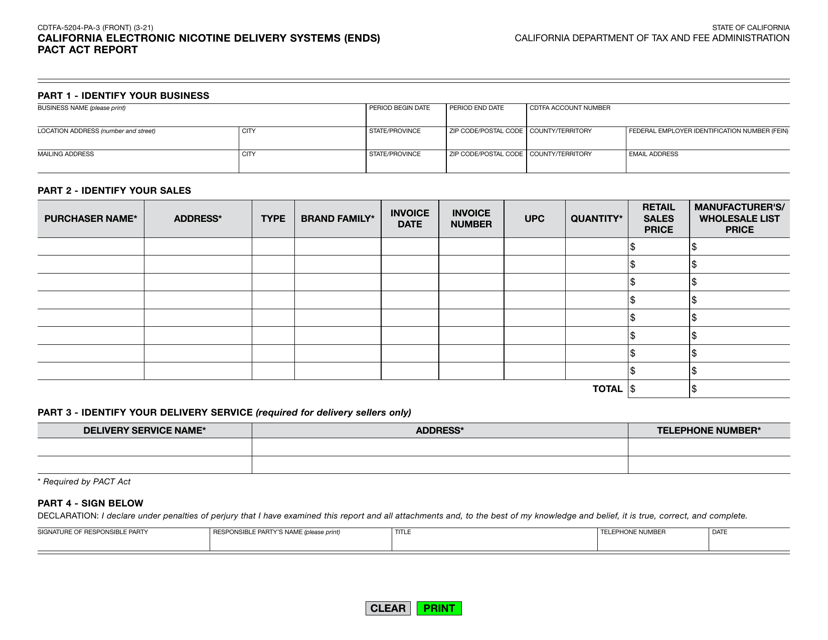

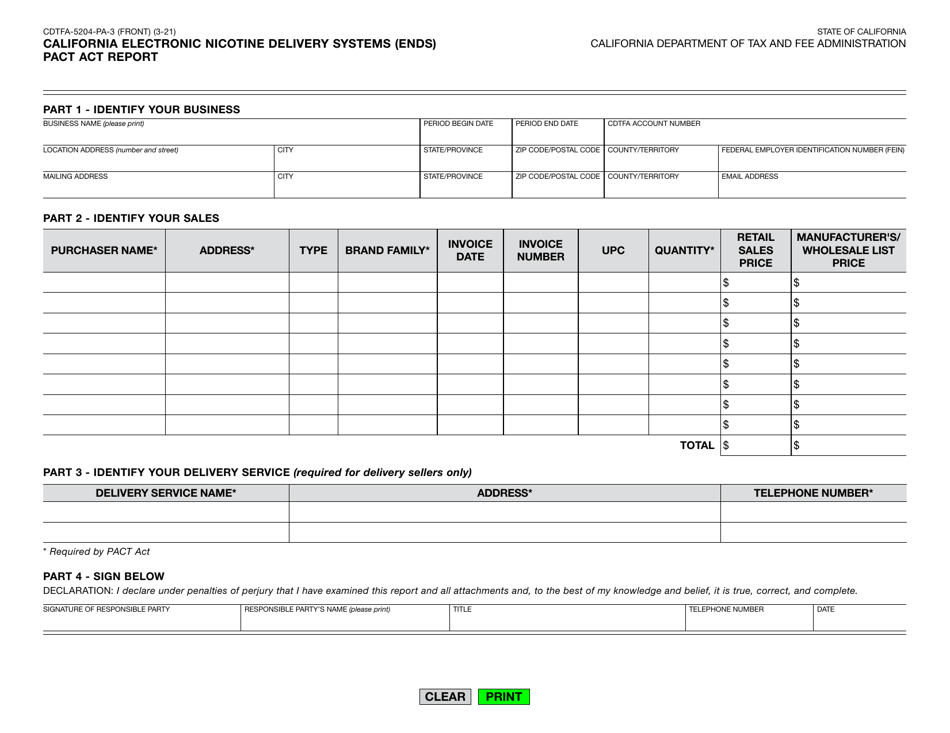

Form CDTFA-5204-PA-3 California Electronic Nicotine Delivery Systems (Ends) Pact Act Report - California

What Is Form CDTFA-5204-PA-3?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CDTFA-5204-PA-3?

A: CDTFA-5204-PA-3 is a form used in California to report the sales of Electronic Nicotine Delivery Systems (ENDS) as required by the PACT Act.

Q: What are Electronic Nicotine Delivery Systems?

A: Electronic Nicotine Delivery Systems (ENDS) include e-cigarettes, vape pens, and other similar devices that deliver nicotine or other substances through an aerosolized solution.

