This version of the form is not currently in use and is provided for reference only. Download this version of

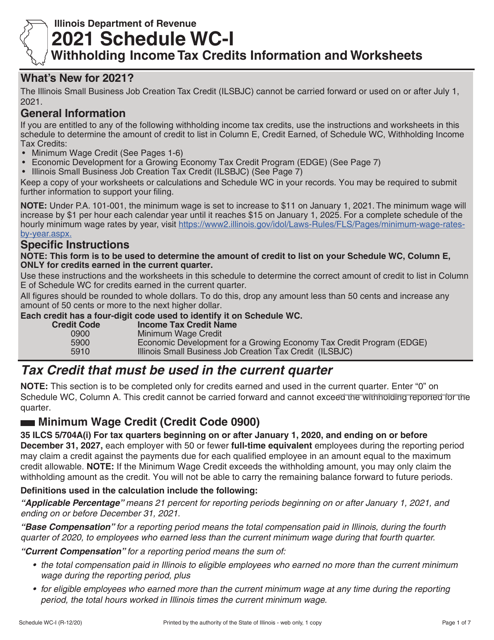

Schedule WC-I

for the current year.

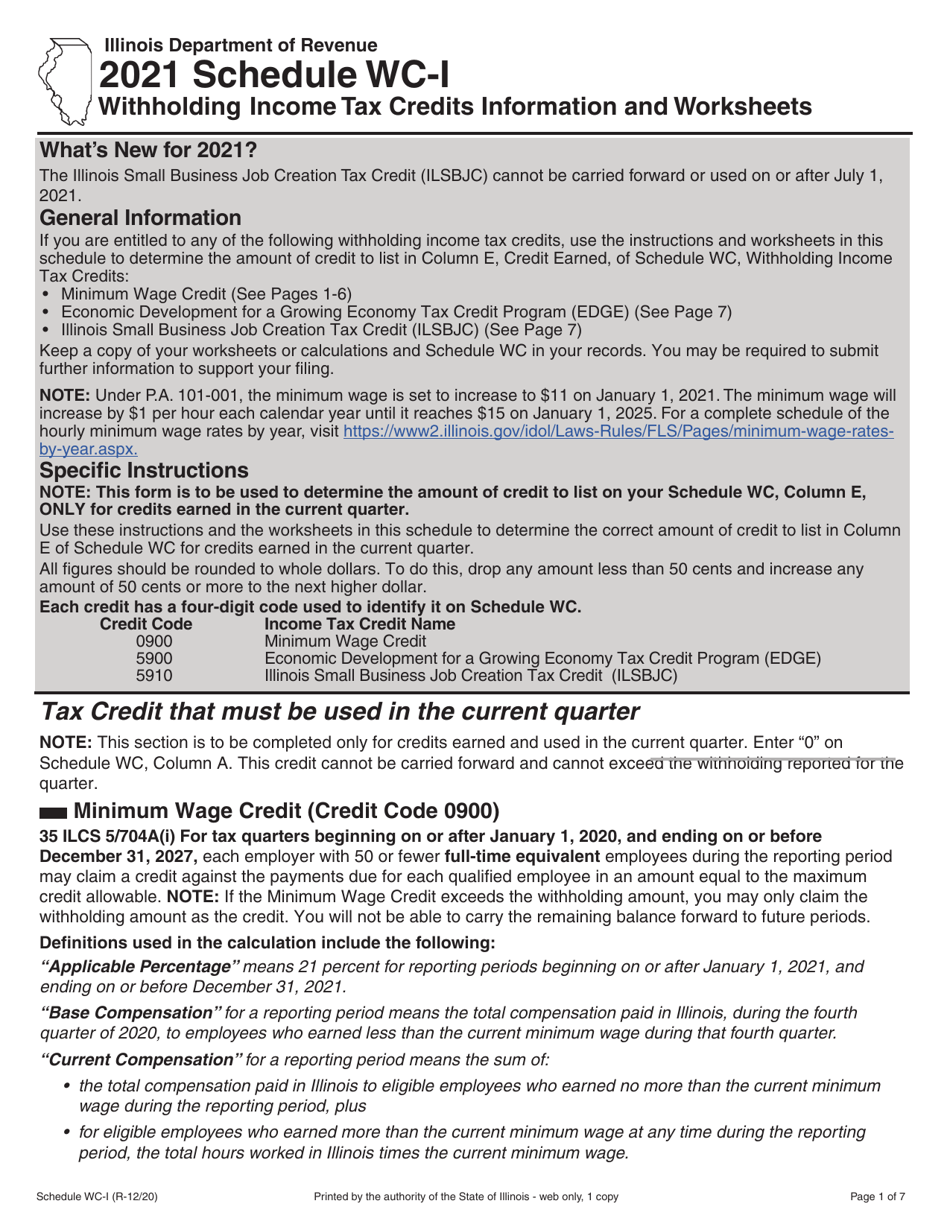

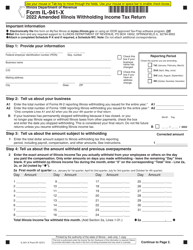

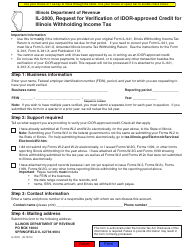

Schedule WC-I Withholding Income Tax Credits Information and Worksheets - Illinois

What Is Schedule WC-I?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WC-I Withholding Income Tax?

A: WC-I Withholding Income Tax is the tax withheld from an employee's wages to cover their Illinois income tax liability.

