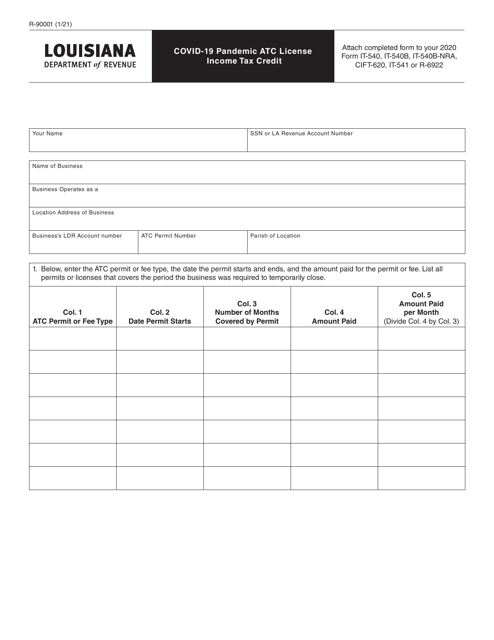

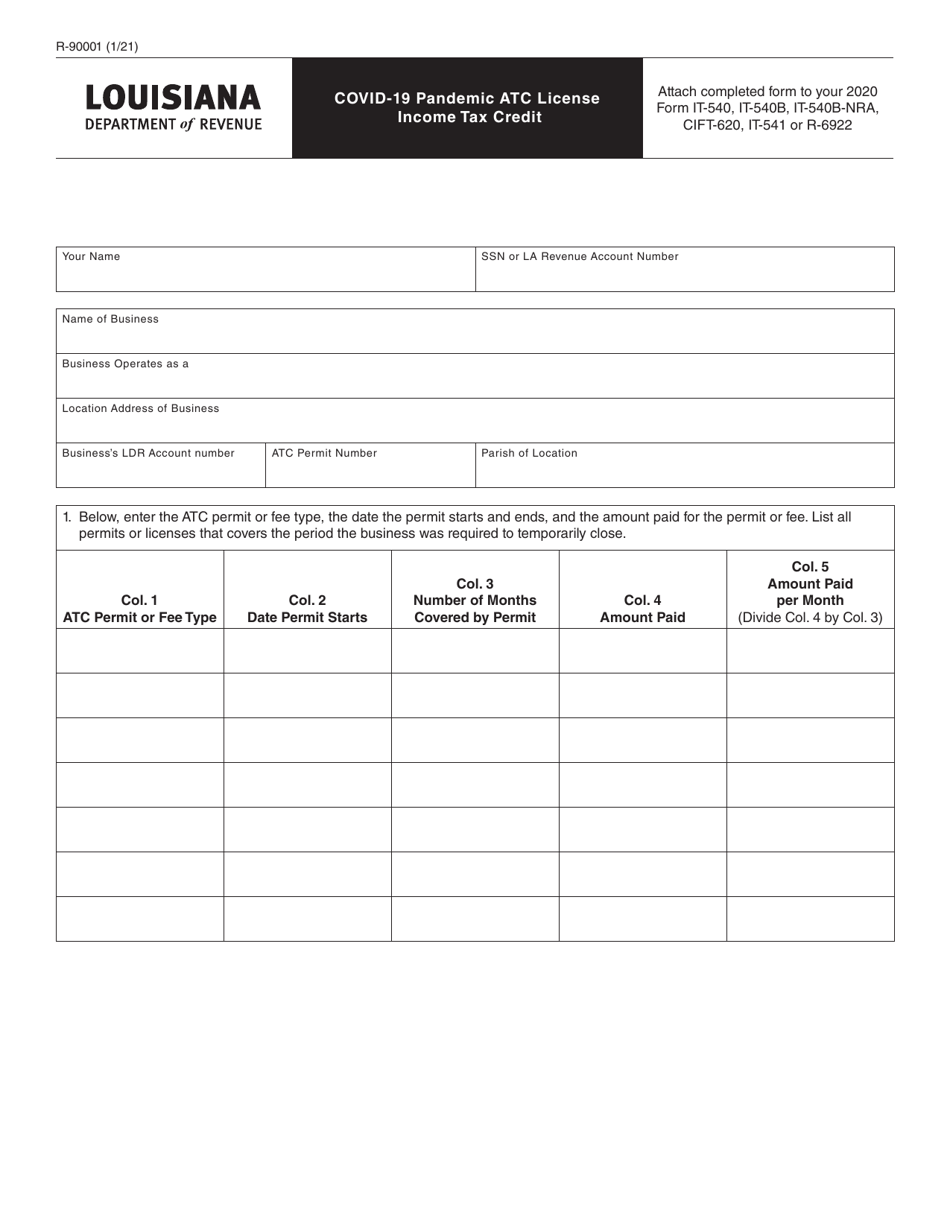

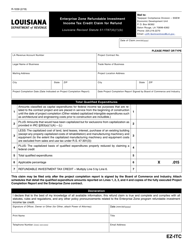

Form R-90001 Covid-19 Pandemic Atc License Income Tax Credit - Louisiana

