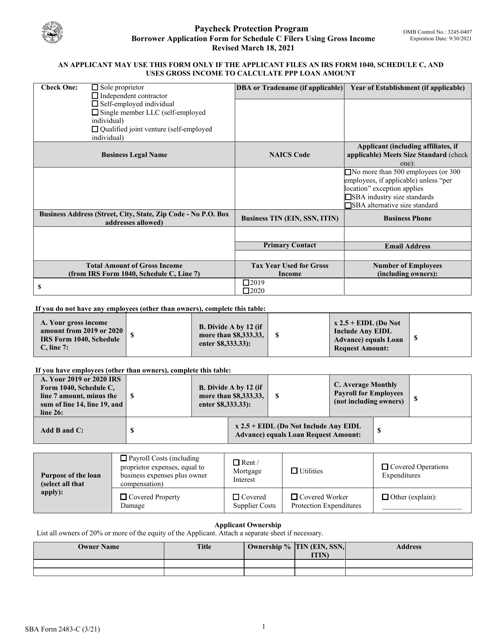

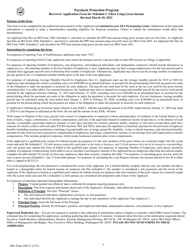

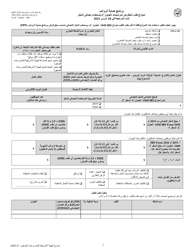

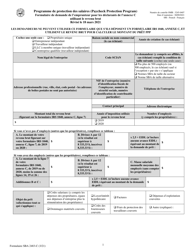

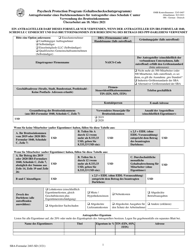

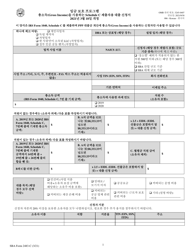

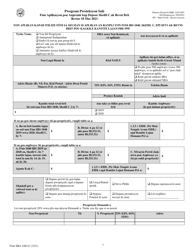

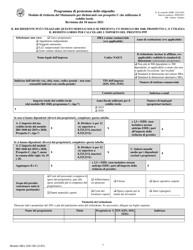

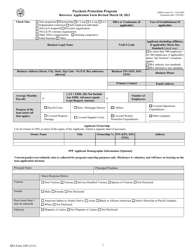

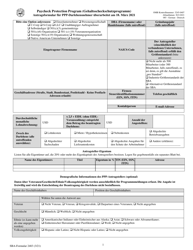

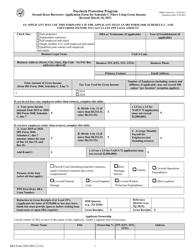

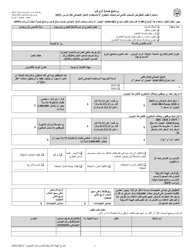

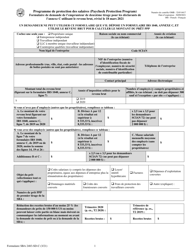

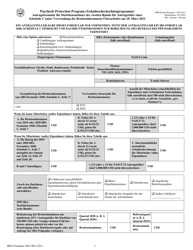

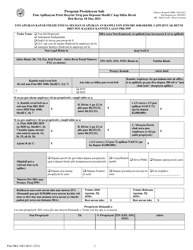

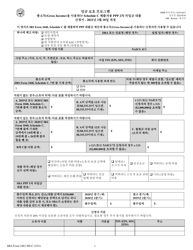

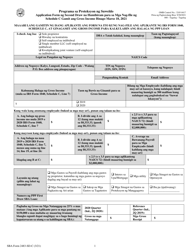

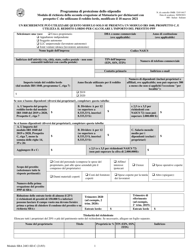

SBA Form 2483-C Borrower Application Form for Schedule C Filers Using Gross Income

What Is SBA Form 2483-C?

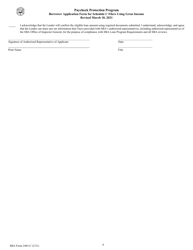

This is a legal form that was released by the U.S. Small Business Administration on March 18, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 2483-C?

A: SBA Form 2483-C is the Borrower Application Form for Schedule C Filers Using Gross Income.

