This version of the form is not currently in use and is provided for reference only. Download this version of

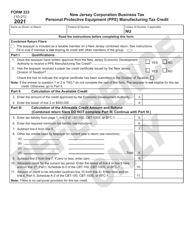

Form 305

for the current year.

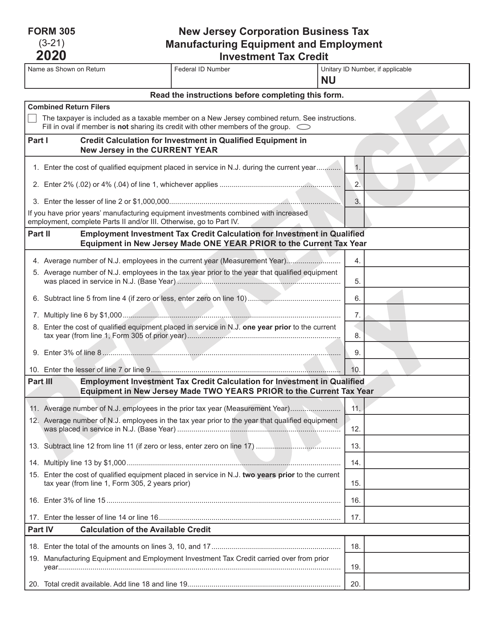

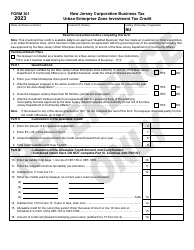

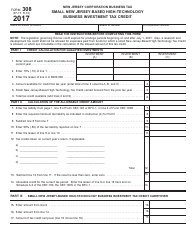

Form 305 Manufacturing Equipment and Employment Investment Tax Credit - New Jersey

What Is Form 305?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 305?

A: Form 305 is a form used to claim the Manufacturing Equipment and Employment Investment Tax Credit in the state of New Jersey.

