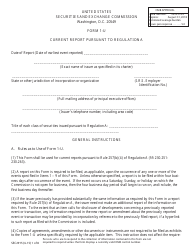

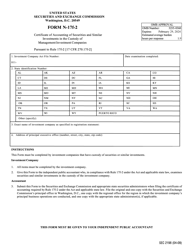

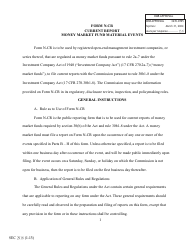

SEC Form 2941 (N-LIQUID) Current Report Open-End Management Investment Company Liquidity

What Is SEC Form 2941 (N-LIQUID)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on February 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SEC Form 2941?

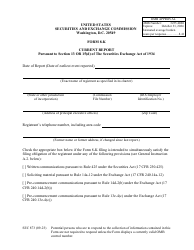

A: SEC Form 2941 is a Current Report for an Open-End Management Investment Company regarding liquidity.

Q: What does N-LIQUID mean?

A: N-LIQUID refers to the specific type of current report for an open-end management investment company regarding liquidity.

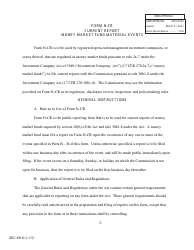

Q: What is an open-end management investment company?

A: An open-end management investment company is a type of investment company that continuously offers new shares to investors and is required to redeem existing shares at the request of the shareholders.

Q: What does liquidity mean in the context of investment companies?

A: Liquidity refers to the ability of an investment company to meet its short-term obligations, such as redeeming shares or paying expenses.

Q: Why is liquidity important for investment companies?

A: Liquidity is important for investment companies to ensure that they can meet the demands of shareholders and fulfill their obligations.

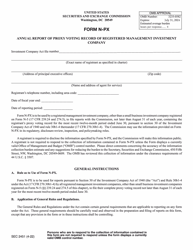

Q: What information is typically included in SEC Form 2941?

A: SEC Form 2941 typically includes information about the investment company's liquidity, such as its cash and cash equivalents, outstanding borrowings, and other factors affecting liquidity.

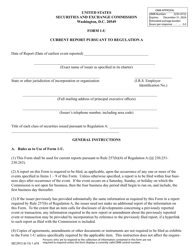

Q: Who needs to file SEC Form 2941?

A: Open-end management investment companies are required to file SEC Form 2941.

Q: Is SEC Form 2941 publicly available?

A: Yes, SEC Form 2941 is publicly available and can be accessed through the SEC's EDGAR database.

Form Details:

- Released on February 1, 2019;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of SEC Form 2941 (N-LIQUID) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.