This version of the form is not currently in use and is provided for reference only. Download this version of

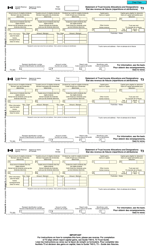

Form T3ATH-IND

for the current year.

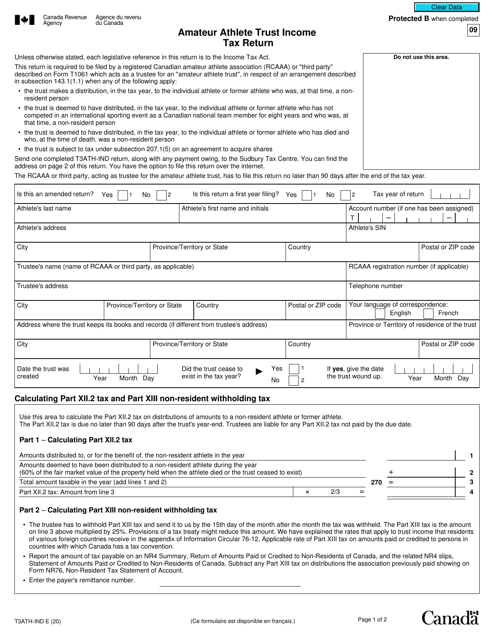

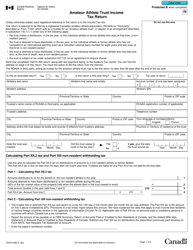

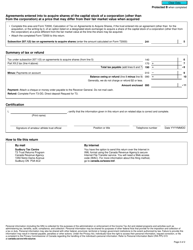

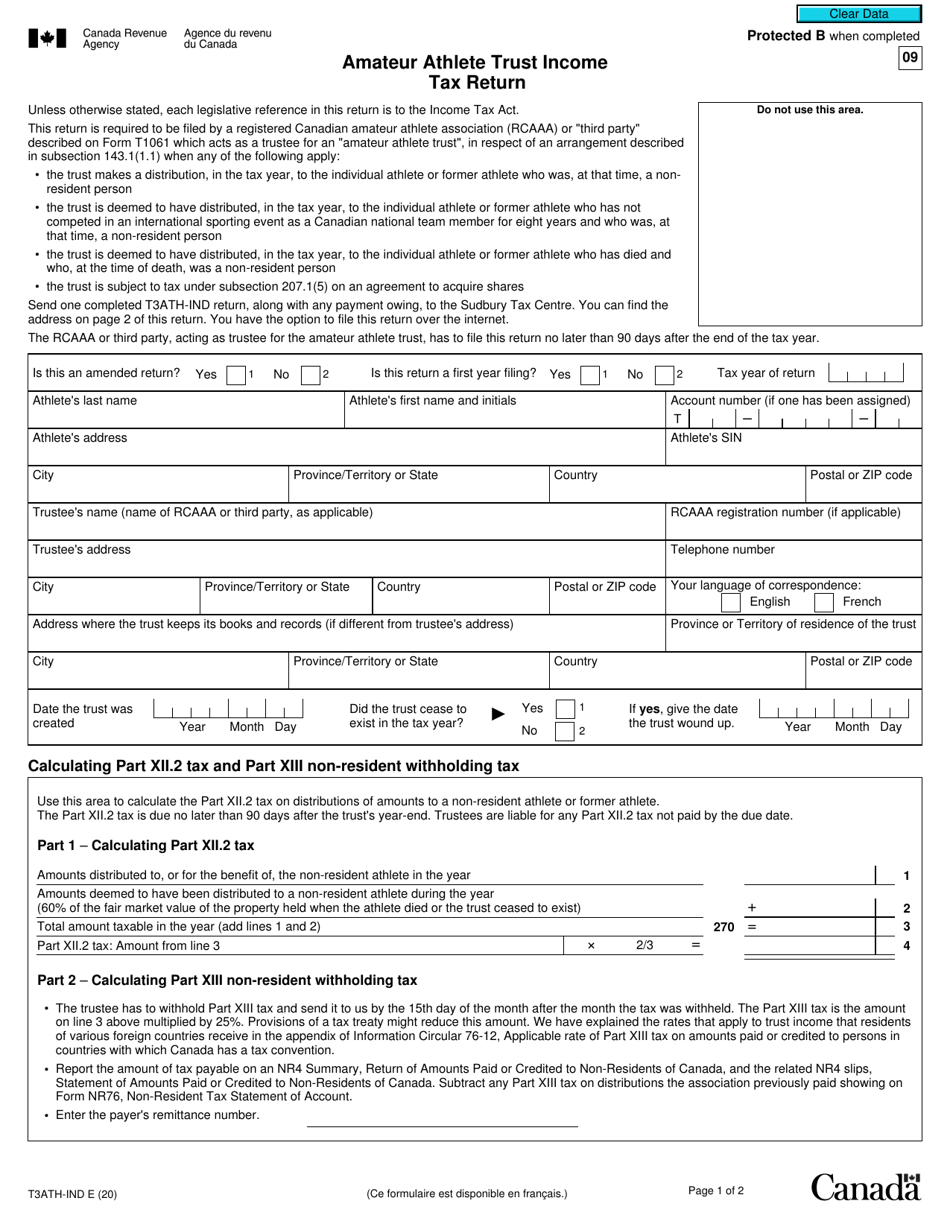

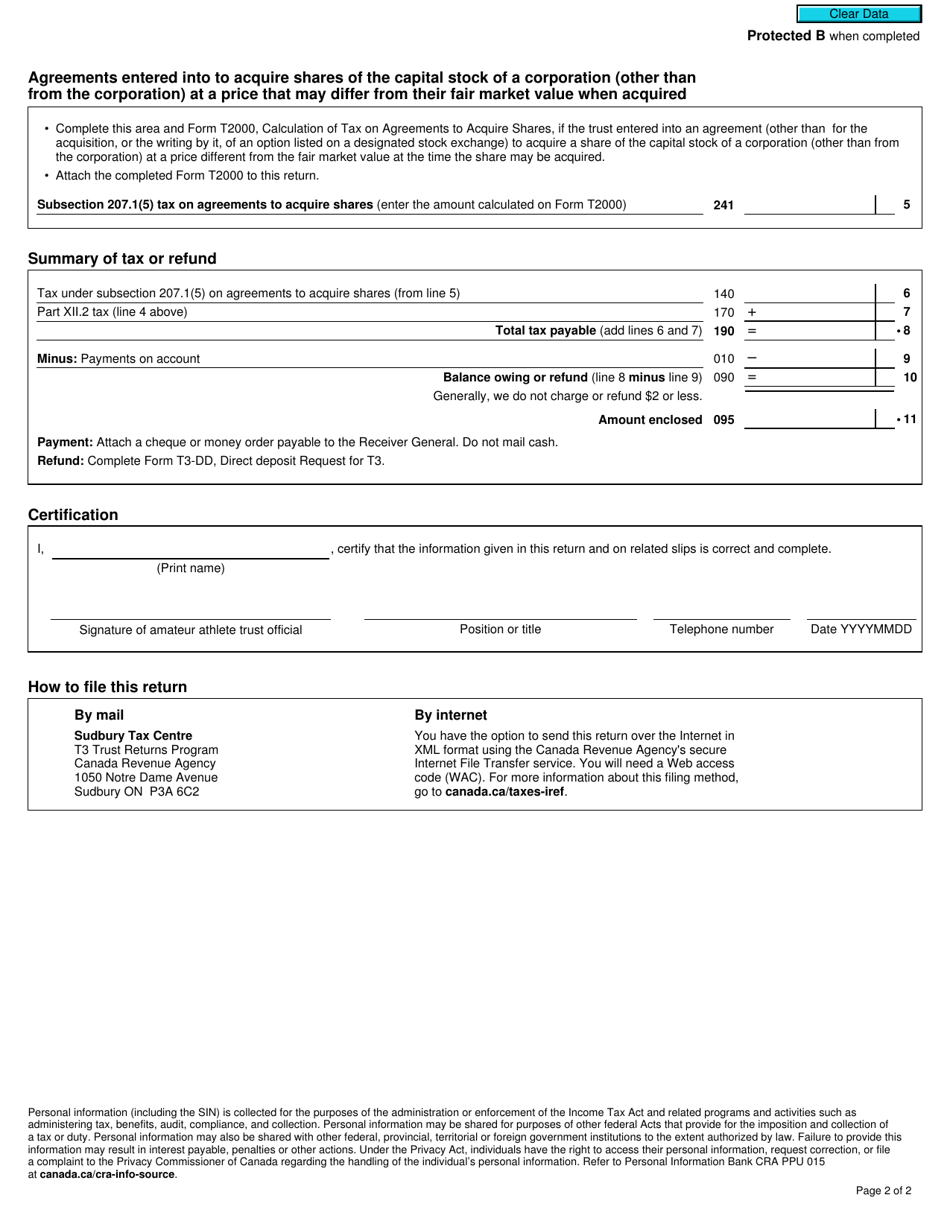

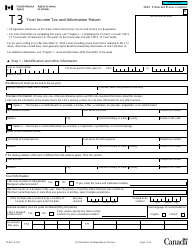

Form T3ATH-IND Amateur Athlete Trust Income Tax Return - Canada

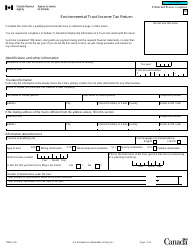

Form T3ATH-IND, Amateur Athlete Trust Income Tax Return, is used by amateur athlete trusts in Canada to report their income and calculate the tax payable. It is specifically designed for trusts that hold funds for the benefit of amateur athletes.

The Form T3ATH-IND Amateur Athlete Trust Income Tax Return in Canada is filed by amateur athletes who have an athlete trust.

FAQ

Q: What is Form T3ATH-IND?

A: Form T3ATH-IND is the income tax return form specifically for Amateur Athlete Trust.

Q: Who should file Form T3ATH-IND?

A: Individuals who have income through an Amateur Athlete Trust should file the Form T3ATH-IND.

Q: What is an Amateur Athlete Trust?

A: An Amateur Athlete Trust is a trust set up to provide financial support to amateur athletes.

Q: What income is reported on Form T3ATH-IND?

A: Only the income earned through an Amateur Athlete Trust should be reported on Form T3ATH-IND.

Q: What is the purpose of Form T3ATH-IND?

A: The purpose of Form T3ATH-IND is to calculate and report the income and taxes owed on income earned through an Amateur Athlete Trust.

Q: When is Form T3ATH-IND due?

A: Form T3ATH-IND is due on or before the filing deadline for trusts, which is 90 days after the end of the trust's fiscal year.