This version of the form is not currently in use and is provided for reference only. Download this version of

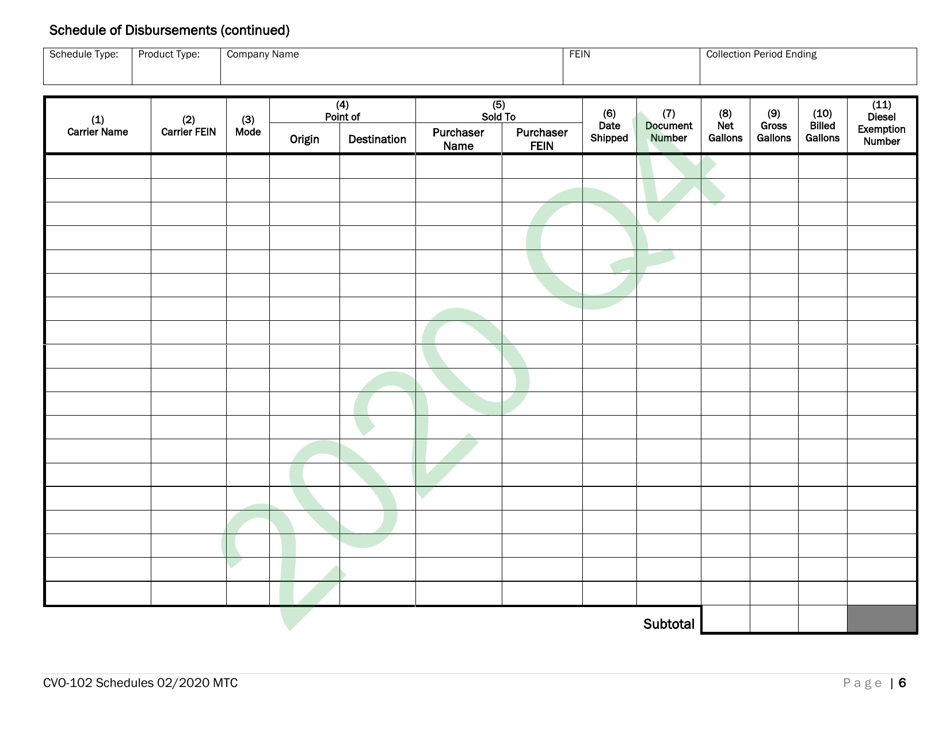

Form CVO-102

for the current year.

