This version of the form is not currently in use and is provided for reference only. Download this version of

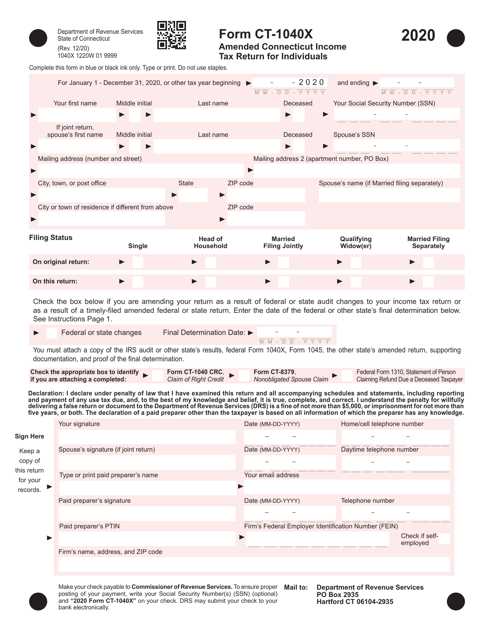

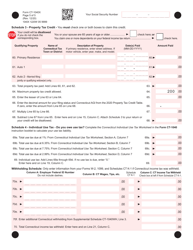

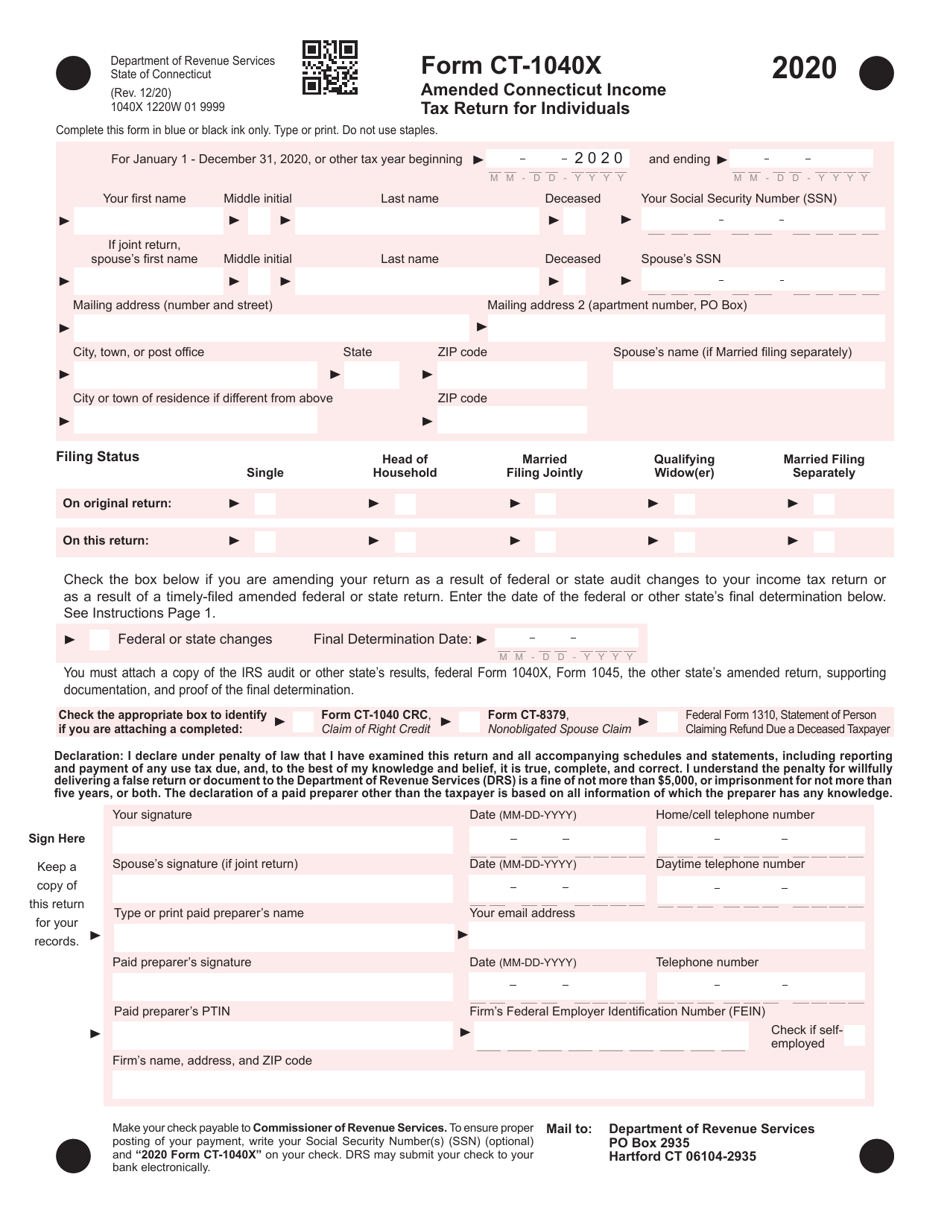