What Is Form R-90001?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

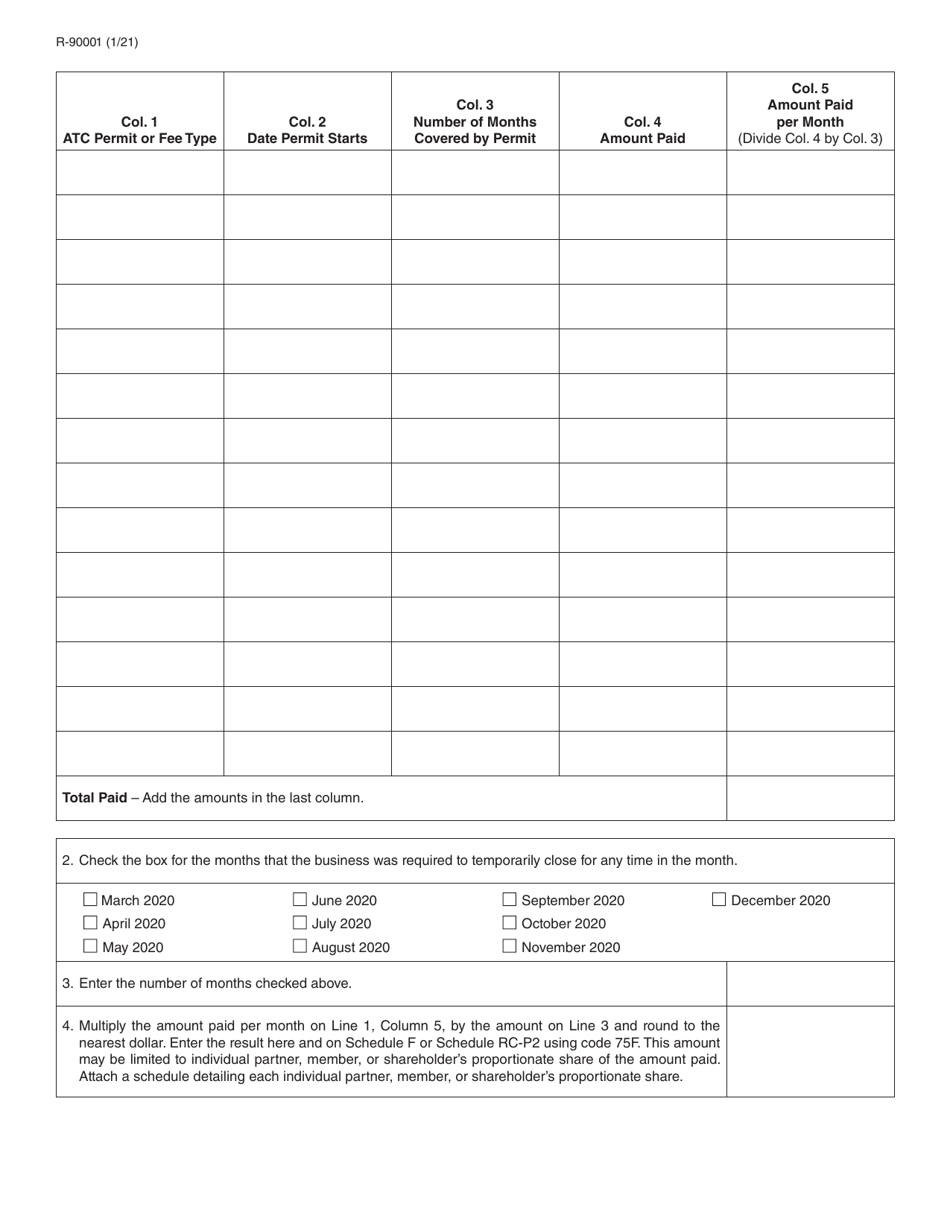

Q: What is Form R-90001?

A: Form R-90001 is a tax form related to the Covid-19 Pandemic Atc License Income Tax Credit in Louisiana.

