This version of the form is not currently in use and is provided for reference only. Download this version of

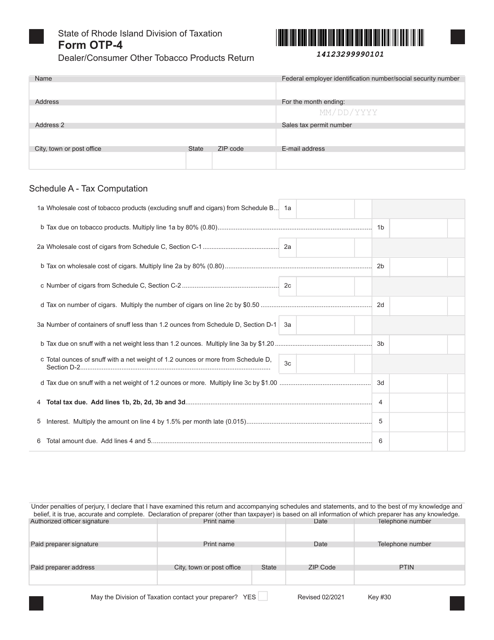

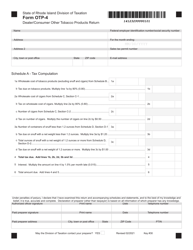

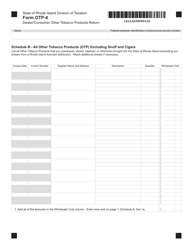

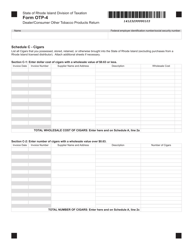

Form OTP-4

for the current year.