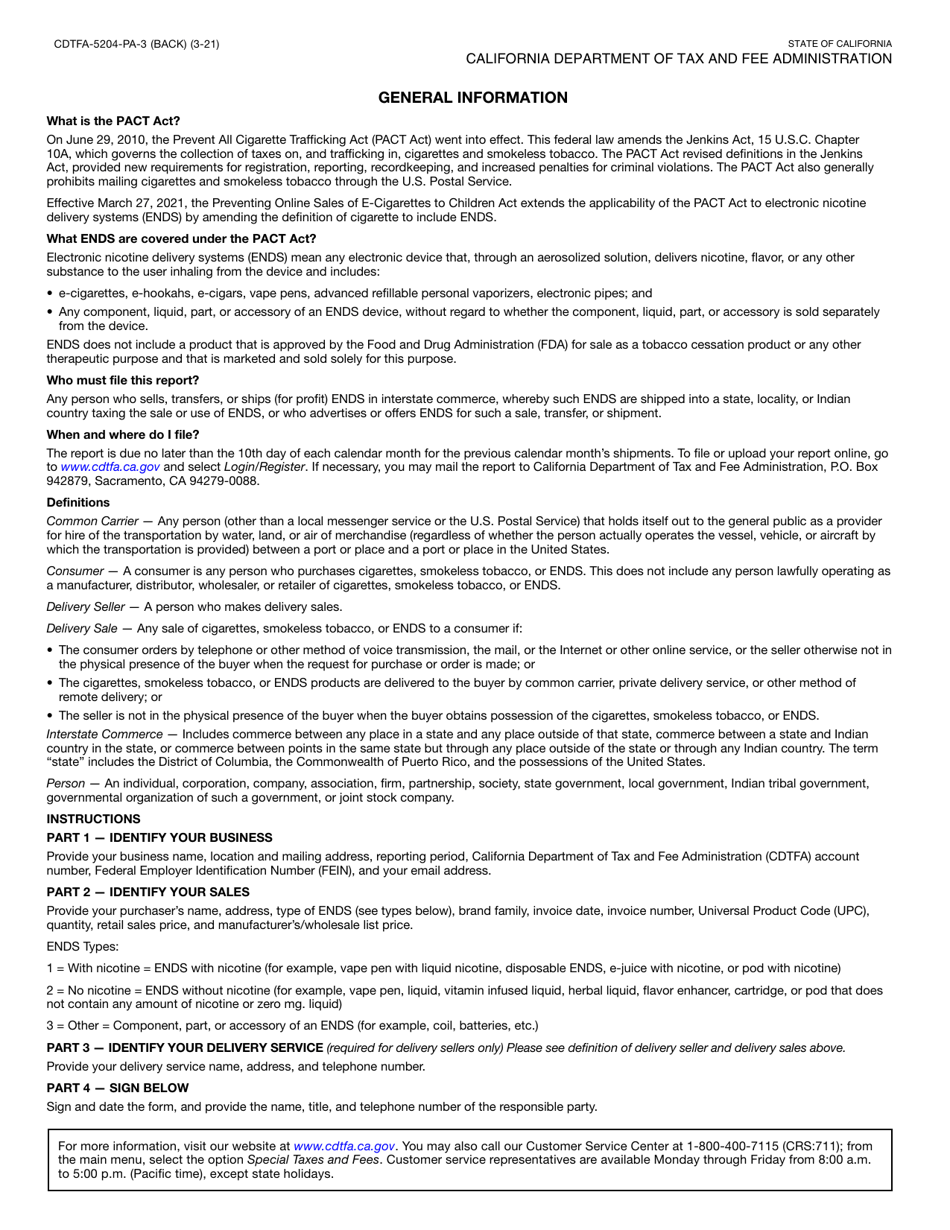

Q: What is the PACT Act?

A: The PACT Act stands for Prevent All Cigarette Trafficking Act and it regulates the sales and transportation of cigarettes and other tobacco products, including electronic nicotine delivery systems.

Q: Who is required to file CDTFA-5204-PA-3?

A: Any person or entity engaged in the sale of electronic nicotine delivery systems in California is required to file CDTFA-5204-PA-3.

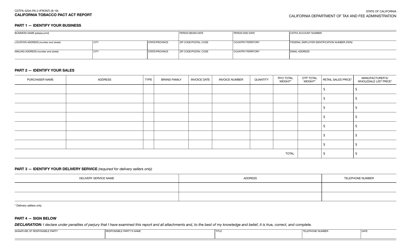

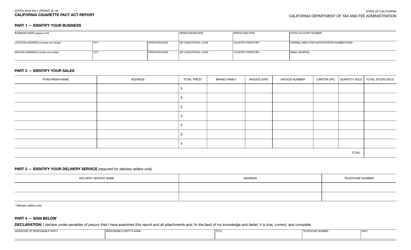

Q: What information is required on the CDTFA-5204-PA-3 form?

A: The form requires information such as the total number of electronic nicotine delivery systems sold, the name and address of the seller, and the name and address of the buyer.

Q: When is the CDTFA-5204-PA-3 filing deadline?

A: The filing deadline for CDTFA-5204-PA-3 is the 10th day of each month for the previous calendar month's sales.

Q: Are there any penalties for not filing CDTFA-5204-PA-3?

A: Yes, failure to file the CDTFA-5204-PA-3 form or filing a false or fraudulent form may result in penalties, fines, or other enforcement actions.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-5204-PA-3 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.