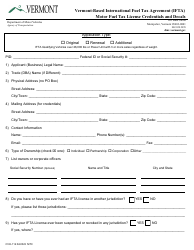

This version of the form is not currently in use and is provided for reference only. Download this version of

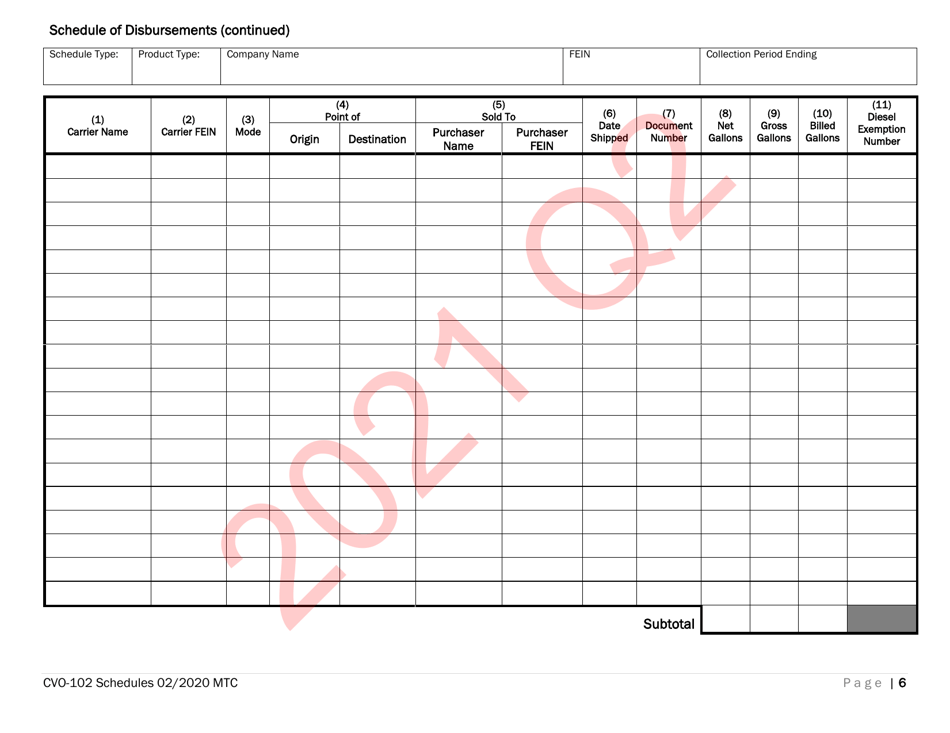

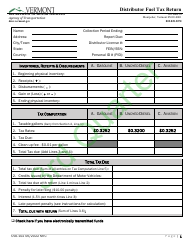

Form CVO-102

for the current year.