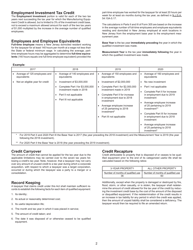

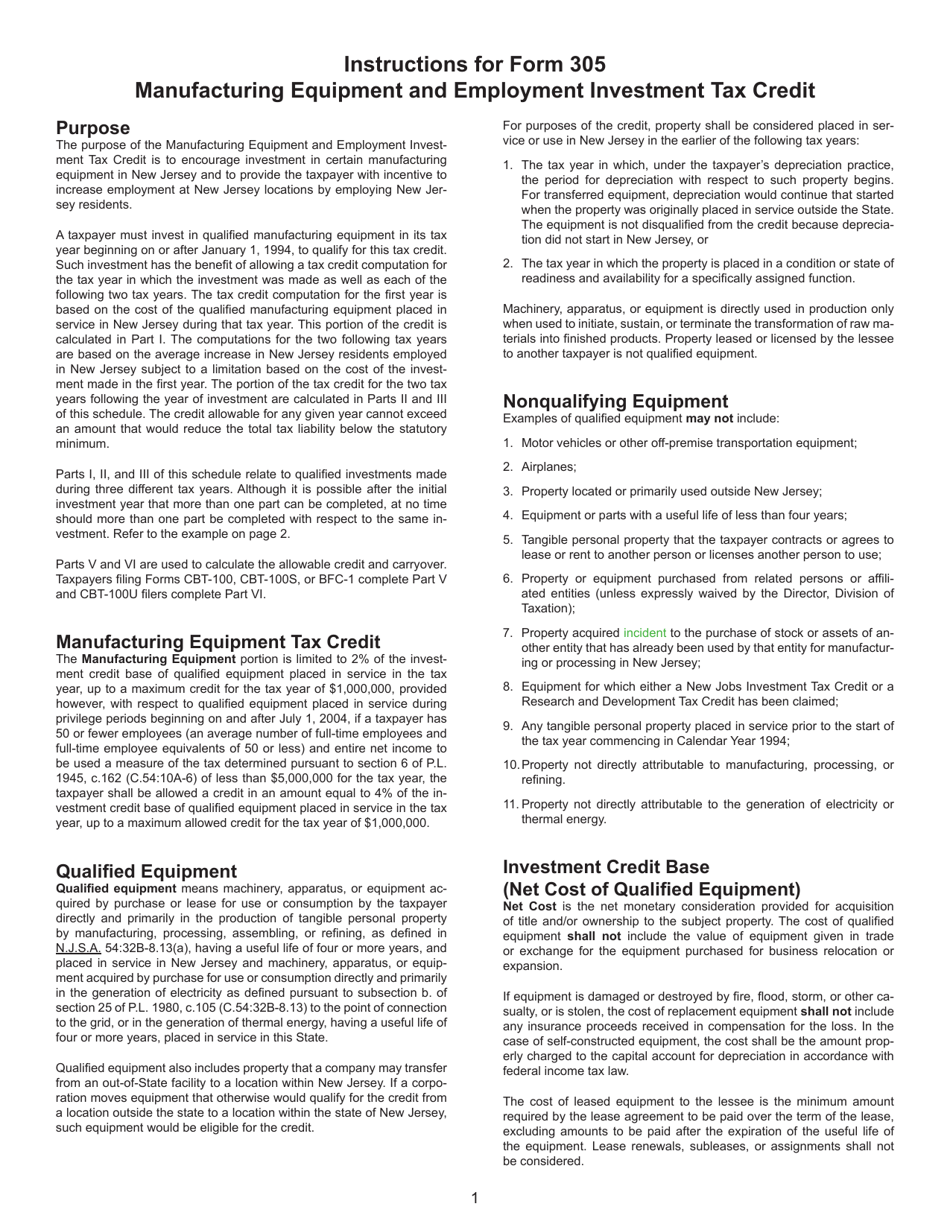

Q: What is the Manufacturing Equipment and Employment Investment Tax Credit?

A: The Manufacturing Equipment and Employment Investment Tax Credit is a tax credit offered by the state of New Jersey to businesses that invest in manufacturing equipment and create new jobs.

Q: Who is eligible to claim the tax credit?

A: Businesses that meet the requirements set by the state of New Jersey, including investing in qualifying manufacturing equipment and creating new jobs, are eligible to claim the tax credit.