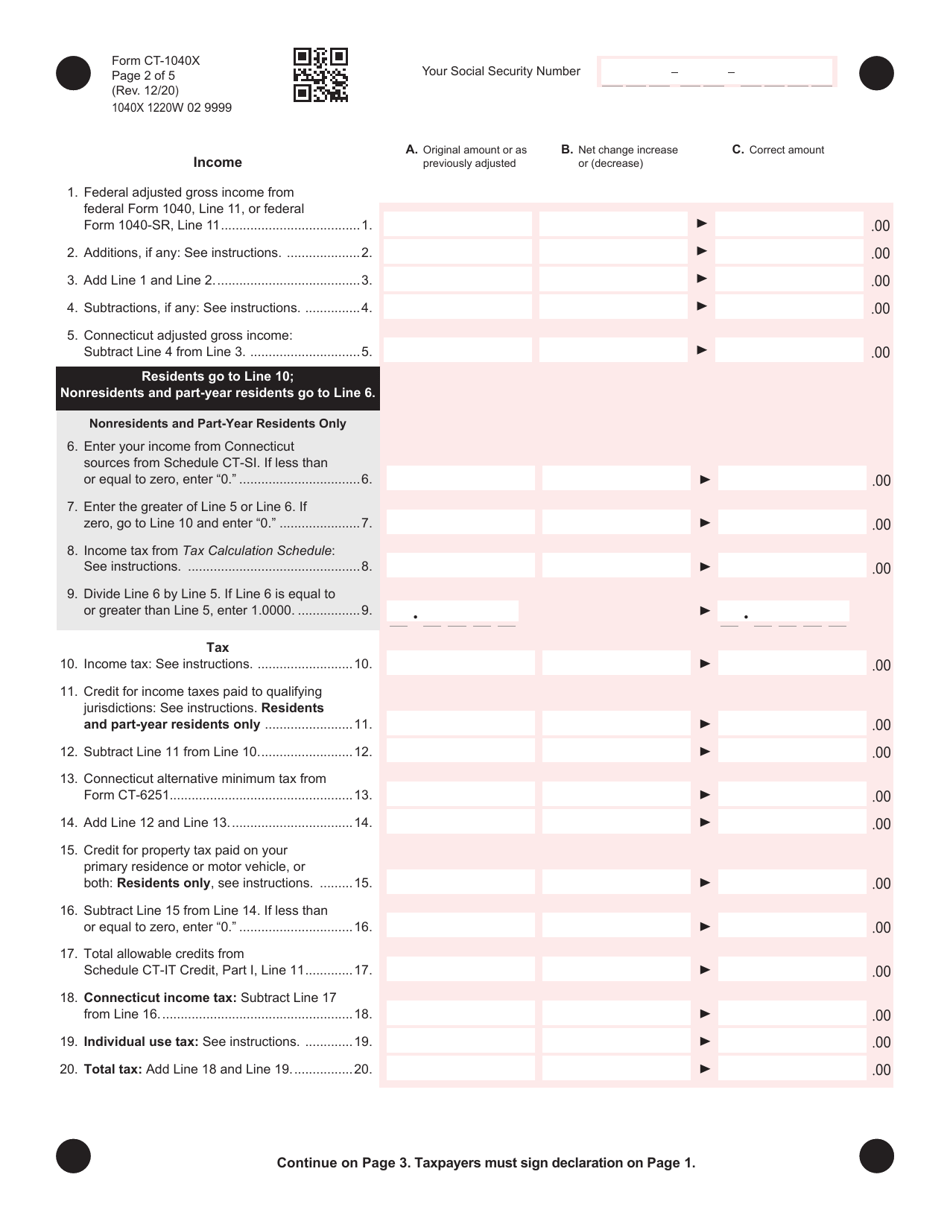

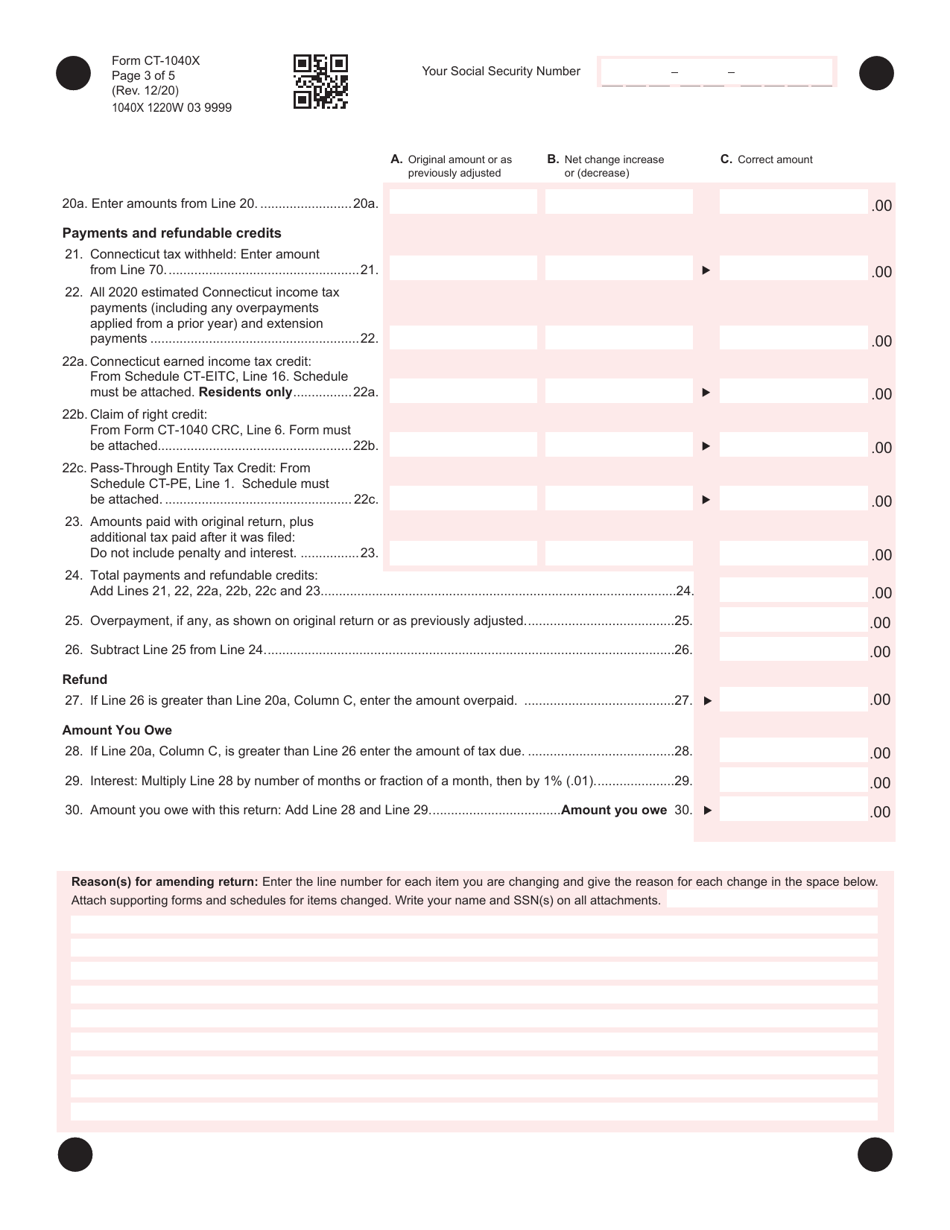

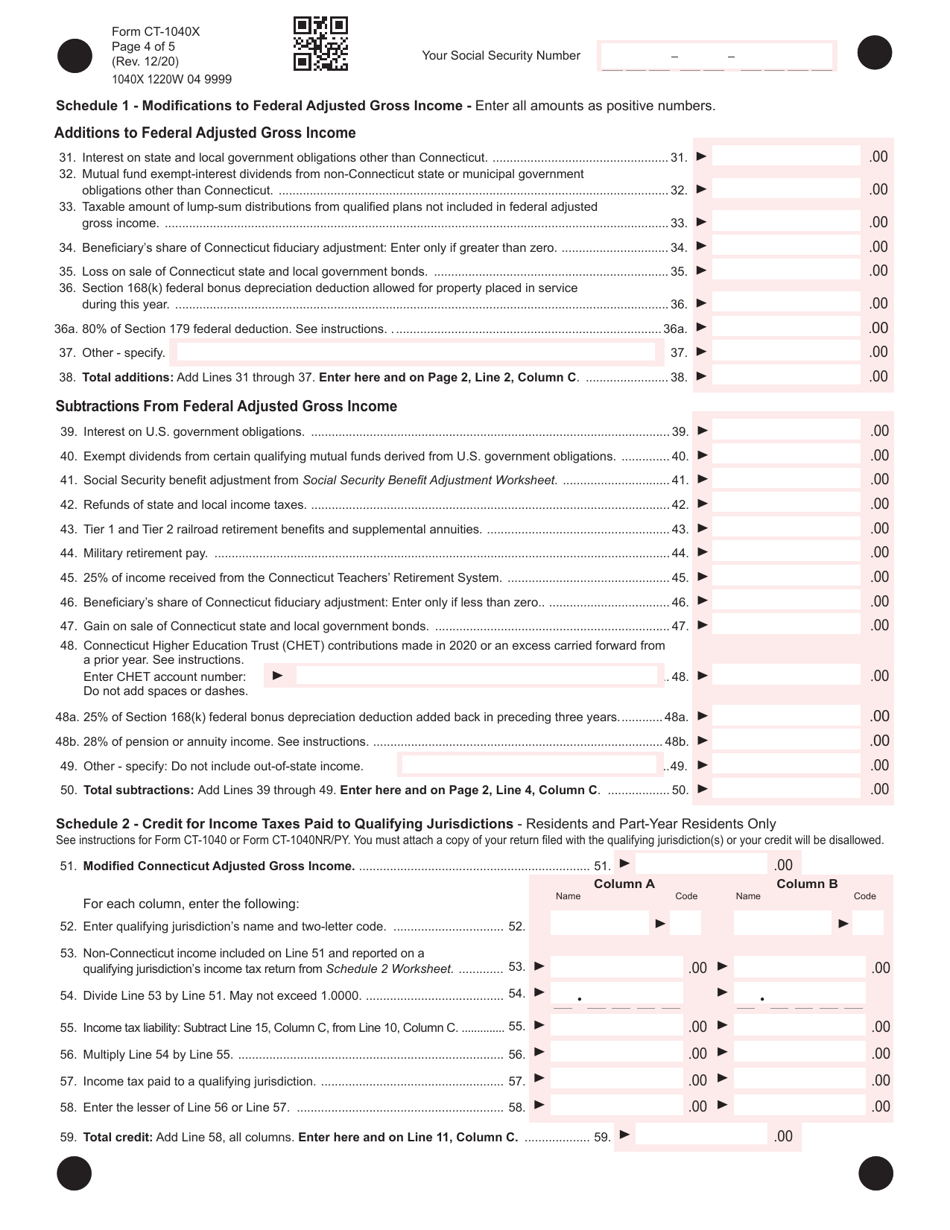

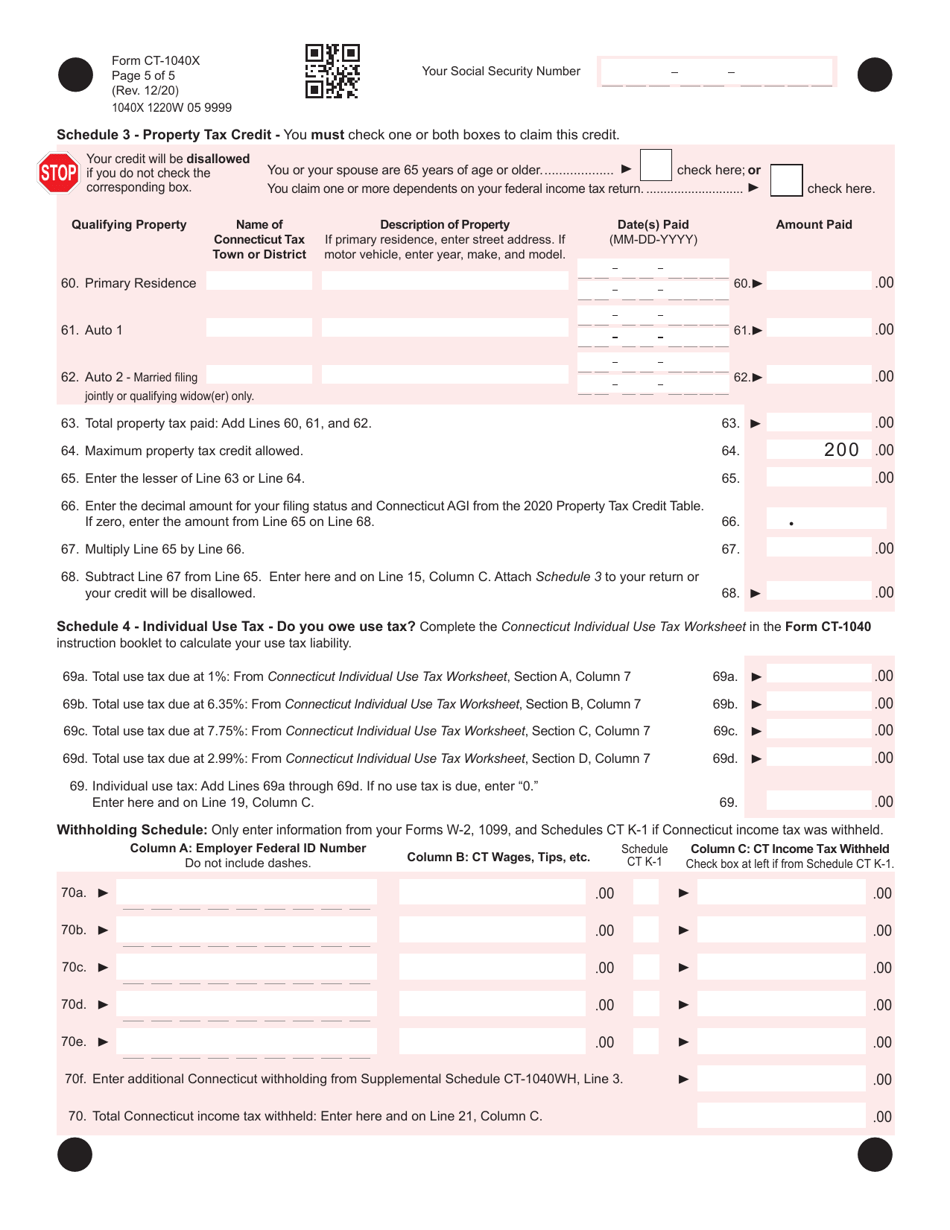

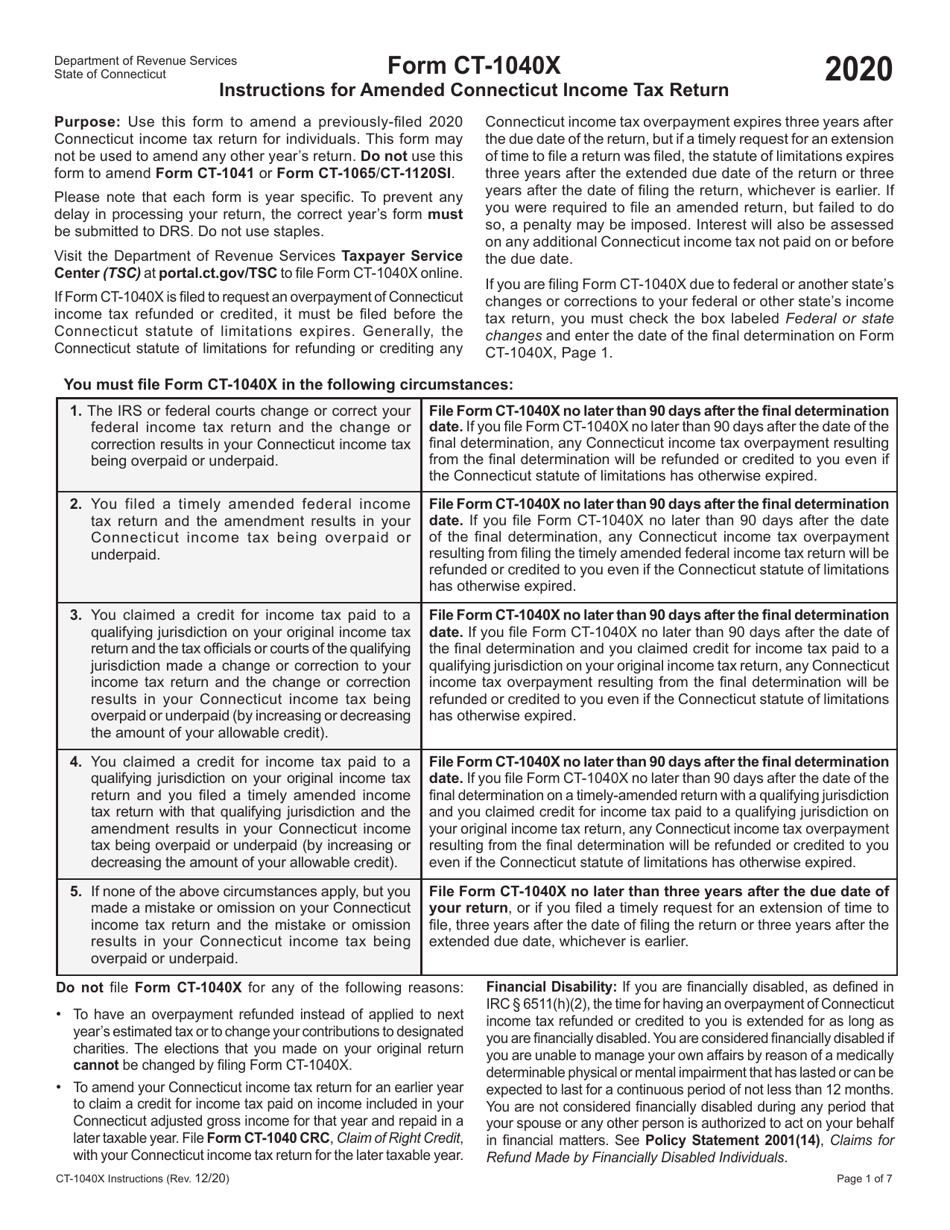

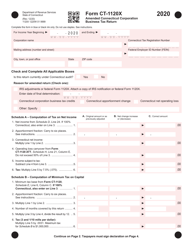

Form CT-1040X

for the current year.

Form CT-1040X Amended Connecticut Income Tax Return for Individuals - Connecticut

What Is Form CT-1040X?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

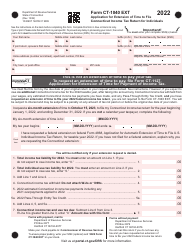

Q: What is Form CT-1040X?

A: Form CT-1040X is an amended Connecticut Income Tax Return for individuals.

Q: Who should file Form CT-1040X?

A: You should file Form CT-1040X if you need to make changes to your previously filed Connecticut Income Tax Return.

Q: Why would I need to file Form CT-1040X?

A: You would need to file Form CT-1040X if you made errors or need to make changes to your original Connecticut Income Tax Return.

Q: Is there a deadline to file Form CT-1040X?

A: Yes, the deadline to file Form CT-1040X is generally within three years from the original due date of your Connecticut Income Tax Return.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040X by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.