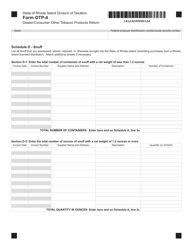

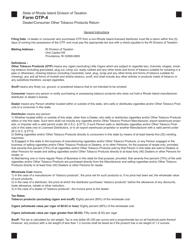

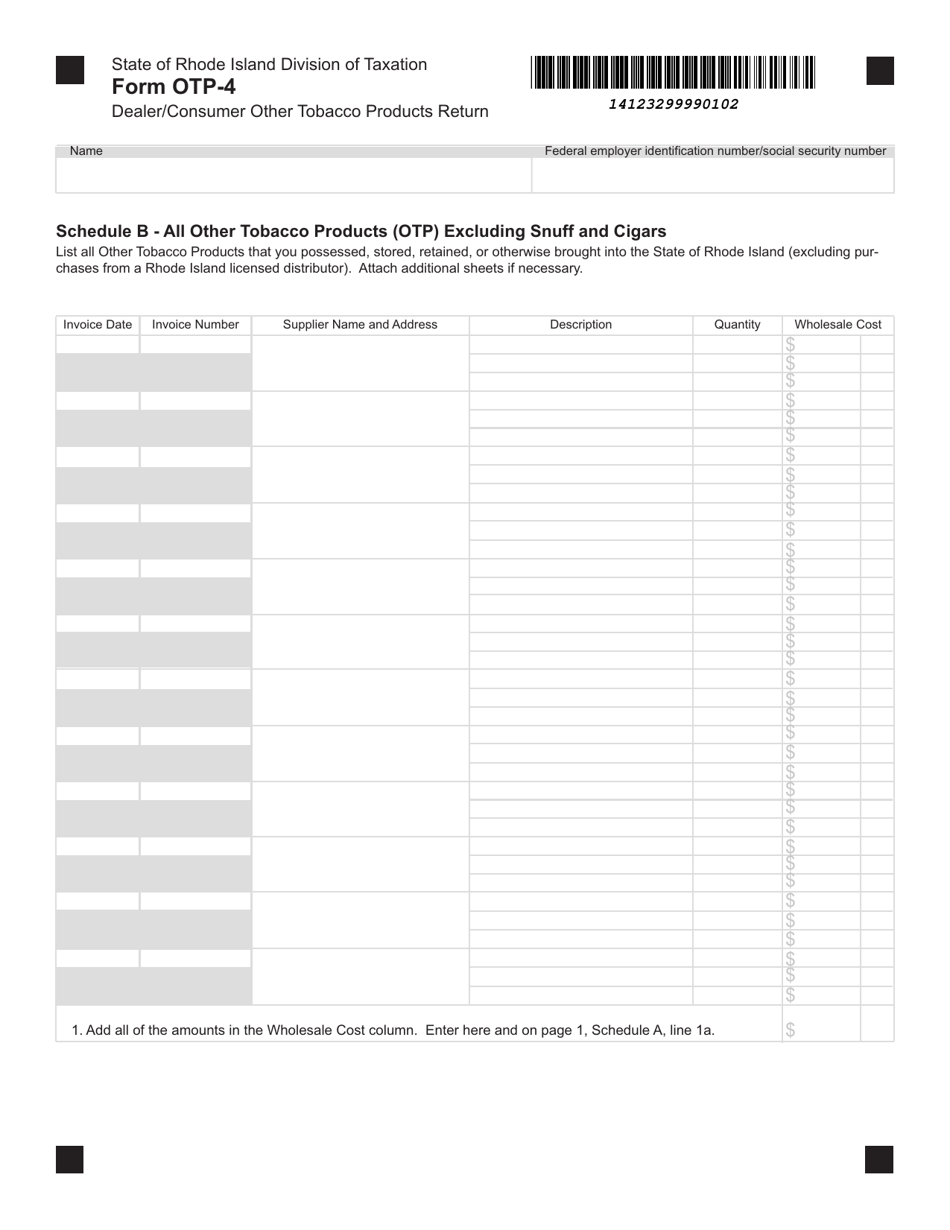

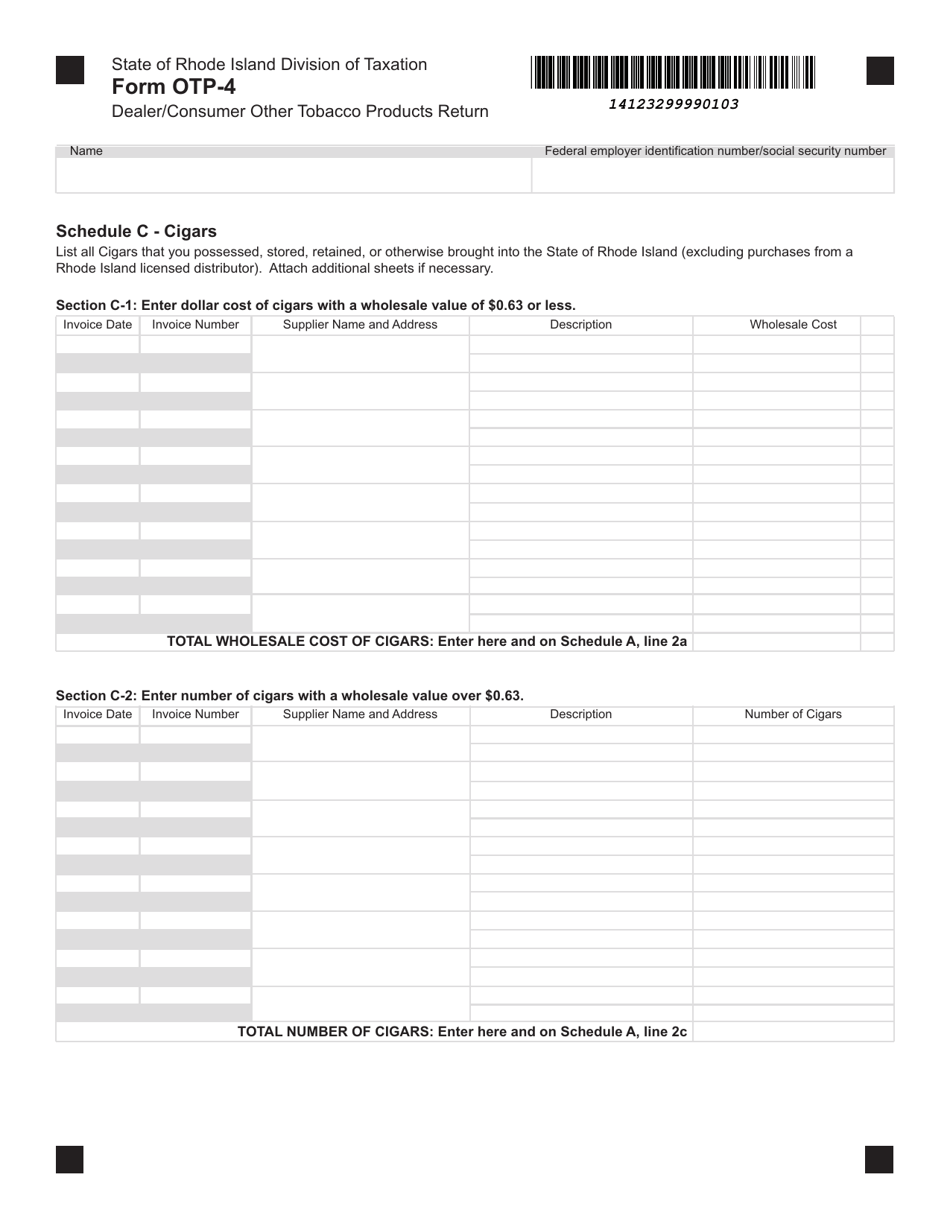

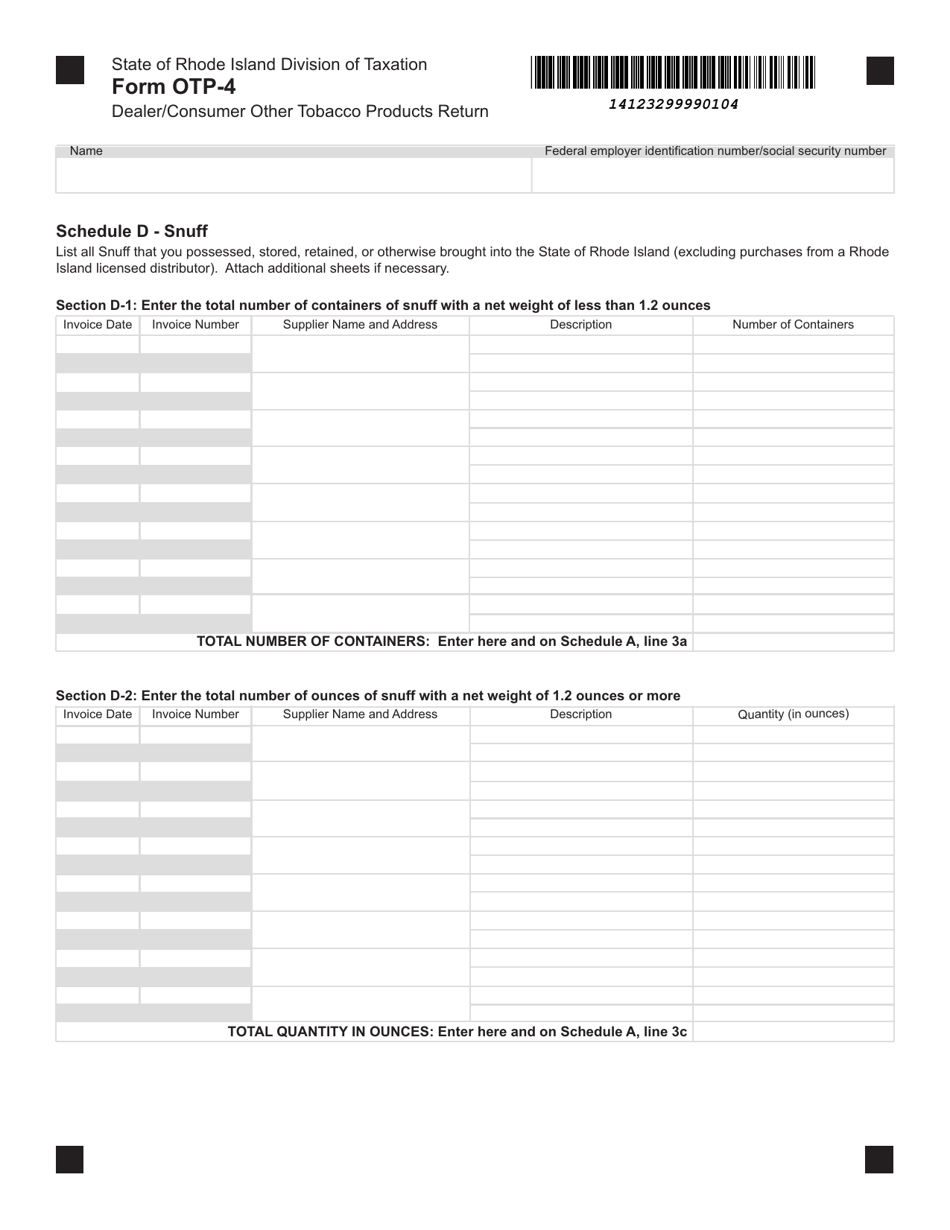

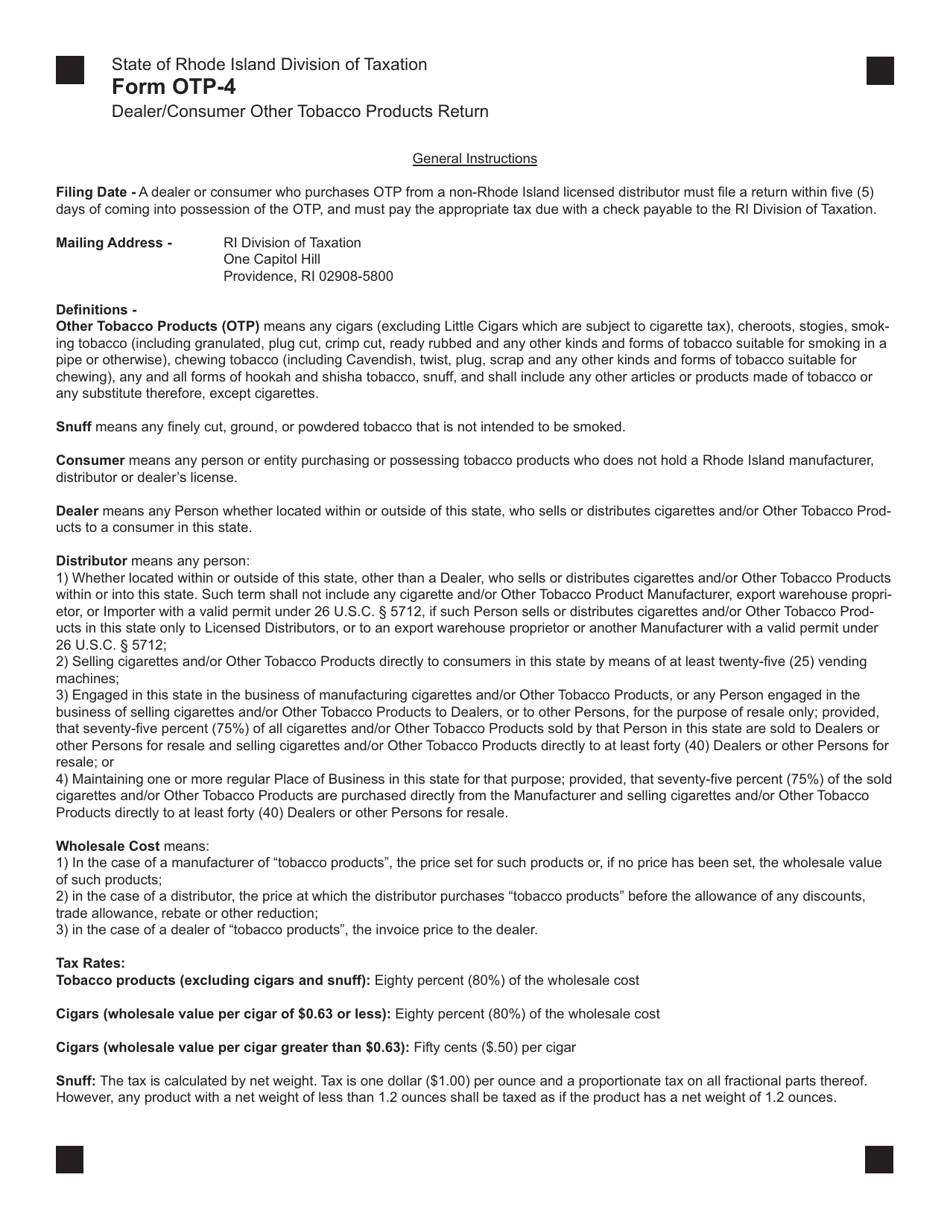

Form OTP-4 Dealer / Consumer Other Tobacco Products Return - Rhode Island

What Is Form OTP-4?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTP-4 form?

A: The OTP-4 form is the Dealer/Consumer Other Tobacco Products Return form for Rhode Island.

Q: Who needs to file the OTP-4 form?

A: Both dealers and consumers of other tobacco products in Rhode Island need to file the OTP-4 form.

Q: What is the purpose of the OTP-4 form?

A: The OTP-4 form is used to report and pay the tax on other tobacco products in Rhode Island.

Q: How often does the OTP-4 form need to be filed?

A: The OTP-4 form needs to be filed on a quarterly basis by the specified due date.

Q: What information is required on the OTP-4 form?

A: The OTP-4 form requires the reporting of total sales, taxable sales, and the amount of tax due.

Q: Is there a penalty for late filing of the OTP-4 form?

A: Yes, there may be a penalty for late filing of the OTP-4 form, so it is important to submit it by the due date.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP-4 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.