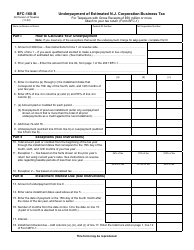

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CBT-150

for the current year.

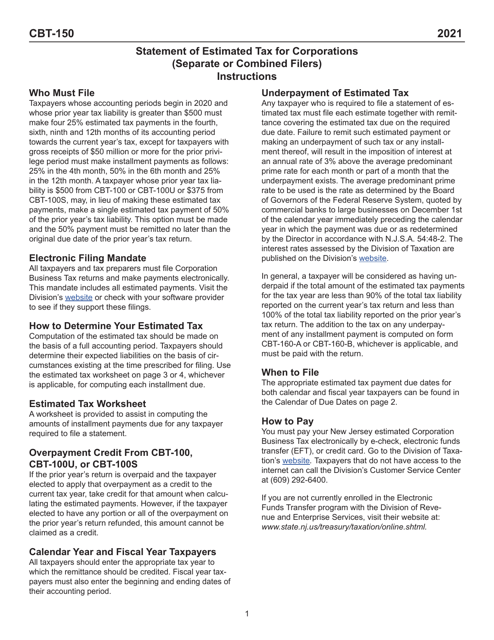

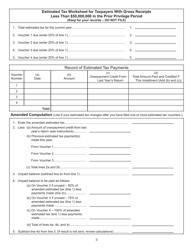

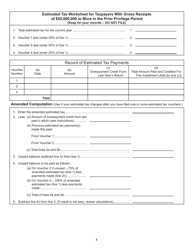

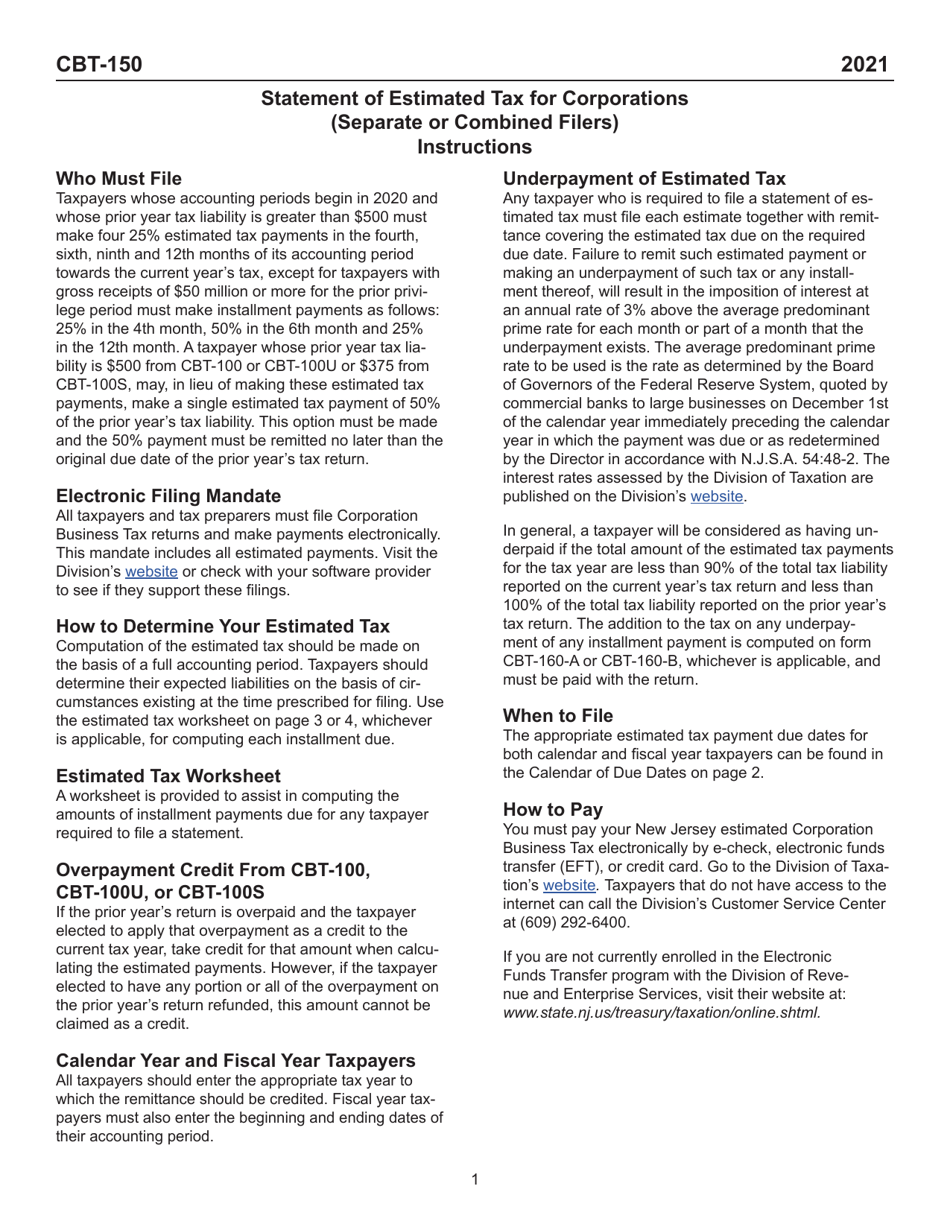

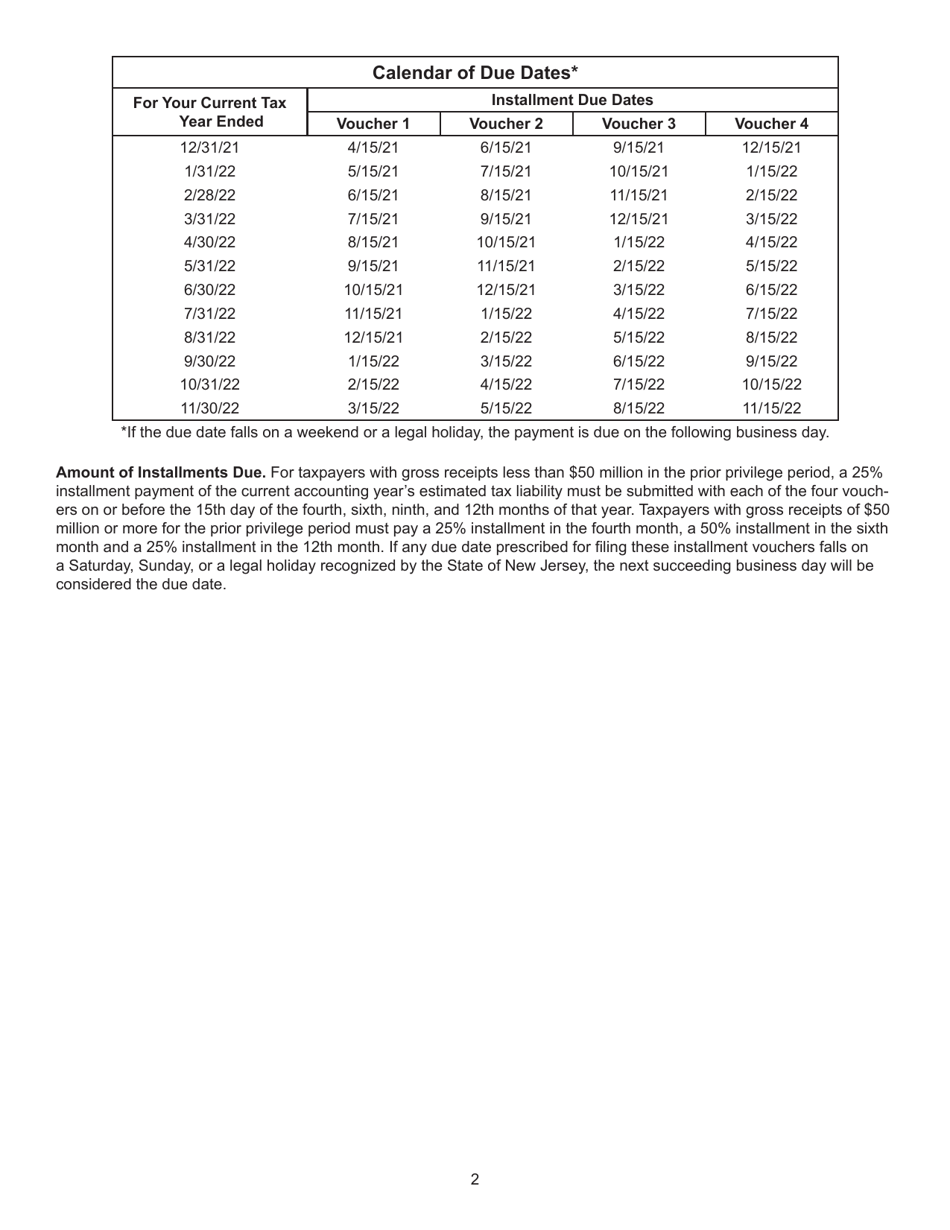

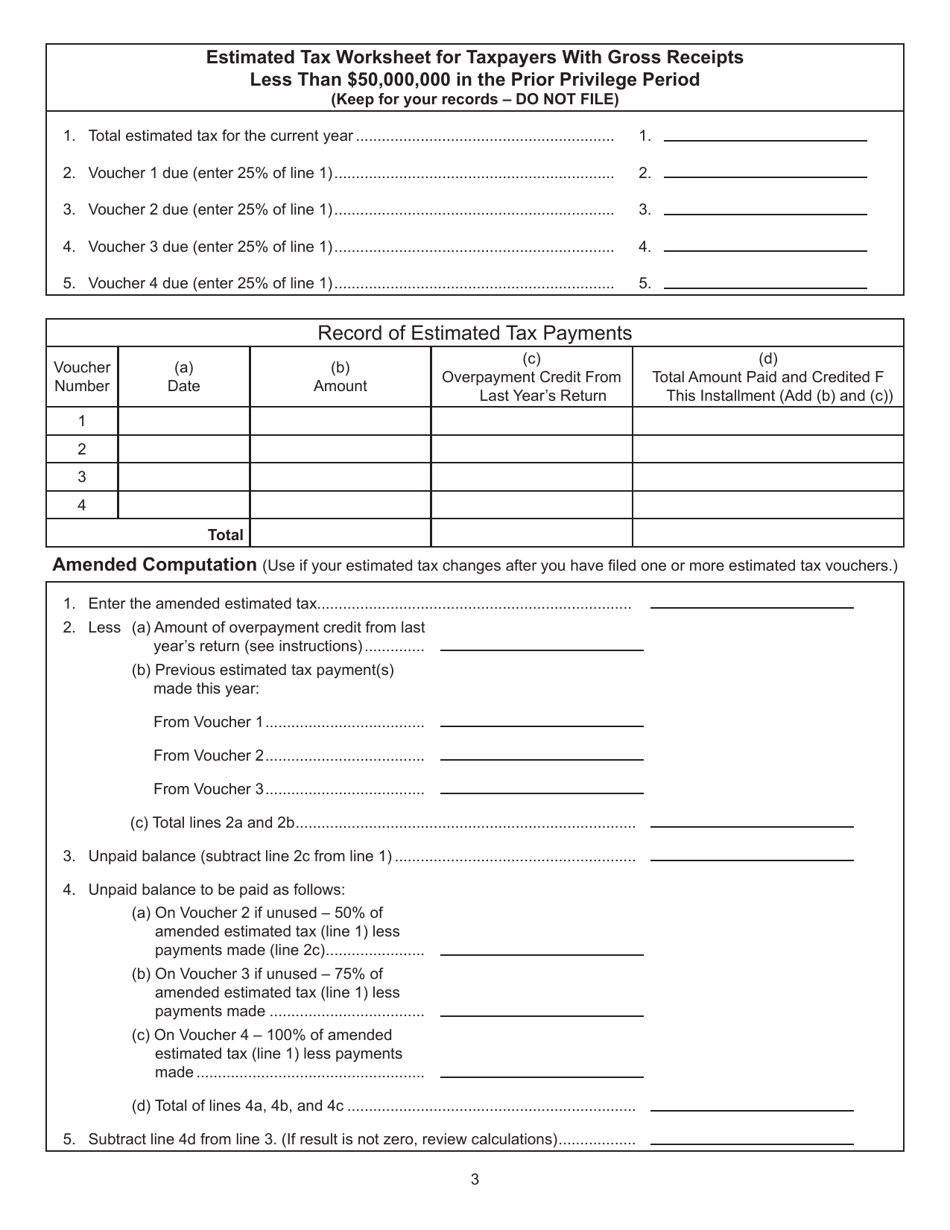

