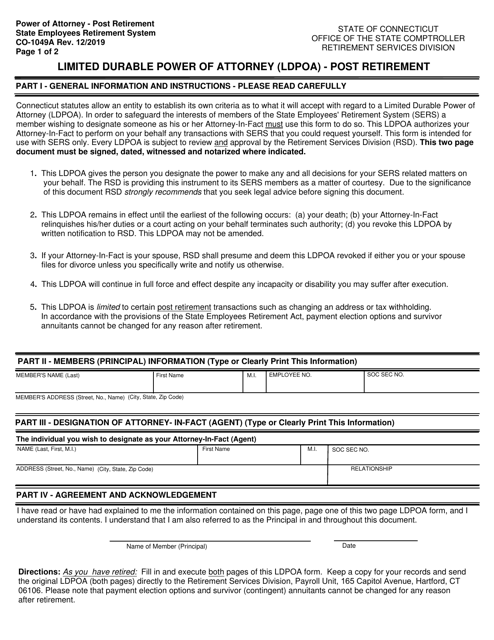

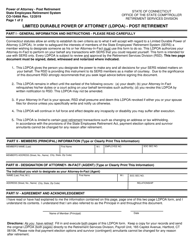

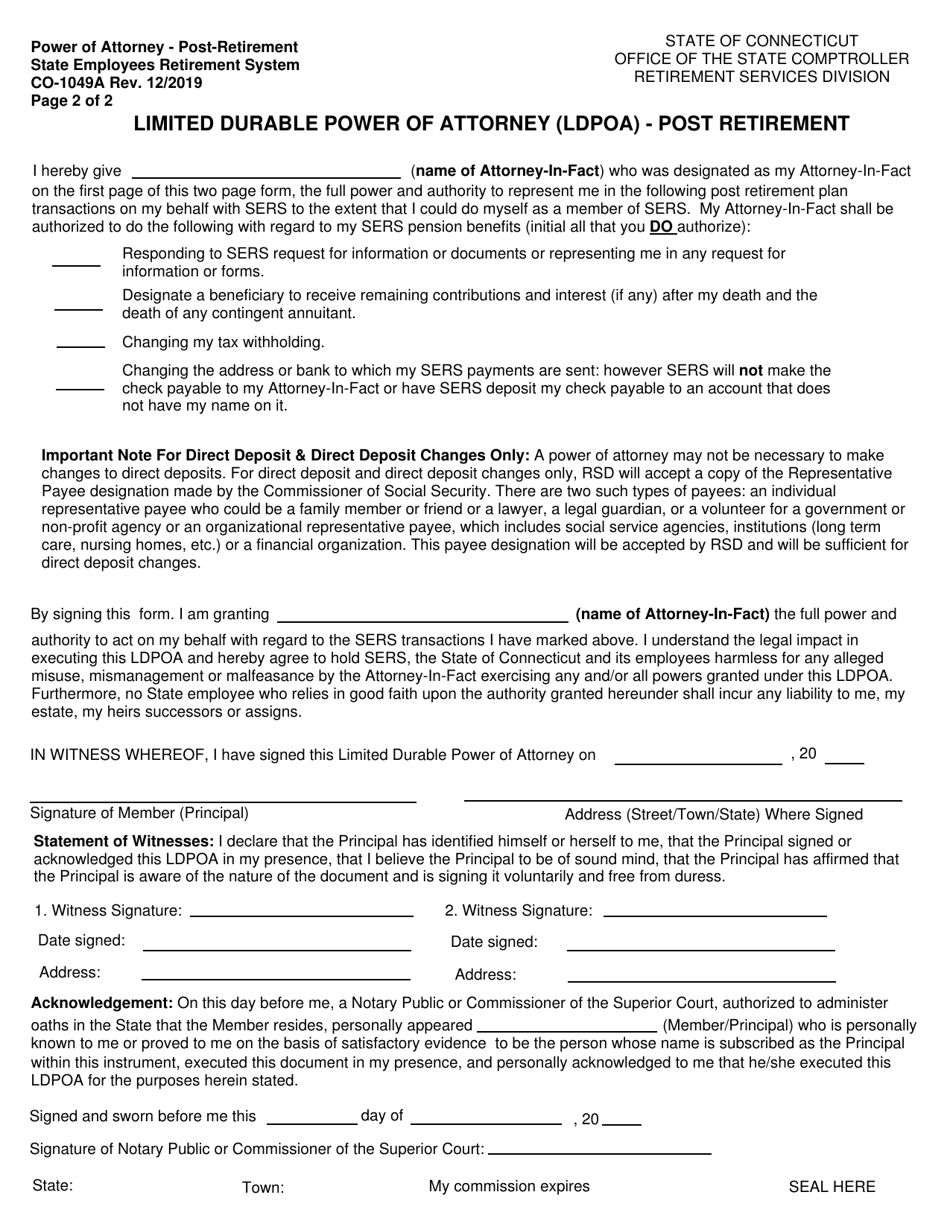

Form CO-1049A Limited Durable Power of Attorney (Ldpoa) - Post Retirement - Connecticut

What Is Form CO-1049A?

