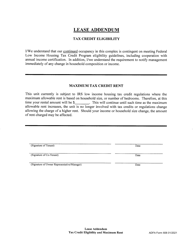

ADFA Form 605 LIHTC Lease Addendum - Smoke Detector - Arkansas

What Is ADFA Form 605?

This is a legal form that was released by the Arkansas Development Finance Authority - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

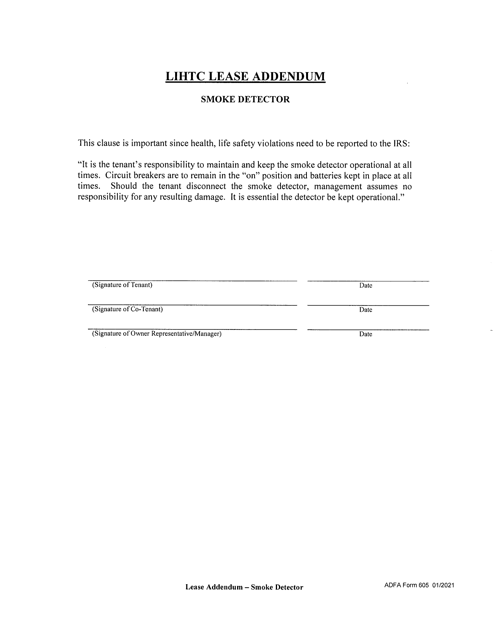

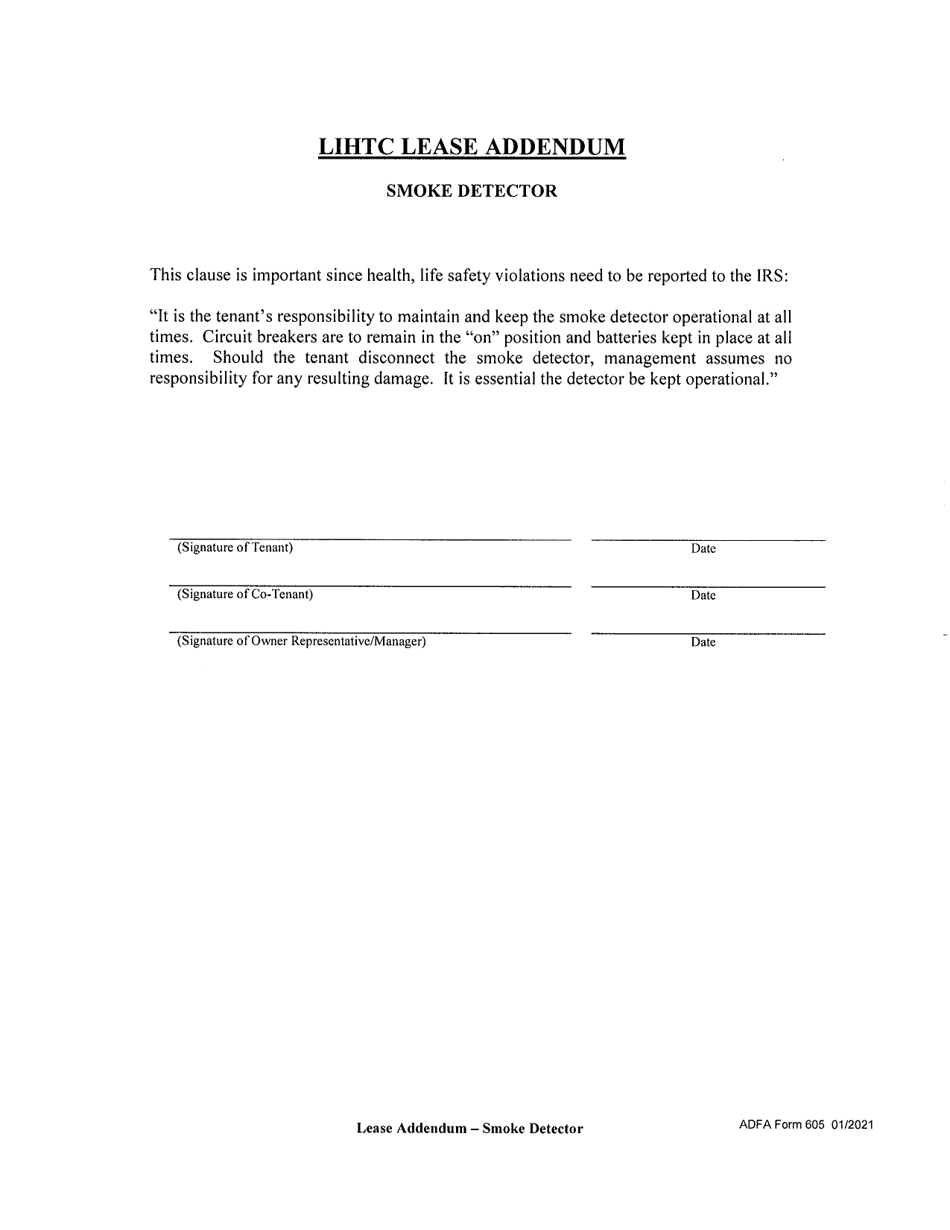

Q: What is ADFA Form 605?

A: ADFA Form 605 is a Lease Addendum specific to LIHTC (Low-Income Housing Tax Credit) properties in Arkansas.

Q: What is the purpose of the LIHTC Lease Addendum?

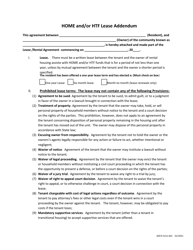

A: The LIHTC Lease Addendum is used to add additional provisions and requirements related to LIHTC properties, such as smoke detectors.

Q: What does LIHTC stand for?

A: LIHTC stands for Low-Income Housing Tax Credit.

Q: What does the LIHTC Lease Addendum cover?

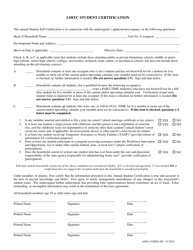

A: The LIHTC Lease Addendum covers specific requirements for LIHTC properties, such as the installation and maintenance of smoke detectors.

Q: What is the role of a smoke detector in the LIHTC Lease Addendum?

A: The LIHTC Lease Addendum includes provisions related to the installation, maintenance, and testing of smoke detectors in the rental unit.

Q: Is the LIHTC Lease Addendum applicable to all properties?

A: No, the LIHTC Lease Addendum is specifically for LIHTC properties in Arkansas.

Q: Do I need to sign the LIHTC Lease Addendum if I live in an LIHTC property?

A: Yes, if you live in an LIHTC property in Arkansas, you may be required to sign the LIHTC Lease Addendum as part of your rental agreement.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arkansas Development Finance Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of ADFA Form 605 by clicking the link below or browse more documents and templates provided by the Arkansas Development Finance Authority.