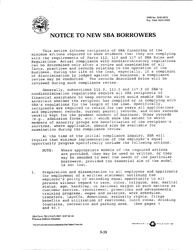

Q: Who should use SBA Form 2483-C?

A: Schedule C filers, who are self-employed individuals or sole proprietors, should use SBA Form 2483-C.

Q: What is the purpose of SBA Form 2483-C?

A: The purpose of SBA Form 2483-C is to apply for a loan under the Paycheck Protection Program (PPP) using gross income.

Q: What information is required in SBA Form 2483-C?

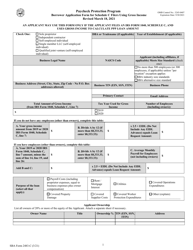

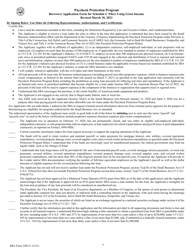

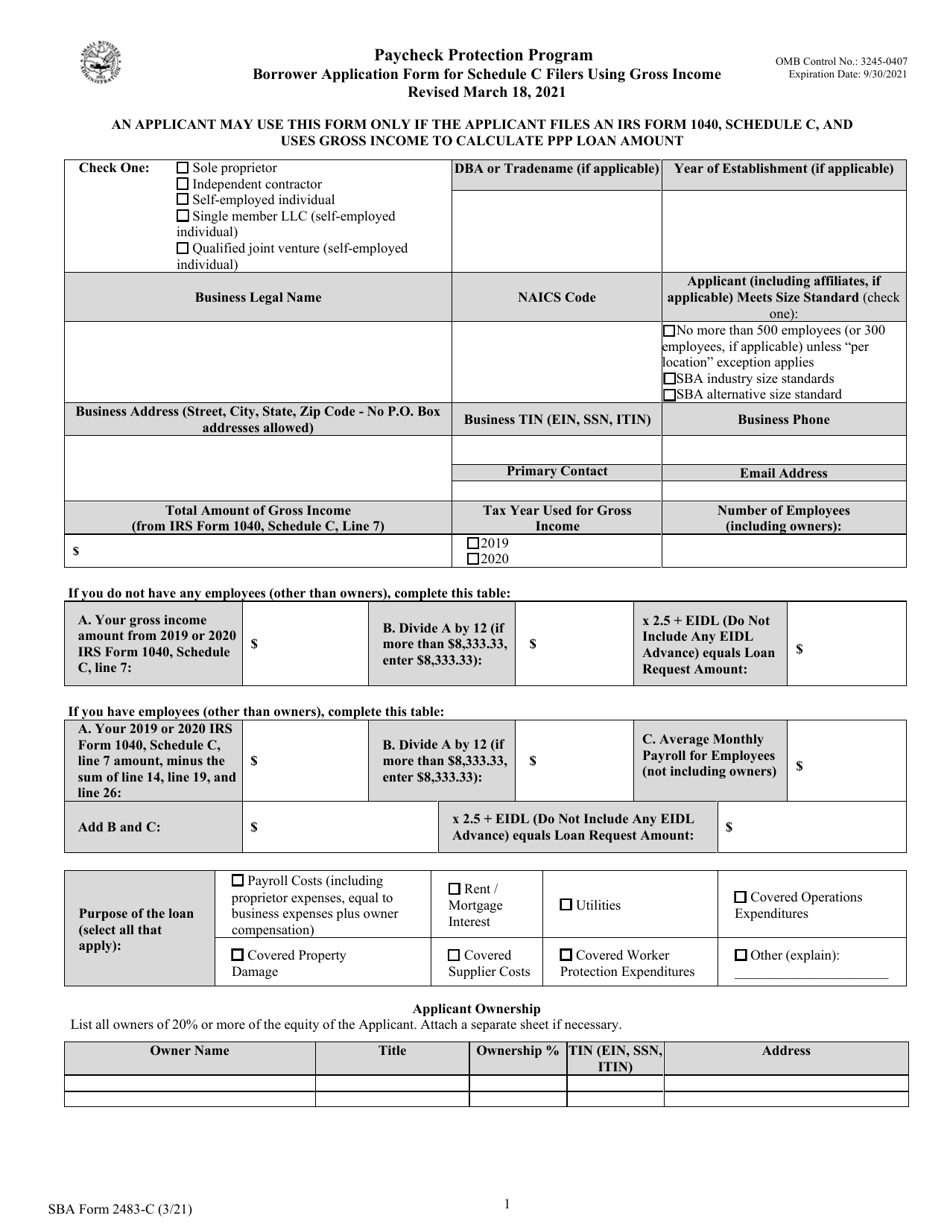

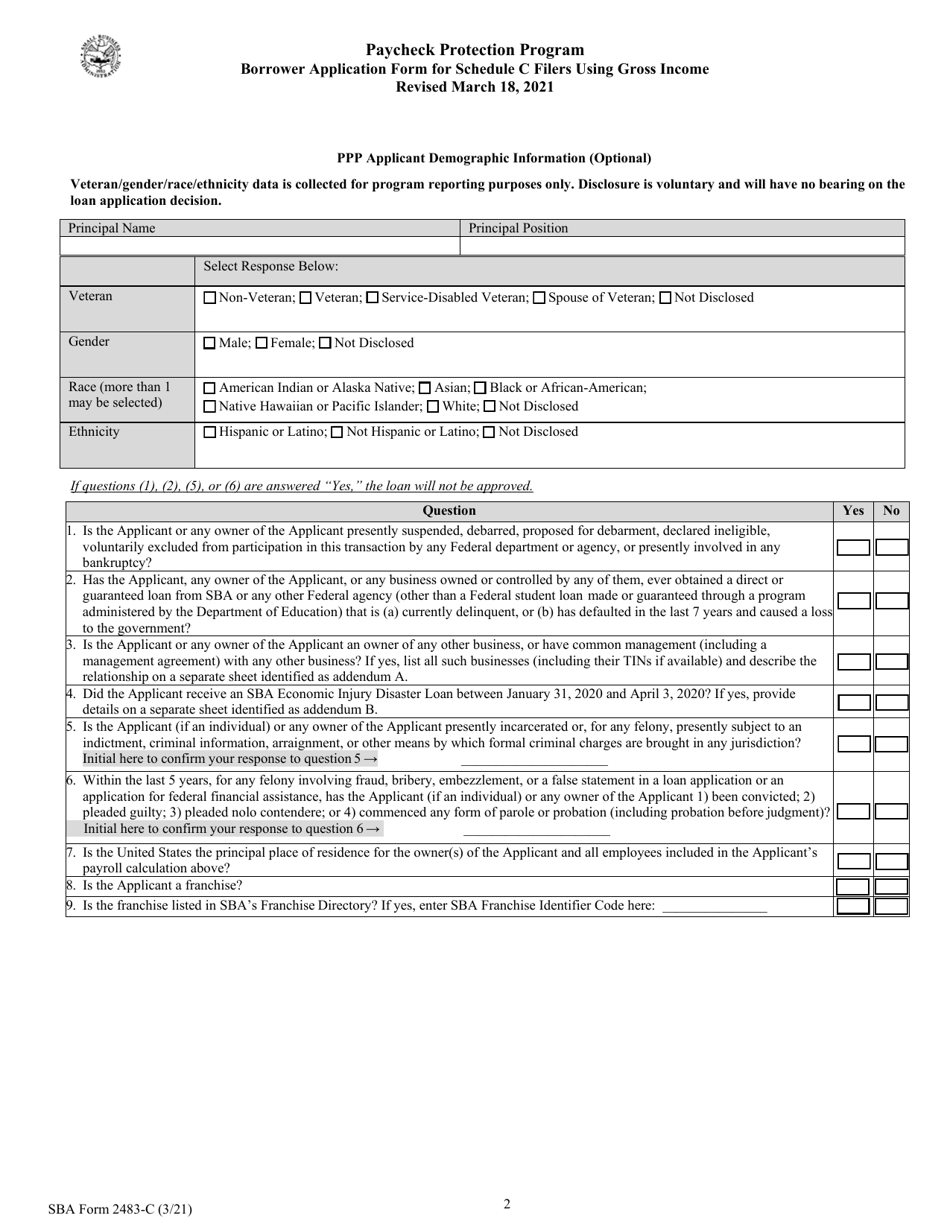

A: SBA Form 2483-C requires information related to your business, personal information, loan amount requested, gross income calculation, and certifications.

Q: Do I need any supporting documents to complete SBA Form 2483-C?

A: Yes, you may need supporting documents such as IRS forms, bank statements, or other financial records to complete SBA Form 2483-C.

Q: Can I submit SBA Form 2483-C electronically?

A: Yes, you can submit SBA Form 2483-C electronically through the approved lenders or participating financial institutions.

Form Details:

- Released on March 18, 2021;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 2483-C by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.