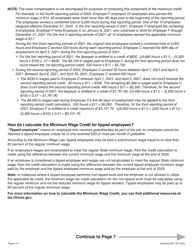

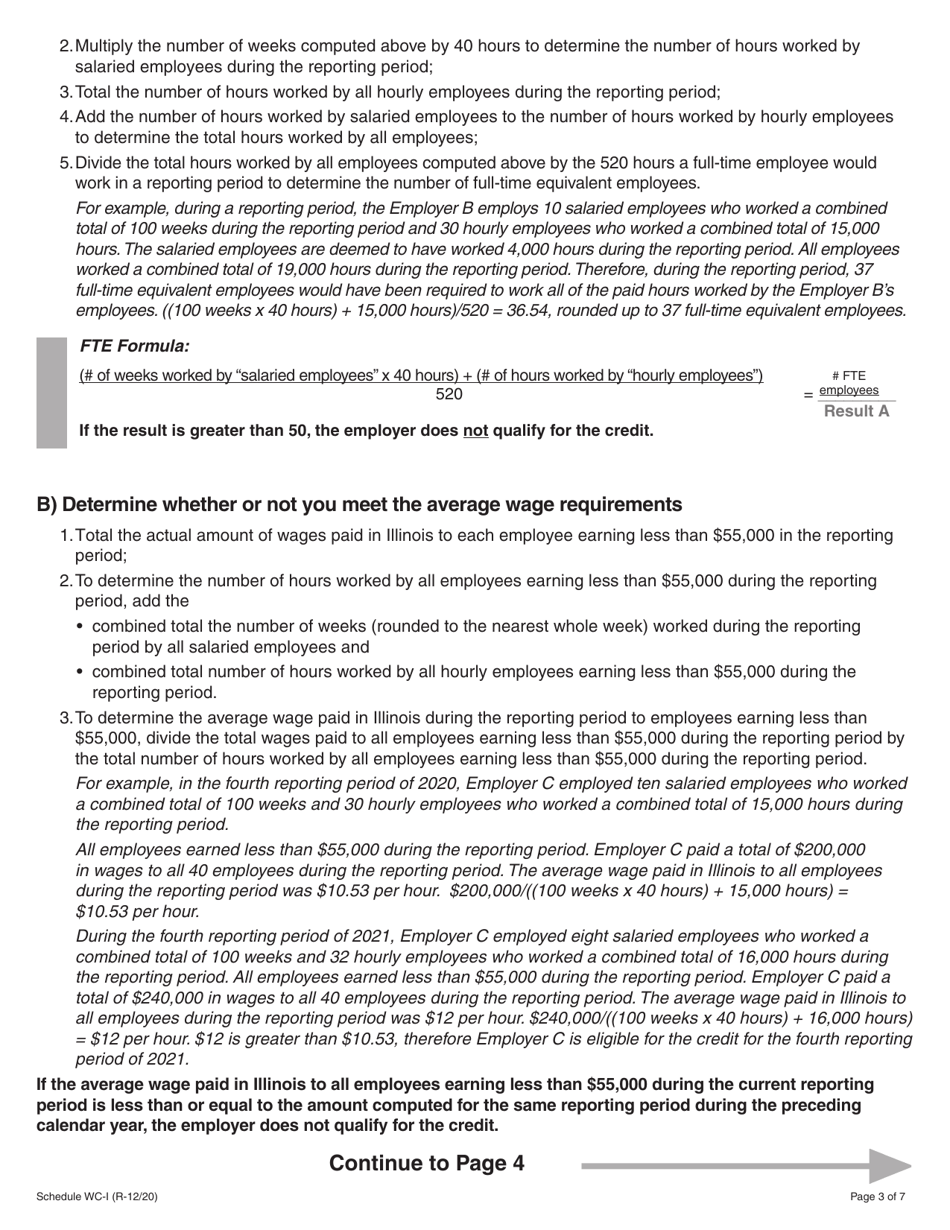

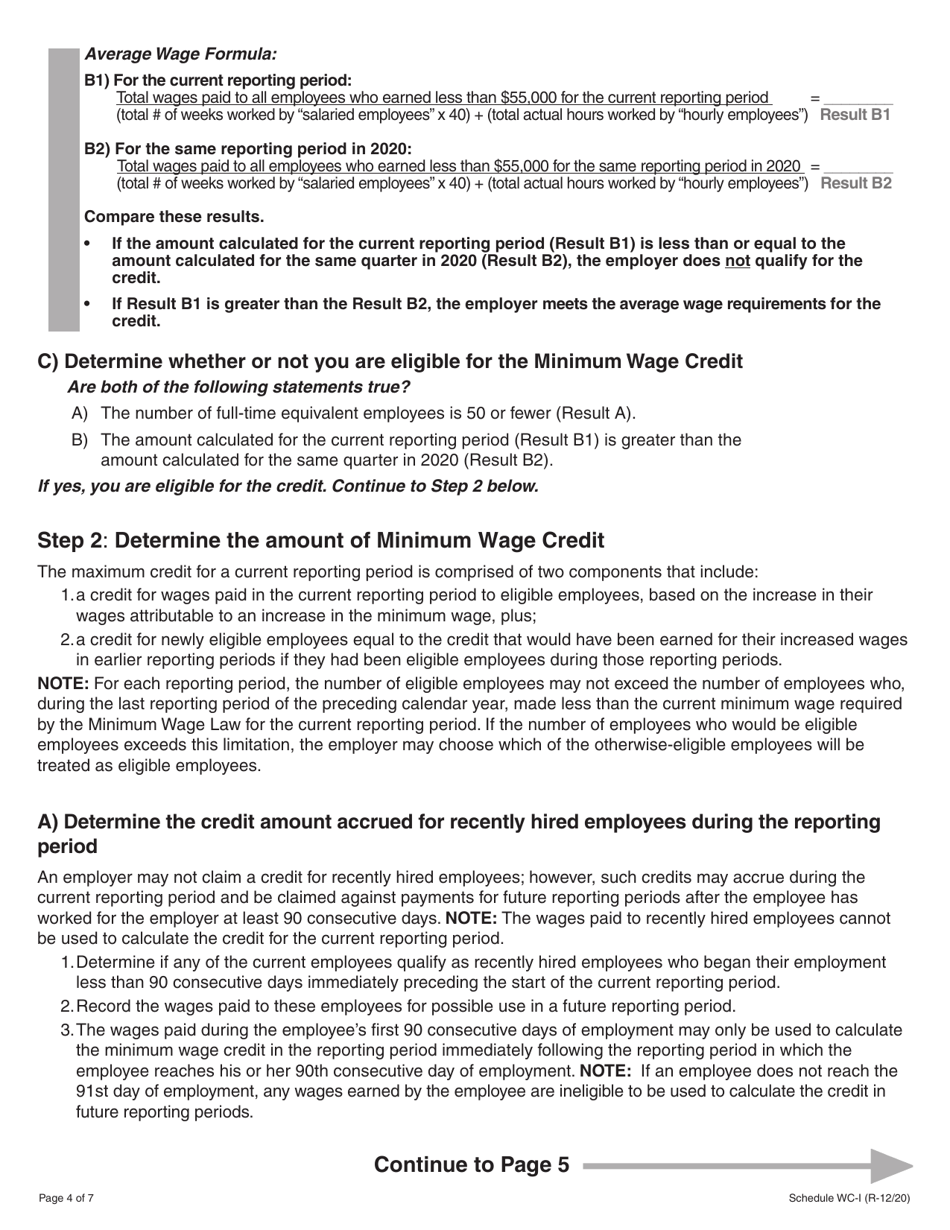

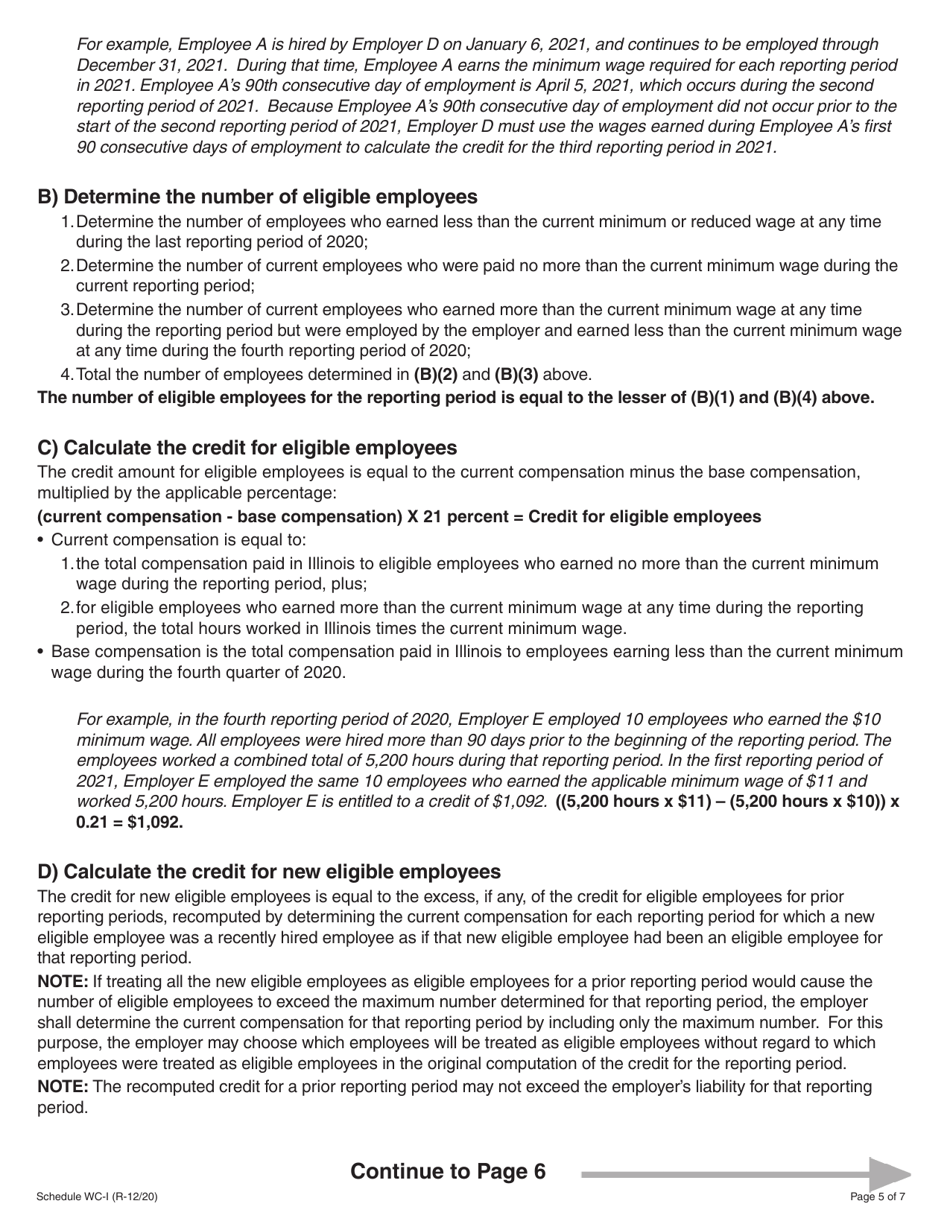

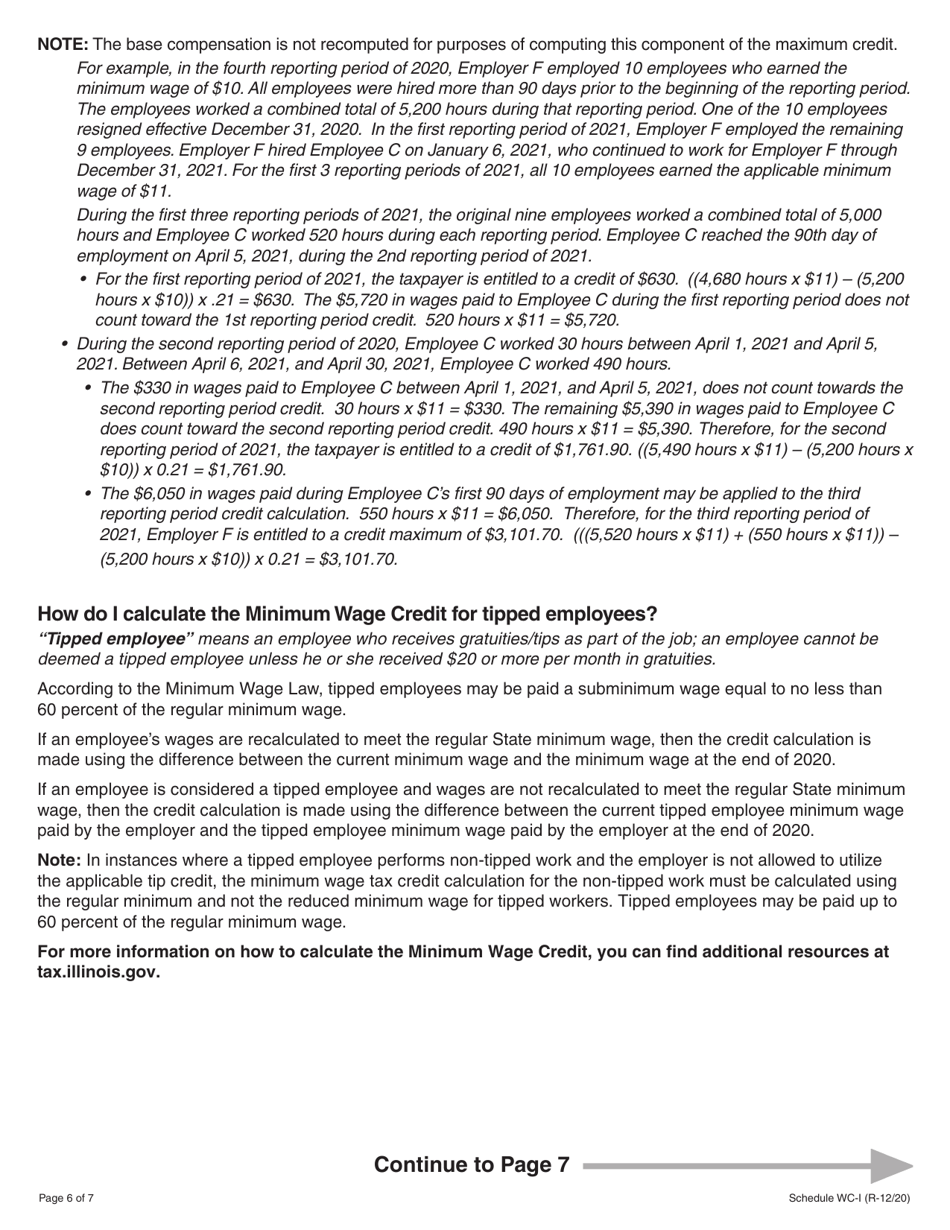

Q: How are WC-I Withholding Income Tax credits calculated?

A: WC-I Withholding Income Tax credits are calculated based on the number of dependents and exemptions claimed by the employee.

Q: Do I need to file a separate form for WC-I Withholding Income Tax credits?

A: No, the WC-I Withholding Income Tax credits are calculated and claimed on the employee's annual Illinois income tax return.

Q: What are the requirements for claiming WC-I Withholding Income Tax credits?

A: To claim WC-I Withholding Income Tax credits, the employee must meet certain eligibility criteria and provide documentation of their dependents and exemptions.

Q: Can I claim WC-I Withholding Income Tax credits if I am not an Illinois resident?

A: No, WC-I Withholding Income Tax credits are only available to Illinois residents.