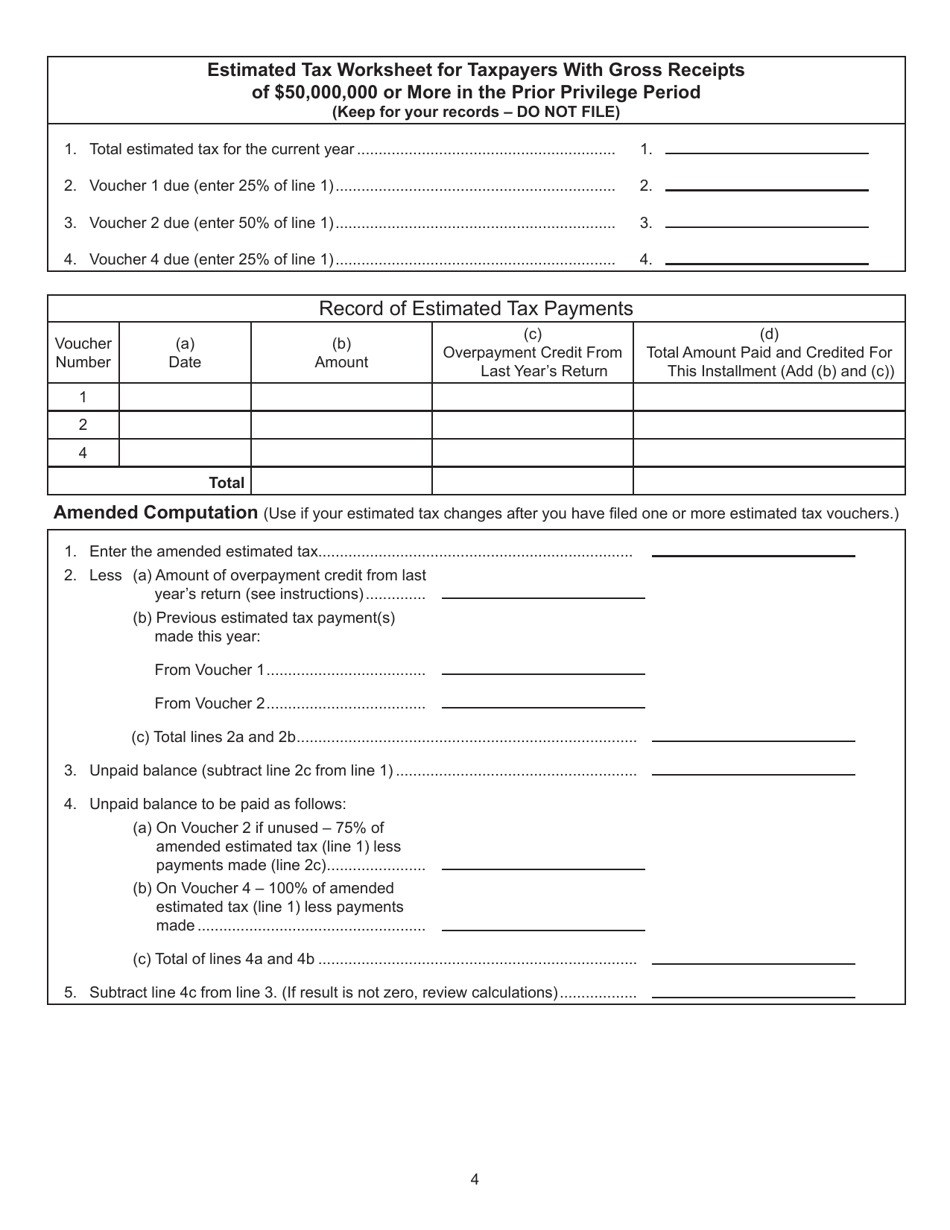

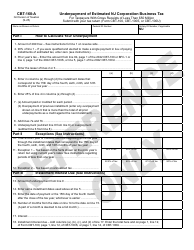

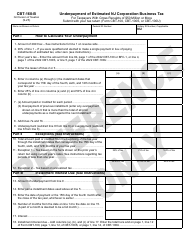

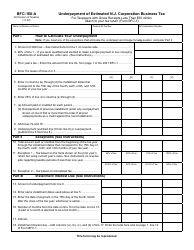

Form CBT-150 Estimated Tax Worksheet for Taxpayers With Gross Receipts Less Than $50,000,000 in the Prior Privilege Period - New Jersey

What Is Form CBT-150?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CBT-150?

A: Form CBT-150 is an estimated tax worksheet for taxpayers in New Jersey.

Q: Who should use Form CBT-150?

A: Taxpayers with gross receipts less than $50,000,000 in the prior privilege period should use Form CBT-150.

Q: What is the purpose of Form CBT-150?

A: The purpose of Form CBT-150 is to calculate estimated tax payments for taxpayers in New Jersey.

Q: What is the prior privilege period?

A: The prior privilege period refers to the previous tax year.

Q: Is Form CBT-150 specific to New Jersey only?

A: Yes, Form CBT-150 is specific to taxpayers in New Jersey.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CBT-150 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.