This version of the form is not currently in use and is provided for reference only. Download this version of

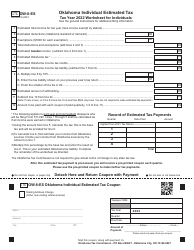

Form OW-8-ESC

for the current year.

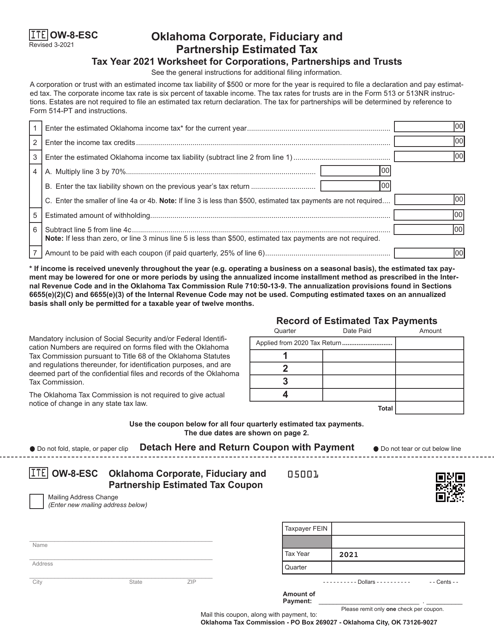

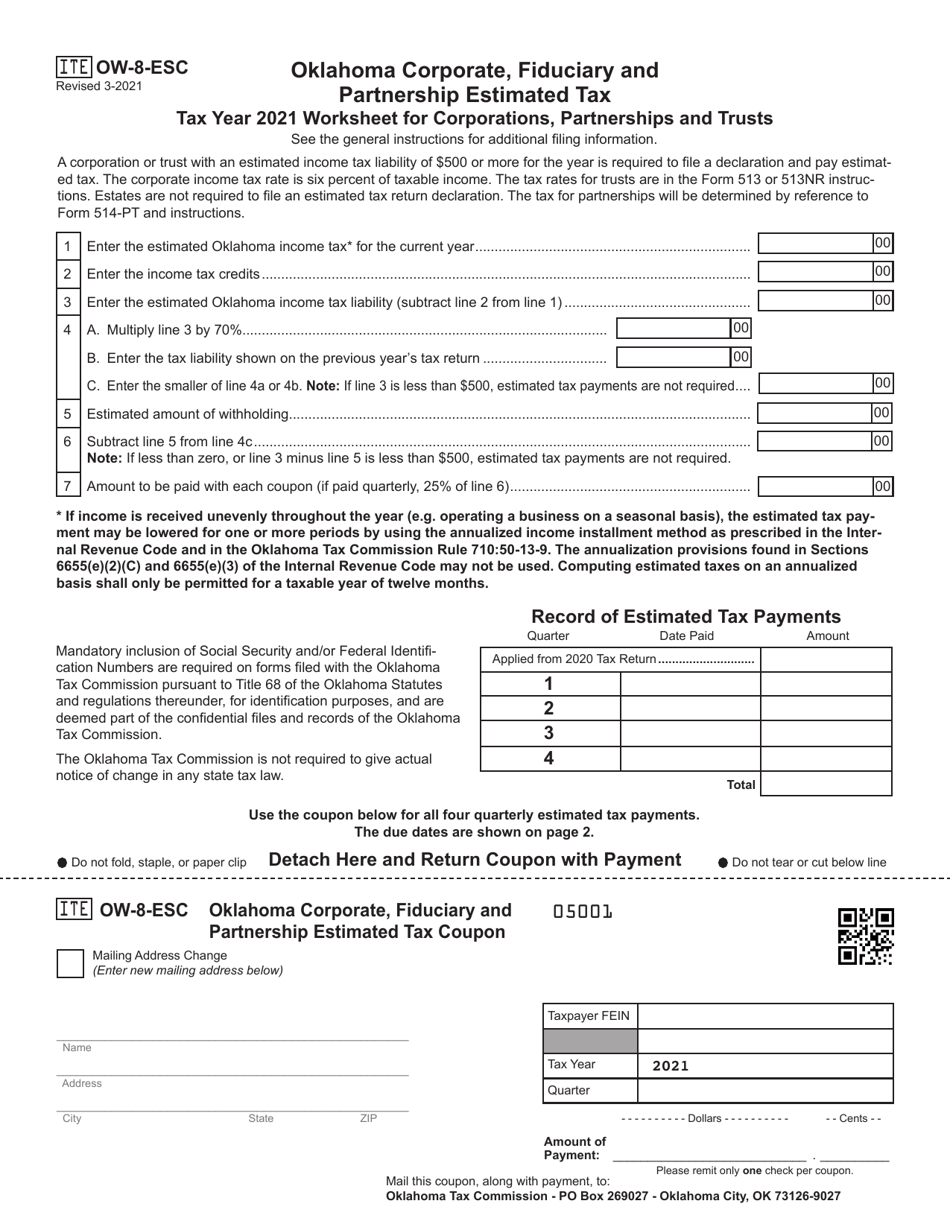

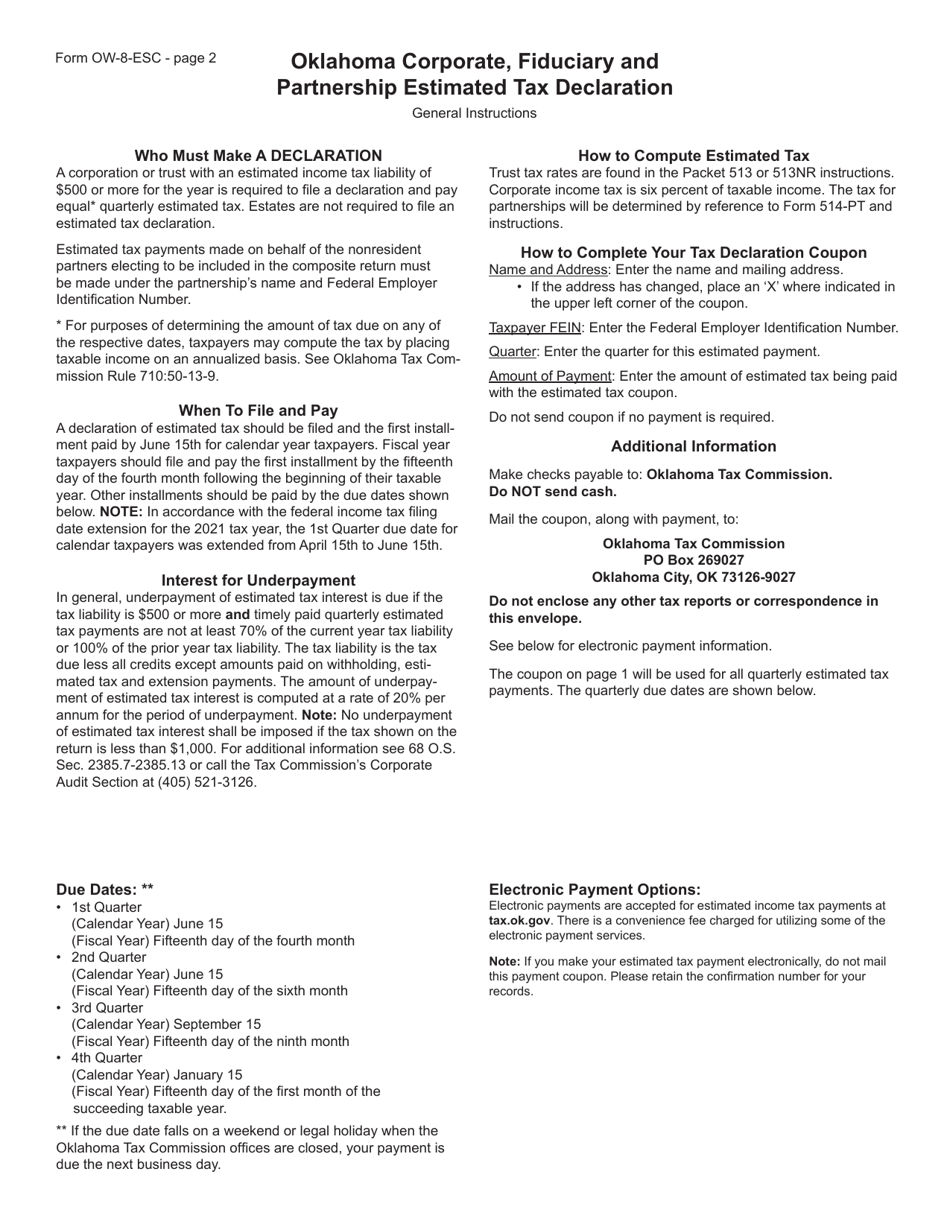

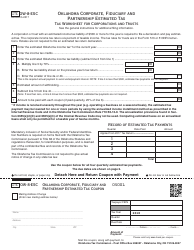

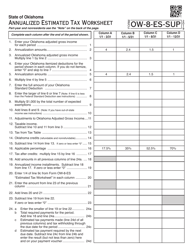

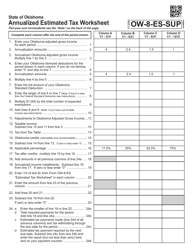

Form OW-8-ESC Oklahoma Corporate, Fiduciary and Partnership Estimated Tax Worksheet for Corporations, Partnerships and Trusts - Oklahoma

What Is Form OW-8-ESC?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OW-8-ESC?

A: Form OW-8-ESC is the Oklahoma Corporate, Fiduciary and Partnership Estimated Tax Worksheet for Corporations, Partnerships, and Trusts in Oklahoma.

Q: Who needs to file Form OW-8-ESC?

A: Corporations, partnerships, and trusts in Oklahoma need to file Form OW-8-ESC.

Q: What is the purpose of Form OW-8-ESC?

A: Form OW-8-ESC is used to calculate and pay estimated taxes for corporations, partnerships, and trusts in Oklahoma.

Q: What information is required on Form OW-8-ESC?

A: Form OW-8-ESC requires information about income, deductions, credits, and estimated tax payments.

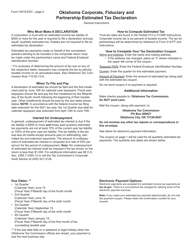

Q: When is Form OW-8-ESC due?

A: Form OW-8-ESC is due on the 15th day of the fourth, sixth, ninth, and twelfth months of the taxable year.

Q: Is there a penalty for not filing Form OW-8-ESC?

A: Yes, there may be penalties for not filing Form OW-8-ESC or for underpaying estimated taxes.

Q: Can Form OW-8-ESC be filed electronically?

A: Yes, Form OW-8-ESC can be filed electronically through the Oklahoma Taxpayer Access Point (OKTAP).

Q: Can I make changes to Form OW-8-ESC after filing?

A: Yes, you can make changes to Form OW-8-ESC by filing an amended return or by contacting the Oklahoma Tax Commission.

Q: Do I need to attach any documents to Form OW-8-ESC?

A: Generally, you do not need to attach any documents to Form OW-8-ESC, but you should keep them for your records.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OW-8-ESC by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.