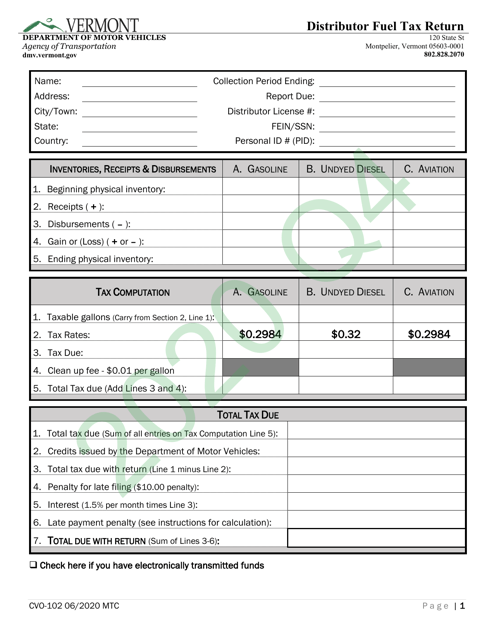

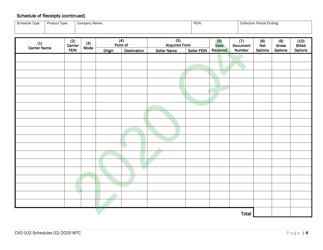

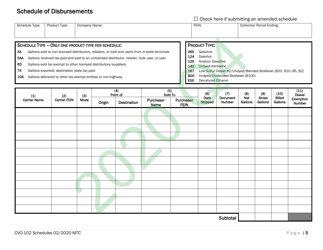

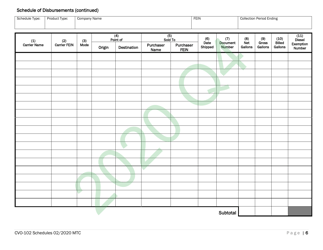

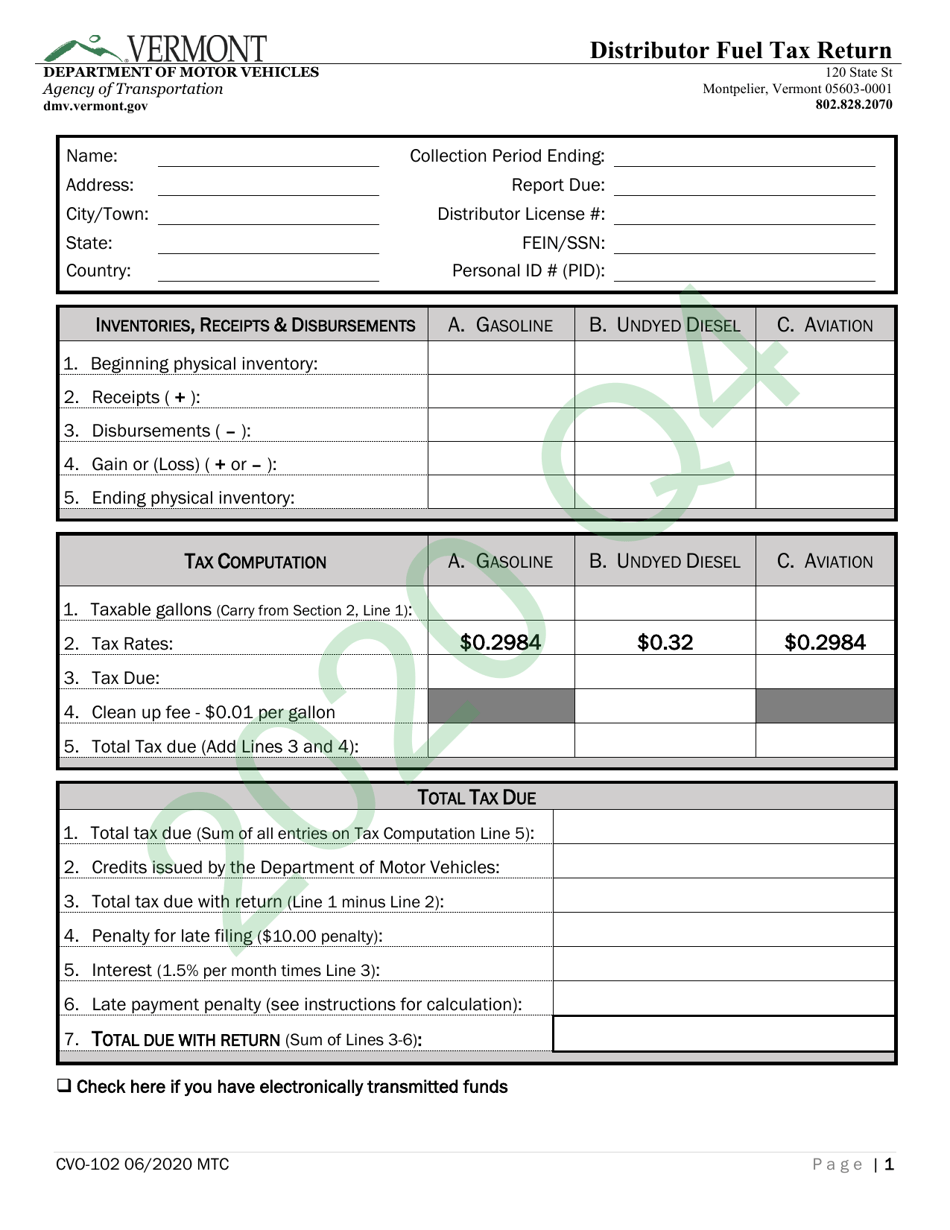

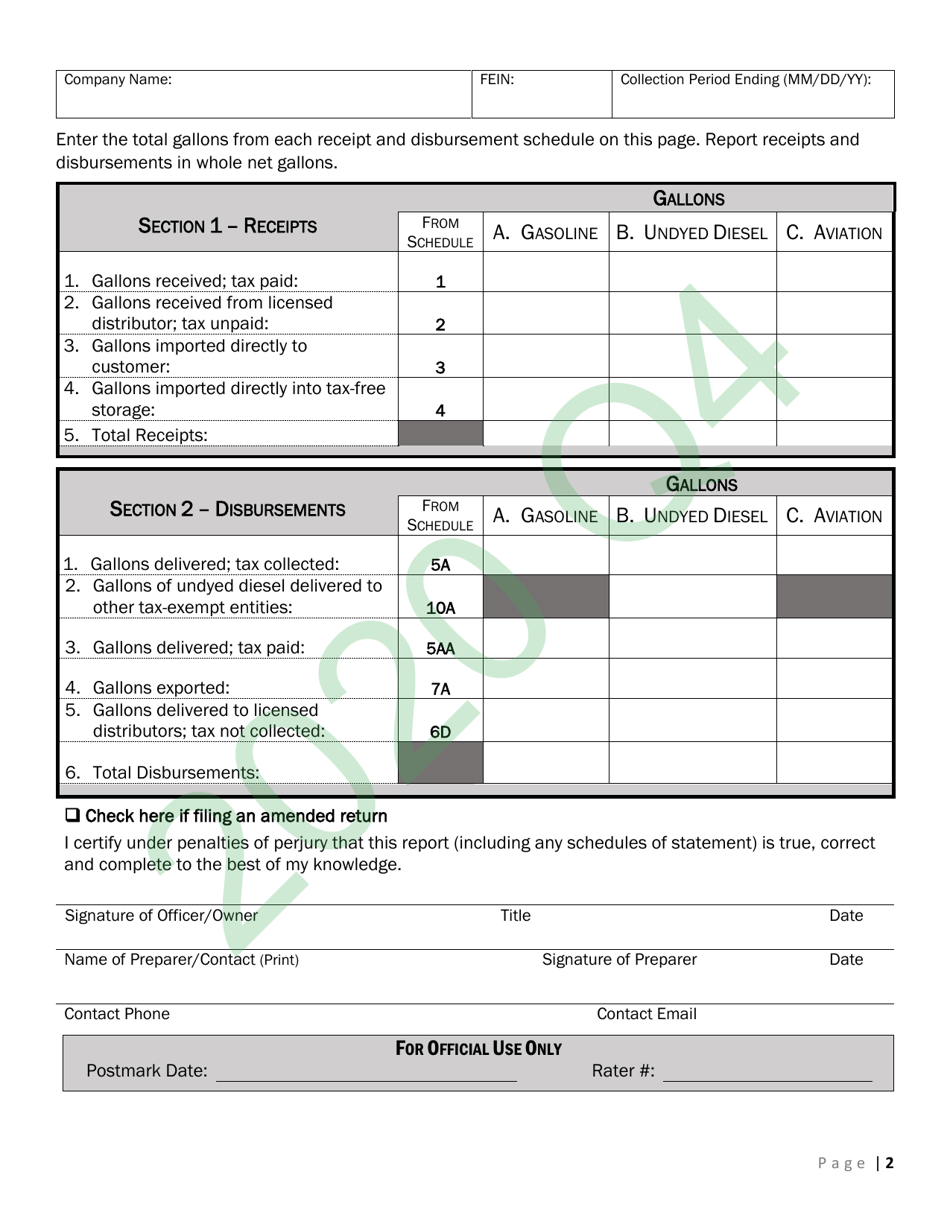

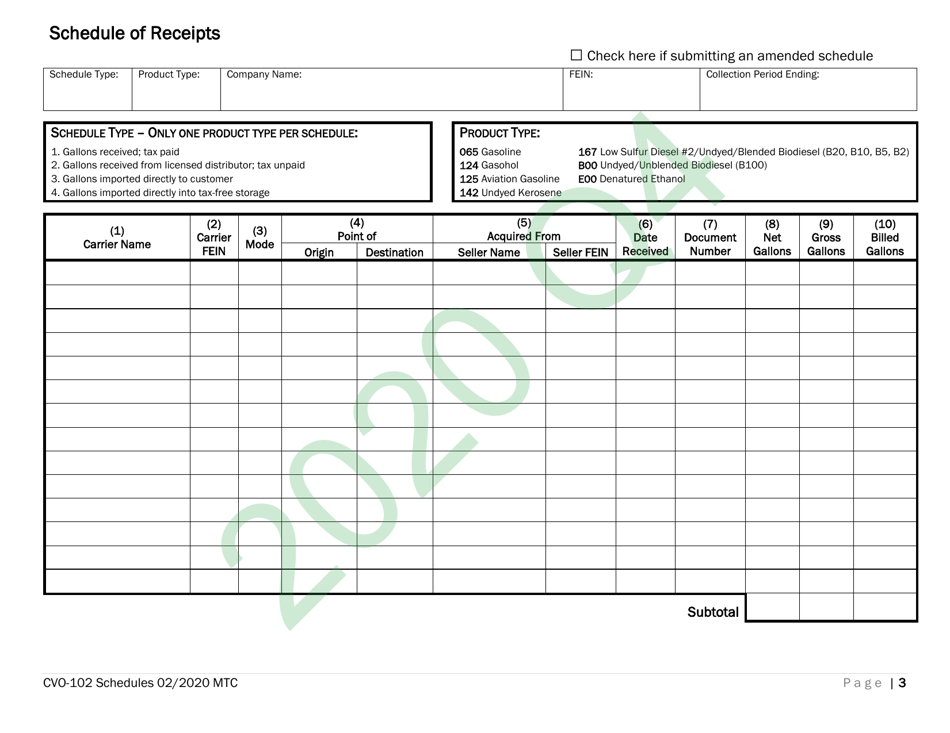

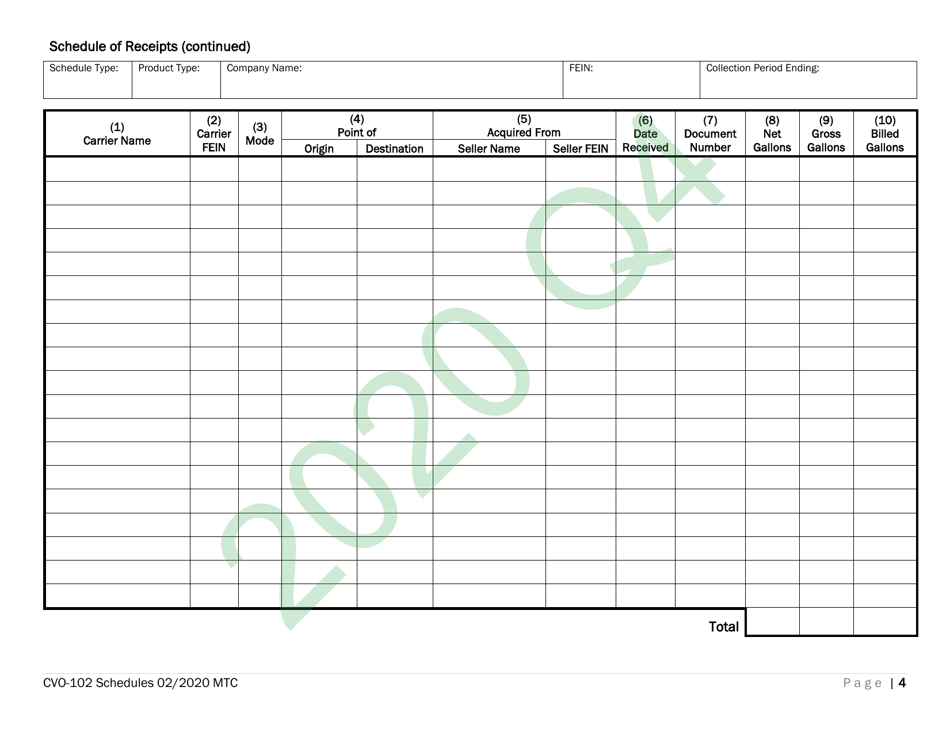

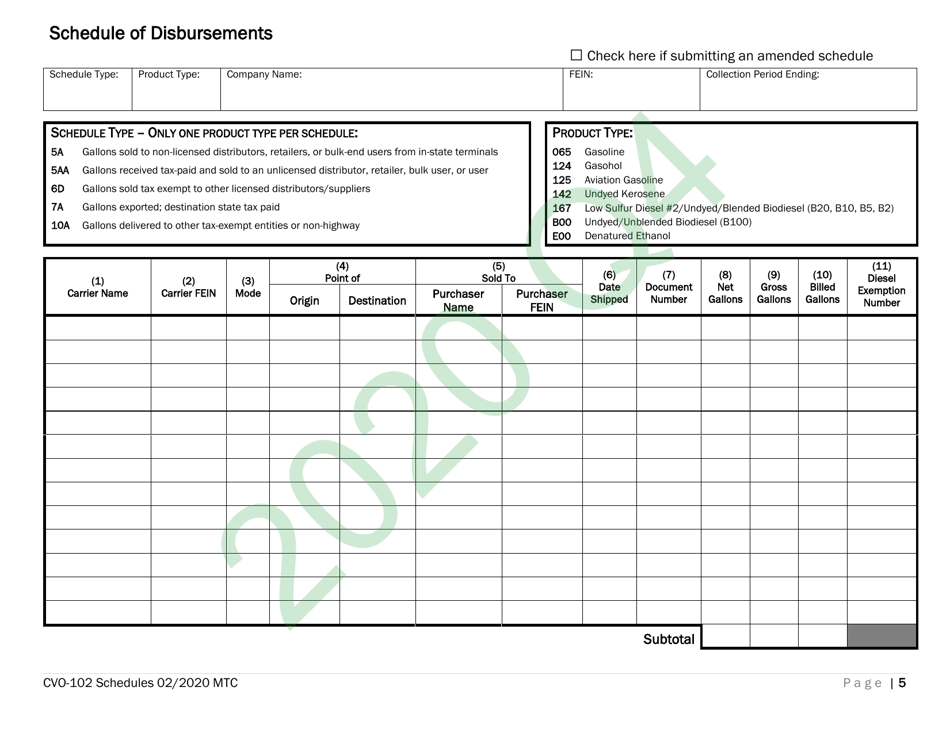

