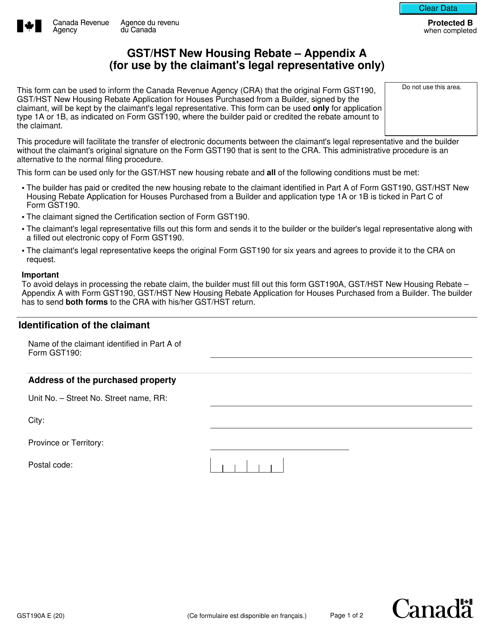

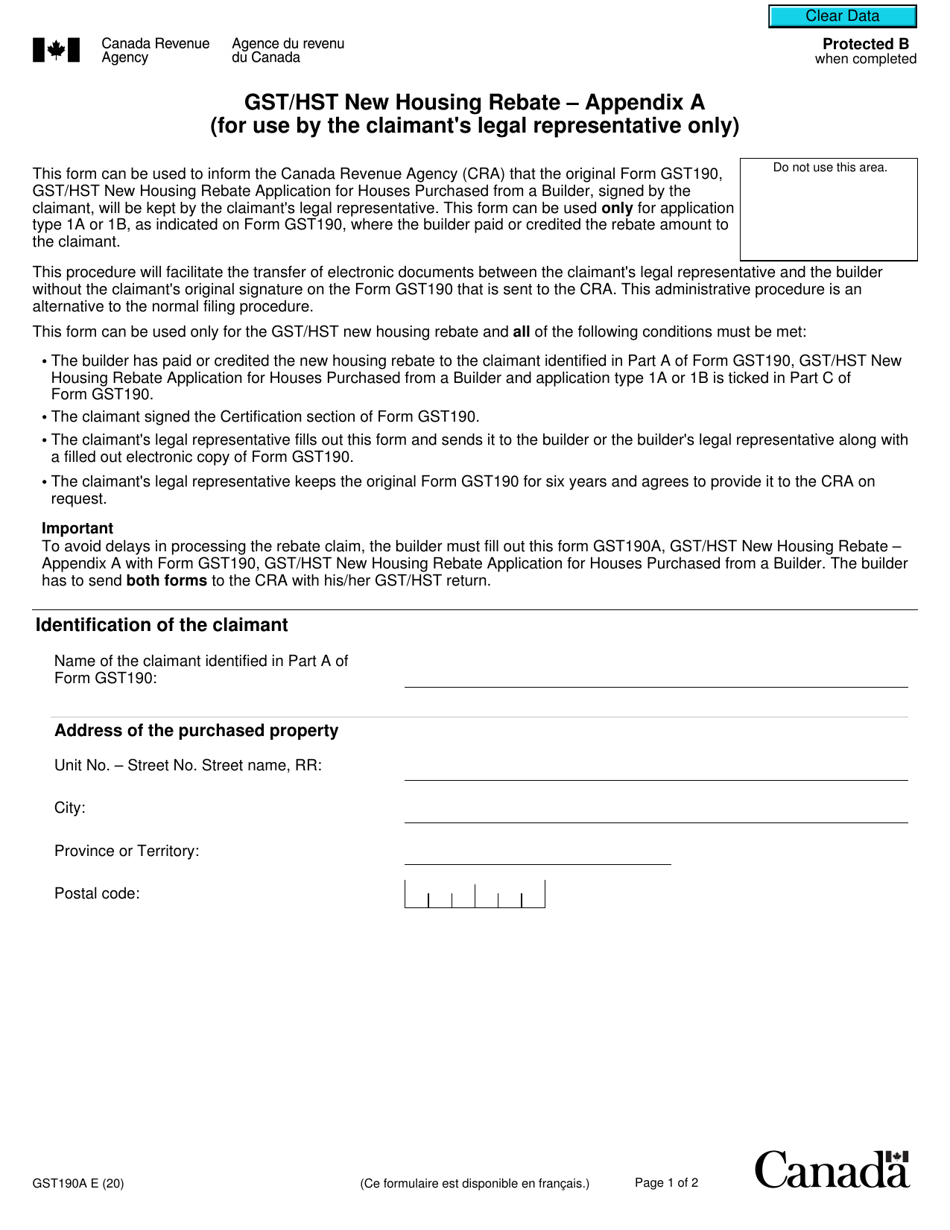

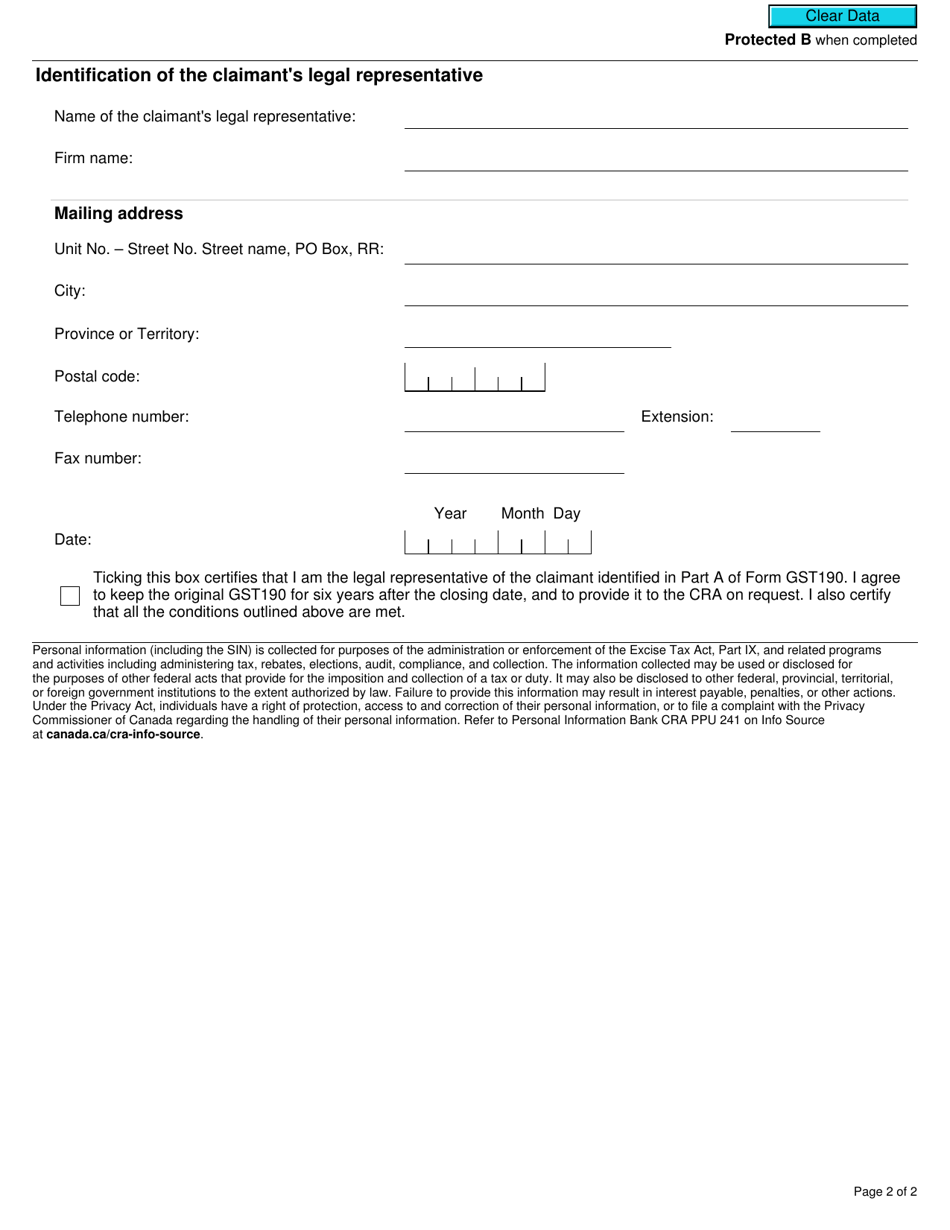

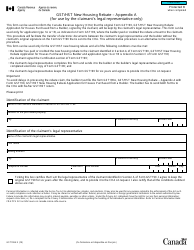

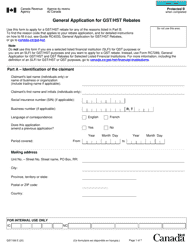

Form GST190A Appendix A Gst / Hst New Housing Rebate (For Use by the Claimant's Legal Representative Only) - Canada

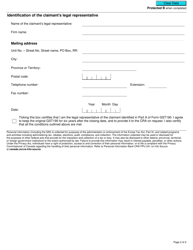

Form GST190A Appendix A is used in Canada for claiming the GST/HST New Housing Rebate. It is specifically intended to be used by the claimant's legal representative.

The Form GST190A Appendix A GST/HST New Housing Rebate (For Use by the Claimant's Legal Representative Only) is typically filed by the claimant's legal representative in Canada.

FAQ

Q: What is the GST/HST new housing rebate?

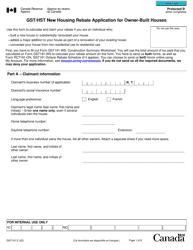

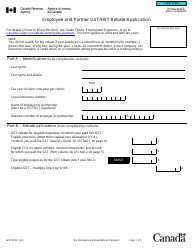

A: The GST/HST new housing rebate is a refund of a portion of the goods and services tax (GST) or the harmonized sales tax (HST) paid on the purchase of a new or substantially renovated home.

Q: Who is eligible for the GST/HST new housing rebate?