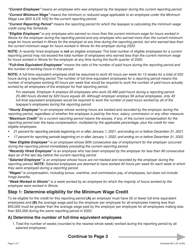

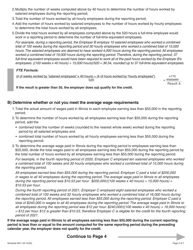

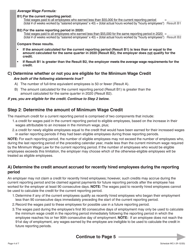

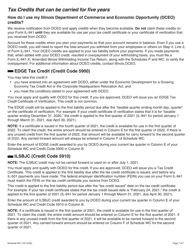

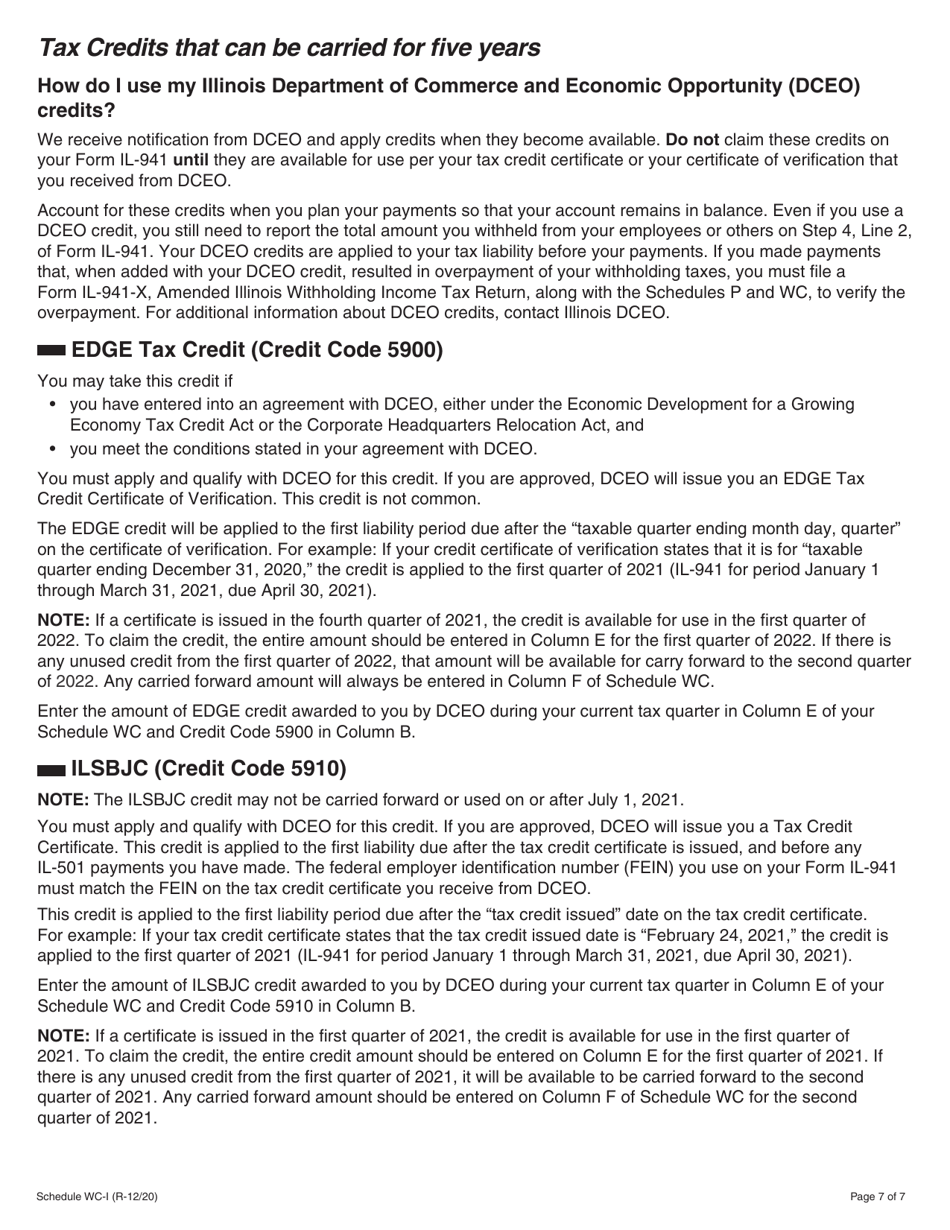

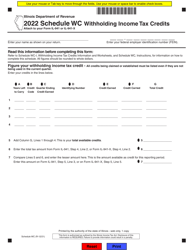

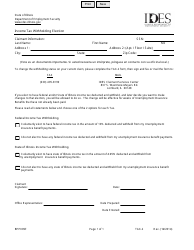

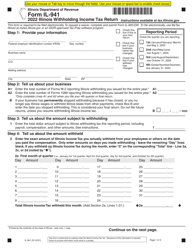

Q: What other information is provided in the Schedule WC-I Withholding Income Tax Credits Information and Worksheets - Illinois document?