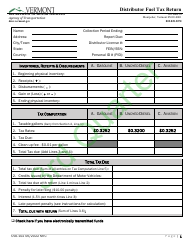

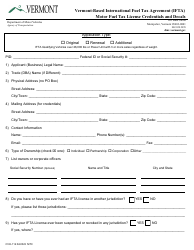

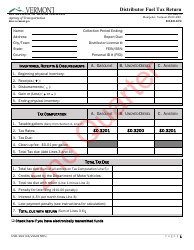

Form CVO-102 Distributor Fuel Tax Return (Q4) - Vermont

What Is Form CVO-102?

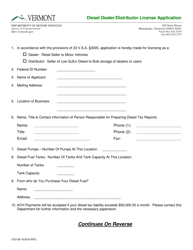

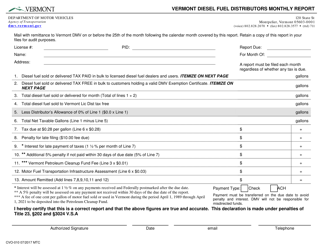

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CVO-102?

A: Form CVO-102 is the Distributor Fuel Tax Return for the state of Vermont.

Q: When is Form CVO-102 due?

A: Form CVO-102 is due on a quarterly basis.

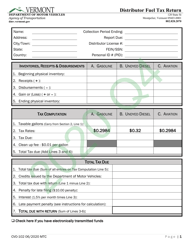

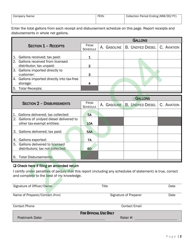

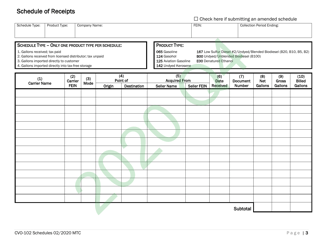

Q: What does Form CVO-102 report?

A: Form CVO-102 reports the fuel tax liability for distributors in Vermont.

Q: Who needs to file Form CVO-102?

A: Distributors of fuel in Vermont need to file Form CVO-102.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form CVO-102.

Q: What should I do if I need assistance with Form CVO-102?

A: If you need assistance with Form CVO-102, you should contact the Vermont Department of Motor Vehicles.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-102 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.