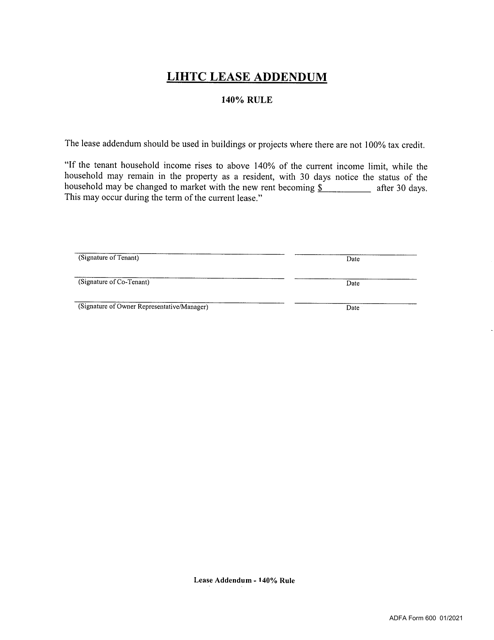

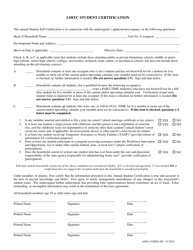

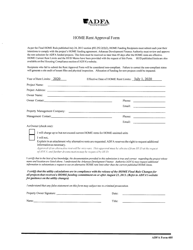

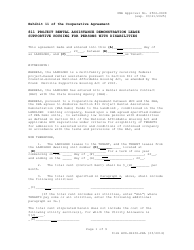

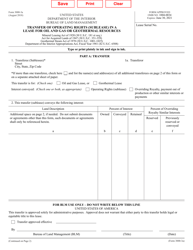

ADFA Form 600 LIHTC Lease Addendum - 140% Rule - Arkansas

What Is ADFA Form 600?

This is a legal form that was released by the Arkansas Development Finance Authority - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ADFA Form 600?

A: ADFA Form 600 is a LIHTC Lease Addendum used in Arkansas.

Q: What is LIHTC?

A: LIHTC stands for Low-Income Housing Tax Credit.

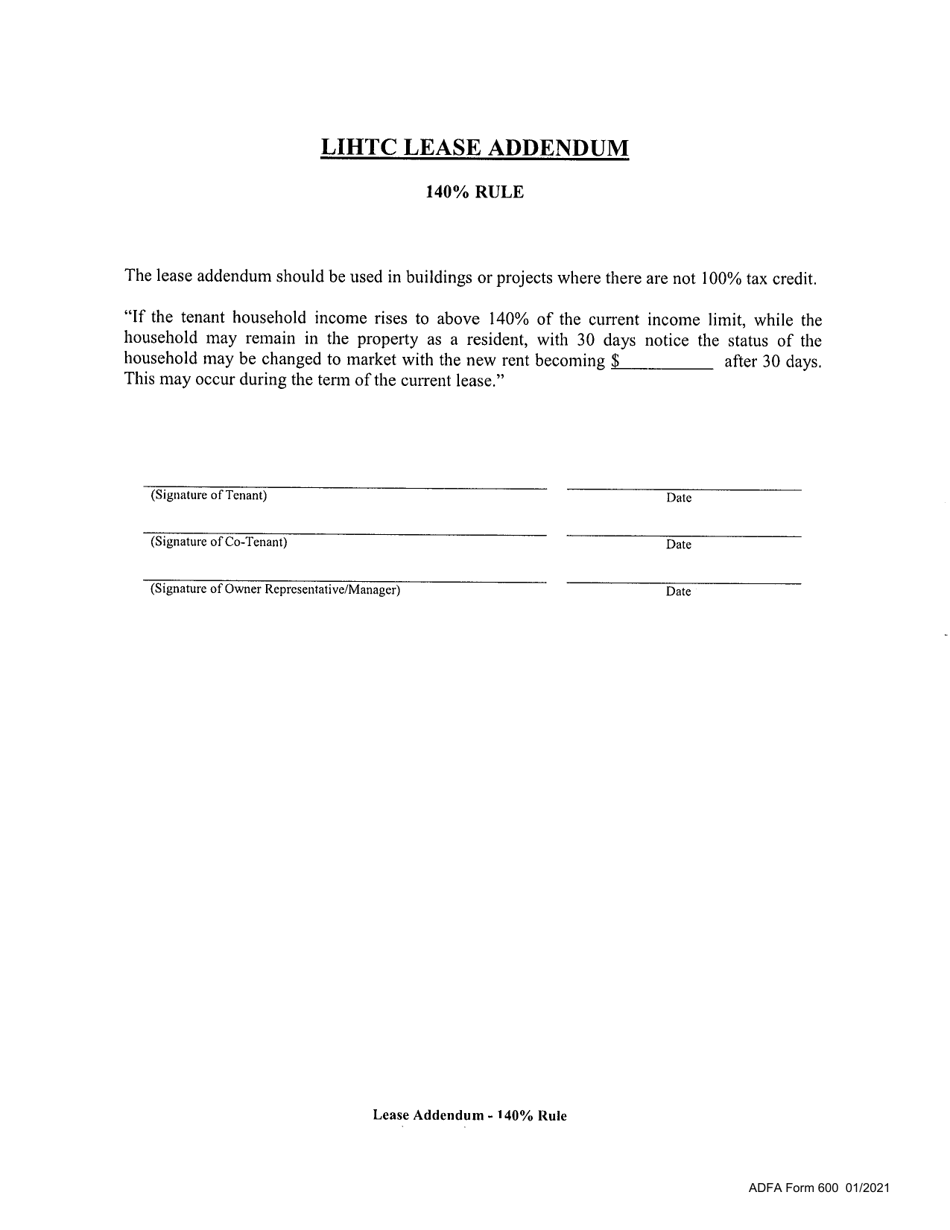

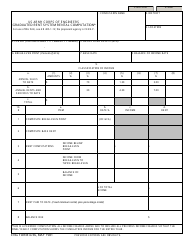

Q: What is the 140% Rule?

A: The 140% Rule is a requirement that at least 40% of units in a LIHTC property must be occupied by tenants with incomes at or below 140% of the area median income.

Q: How does the 140% Rule work?

A: The 140% Rule requires that landlords ensure that at least 40% of tenants in LIHTC properties meet the income requirements.

Q: Why is the 140% Rule important?

A: The 140% Rule is important because it helps to ensure that LIHTC properties provide affordable housing for low and moderate-income individuals and families.

Q: Who does the 140% Rule apply to?

A: The 140% Rule applies to landlords and tenants of LIHTC properties in Arkansas.

Q: Are there any exceptions to the 140% Rule?

A: There may be certain exceptions or waivers available for the 140% Rule in specific cases, but these would need to be approved by the appropriate authorities.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arkansas Development Finance Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of ADFA Form 600 by clicking the link below or browse more documents and templates provided by the Arkansas Development Finance Authority.