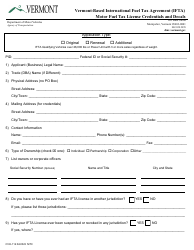

This version of the form is not currently in use and is provided for reference only. Download this version of

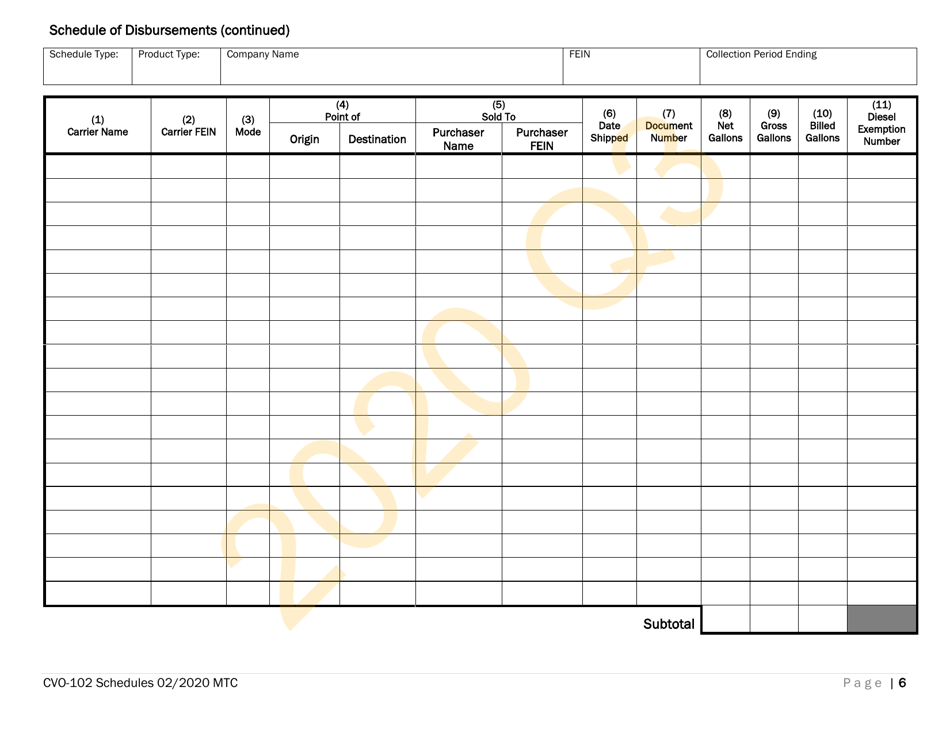

Form CVO-102

for the current year.

