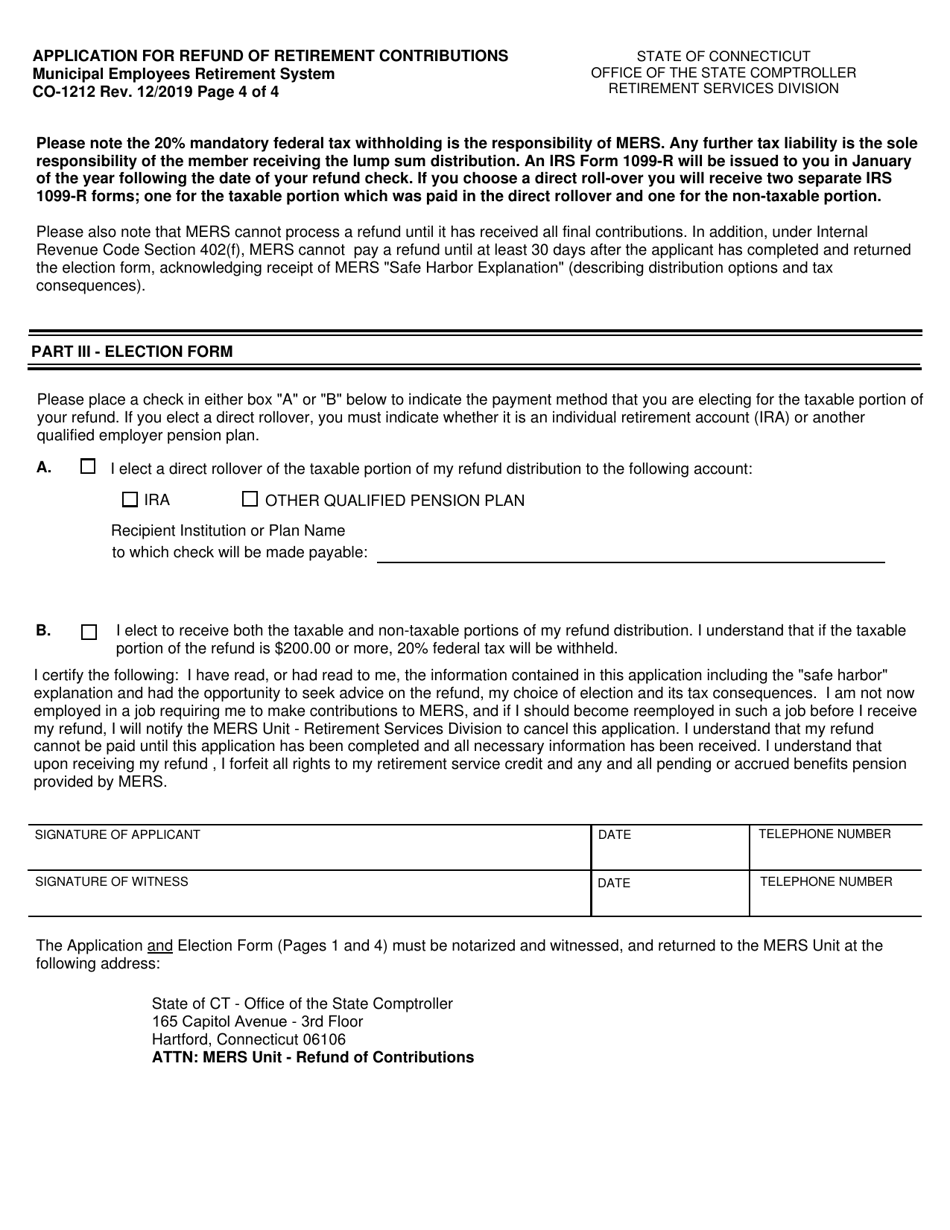

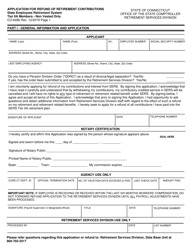

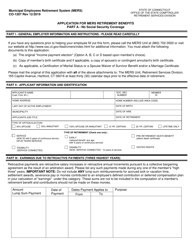

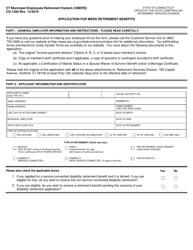

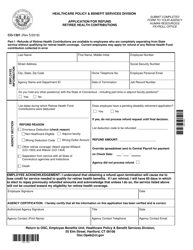

Form CO-1212 Mers Application for Refund of Retirement Contributions for Non-vested Members - Connecticut

What Is Form CO-1212?

This is a legal form that was released by the Connecticut Office of the State Comptroller - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CO-1212?

A: Form CO-1212 is the MERS Application for Refund of Retirement Contributions for Non-vested Members in Connecticut.

Q: Who is eligible to use Form CO-1212?

A: Non-vested members of the Municipal Employees' Retirement System (MERS) in Connecticut are eligible to use Form CO-1212.

Q: What is the purpose of Form CO-1212?

A: The purpose of Form CO-1212 is to apply for a refund of retirement contributions for non-vested MERS members.

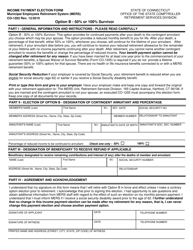

Q: How do I complete Form CO-1212?

A: You need to provide personal information, employment details, and sign the form to complete Form CO-1212.

Q: Is there a filing deadline for Form CO-1212?

A: Yes, Form CO-1212 must be filed within five years from the date of termination of your MERS membership.

Q: Are there any fees associated with filing Form CO-1212?

A: No, there are no fees associated with filing Form CO-1212.

Q: How long does it take to process Form CO-1212?

A: The processing time for Form CO-1212 varies, but it generally takes several weeks to several months.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Connecticut Office of the State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CO-1212 by clicking the link below or browse more documents and templates provided by the Connecticut Office of the State Comptroller.