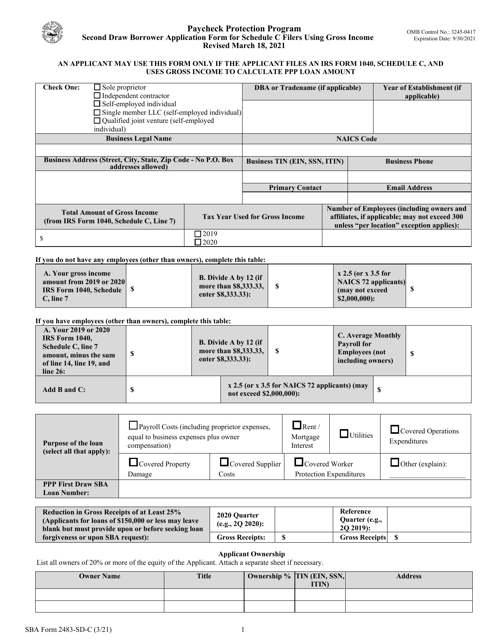

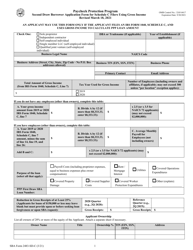

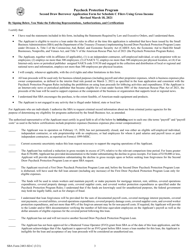

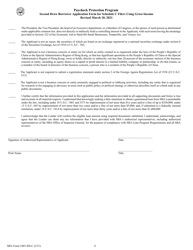

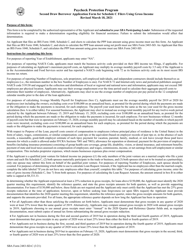

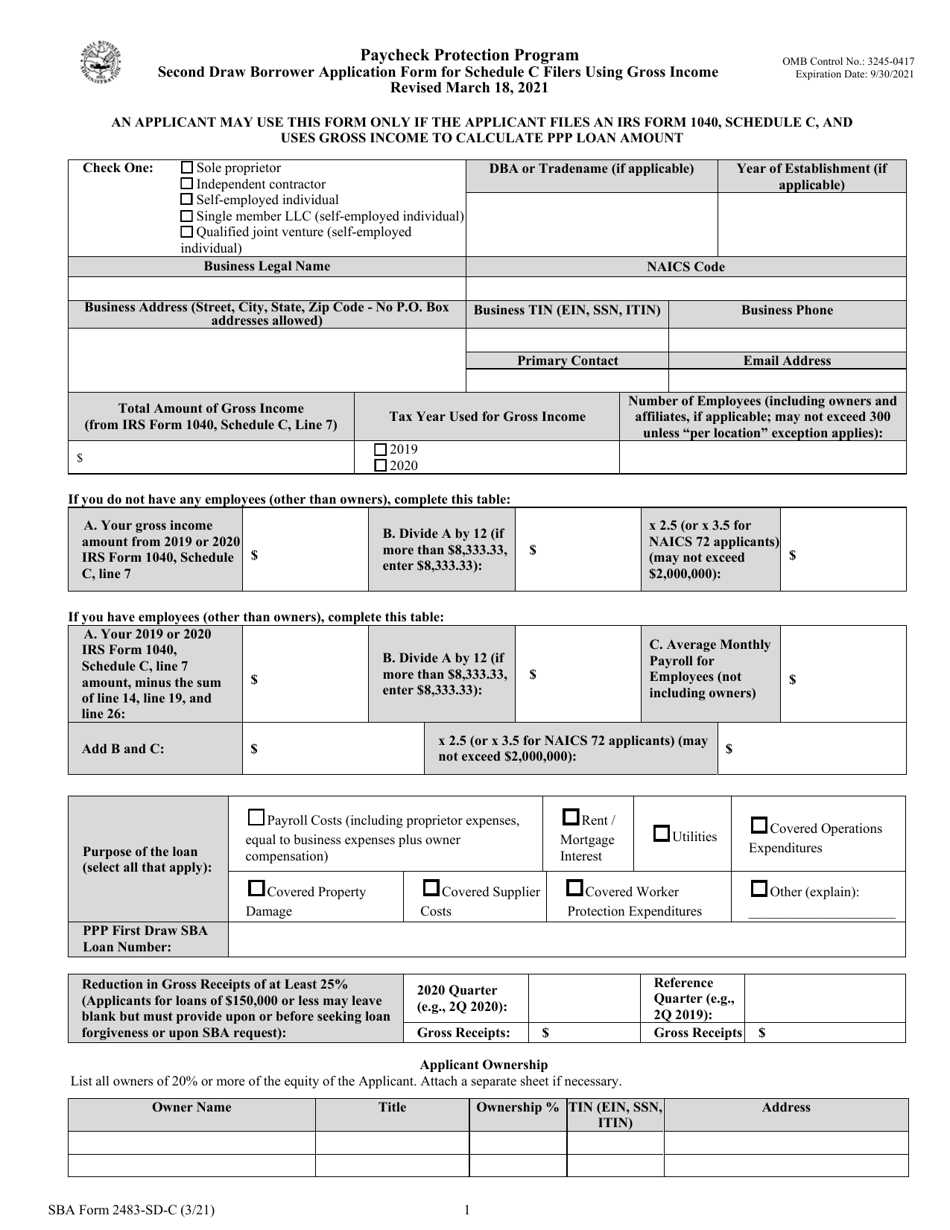

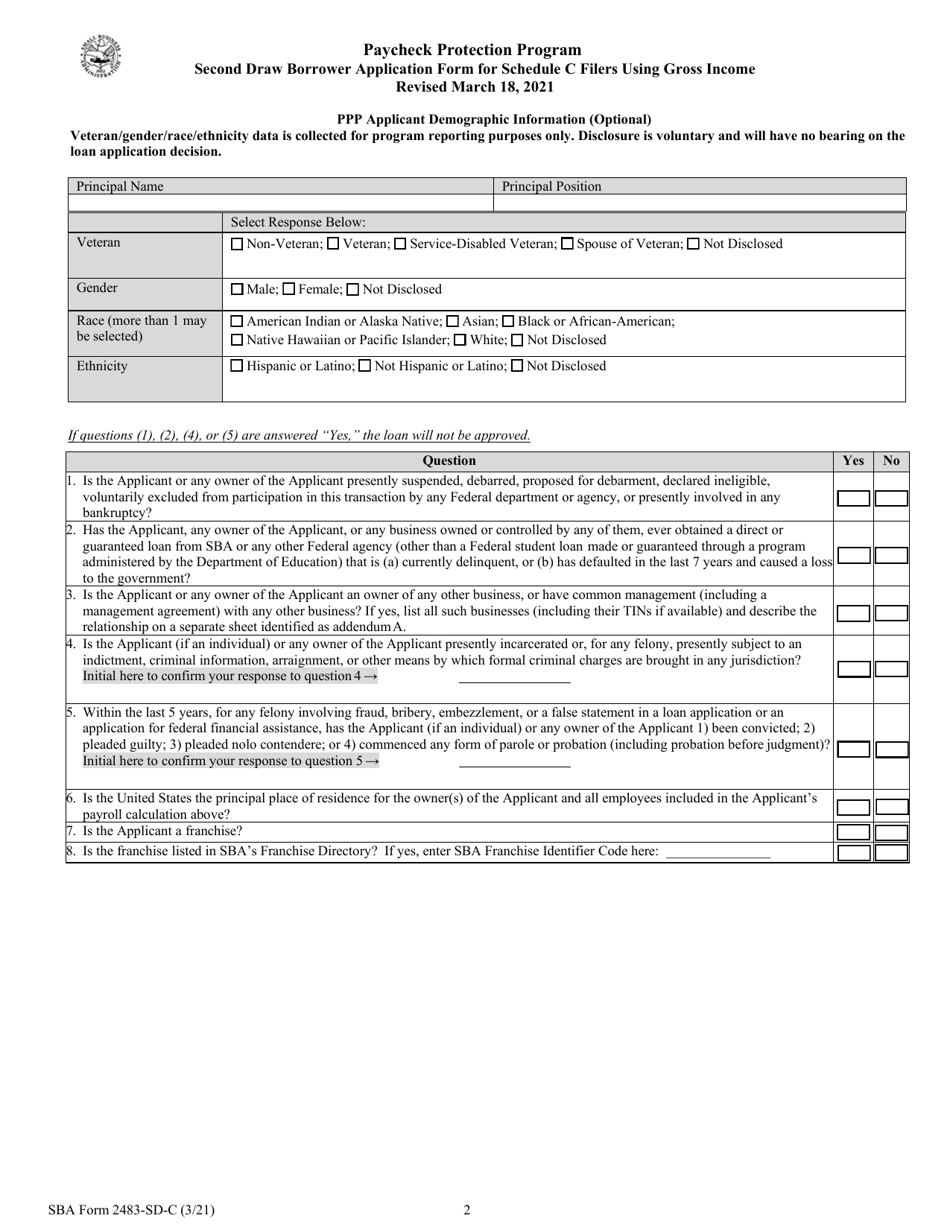

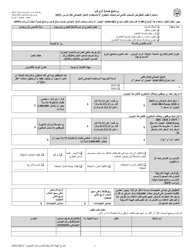

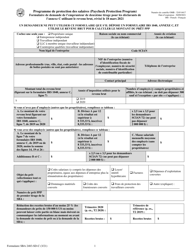

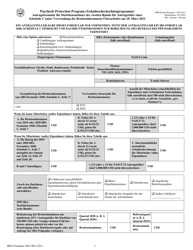

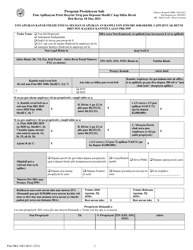

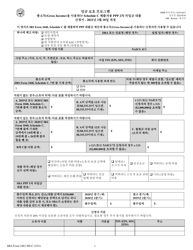

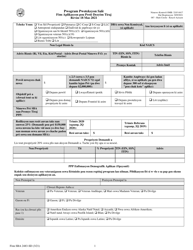

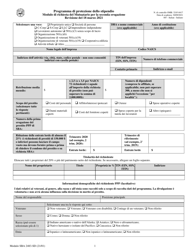

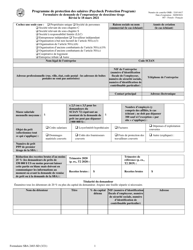

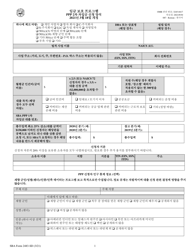

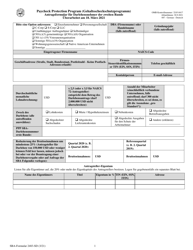

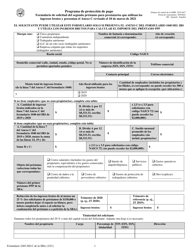

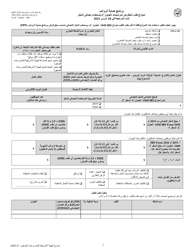

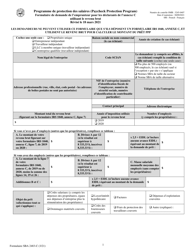

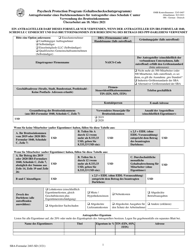

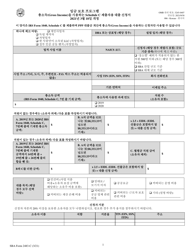

SBA Form 2483-SD-C Second Draw Borrower Application Form for Schedule C Filers Using Gross Income

What Is SBA Form 2483-SD-C?

This is a legal form that was released by the U.S. Small Business Administration on March 18, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 2483-SD-C?