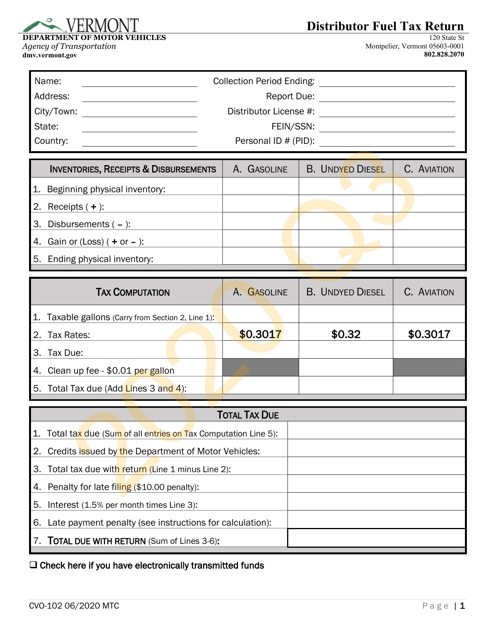

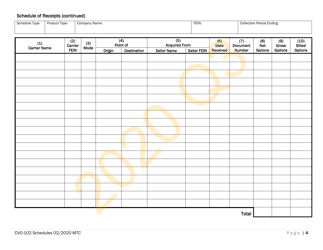

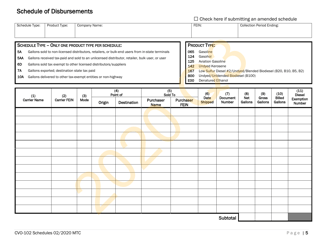

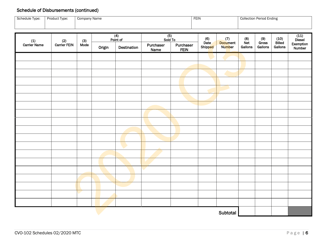

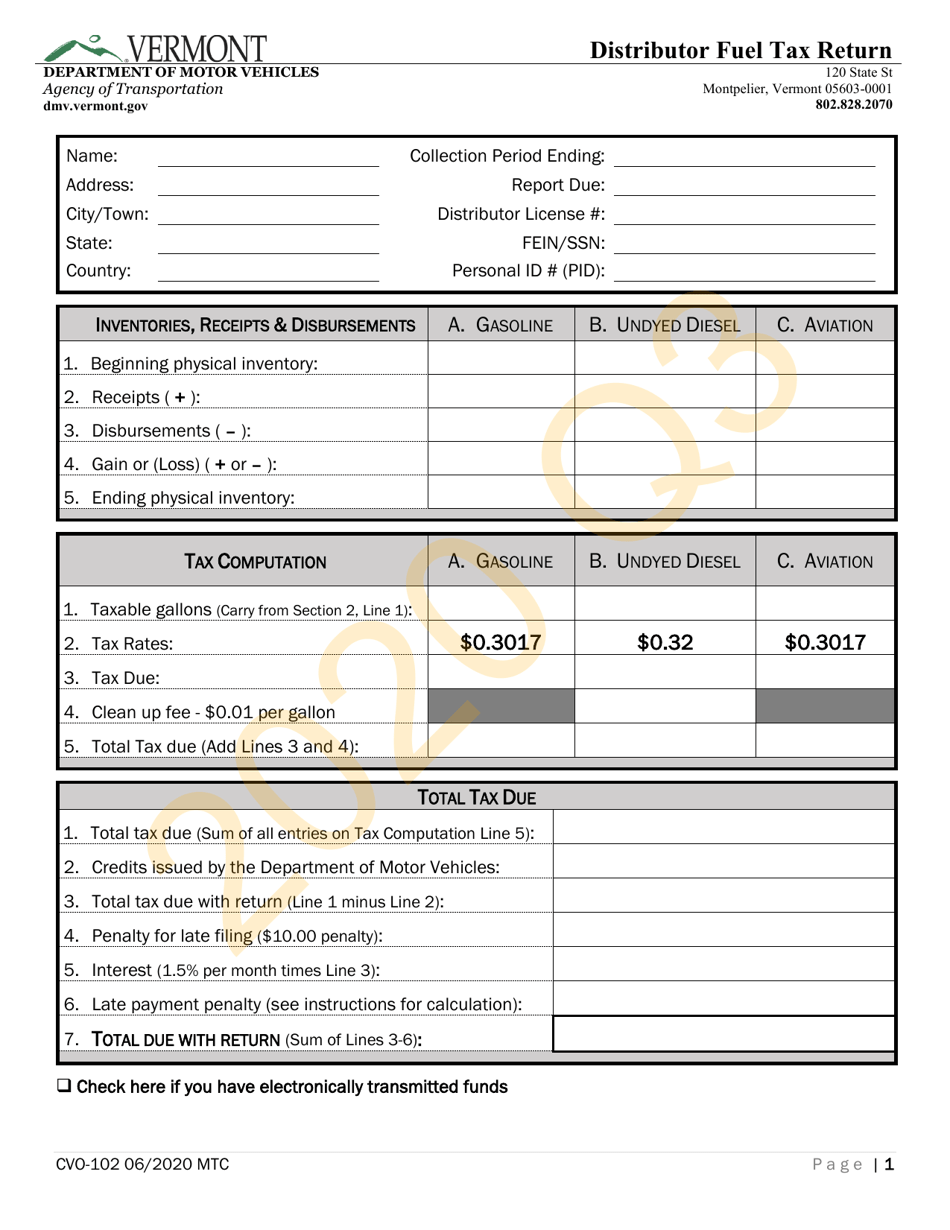

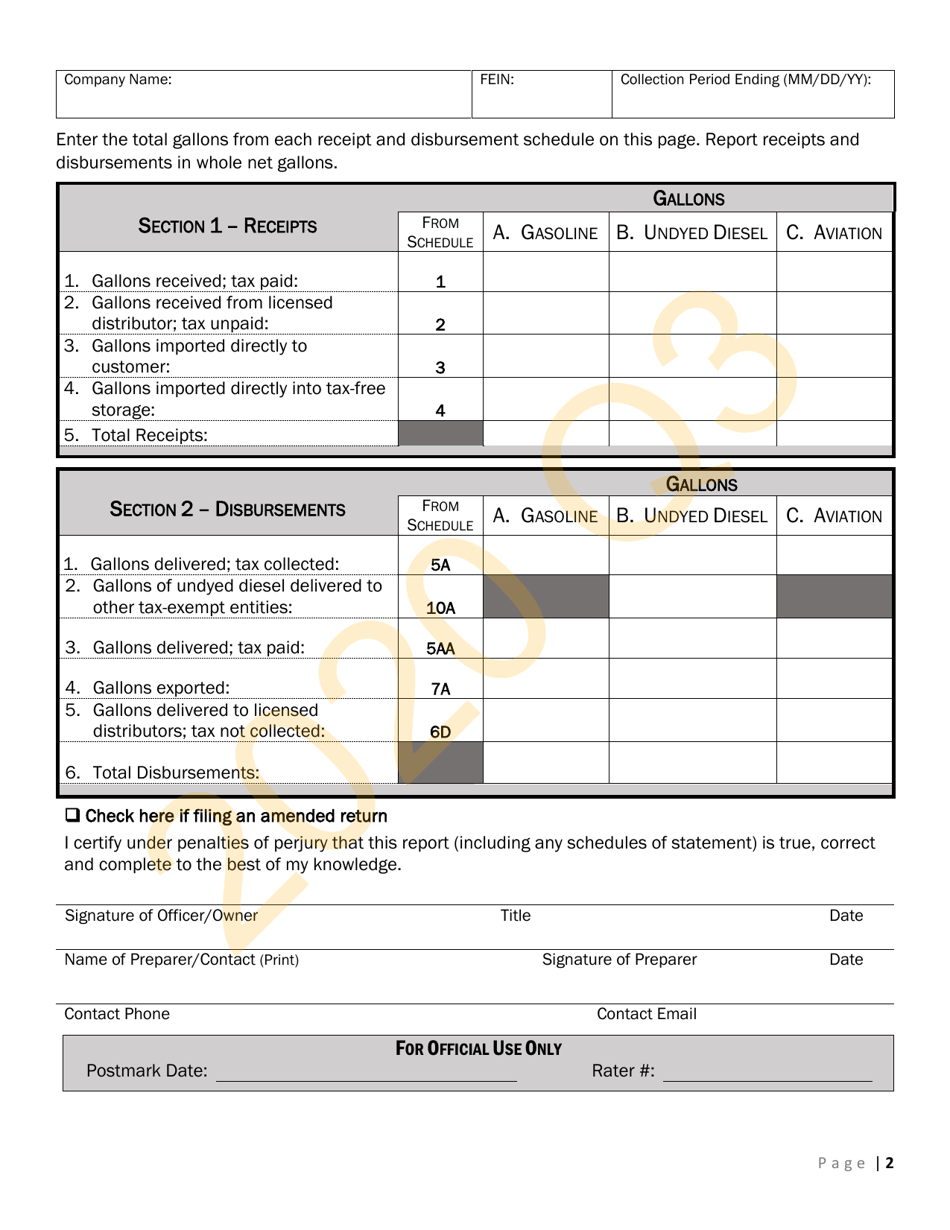

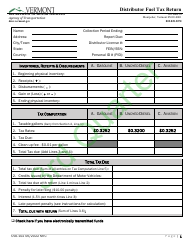

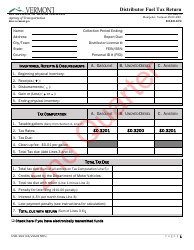

Form CVO-102 Distributor Fuel Tax Return (Q3) - Vermont

What Is Form CVO-102?

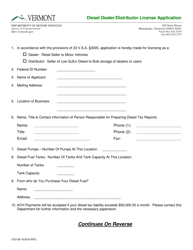

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CVO-102?

A: Form CVO-102 is the Distributor Fuel Tax Return for Vermont.

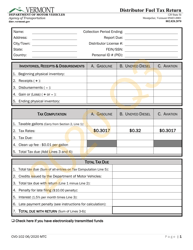

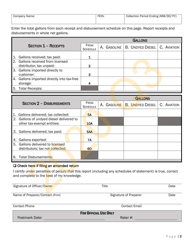

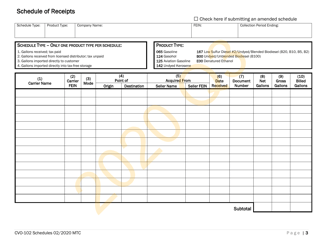

Q: What does the Form CVO-102 cover?

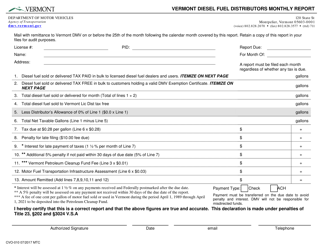

A: Form CVO-102 covers the reporting and payment of fuel taxes by distributors in Vermont.