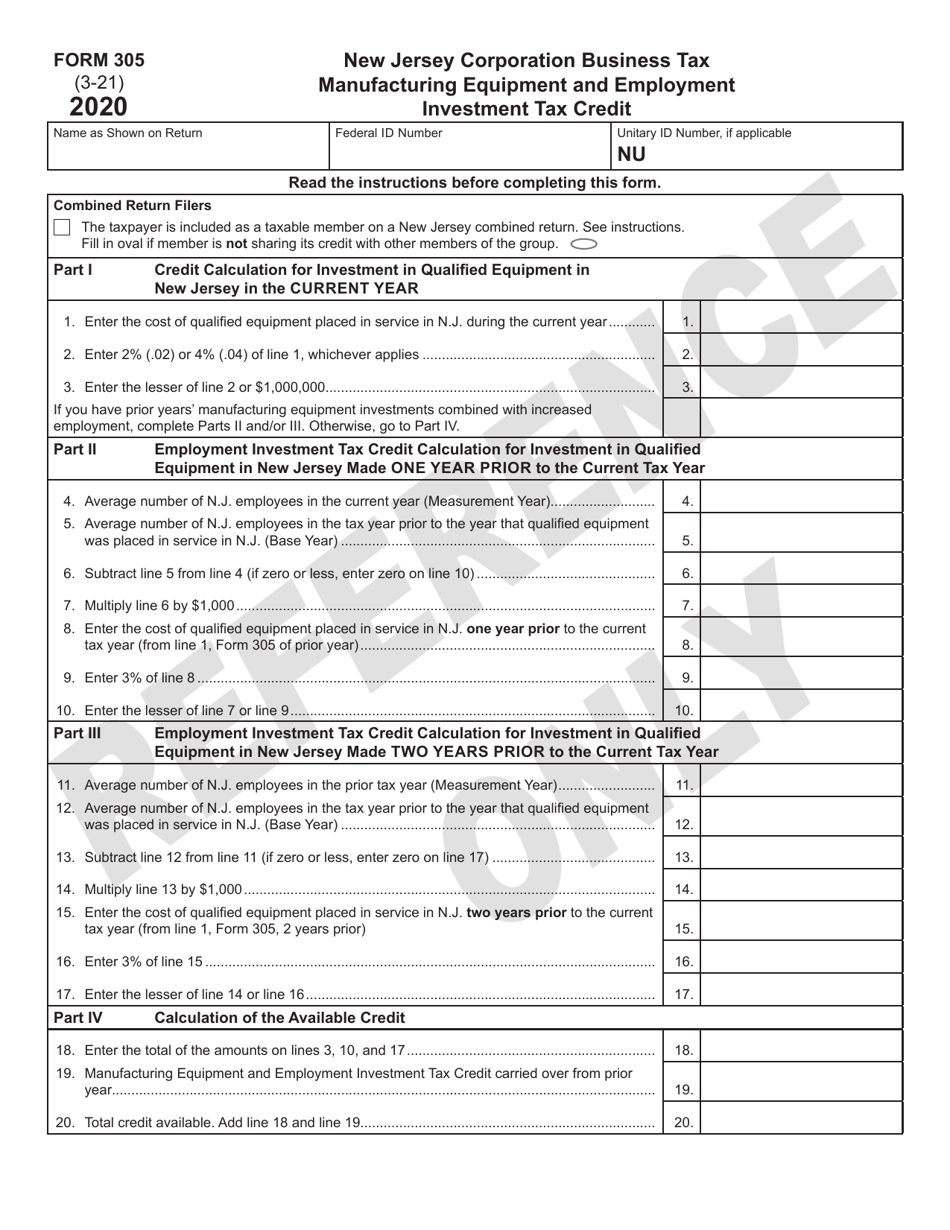

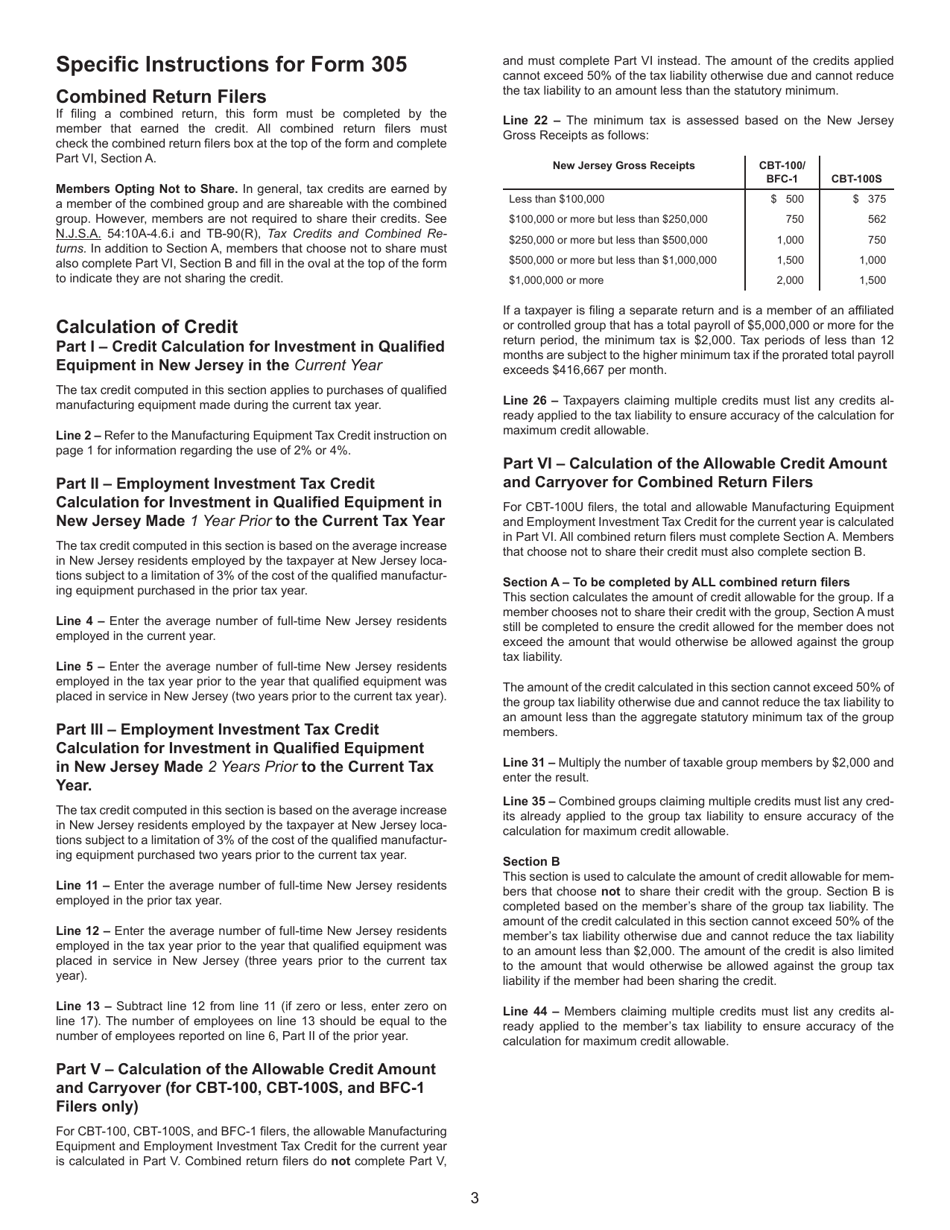

Q: How do I fill out Form 305?

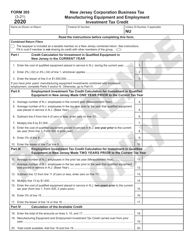

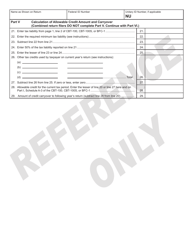

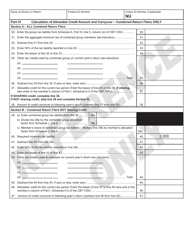

A: Form 305 requires information about your business and the equipment you have purchased. You will need to provide details about the cost and description of the equipment, as well as the number of new jobs created.

Q: How much is the tax credit?