A: SBA Form 2483-SD-C is the Second Draw Borrower Application Form specifically for Schedule C filers using gross income.

Q: Who is eligible to use SBA Form 2483-SD-C?

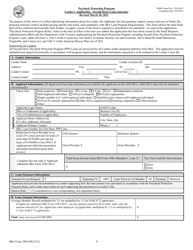

A: Schedule C filers who are applying for a second draw loan and will be using their gross income for calculation are eligible to use this form.

Q: What is a Second Draw Borrower Application?

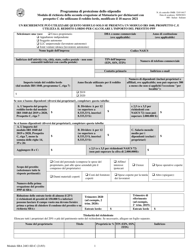

A: A Second Draw Borrower Application is the form used by small business owners to apply for a second round of financing through the Paycheck Protection Program (PPP).

Q: What is a Schedule C filer?

A: A Schedule C filer is a self-employed individual who reports their business income and expenses on Schedule C of their personal income tax return (Form 1040).

Q: What is gross income?

A: Gross income refers to the total income earned by a business before deducting any expenses.

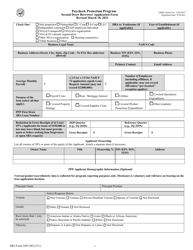

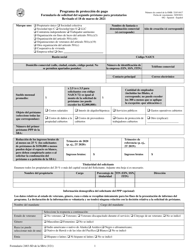

Q: What information is needed to complete SBA Form 2483-SD-C?

A: To complete SBA Form 2483-SD-C, you will need to provide information such as your business name, Taxpayer Identification Number (TIN), loan amount, and gross income.

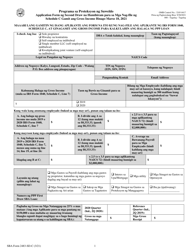

Q: Do I need to submit any supporting documents with SBA Form 2483-SD-C?

A: Yes, you will need to submit supporting documents such as 2019 or 2020 tax forms, bank statements, and other relevant financial records to verify your gross income.

Q: Is there a deadline to submit SBA Form 2483-SD-C?

A: The deadline to submit SBA Form 2483-SD-C is determined by the SBA and may vary, so it is important to check the latest guidelines and deadlines.

Q: Can I apply for a second draw loan if I am not a Schedule C filer?

A: Yes, even if you are not a Schedule C filer, you may still be eligible for a second draw loan under different eligibility criteria. You would need to use the appropriate application form based on your filing status.

Form Details:

- Released on March 18, 2021;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 2483-SD-C by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.