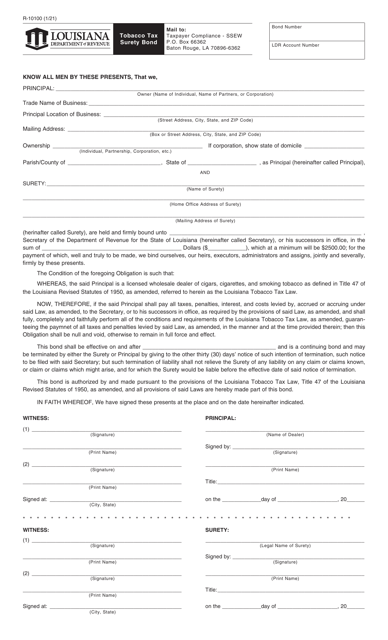

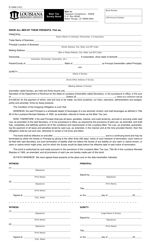

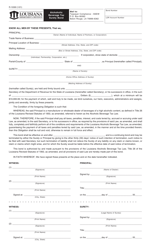

Form R-10100 Tobacco Tax Surety Bond - Louisiana

What Is Form R-10100?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10100?

A: Form R-10100 is the Tobacco Tax Surety Bond for the state of Louisiana.

Q: What is a tobacco tax surety bond?

A: A tobacco tax surety bond is a type of security that guarantees payment of tobacco taxes to the government.

Q: Why is Form R-10100 required in Louisiana?

A: Form R-10100 is required in Louisiana to ensure that tobacco wholesalers comply with state tax laws and obligations.

Q: Who needs to file Form R-10100?

A: Tobacco wholesalers in Louisiana need to file Form R-10100.

Q: What information is required on Form R-10100?

A: Form R-10100 requires information such as the principal's name, address, and business details.

Q: Is a surety bond the only option for meeting the tobacco tax obligation?

A: No, a surety bond is not the only option. Wholesalers may also choose to pay the tax obligation in cash or provide an irrevocable letter of credit.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10100 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.