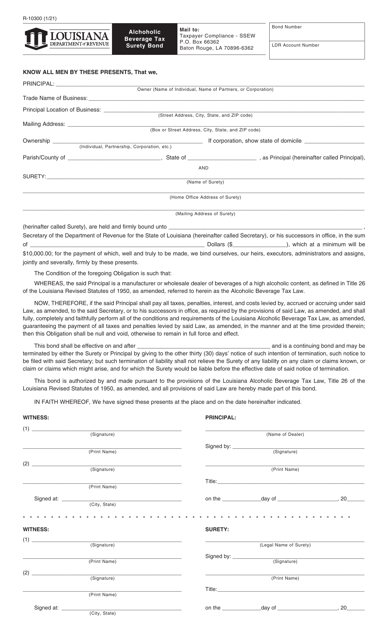

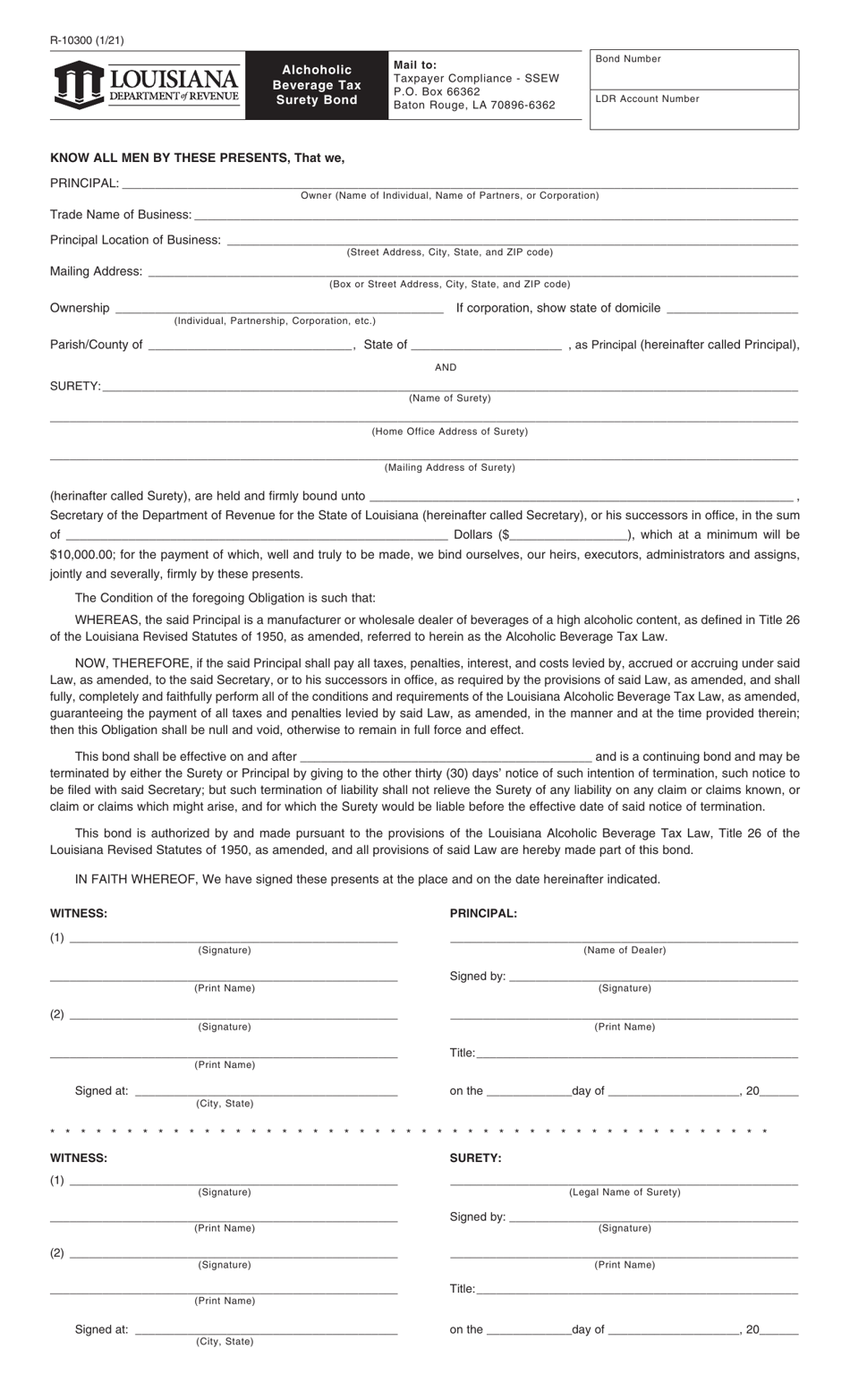

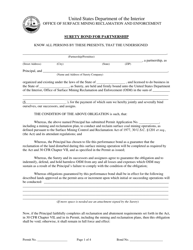

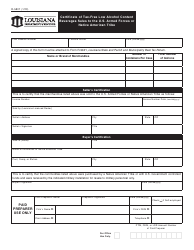

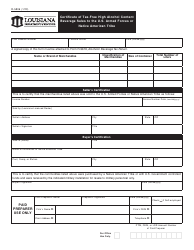

Form R-10300 Alchoholic Beverage Tax Surety Bond - Louisiana

What Is Form R-10300?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

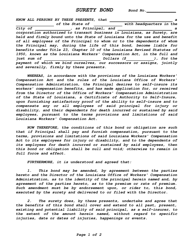

Q: What is Form R-10300?

A: Form R-10300 is the Alcoholic Beverage Tax Surety Bond in Louisiana.

Q: What is the purpose of Form R-10300?

A: The purpose of Form R-10300 is to provide a surety bond for the payment of alcoholic beverage taxes in Louisiana.

Q: Who needs to file Form R-10300?

A: Any person or business engaged in the sale of alcoholic beverages in Louisiana needs to file Form R-10300.

Q: Why is a surety bond required for alcoholic beverage taxes?

A: A surety bond is required to ensure that the taxes on alcoholic beverages are paid to the state government.

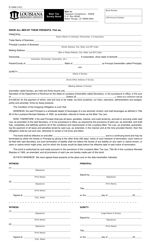

Q: Is there a deadline for filing Form R-10300?

A: Yes, the deadline for filing Form R-10300 is determined by the Louisiana Department of Revenue.

Q: What happens if I fail to file Form R-10300?

A: Failure to file Form R-10300 may result in penalties and fines imposed by the Louisiana Department of Revenue.

Q: Can I cancel the Alcoholic Beverage Tax Surety Bond?

A: Yes, the Alcoholic Beverage Tax Surety Bond can be cancelled by providing a written notice to the Louisiana Department of Revenue.

Q: Are there any exemptions to filing Form R-10300?

A: Exemptions to filing Form R-10300 may apply to certain nonprofit organizations or government entities.

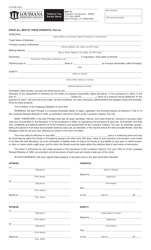

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10300 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.