This is a legal form that was released by the Connecticut Office of the State Comptroller - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

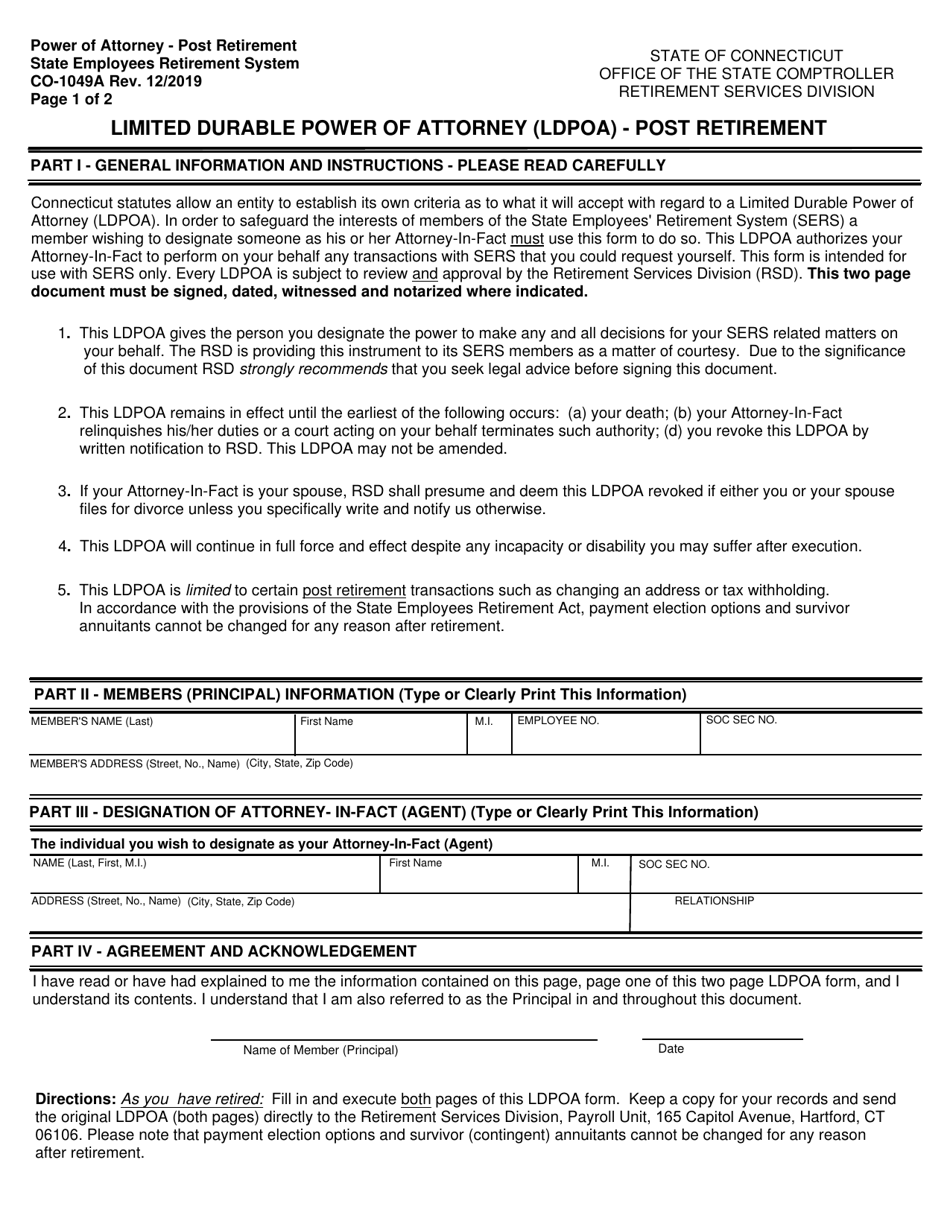

Q: What is a CO-1049A Limited Durable Power of Attorney (LDPOA) form?

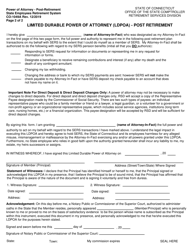

A: It is a legal document that grants someone the authority to act on your behalf for specific financial matters in Connecticut after you retire.

Q: What does "limited" mean in the CO-1049A LDPOA form?

A: It means that the powers granted to the person you choose are restricted to specific financial matters outlined in the form.

Q: When should I use the CO-1049A LDPOA form?

A: You can use it if you want to appoint someone to handle your financial affairs in Connecticut after you have retired.

Q: Can I customize the powers granted in the LDPOA form?

A: Yes, you can specify the exact powers you want to grant to the person you designate.

Q: Do I need to have the LDPOA form notarized?

A: Yes, you must have the form notarized in order for it to be legally valid in Connecticut.

Q: Can I revoke the LDPOA form at any time?

A: Yes, you have the right to revoke the LDPOA form as long as you are mentally competent to do so.

Q: How long is the CO-1049A LDPOA form effective?

A: The form remains effective until it is revoked or until your death, unless you specify an expiration date in the form.

Q: Can I use the LDPOA form for healthcare-related decisions?

A: No, the LDPOA form only grants authority for financial matters. For healthcare decisions, you would need a separate healthcare directive or power of attorney form.

Q: Can I use the LDPOA form for someone else who is retiring in Connecticut?

A: No, the LDPOA form is specific to an individual and cannot be used to grant authority on behalf of another person.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Connecticut Office of the State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CO-1049A by clicking the link below or browse more documents and templates provided by the Connecticut Office of the State Comptroller.