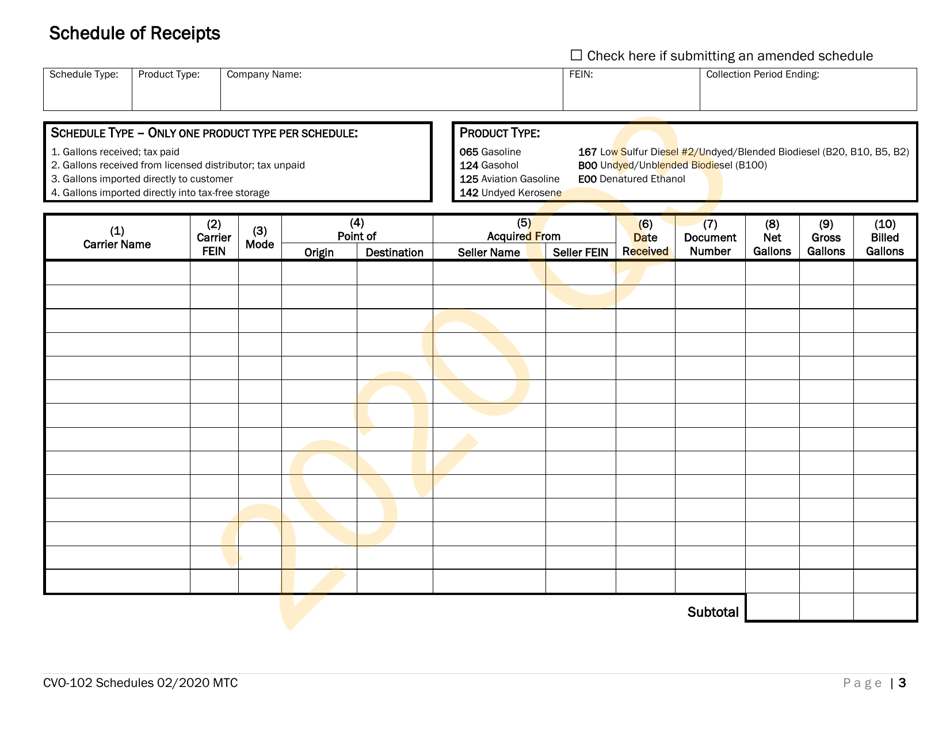

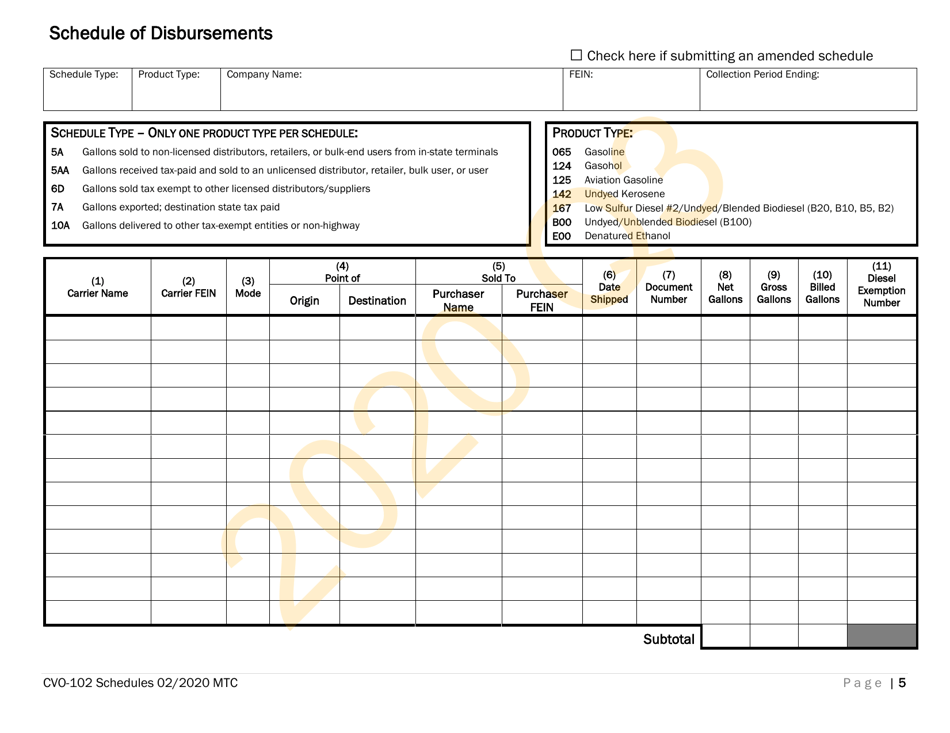

Q: What types of fuel are covered by Form CVO-102?

A: Form CVO-102 covers gasoline, diesel, biodiesel, and alternative fuels.

Q: Who needs to file Form CVO-102?

A: Distributors of fuel in Vermont need to file Form CVO-102.

Q: When is Form CVO-102 due?

A: Form CVO-102 is due quarterly, with Q3 covering the months of July, August, and September.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-102 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.