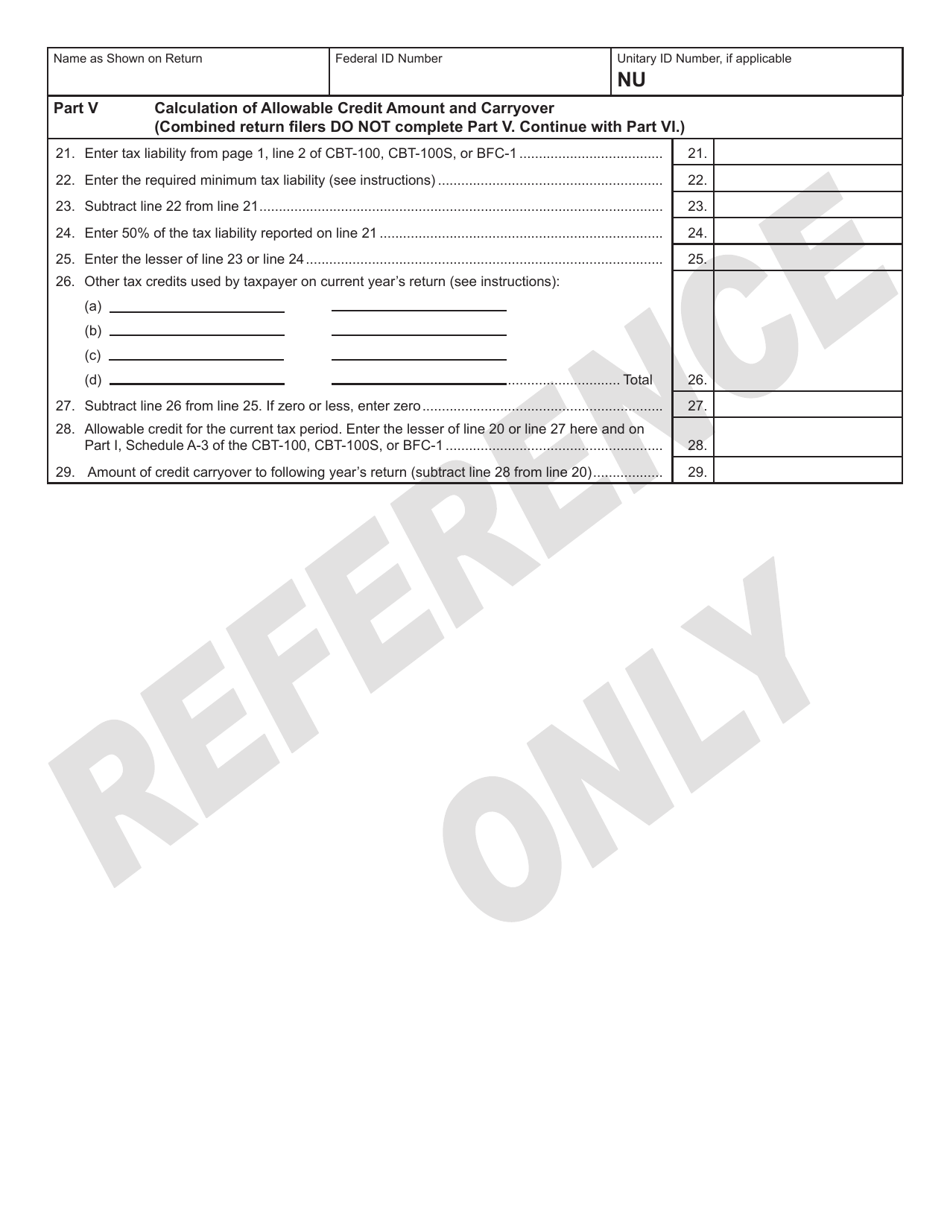

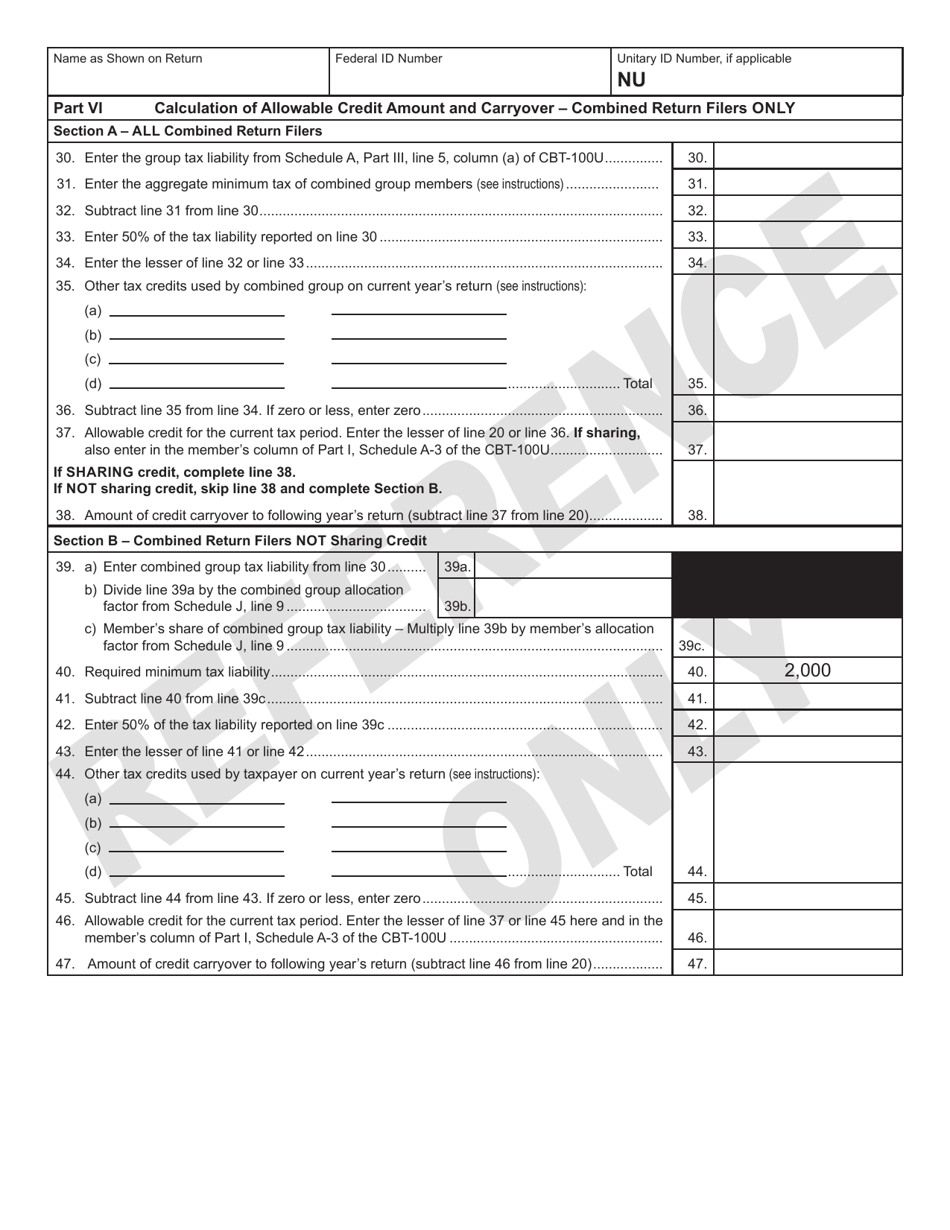

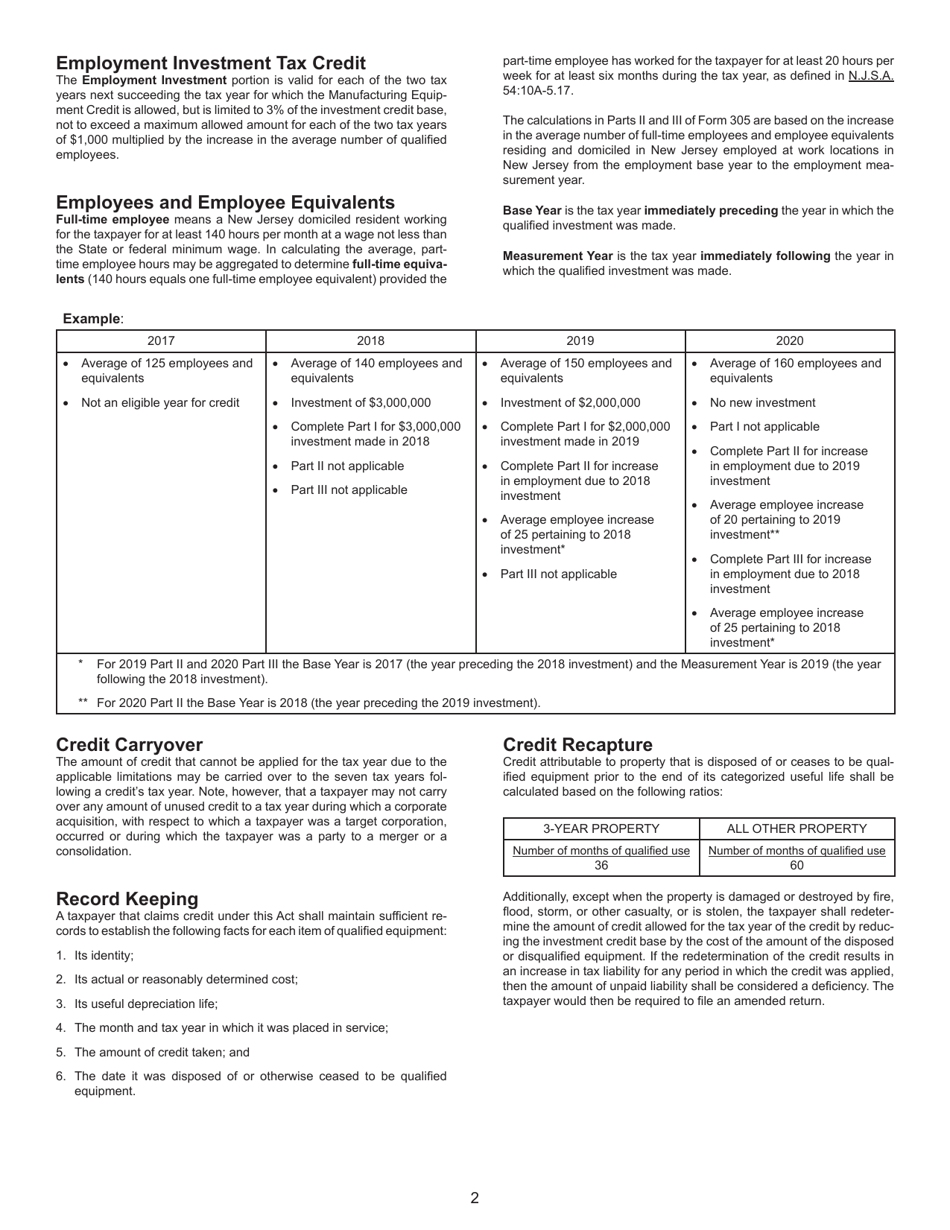

A: The amount of the tax credit depends on the cost of the qualifying manufacturing equipment and the number of new jobs created. The specific calculation can be found in the instructions for Form 305.

Q: Can the tax credit be carried forward or transferred?

A: Yes, unused tax credits can be carried forward for up to 15 years or transferred to another qualified taxpayer.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 305 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.