A: Individuals who have purchased a new or substantially renovated home, and meet certain criteria, are eligible to claim the GST/HST new housing rebate.

Q: What is a substantially renovated home?

A: A substantially renovated home is a home that has undergone major renovations, such as substantial additions or structural alterations.

Q: How much is the GST/HST new housing rebate?

A: The amount of the rebate will vary depending on the purchase price of the home and the applicable tax rate. The maximum rebate for a new home is $6,300.

Q: How do I apply for the GST/HST new housing rebate?

A: To apply for the GST/HST new housing rebate, you must complete and submit Form GST190A Appendix A to the Canada Revenue Agency (CRA). The form must be completed by the claimant's legal representative.

Q: When should I apply for the GST/HST new housing rebate?

A: You should apply for the GST/HST new housing rebate within two years from the date of purchase or the date the renovation is substantially completed.

Q: Is the GST/HST new housing rebate taxable?

A: No, the GST/HST new housing rebate is not considered taxable income.

Q: Can I claim the GST/HST new housing rebate for a rental property?

A: No, the GST/HST new housing rebate is only available for the purchase or construction of a home that is intended to be the claimant's primary place of residence.

Q: Can I claim the GST/HST new housing rebate for a second home?

A: No, the GST/HST new housing rebate is only available for the claimant's primary place of residence.

Q: What supporting documents are required to claim the GST/HST new housing rebate?

A: You will need to provide copies of the purchase agreement or agreement to build, as well as any other relevant documents to support your claim.

Q: Can I claim the GST/HST new housing rebate if I purchased a previously owned home?

A: No, the GST/HST new housing rebate is only available for new or substantially renovated homes.

Q: Can I claim the GST/HST new housing rebate for a home that I built myself?

A: Yes, you can claim the GST/HST new housing rebate for a home that you built yourself, as long as it meets the eligibility criteria.

Q: Is there a time limit to claim the GST/HST new housing rebate?

A: Yes, you must apply for the GST/HST new housing rebate within two years from the date of purchase or the date the renovation is substantially completed.