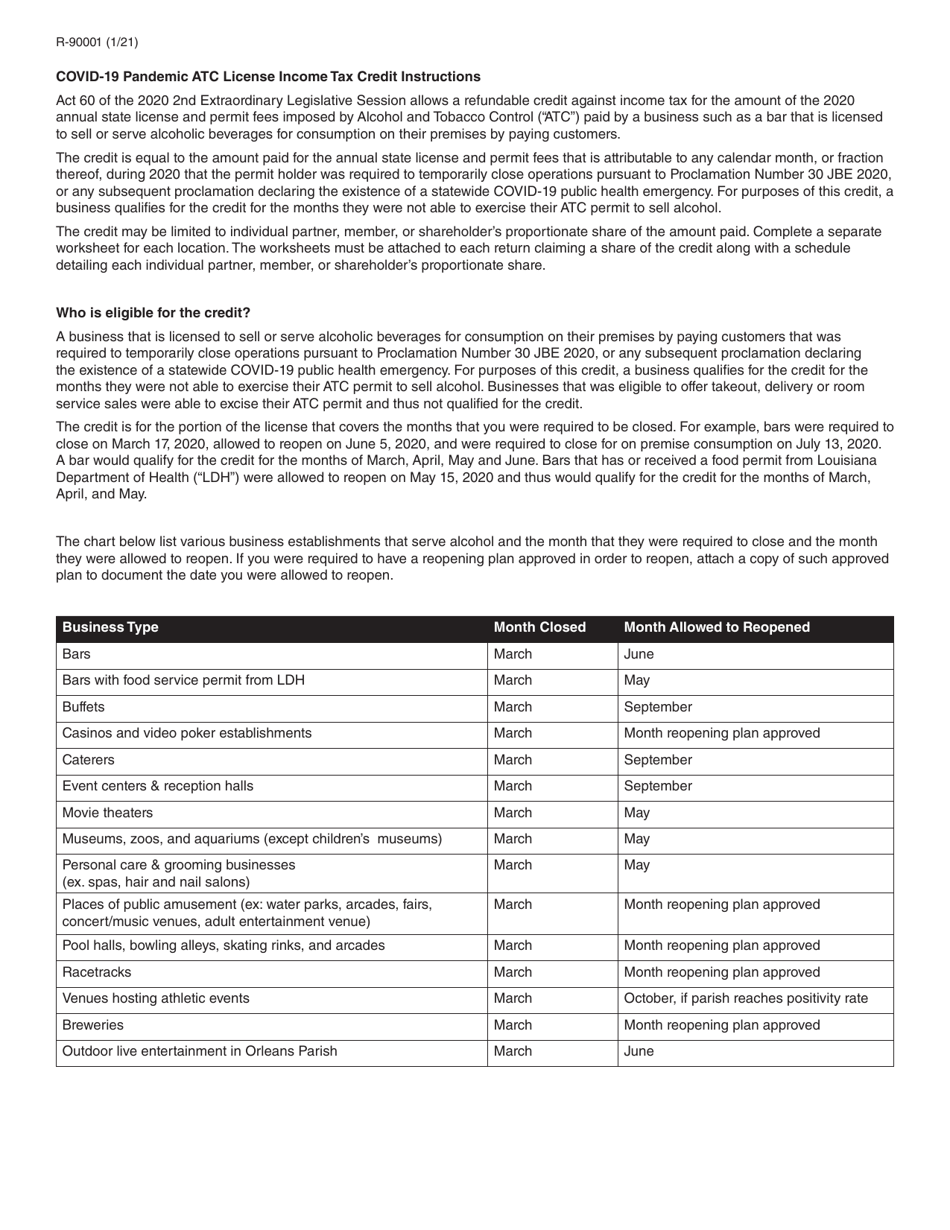

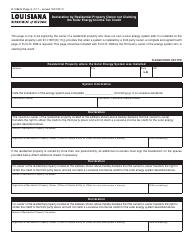

Q: What is the Covid-19 Pandemic Atc License Income Tax Credit?

A: The Covid-19 Pandemic Atc License Income Tax Credit is a credit offered by the state of Louisiana to certain businesses that hold an alcoholic beverage permit or retail dealer's permit.

Q: Who is eligible for the Covid-19 Pandemic Atc License Income Tax Credit?

A: Businesses that hold an alcoholic beverage permit or retail dealer's permit in Louisiana may be eligible for this tax credit.

Q: What is the purpose of the Covid-19 Pandemic Atc License Income Tax Credit?

A: The purpose of this tax credit is to provide relief to businesses in the alcoholic beverage industry that were impacted by the Covid-19 pandemic.

Q: How can I claim the Covid-19 Pandemic Atc License Income Tax Credit?

A: To claim this tax credit, businesses must file Form R-90001 with the Louisiana Department of Revenue.

Q: Are there any limitations or requirements for the Covid-19 Pandemic Atc License Income Tax Credit?

A: Yes, there are certain limitations and requirements that businesses must meet in order to qualify for this tax credit. These include having a net profit for the tax period, being in compliance with tax laws and regulations, and other eligibility criteria.

Q: Is there a deadline for filing Form R-90001?

A: Yes, businesses must file Form R-90001 by the due date of their final return for the tax period in which the credit is claimed.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-90001 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.