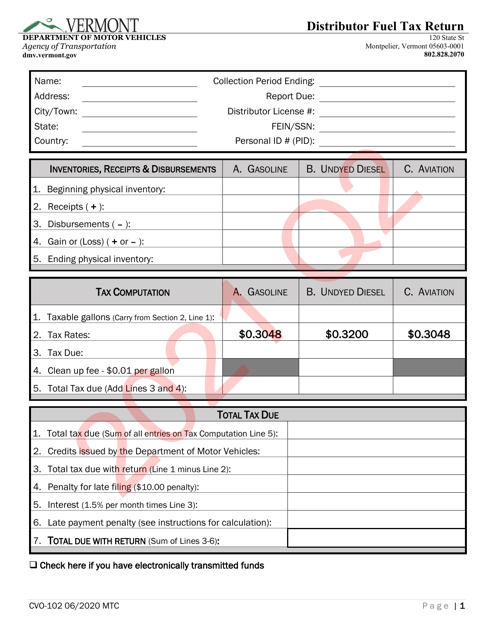

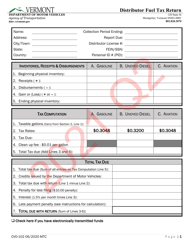

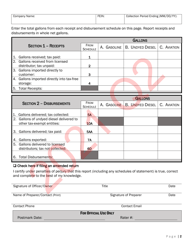

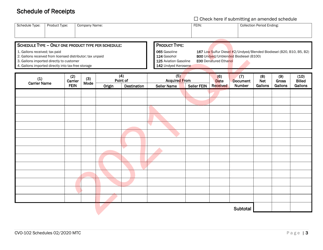

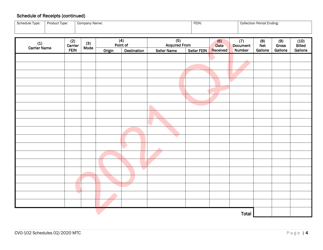

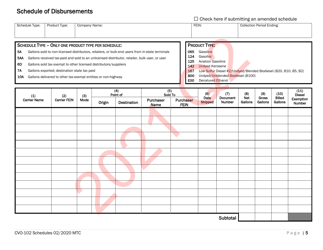

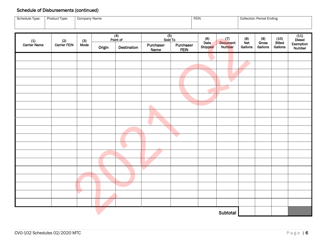

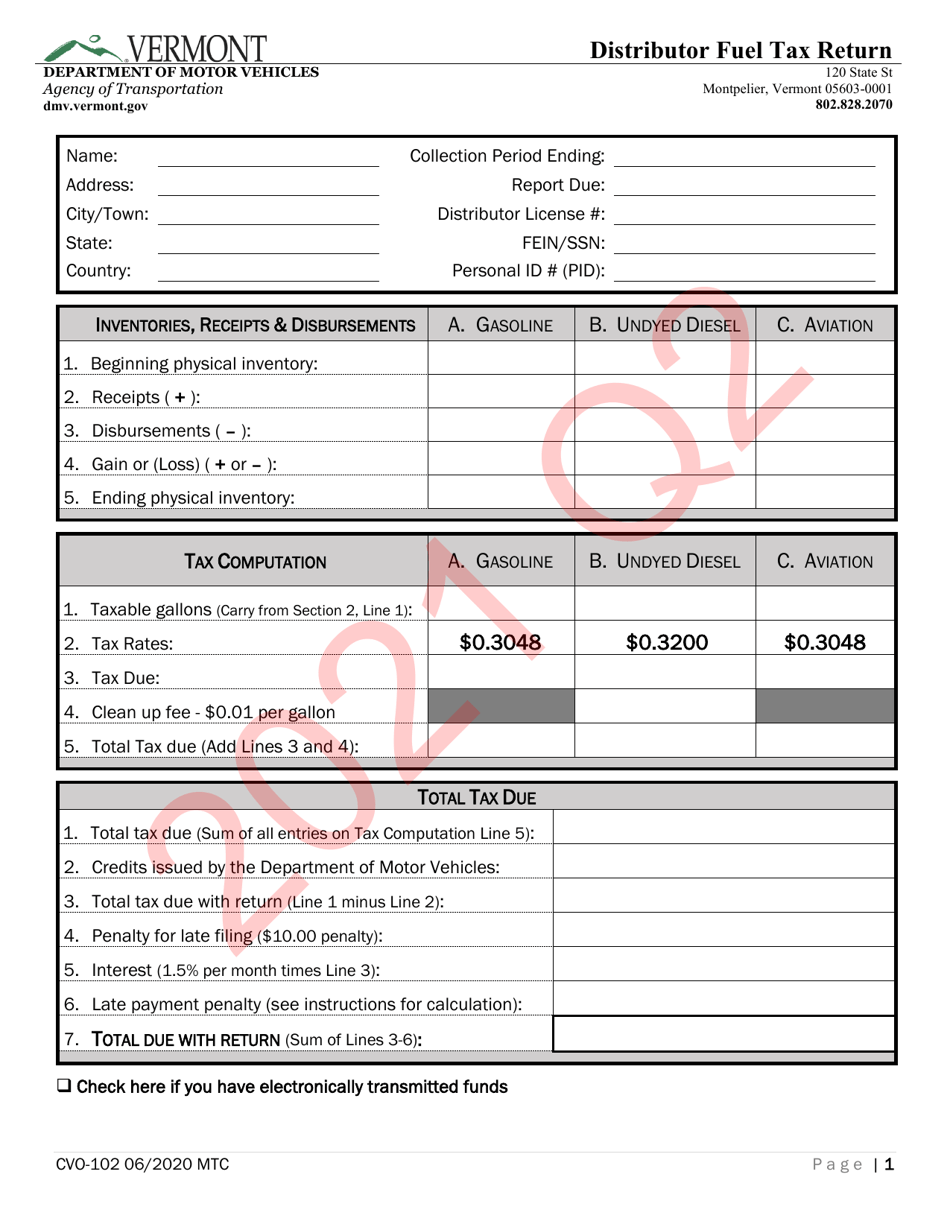

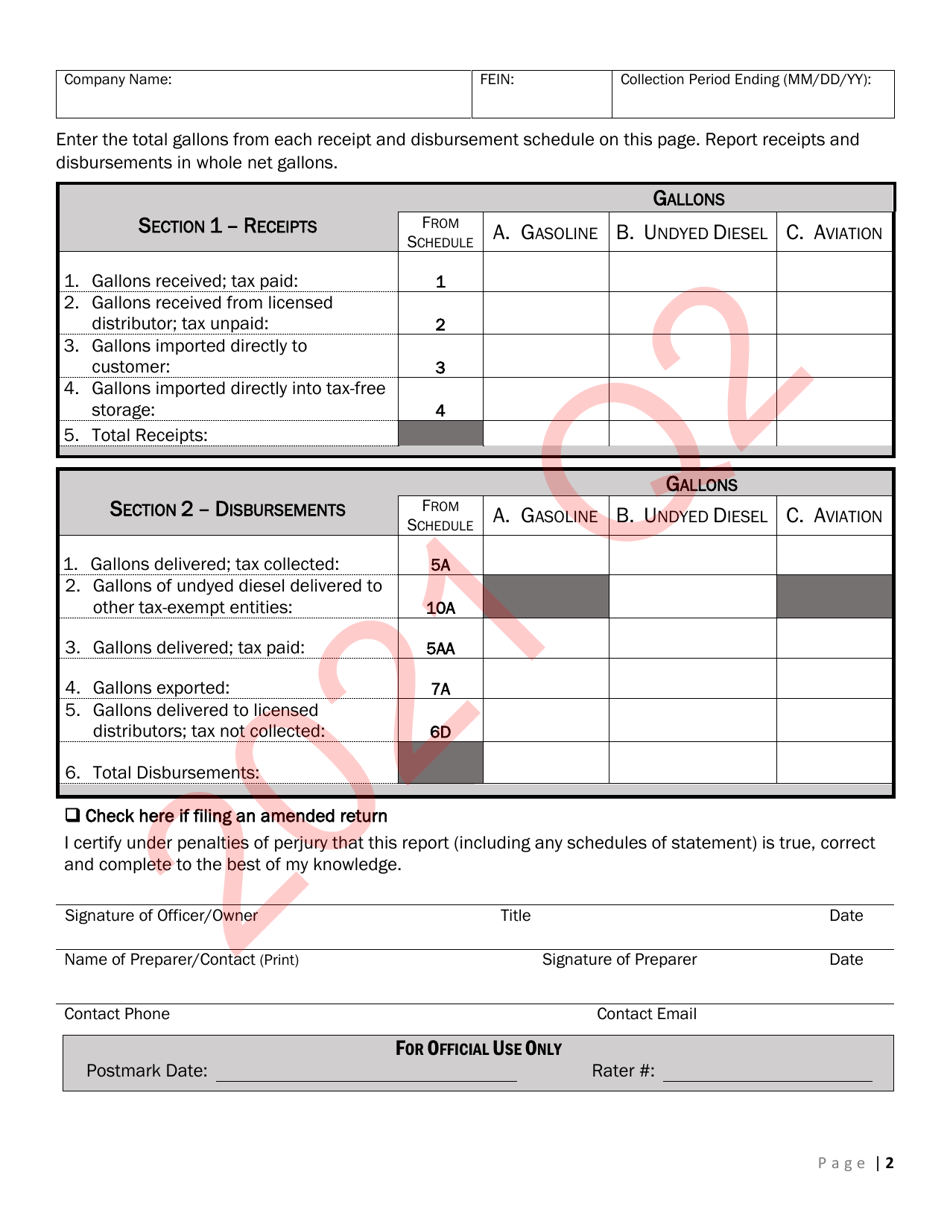

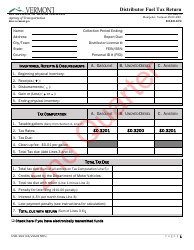

Form CVO-102 Distributor Fuel Tax Return (Q2) - Vermont

What Is Form CVO-102?

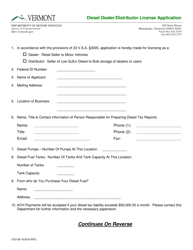

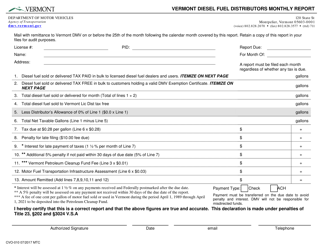

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CVO-102?

A: Form CVO-102 is the Distributor Fuel Tax Return in Vermont.

Q: Who needs to file Form CVO-102?

A: Distributors of fuel in Vermont need to file Form CVO-102.

Q: What is the purpose of Form CVO-102?

A: Form CVO-102 is used to report fuel sales and calculate the tax due.

Q: What period does Form CVO-102 cover?

A: Form CVO-102 is for the second quarter (Q2) of the year.

Q: When is Form CVO-102 due?

A: Form CVO-102 is due on or before the last day of the month following the end of the quarter.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-102 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.