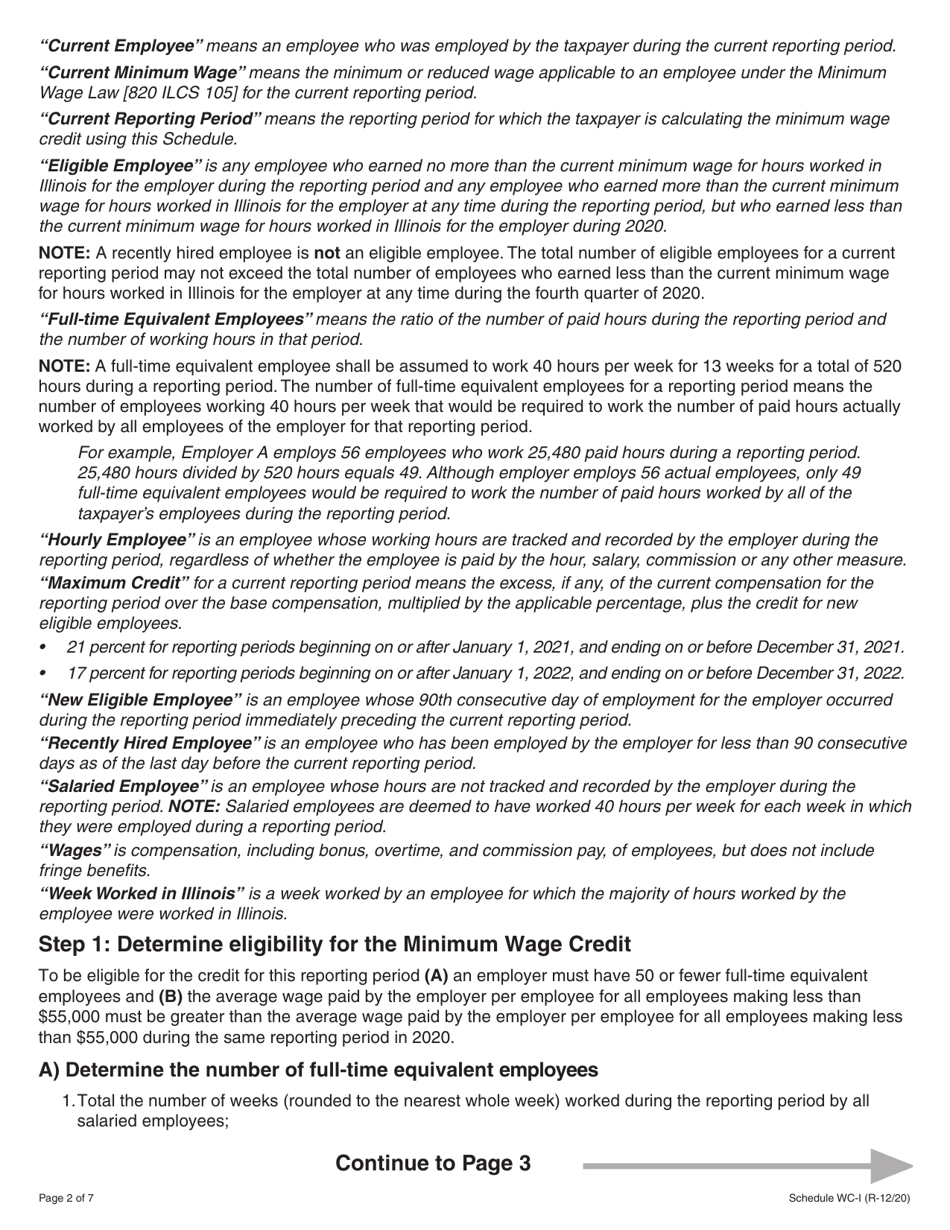

A: The document provides instructions and guidelines for calculating WC-I Withholding Income Tax credits, as well as examples and worksheets to help individuals determine their eligibility and claim the credits.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule WC-I by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.